Disclaimer: The Blog on Indian Banking Sector is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. The intention to share write ups on this blog is to create a repository of ideas so that investors can have a look at various frameworks & approaches. Please read the detailed disclaimer at the bottom of the post.

Sweden Banking Crisis Of The 1990s.

This blog is in continuation to our blog series on Banking Sector. We all know about the financial crisis of 2008, but very few of us are aware of the banking crisis of Sweden of 1990s. Sweden faced biggest economic crisis post World War II in the early 1990s, and banks were at the centre of the crisis. Many years of regulated low interest rates had resulted in considerable overinvestment in Sweden, which led to asset bubble. This article focuses on the causes of the crisis, its effects on the Swedish economy and how Sweden effectively came out of the crisis.

Pre Crisis Period

Prior to the crisis of the 1990s, Sweden was known as a rich welfare state, immune to the high unemployment that plagued many Western European economies since the 1970s. However, this was the outcome of capital account regulations which isolated the country from the rest of the world.

In the mid-1980s, Sweden’s financial system underwent major deregulation, which made Sweden financially integrated with world financial markets. This deregulation was the main impulse behind a strong boom-bust cycle for Sweden.

The Boom Period (1985 – 1990)

The strong political position of the labor unions led to employment emerging out as major policy goal. Hence, prior to the crisis of the 1990s, Sweden was known as a rich welfare state, immune to the high unemployment that plagued many Western European economies since the 1970s.

After the 1985 election, Swedish central bank ‘Riksbank’ abolished the quantitative controls on lending by commercial banks. This was the 1st move towards the build-up of the crisis. Historically, the households and the companies were restricted in their choice of portfolios due to the regulations introduced in the 1950s. The tax system favoured borrowings and prevailing inflation and expectation of further high inflation compounded these portfolio imbalances. The commercial banks faced more aggressive competition for market share, to which they adjusted by expanding credit.

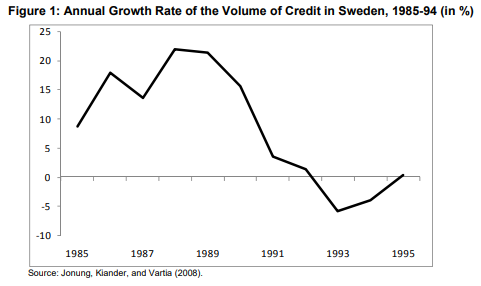

The outcome of these incentives led to rapid debt growth between 1986 and 1988. We can see the Annual Growth Rate of the Volume of Credit in Sweden during 1985-94 period.

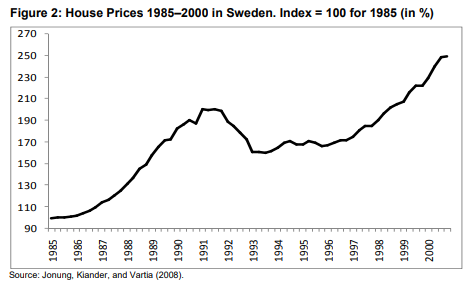

A large portion of this new credit was channelled into property and share markets. This led to rapid increase in house prices. This rise in assets was further used as collateral for additional borrowing!

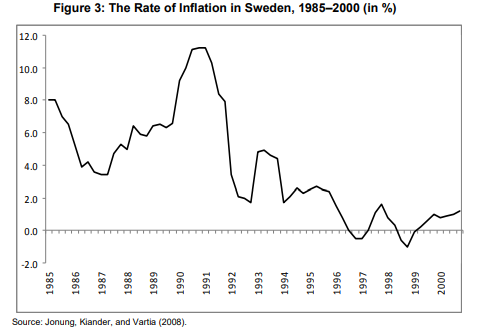

This process was fuelled by rising rate in inflation. Inflation expectations followed the rise in the inflation rate, which peaked in 1990.

