Despite real estate / land / home prices being on the softer side over the past 5 years, affordability has not gone up. Why is it so ? Predominantly due to 2 reasons.

- Incomes have grown at a lower rate & new employment creation is under pressure

- Land prices have not gone up, but they haven’t corrected as well.

General assumption of time correction in housing markets can be questioned since incomes are under pressure. Given this backdrop, can Indian housing demand & perhaps real estate markets revive soon? Housing is the growth engine of any economy as it fuels the entire ecosystem around it, is labour intensive & leads to a virtuous cycle. However, looking at the hard data points, it appears that India’s housing markets, at least in the urban pockets are going to take some more time to catch up.

While overall markets may take some time to catch up, there is a big opportunity here. Especially for builders who can do a faster buildout, execute the projects on time at attractive price points. Such projects are likely to be lapped up faster. Sales velocity can be higher for such projects since there is a huge supply side disruption. Many builders are stuck with legacy projects which were launched during the heydays of real estate boom and were priced in at sky high prices.

There is a huge unmet demand of housing for middle income households. If offered at a good price point & with timely execution, sales of such projects can fly of the shelf. This theme has the potential to throw many unlikely winners in the real estate space. Last mover advantage at play ?

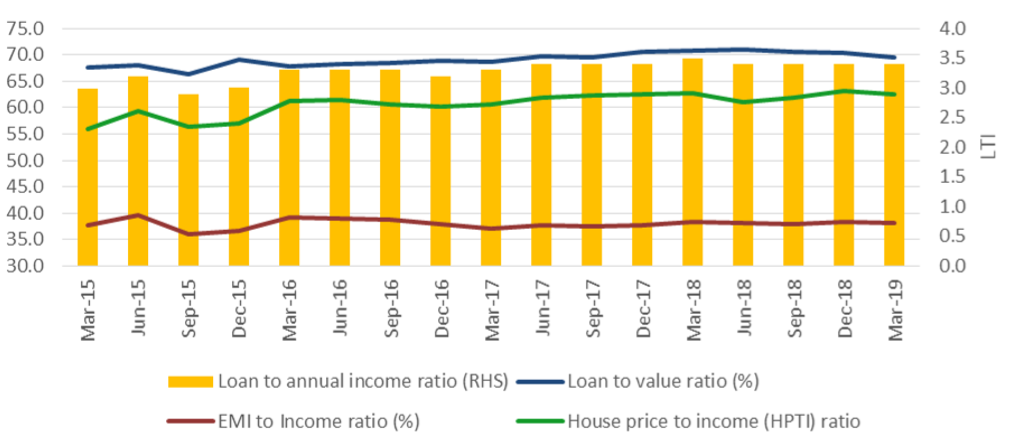

The following is data analysis on housing loans disbursed by banks and housing finance companies in top 13 cities across India. It covers various ratios which measure how affordability of real estate has changed from March 2015 to March 2019.

Median Ratios

Median Loan to Value (LTV) ratio:

It has increased from 67.7% to 69.6%, increasing the loan share given by financing companies. Housing Finance Companies have highest LTV ratio of 72.0%, whereas Foreign Banks have lowest LTV ratio of 62.9% as of March 2019. Interestingly, highest increase in LTV ratio has been for Foreign Banks from 48.0% to 62.9% since March 2015. June 2018 was peak for median LTV ratio on industry level at 71.1%. Foreign Banks are the only financing institutions who have continued to increase their LTV ratio post June 2018 as well.

Median EMI to Income (ETI) ratio:

Foreign banks have the lowest ETI ratio of 28.5% as of March 2019. Housing Finance Companies and Private Sector Banks have seen ETI ratio reduce since March 2015. Mumbai, Pune and Ahmedabad are the only 3 cities to have ETI ratio above 40%.

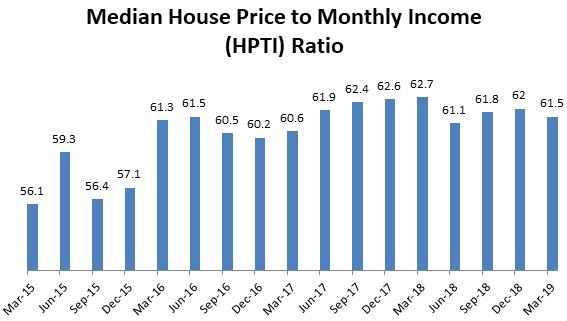

Median House Price to Income (HPTI) ratio:

The ratio has increased from 56.1x in March 2015 to 61.5x in March 2019. The affordability of housing has decreased, as the Job Creation in Corporate India has been slow. Mumbai has highest HTPI ratio of 74.4x as of March 2019.

Median Loan to Annual Income ratio:

It has increased from 3.0x to 3.4x, decreasing the affordability of homes. Every quarter, Mumbai has had highest Loan to Annual Income ratio amongst the 13 cities.

Further on What’s Happening With India’s Real Estate Markets and other major global cities can be understood from the summary of JLL’s Global Office Rental Clock.

Residential Asset Price Monitoring Survey by RBI

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.