Firms where good will is significant part of Assets warrants for closer investigation since good will entries can be a playground for dubious management. As a thumb rule, it is advisable for an investor to understand how a management values an acquisition.

Questions for Goodwill accounting –

Q1. How did the management value the acquisition?

Q2. How much percentage is good will of the total assets of the target?

Q3. Did the acquirer firm revalue the targets assets and liabilities for fair valuation?

Note – If the assets are re-valued upwards then acquisition good will be less, which is good in general because good will is not amortised, it is tested fir impairment annually and dubious management can play around good will at will to cheat share holders.

The following article will discuss accounting entries related to good will.

Accounting for Goodwill

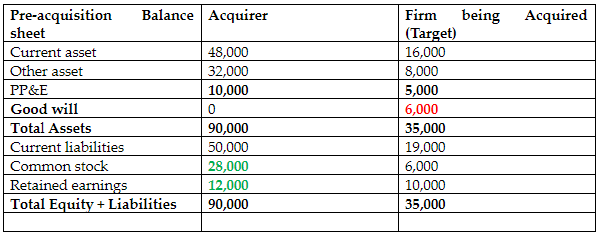

- During acquisition both entities continue to exist in parent-subsidiary relationship. When the percentage ownership is less than 100%, the parent prepares consolidated financial statement but reports the un owned (minority interest) on its balance sheet.

- In acquisition all of subsidiaries revenue, expenses, assets and liabilities are combined with the parent. Intercompany transactions are excluded.

- The equity of the firm being acquired is ignored on the balance sheet of the combined entity.

The non-controlling interest in the acquired firm is represented on the balance sheet in the equity side. The formula to calculate the minority interest or non-controlling interest is percentage of acquired firm not owned by the acquirer multiplied by the fair value of equity of the acquired firm (share capital+ retained earnings).

Re Valuation of the Assets & Liabilities of the Acquired Firm

Net assets value or Book Value (equity) of the acquired firm is 16,000 Rs (6,000+10,000).

Acquirer acquired 80% of the acquired firm for 8,000 Rs.

Let’s suppose fair value of the PP&E of the firm being acquired is 6,000 (5,000 +1,000).

All other assets and liabilities of the acquired firm are already fairly valued.

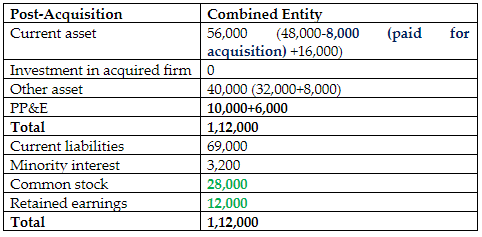

Post-acquisition, PP&E of the consolidated entity will be 10,000 + 6,000 (acquirer PP&E + fair value of PP&E of the firm being acquired)

Good will (6,000) in the acquired firm is completely ignored in the consolidated balance sheet post acquisition.

Re valued Net Asset Value (book value or equity) of the Acquired Firm (Target)

After revaluing PP&E and other assets and liabilities of the acquired firm, fair value of net asset value or equity is calculated as follows-

16,000 (current asset) +8,000 (other asset) + (5,000+1,000) (fair value of PP&E) – 19,000 (current liabilities) = 11,000.

Older Net asset value (book value or equity) of the acquired firm, 6,000 + 10,000 = 16,000 Rs.

Good will should not be high of the acquired firm. During acquisition, the good will of the acquired firm is completely ignored post which you re-evaluate the fair value of net assets of the acquired firm. You value PP&E, other assets and liabilities and arrive at new equity value for the acquired firm. If the good will of the acquired firm is a high percentage of total assets and if the purchase price falls short of the fair value of net assets then it is detrimental for the shareholders of the acquired firm.

Shareholders are better off in firms where good will is low in the acquired firms since it does not get amortised, it is evaluated for impairment annually.

Our acquired firm had a good will of 6,000, or 17% of all assets, which then got excluded post acquisition.

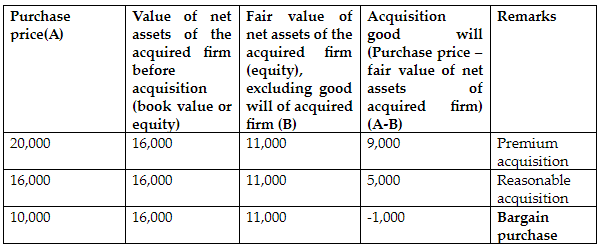

We can have 3 scenarios for the purchase price of the acquired firm–

- 20,000 Rs

- 16,000 Rs

- 10,000 Rs

Various Scenarios

Acquisition good will is recorded on the balance sheet of the combined entity.

In situation where the acquisition price is less than fair value of net assets acquired. Both IFRS and GAAP require that difference between fair value of net assets and purchase price be recognised as a gain in the income statement.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.