To – All Clients & Partners

Best wishes for the new year 2020 !

2019 has been a challenging Year for all of us. A heady cocktail of economic slowdown, slow earnings momentum in core sectors, liquidity crunch & SEBI’s reclassification norms led to a complete meltdown in broader markets, especially the midcap & small cap segments.

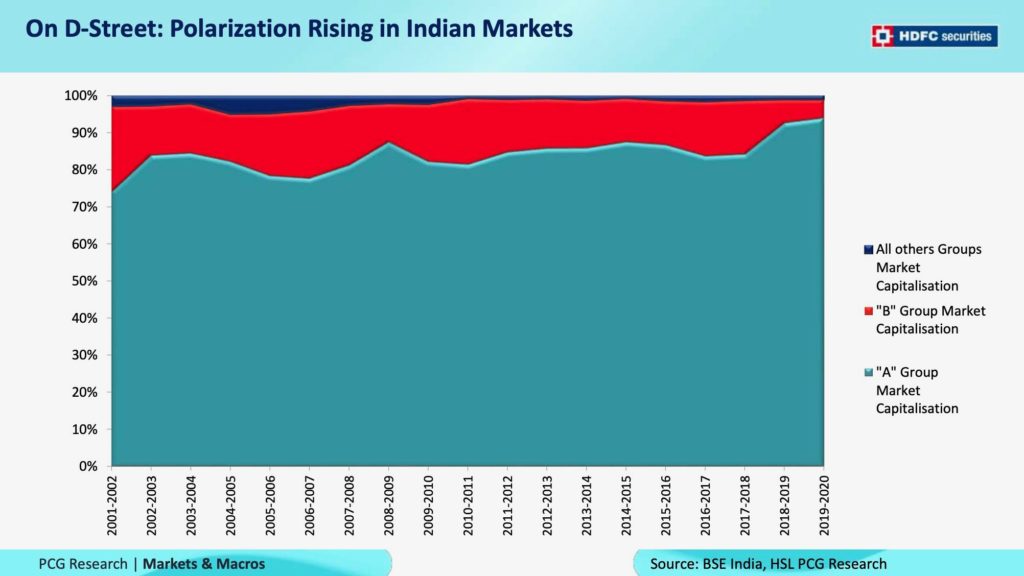

This one chart illustration by HDFC securities explains what really transpired during calendar year 2019.

This is clearly an earnings driven market. Wherever there is earnings certainty for the next 4 quarters, markets are willing to pay a premium. While asset-based companies are being ignored despite deep value & performance improvement. This scenario has opened up many pockets of opportunities as we enter 2020.

A Lot More Opportunities

2020 promises to be a year with full of extremely attractive opportunities. After a gap of almost 3 years, we are finding quite a few new investment ideas due to price correction, time correction & improvement in underlying businesses.

We see tremendous value emerging in large cap stocks. Barring top 10-15 stocks from IT, Private Banking / Financials & select consumer facing companies rest of the large cap category is highly underpriced. A mere reversion to mean & a slight hint of growth should result in good risk adjusted returns over the next 12 months or so. Stocks like SBI, Vedanta, GAIL, Coal India and few others are worth investigating from medium to long term perspective.

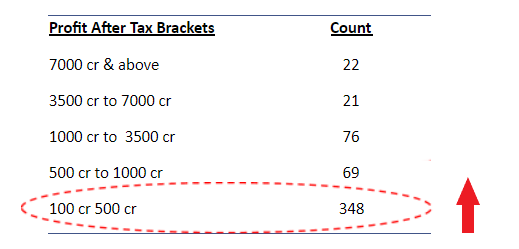

At the same time, we can spot quite a few high growth midcaps & small caps that are finally coming into attractive zone either due to time correction over the last 3 years or big price correction from December 2017 top. Especially the stocks with potential to enter 500 cr profit after tax club on a sustainable basis are of high interest to us.

Companies That Can Make A Comeback To 500 cr PAT Club

In 2010, 128 listed companies were making a profit after tax of more than 500 crores. And only ~80 out of those 128 companies continue to make 500 crores plus profit after tax in 2019. Rest of them have dropped out due to cyclical or structural reasons. We are on the look out for companies that can make a come back to this list as the cycle turns in favor.

New Companies That Can Enter 500 cr PAT Club On A Sustainable Basis

In 2019 – the number of companies making profit after tax of more than 500 crores has moved to 188. Resulting in almost 100 new entrants to the club. At this point, we are able to find few opportunities that can potentially enter the 500-crore profit after tax number on a sustainable basis or get somewhere close to the number. These are growing companies in the mid & small cap space.

The 500 crore PAT number matters, as this is the point where a major re-rating in the valuations takes place. As businesses become large, their ability to re-invest & grow accelerates, ability to protect margins goes up & the valuation matrix changes as well. In a country like India, it is very difficult to build a scalable business. Companies which are able to build such businesses on a sustainable basis & stay there for a longer time, are likely to fetch a valuation premium & increased institutional participation.

Looking Forward – 2020, The Year Full Of Action

In November 2019, Alpha Invesco completed 10 years of operations. Over the last decade, we have worked relentlessly to enhance our investment frameworks, broaden the investment universe. 2019 was a year where we reflected upon our mistakes, expanded the team, gained insights on a lot many new industries / sectors which we never used to look at before, and have developed inhouse screening tools. We are looking forward for a year full of action with significant changes & additions to our investment portfolios.

Regards

Chetan Phalke

CIO – Alpha Invesco Research

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.