Alpha Invesco’s annual client meet was conducted at Pune, on 18th August 2019. This was the 3rd year since we started this initiative. The idea is to interact with all our subscribers & partners, give our view on the present scenario, and find ways to improve our services with their feedback.

For clients who could not make it, we have published a webinar by our CIO, Chetan Phalke in the login section

Here are some of the key points that were discussed during the meeting.

Biggest Opportunities Are Born During Maximum Pessimism

Slowdown ! It seems to be the talk of the town today. Slowdown in few sectors is visible, but that doesn’t mean the entire economy is into a tailspin. Growth is shifting from southern & western parts of India to other parts. While discretionary consumption has slowed down, demand for basic goods is only going up. We must adjust our investment portfolio’s accordingly.

Global scenario, trade war might impact certain industries. Only 12% of India’s GDP is exports, but 55% of Sensex earnings are exposed to global markets. Impact will be limited to few segments of the economy. Indian stock markets are witnessing a polarized situation at this point of time & only few stocks are doing well.

Investors are disappointed with Modi governments first budget & are getting impatient. 1991 budget, which is considered to be the most reformist budget in the history of independent India saw corporate tax rates going up from 40% to 45%. Things are not as bad as they seem to be. Few tax related announcements, and lack of stimulus announcement have crowded out the good work done so far.

We think the narrative can change very quickly once the government responds with policy & regulatory measures.

Is This The Time To Panic Or Time To Review ?

We should be worried only if the investment hypothesis has gone wrong. And not just because the stock prices have fallen from the top. We are correcting the errors, re-adjusting allocations wherever it is required & navigating our subscribers through this downcycle.

Think in terms of switching wherever we have to rethink about stock selection or allocation.

Portfolio Losses Are Permanent Or Quotational ?

We believe our portfolio companies have the ability to survive current period of economic difficulty. Current drawdowns in stocks are quotational.

Dealing with lows is a part of investment journey. We discussed few examples from our own past experiences. i.e. KRBL went up from 30 rs to 54 rs & then fell all the way to 18 rs. Eventual exit was done above 500 rs. Similar things happened in other stocks like IFB industries.

Liquidity Crisis, Scarcity Of Capital Is Good In A Way !

Current liquidity crisis is good for well managed asset heavy businesses. Companies will start chasing cash flow. Look for companies that will survive & end up in becoming even bigger due to course correction & better balance sheet management.

Stocks, Hypothesis & Pain Points In Our Portfolio

Our CIO Chetan Phalke & research team colleagues Keval Shah, Zain Iqbal interacted with the subscribers & discussed all stocks in the portfolio.

We also discussed the pain points in the portfolio & how we intend to address it.

Start With Small Positions > Scale Up On Conviction > Load Up On Evidence

Portfolio Performance

This is not the first instance of large portfolio drawdowns. Our portfolio too has suffered in this fall. However, over the long term, outcomes have fared well for us & they will continue to work in our favor as long as our entry valuations and investment premise is sound.

