Alpha Invesco Research – Annual Letter 2017-18

Dear Partner,

2018 is turning out to be an eventful year for Indian equities. After witnessing peak buying frenzy during December 2017-January 2018, we are now seeing the pendulum swing on the other side. As I write this, there is a huge turmoil in most of the small & midcap stocks. These are indeed challenging times for equity investors. Ability to remain calm in the middle of this chaos shall separate men from the boys. Such falls will test our conviction in the ideas we hold and reinforce the importance of buying stocks at reasonable valuations.

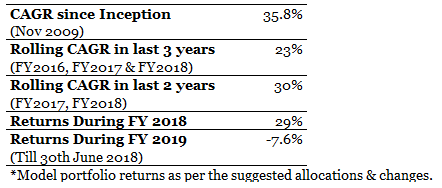

Performance & Portfolio Changes In 2018

During FY 18, we added just 1 new stock idea in September 2017 & exited 4 stocks in August 2017. ( Mirza International, Wim Plast, Talwalkars & Take Solutions )

In the last 24 months we added 4 new stocks, while exited 8 stocks.

For FY 19, we have added 2 new stocks during April & May 2018. There are 7 active recommendations at this point. 2 are below 1000 crore market cap while remaining 5 are above 4000 crore market cap. We continue to follow concentrated investment approach, with top 2 ideas being at 20% allocation each. The approach is to not to have more than 10 stock ideas at any point of time. If we like 11th idea, then something from the top 10 has to go out of the portfolio.

Exits

We exited from 4 stocks during FY 2018.

Mirza International was trading at a market cap of almost ~1900 crores ( 150-160 rs ) in the first half of FY18. The valuations were too high for a business that had two thirds of its revenue coming from B2B business. The management wants to grow the branded piece quite aggressively & is going for a huge expansion plan with 150+ stores already up & running. This is a highly competitive segment with extended periods of discounts & sale offers. One bad season & there could be huge inventory pile up. We would rather prefer to let the business scale up to a certain level, see the sustainability of such high growth & then take a fresh view. Or we might re-consider if the stock is available at dirt cheap valuations where we can leave some room for uncertainty over the quality of growth.

We exited Wim Plast purely on the valuation concerns. At a market cap of ~1800 crores ( 1400-1500 rs ), the stock was trading at 5x sales, 35x PE multiple with slowing revenue growth numbers. A company with a revenue of ~350 crores operating in a molded furniture segment certainly didn’t deserve these valuations.

Talwalkars ( 300-320 rs ) & Take Solutions ( 150-170 rs ) exit was based on their lack of cash generation and some questionable financial engineering by the management. There were several red flags in the balance sheet due to which we exited both the stocks during August 2017.

Struggle To Find New Ideas, Our Approach & Mistakes

We were struggling throughout last 2 years to find new investible ideas that we understand & are within our circle of competence. At a very fundamental level, I am not wired to pay up & buy stocks at high valuations. Maybe mainly because Alpha Invesco began its journey in 2009, when everything was available at dirt cheap prices. I believe every individual investors investment philosophy is largely influenced by their return expectations & at what time they started their respective investment journey. Back then it was a relatively easy environment to pick stocks. Even average stock pickers did well in those days, provided they had an above average temperament to buy & hold on to the stocks. Our initial gains came not because of our stock picking skills, but mainly because of extraordinarily cheap entry valuations. The temperament to hold on to stocks combined with strokes of luck played big role as well. The environment has changed significantly after 2016. Most of the pockets are overvalued & do not fit into the traditional ‘buy cheap’ criteria. We passed on many investible ideas as a result. Overvalued pockets became even more fancied in 2016 / 2017, and we just kept on watching from the sidelines. As a result, we haven’t benefited significantly from the midcap mania of last 2 years. This has been one of the most challenging period for us. It has forced us to sharpen the stock picking skills & made us realize on how much we don’t know !

Our approach has evolved from pure growth seekers to value + growth over the last few years. We continue to prefer stocks where there is large undervaluation, and the business already has a substantial revenue base, widespread distribution network / reach, installed manufacturing capabilities along with leadership position in their respective segments. A combination of suppressed ROE’s + very high entry barriers is another area where we continue to look for opportunities. These pockets are usually overlooked due to their unattractive historical ROCE / ROE profiles, or historic capital mis-allocation mistakes by the management.

These companies can improve profitability by correcting their cost structures & leveraging existing capabilities. Such businesses, if operating in a sector where there is a long growth highway, can have sustainable & predictable growth over a period of time. Sometimes capital mis-allocation in a structural growth trend can present an attractive opportunity & is often ignored by the main street. In such scenario’s, the managements get enough time to do course correction, avoid historical mistakes & get their act right. When these companies start delivering the numbers, re-rating is swift due to earnings visibility & entry barriers. A combination of earnings + re-rating drives the shareholder value creation & is worth the wait. This approach has certainly saved us from making big blunders & entering stocks at high valuations.