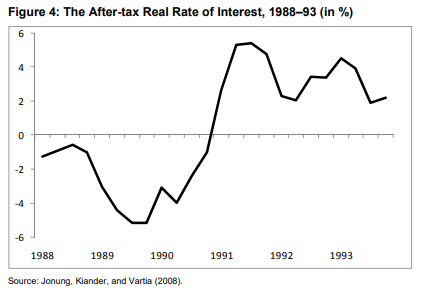

This very high inflation rate led to real after-tax interest rates turning negative.

This negative interest rates made it tempting for taking on additional loans for investments and consumption. This resulted in creation of a credit bubble in the economy. Consumption led to overheating of the economy, with households consuming more than their disposable income. Government tax earnings also witnessed sharp growth during the boom period as the consumption and income growth led to higher tax revenues for the government.

The rise is real assets led to further growth in construction sector and hence the labour market saw strong demand. The unemployment rate went to as low as 2% in the end of the 1980s. Due to this rapid domestic expansion, exports declined while imports soared, which further led to worsening of the current account.

This expansionary impulse was not countered by any contractionary policy until 1989 – 1991.

The Bust and Crisis of 1991–93

Rise of Interest Rates :

Sweden introduced a major tax reform in 1990 – 91, known as the ‘the tax reform of the century’, which favoured savings and worsened the conditions for loan-financed investments. Also, their capital account controls were abolished in 1989, prompting an outflow of capital from Sweden. Additionally, international factors also forced Swedish interest rates upwards. Reunification of Germany led to raising of German and hence European interest rates, and hence to defend the krona rate, the Riksbank had to raise interest rates in Sweden by more than rates in the rest of Europe.

The Bust :

This increase in interest rates led to decline in the price of assets. This led to reduction in wealth as these assets were financed by loans whose nominal value remained unchanged. This led to increase in number of bankruptcies.

Households adjusted their portfolios by reducing consumption and by increasing savings. The savings ratio rose from a negative level at the end of the 1980s to ~8% in 1993. This change in private savings was a significant feature of the crisis. Unemployment rate also had increased from ~2% to ~8%.

The domestic situation undermined the credibility of the pegged krona rate. The authorities were trapped in a situation where external conditions (the currency crisis) required contractionary measures, while domestic considerations (the banking crisis) demanded an expansionary policy. The more the Riksbank tried to defend the pegged krona rate by raising interest rates, the deeper the domestic crisis became.

The Recovery

Taking Control Over Banks :

In September 1992, the Swedish government intervened to prevent a major financial collapse by announcing a blanket guarantee for the liabilities of the banking system. A bank support authority was set up a few months later, and two banks, Nordbanken and Gotabanken, ended up under government control.

Attempt Of Taking Control Over The Krona :

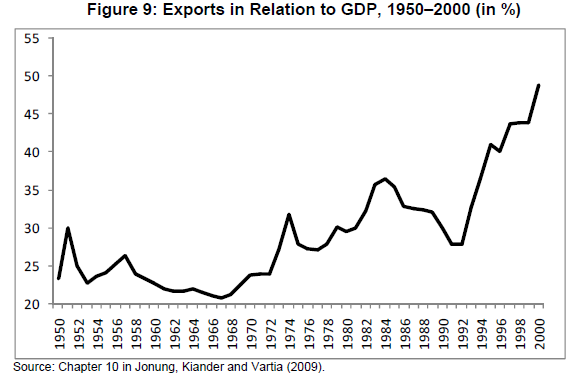

The Riksbank defended the krona by significantly raising its overnight rates. For a very short period, the marginal interest rate (the overnight rate) was 500%! However, government’s defence for Krona couldn’t last longer and it came under massive speculative attack. Finally, a floating exchange rate was introduced, which led to depreciation of the Krona. However, this marked the end of the crisis and the beginning of the recovery of the Swedish economy. The depreciation of the Krona helped Sweden increase its exports. Exports accounted for 28% of GDP in 1992, which increased to 45% of GDP by year 2000! Other factors that helped the exports improve were wage moderation, productivity improvement, and Sweden’s entry into the European Union in 1995.