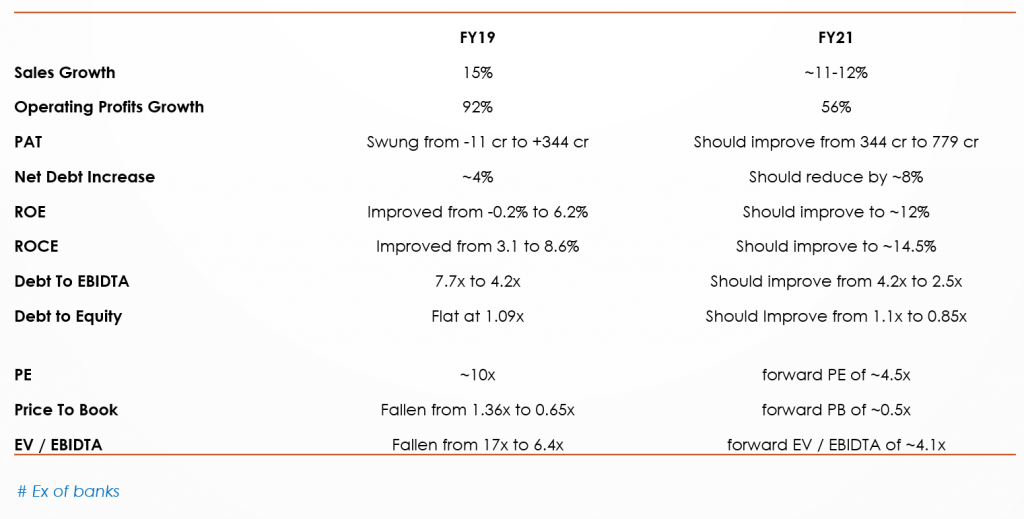

Our portfolio composition consists of turnarounds + companies with underpriced growth. We intend to add growth oriented themes as valuations are finally coming in our comfort zone.

# FY 21 numbers are indicative estimates

Looking at the present valuations & future prospects of our investee companies, we are very confident on the portfolio outcome over the next 8 quarters.

Areas That We Are Interested In

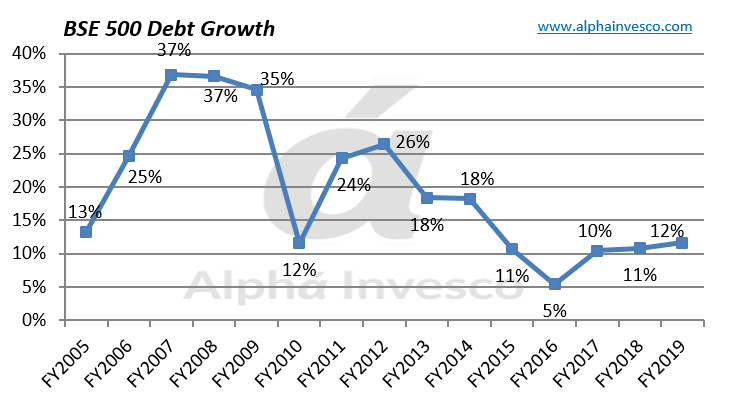

- FY 04 to FY 09 – saw a huge boom in manufacturing, core sectors led by global factors.

- FY 09 to FY 14 – witnessed a big capex cycle, spurious lending by banks, crony capitalism

- FY 14 to FY 19 – Consolidation, weaker players going bankrupt, capacity utilization inching up steadily

- FY 19 to FY 24 – Revival in core sector led by domestic demand ? what are the potential triggers?

Times have changed; India is going through a period of big adjustment due to regulatory framework such as GST & NCLT, coupled with increased tax compliance. We believe even if the credit growth in the listed companies does not mirror the growth rates of the past, a decent credit growth from here on will propel our economy into new orbits.

2014 to 2019 was a period where corporate balance sheets consolidated & we didn’t see much growth. After a long gap, we are likely to see revival of credit & capex cycle.

- Who is going to lend to corporates when the cycle revives & banking NPA’s are behind ?

- Who is going to put up a new brownfield / greenfield power & steel plants ?

- Who is going to benefit from the infrastructure, railway spends led by the government ?

- Who will do well when the growth shifts from western india to eastern parts of India ?

- Is the growth in old economy stocks priced in at todays valuations ?

- Even when the core economic recovery is in sight, how long will PSU’s continue to trade at bankruptcy valuations ?

Areas That We Are Not Interested In

- Crowded trades.

- Quality & growth at astronomical / historically high valuations.

- Done & dusted themes.

- Commodities trading at FMCG valuations

Q n A

We had a detailed question & answer session post the presentation by our CIO, Chetan Phalke.

Clients were concerned about the impact of slowdown, drawdowns in the portfolio & how to adjust allocations after the recent correction. Some clients were interested in knowing if this is the time to go aggressive & increase the commitment in certain stocks.

Also, we discussed few other topics like disruption in the media space, hyper competition in telecom, current state of slowdown in the automobile industry, power & utility sector etc.

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-25886699, 020-48931507

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.