BSE 500 companies account for 85% of Sales, 93% of Total Assets and 95% of the Total Market Cap of all the listed companies in India. Hence, BSE 500 forms a very good proxy to the listed universe of Indian Stock Market. In the below article, we have analysed the Employee Cost and Employee Count data of the BSE 500 companies since 2014 and noted down some observations.

Key point to remember for the below analysis is –

- BSE 500 compositions are as of September 2019 quarter. The index composition would vary a lot over last 5 years, however the latest composition includes companies who would have performed really good over last 5 years and hence now they are part of the index.

- Employee count – As per reported by the annual reports of companies & ACE equity database. Apart from official employee count, almost all companies have temporary staff / contract labours. That makes it more of a representative analysis, which gives a broad sense of what is happening on the hiring & wages front.

- Employee Cost is in Rs. Crore.

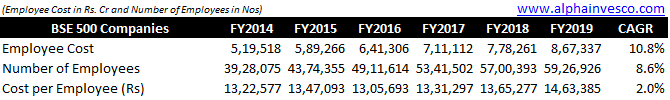

Employee Cost and Employee Count data for BSE 500 Companies

BSE 500 companies have added 2 million employees since 2014. However, Employee Cost per Employee has grown by only 2% CAGR over the period.

The actual number of employees working in BSE 500 companies would be well above 6 million, as some companies’ employee count data is not available and hence is not being added in the table below. Also, the employee count excludes the contract workers / labourers.

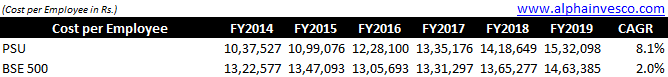

Employee Cost and Employee Count data for PSU Companies

Cost per Employee for PSU companies has grown at much higher rate of 8.1% and is more than the BSE 500 average in FY 2019, which used to be lesser than BSE 500 average in FY 2014.

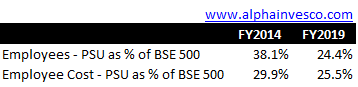

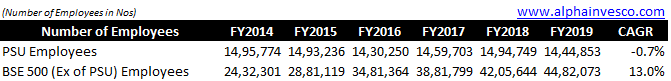

PSU Employee Count Is Down Over The Last 5 Years

PSU’s have actually reduced ~50,000 employees in last 5 years.

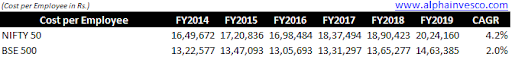

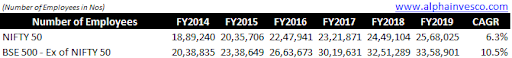

Employee Cost and Employee Count data for NIFTY 50 Companies

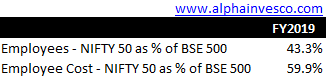

NIFTY 50 companies spend more on their employees than BSE 500 average, and the number is growing further.

NIFTY 50 companies account for 60% of the Employee Cost of BSE 500 total Employee Cost. However, NIFTY 50 companies account for only ~43% of the Employee Count of BSE 500.

The job creation of BSE 500 (ex of NIFTY 50 companies) is at quicker rate compared to NIFTY 50 companies.

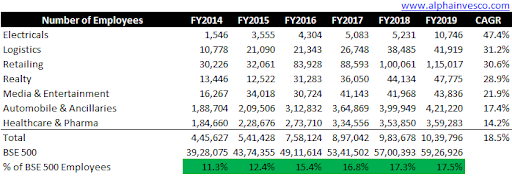

Fastest Job Creating Sectors & Industries

The fastest job creating industries in India over last 5 years are diverse, namely Electricals, Logistics, Retailing, Realty, Media & Entertainment, Automobile & Ancillaries and Healthcare & Pharma. These industries have seen their share of employee count in BSE 500 increase from 11% to 18% since 2014.

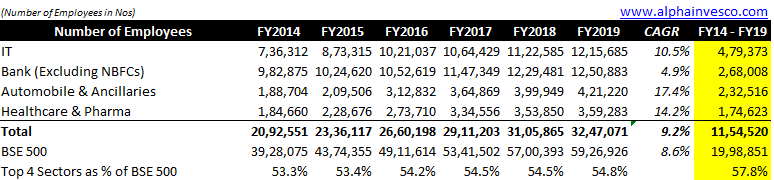

58% Of Incremental Job Creation Led By 4 Sectors

4 sectors i.e. IT, Bank (Excluding NBFCs), Auto & Ancillaries and Healthcare & Pharma have created 58% of the new jobs in last 5 years. They have created 1.1 million jobs out of 2 million jobs created by BSE 500 companies.

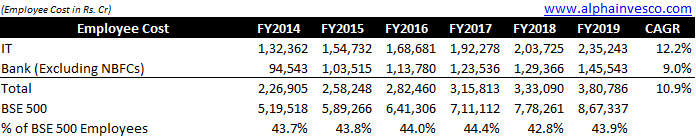

IT & Banks (Excluding NBFCs) account for 43% of Employee Cost of all BSE 500 companies

IT & Banks (Excluding NBFCs) employ 41.6% of BSE 500 employees, and their employee cost is 43.9% of BSE 500 total employee cost.

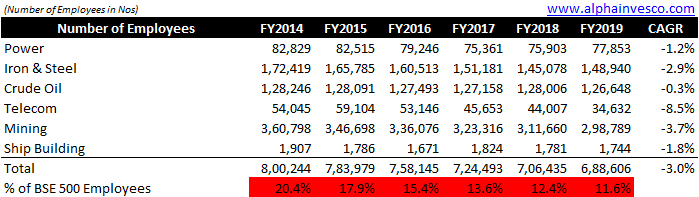

Industries & Sectors with Lacklustre & Declining Job Growth

Weak job creation can be seen in the following industries of Power, Iron & Steel, Crude Oil, Telecom, Mining and Ship Building. These industries have literally halved from 20% to 11% (their share in BSE 500 employees) in employee count during 2014 to 2019. Most of these are old economy / capital intensive sectors.

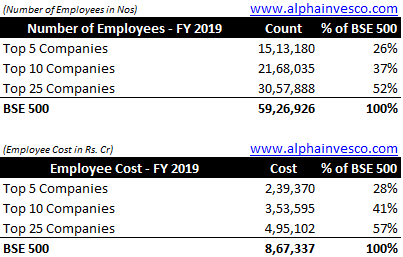

Top 25 Companies Employ 52% of Total BSE 500 Employees

Concentration of Employees in top BSE 500 companies is very high. Top 5 companies employ 1/4th of the employees and top 25 companies employ half of the employees.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.