We realize that we paid too much attention to cheapness of the stock & gave less weightage to other aspects. We ended up owning quite a few mediocre names in our portfolio. It was a major mistake. Now we pay equal attention to the quality of growth, business sustainability & visibility, entry barriers, unit level economics, accounting / forensics & balance sheet survival capabilities along with attractive valuations.

The Midcap Meltdown

Over the last 3 years, across the board PE re-rating drove stock prices to sky high valuations. Commodity plays with short lived gains were given obscenely high multiples. At the same time many growth stories were overdone. India is a country within a country, almost like a continent in itself. So many different cultures & geographies result in different consumption as well as government spending patterns. There are multiple factors at play & companies face a lot of challenges in scaling up. Every region will have a dominant brand or a player in a particular segment. Consumption patterns vary depending on the regional per capita incomes, state government spending etc. It is difficult for a new entrant to break in & succeed on a different pitch. As a result, the death rates are very high among smaller companies. And the ones who survive may witness tapering growth rates after reaching a certain scale. Very few outliers succeed in penetrating multiple regions, build a successful franchise and post multiyear growth periods.

Over the last decade most businesses grew on a very small base. These high growth rates were further extrapolated into future. Their stocks were given higher multiples on top of it. Once the low base effect got over, the expected growth in most midcaps was just not coming in since last couple of years or so, however the valuations still remained expensive. The re-rating sustained in the hope of good days coming back. Finally, this double counting of high growth rates & high multiple is getting corrected and we are seeing a sizeable correction across the board. The stocks were priced to perfection & there was just no room for error. Chasing growth momentum at any price has simply not worked out.

2017-18 also saw unorganized to organized theme as one of the biggest consensus trade in the aftermath of GST & Demonetization. For most of the analysts, anything that is not listed is unorganized ! This so called unorganized sector is now coming into the mainstream. With better technologies, marketing strategies and access to capital, the unorganized / regional incumbents are making a strong comeback & giving a tough fight to the organized players from listed universe.

General Elections 2019

As we move in to the second half of 2018, we are likely to hear all sorts of noise on general elections that are due in May 2019. Everybody on the street will have their own seat projections for the BJP & Congress led mahagathbandhan. But before you spend your time & mental bandwidth on all these discussions, just take a look at what has happened in the past. Which political analyst predicted that Modi will win 282 seats in 2014 ? Which media house predicted Yogi Adityanath’s 320+ seat victory in UP ? Did anyone ever think that Nitish Kumar would join NDA again ? Did anyone predict Congress win in 2009 elections, which were held within 8 months after the Mumbai terrorist attacks ? Which political pundit anticipated Vajpayee’s defeat in 2004 ?

Even if you look at US elections, not a single poll predicted Donald Trump’s win!

The point is, nobody really knows ! Period. Just stick to the basics & pay attention to what you are buying, why you are buying & what valuations are you paying.

Macro’s, Rupee, Oil, Dollar etc.

“If you have spent more than 13 minutes analyzing economic & market forecasts, you’ve wasted 10 minutes.” – Peter Lynch

In 2013, the analyst community wrote an obituary to the Indian economy & stocks when rupee touched around 69-70 odd levels on the back of deteriorating fiscal situation. Rupee stabilized & bounced back sharply in the following months !

Not so long ago, demonetization happened out of nowhere. Which economic forecasting model anticipated demonetization? And the funny part was, investor community even started analyzing the effects of de-monetization when managements themselves were not sure of its impact on their businesses. Despite all dooms day predictions, the economy bounced back far quickly than anticipated. The problem with our field is, everybody simply extrapolates the data without factoring in any political / government / market forces intervention.

Nobody has any clue, yet forecasters take a shot at predicting macro’s. Look at the forecasting track record of all leading global / Indian economists and you’ll know. Macro’s are definitely important & they do matter a lot. Certain macro & political events can change the course of global economics in a snapshot. However, it is very difficult to arrive at a conclusion & have some actionables based on the available data. The world will always remain uncertain & as investors we must take it into stride and move on. If we wait for clarity on macro fronts, we will always remain jittery. There are many investors who have made tons of money based on their ability to get the macro call right. However we do not have that ability & rely heavily on bottom up approach.

At Alpha Invesco, we do not have any view on the short-medium term macro’s or political events. We do not know how things will pan out on these fronts. We don’t even know how the markets will behave in FY19-20. We are as clueless as an average joe on the street. But what we do know is that Indian GDP will continue to grow at 6-7%+ growth rates, our per capita incomes will cross 2000 US$ soon, the purchasing power is slowly moving up, government’s ability to spend is going up as their budget size grows in absolute terms and so on.

It may not sound very intelligent. After all financial analysts are supposed to have a view on everything! But we will stick to the basics and instead focus on identifying stocks with good margin of safety & reasonable return potential. Keeping things simple works most of the times.