Setting of Inflation Rate :

The fall of Krona in November 1992 meant the end of pegged exchange rate for Krona and allowed the Riksbank to move towards lower interest rates. The Riksbank set the target inflation rate at 2% (+/- 1%). We can see in the above Inflation Rate chart how the Swedish inflation rate declined suggesting the credibility gained by the new monetary policy regime.

Cuts in Government Expenditures :

The crisis had led to huge fiscal deficits. The newly elected government in 1994 decided to implement large cuts in government expenditures and increased taxes. This led to rapid decline in deficit as a share of GDP and government debt to GDP ratio.

The Swedish Bank Resolution Model

In the beginning of the crisis period, the government was adopting ad hoc basis solutions. But as the crisis became severe, the government took systematic steps to maintain the stability of the Swedish financial system.

Blanket Guarantee of Bank Liabilities :

Swedish banks were heavily dependent on foreign financing. To make sure this funding doesn’t dry up, the Swedish government made a press release in September 1992 that the depositors as well as other counterparties of Swedish commercial banks and Swedish financial institutions in which the State was involved were to be fully protected from any future losses on their claims. This guarantee helped in gaining the foreigner’s confidence in the solvency of the Swedish commercial banks. This blanket guarantee helped the Riksbank to support commercial banks including those on the brink of insolvency, regardless of their financial position.

Political Unity :

There was political unity amongst the ruling and the opposition parties, which also helped in the Blanket Guarantee to become a success. The leadership of both the political parties knew that behind the crisis lay a legacy of policy measures taken by both the parties when in power. This political unity helped in passing resolutions timely through the parliament.

Open-ended Funding :

The Bankstödsnämnd, a Bank Support Authority was established, which was to be given open-ended funding, instead of a fixed predetermined budget. This step was taken to avoid the risk of the Bankstödsnämnd being forced to go back to the Riksdag to ask for additional funding at a later stage. The Bankstödsnämnd was set up as an independent agency at a distance from the government, the Riksbank and the Finansinspektion (the financial supervisory authority). This helped to improve the credibility of the bank resolution policy.

Full Information Disclosure :

Banks that turned to the Bankstödsnämnd with requests for support were obliged to give full disclosure of all their financial positions, opening their books completely to scrutiny.

Saving of Banks, and Not the Owners of the Bank :

The owners of the stressed banks were forced to absorb losses. This helped the taxpayers feel that the policy was fair and just as their money was being utilised for saving the stressed banks.

The stressed banks were divided into three categories depending on their intensity of stress levels. Each of these three categories was treated differently by the Bankstödsnämnd. Two bank asset management corporations (AMC) were set up to manage the Non-Performing Assets. In the long run, i.e., about 10–15 years, the two bank AMCs proved to be successful in the sense that the fiscal cost of supporting the financial system was roughly balanced by the revenues received through the liquidation of the asset holdings of the bank AMCs.

Role of Macroeconomic Policies :

The monetary and fiscal policies played very important roles in helping the system recover fairly rapidly. Once the krona was floating, monetary policy was able to focus on domestic conditions. The Riksbank gradually lowered interest rates. The vicious circle of falling asset prices was halted. The fall in interest rates eased the pressure on the banking system, as the economy started to recover. In terms of Fiscal policies, the government’s bank support policy contributed to the rise of the deficit.

Conclusion

Overall, the Swedish bank resolution policy is regarded successful. Some of the reasons being:

-

- Banking system functioned smoothly during the crisis period

-

- There were no bank runs

-

- Rare situations of credit crunch

-

- Process was swift enough

-

- Tax Payers money was well utilized, infact a gain for the government in the long run

- No international organizations like the IMF were involved

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.