Disclaimer: The Blog on ‘Cold Chain Logistics In India’ is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. Please read the detailed disclaimer at the bottom of the post.

Indian Cold Chain Logistics

Agriculture plays a very vital role in India’s economy. As per published reports over ~58% of the rural households depends on agriculture as their primary means of livelihood. The share of primary sectors (including agriculture, livestock, forestry and fishery) is estimated to be 20.4% of the gross value added during 2016-17. India is amongst the largest producers and a leader of various agricultural products, but do we have sufficient technology and infrastructure to preserve and export good quality agricultural resources?

The Indian cold chain involves transportation of temperature-sensitive products. It is a supply chain which takes place through thermal and refrigerated packaging methods to protect the integrity of the products in shipments. The cold chain sector is a combination of surface storage and refrigerated transport.

Indian cold chain is still at a nascent stage. Although, there is large production of perishables but still the cold chain potential remains untapped due to multiple reasons like high share of single commodity cold storage; high initial investment (for refrigerator units and land); lack of Basic Enabling Infrastructure (roads, water supply, power supply, drainage, etc.); lack of awareness for handling perishable produce and lapse of service either by the storage provider or the transporter leading to poor quality produce. Due to fledgling cold supply chain there is a heavy loss of food and other resources. These losses have been stated to be as high as Rs 52,000 to Rs 95,000 crores per annum from the agriculture sector alone.

Inadequate cold-chain infrastructure has hampered India’s food exports as well. Countries across the world have stringent guidelines for import of agricultural and processed food products. The European Union (EU) has raised more notifications, issued more rejections and destroyed more consignments from India as compared to consignments from other developing countries such as Turkey, Brazil, China and Vietnam. India has huge export potential, reflected in the fact that its domestic commodity prices were below export parity prices in 72 per cent of cases.

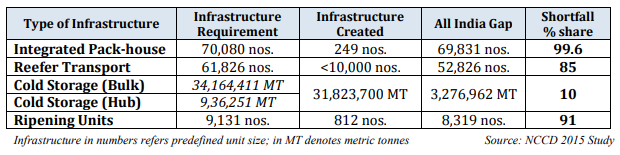

Cold Chain Infrastructure – Status & Gap (2015) :

However, the increasing urbanization and growth of organized retail, food servicing and food processing sectors are boosting the growth of the cold chain industry in India. The trend is now shifting towards establishing multipurpose cold storages and providing end to end services to control parameters throughout the value chain.

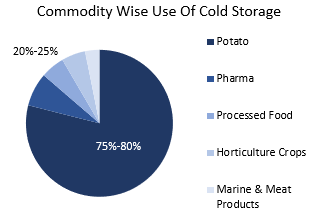

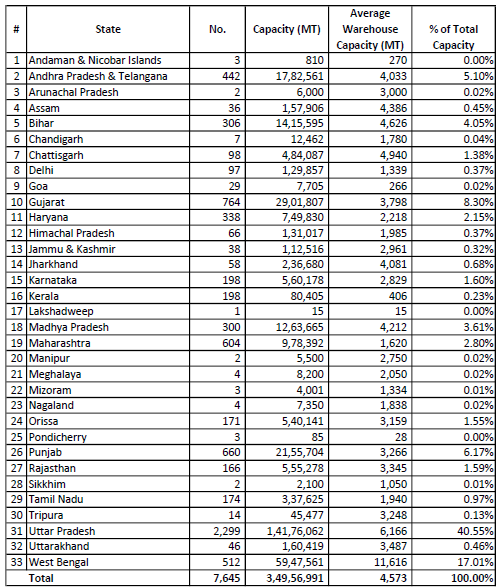

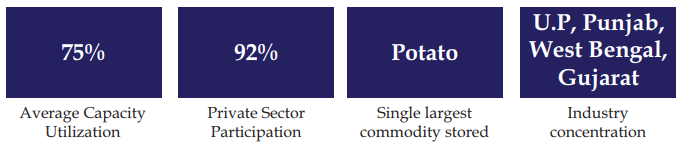

Taking into consideration the geographic spread majority of the cold storages are located in and around potato growing areas. ~61% of the cold storage capacity is concentrated in the states of West Bengal, Uttar Pradesh and Bihar, wherein storage of potatoes accounts for 75-80% of the capacity. Storage units in Maharashtra, parts of Gujarat and the country’s southern states are designed for storing commodities such as dairy products, fruits, processed fish and meat products, and seasonal vegetables. However, the market is gradually getting organized and focus has shifted towards multi-purpose cold storages. Currently ~90% of the cold chain market is unorganized.