Pockets Of Opportunities

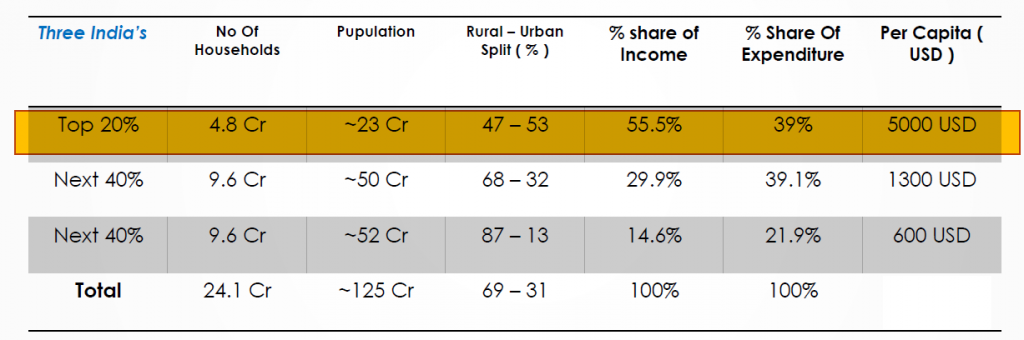

Top 20% of our population has 76% of the surplus ! The middle 40% has the remaining 24%, while the bottom quartile which is almost 40% of the population has 0 surplus ! Yes, 0! These people were never in the consumption pool. The numbers are not going to change overnight. It will be a slow but directional change. In India changes tend to be incremental & not transformational. As investors, there are multiple ways to play this change.

We must not underestimate the power of companies with huge distribution network & reach. Or companies that have great sourcing capabilities. As the business size reaches critical mass, margins of many of these businesses can go through the roof.

We are just listing down few area’s which look interesting & merit further study provided the valuations are in favor. These are some frameworks around which one can build a bank of high potential ideas. Off course, we must then short list companies with ability to generate healthy cash & to earn a respectable return on incremental capital employed.

- Drip irrigation penetration is going up. As drip reaches critical mass, the adaption of fertigation / liquid fertilizers can accelerate. Usage of liquid fertilizers is in very early stages as on date & yet to pick up.

- Farm productivity is going up on the back of mechanization, usage of better fertilizers, techniques etc. Supply of food articles will grow disproportionately. Which will control food inflation. However more & more food needs to get processed over a period of time to increase rural incomes. India is not even processing 2% of its farm output. Plays around food processing can really grow significantly. Food processers, refrigeration, cold chain logistics & transport etc.

- As rural income’s move up, the households are most likely to upgrade their homes before upgrading anything else. Rural home upgradation is a big theme.

- Non PCA PSU banks look interesting. They have huge customer base & presence across India that can be leveraged. Pre-provisioning operating profits are stable or improving in some cases. Need to figure out how close we are towards the peak provisioning.

- Large scale migration & emergence of new urban centers, economic corridors is inevitable if India has to grow at 7-8% plus rates. Rise of MSME’s as a percentage of GDP can go up many folds. Scheme’s like MUDRA have the potential to grow individual enterprises like bamboo shoots! SME lending can be a major opportunity for select banks & NBFC’s.

- Electronic goods manufacturing is a multi-decade opportunity in front of us.

- 8 out of 10 households have a child in their homes. India is a country which is obsessive about their children. There could be very lucrative opportunities in related consumption themes.

- More & more women are coming out to work, are getting financially independent. We can see the change in rural areas as well. We might have interesting opportunities around women consumption. Hygiene & cosmetics products, women’s apparels ?

- India can not afford to become a net importer of steel. 10 mt of net import adds 50000 crores to our import bill. A 90 mt consumption market can not become a 200 mt market on the back of imports despite having the resources i.e. land, labour, iron ore & huge domestic market. Plays around a decade long steel capex cycle look interesting.

- Companies that are selling their products in international markets / have foreign partners and can potentially sell the very same product in India as the population starts affording it.

- Urban & aspirational products which are reaching rural area’s due to ecommerce distribution + technology & smartphones. Aspirational products that rural / semi urban can afford to consume today.

- As number of cars consumed reached critical mass, the market for second hand cars + maintenance & repair + refurbishing can go up exponentially. Plays around extending cars shelf life. Auto ancillaries with focus on after market share ?

And so on….

Despite its limitations and political compulsions, India’s vast & complex economy offers many opportunities to investors. Our economy is not ready to open at one go & go full throttle on capitalism. We are still evolving. Old institutions i.e. government offices, PSU’s are often criticized for their inefficiency, bureaucracy. However, we must not forget that the very same institutions provide stability & have prepared a solid base for future growth. Allowing competition & free markets to grow at a gradual pace will increase the preparedness of the economy. Also, as industry becomes modern & efficient, it tends to spill over into the government functioning as well. People demand same efficiency from government offices / enterprises. From a valuations standpoint, a lot of PSU names are extremely attractive. Many of these companies are monopolies / leaders in their segment with good balance sheets. Investors must take a serious look at this pocket.

This is a good time to run screeners, shortlist investment worthy candidates and keep the work ready for the potential fresh deployment or even switching opportunities that may come our way. Let the main street continue to discuss macros & political uncertainties.

Chetan Phalke

Alpha Invesco Research, July 2018

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.