State-wise Cold Chain Warehouse Capacity In India :

The refrigerated transport in the country is under-developed with less than 10,000 reefer vehicles and zero reefer containers for rail movement. Recent surveys have also indicated that although most of the cold storages facilitate transportation of commodities, 79 percent does not own any transportation. It can be perceived that transport is going to increasingly be the main bottleneck to maintaining the integrity of the cold-chain, along with modern pack-houses as points of origin for fresh farm produce.

Cold stores are the major revenue contributors of the Indian cold chain industry, yet, ~36% of the cold storages in India are believed to have a capacity below 1,000 MT. Thus, lack of proper and adequate food storage, processing and cold chain logistics remains a serious challenge. Nevertheless, the Indian Government is one of the driving forces in developing the cold chain industry and supports private participation through various subsidy schemes.

Subsidy Provided By Ministry Of Food Processing Industries (MOFPI) :

Ministry of Food Processing Industries (MOFPI) provides financial assistance (grant-in-aid) to the tune of 50% the total cost of plant and machinery and technical civil works in General areas and 75% for NE region including Sikkim and difficult areas (J&K, Himachal Pradesh and Uttarakhand) subject to a maximum of Rs.10 crore.

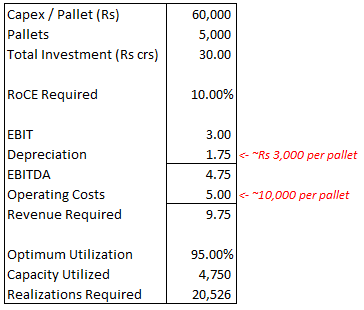

Higher Initial Setup Cost A Major Drawback :

- According to Snowman Logistics (the only listed pureplay cold chain player in India) an estimated cost to set up a multi-commodity cold chain warehouse is in a range of ~Rs 60,000 to 65,000 per pallet (On an average 1 pallet = 1 ton in India).

- Setting up a 5,000 pallets multi commodity warehouse could cost ~Rs 30 crores of initial investment.

- Depreciation and operating costs are considered on the entire capacity as majority cost involved are fixed in nature. Snowman’s costs were a little higher with an average warehouse capacity of ~3,200 pallets which could be brought down with higher capacity

- To earn an RoCE of 10% the warehouse owner will have to store goods for an average annual per pallet realization of ~Rs 20,000.

- Whereas average realizations for few commodities are as below:

- Potatoes: ~Rs 500 to 750 per ton per month

- Fruits & Vegetables: ~Rs 1,000 to 1,500 per ton per month

- Frozen food: ~Rs 1,700 to 1,800 per pallet per month

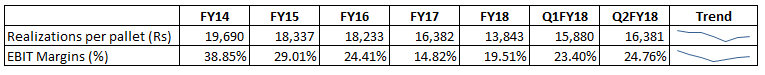

- Realizations & EBIT Margins of Snowman Logistics:

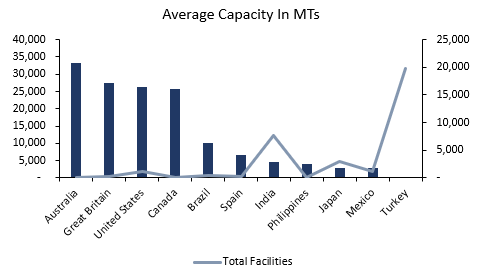

Indian Average Cold Chain Per Warehouse Capacity Way Lower Compared To Global Average :

- In terms of capacity per tons India has the largest warehousing capacity of ~34.95 MT followed by United States and China with capacity of ~30.5 MT and ~24.4 MT respectively.

- However, India’s average cold chain per warehousing capacity is way lower compared to Australia, Great Britain, United States & Canada.

- Higher capacity per warehouse could help reduction of cost and help achieve economies of scales.

- The Indian Cold Chain could further see consolidation and a huge shift from unorganized to organized market in order to achieve economies of scale

Below Emerging Trends Were Observed In Indian Cold Chain Industry :

- Shift from unorganized to organized market

- Focus shifting to end to end cold chain and not just storage

- Modernization of existing stores

- Better and more sophisticated machinery and equipment

- Setting up of multipurpose cold storages rather than conventional single commodity storage

- Modern pack houses

- Ripening Facilities

- Farm-gate or source point Cold storage

- Energy Efficient technology and new storage technology

- Integrated cargo complexes are being planned at major airports in India which will be equipped to handle all kinds of goods, including perishables.

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.