Disclaimer: The Blog on ‘Coal India’ is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. The intention to share write ups on this blog is to create a repository of ideas so that investors can have a look at various frameworks & approaches. Please read the detailed disclaimer at the bottom of the post.

Introduction – Coal India

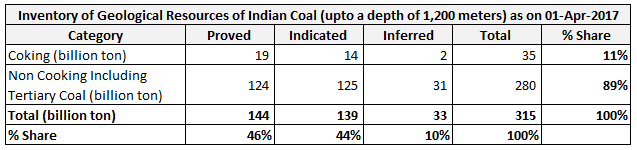

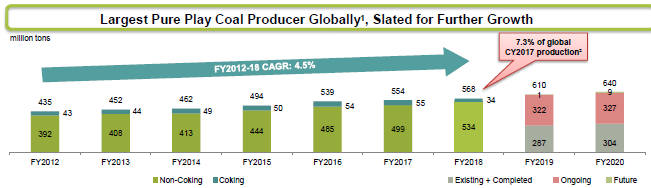

Coal India is the largest coal manufacturer in the world with total production of 567 MT in FY2018. Coal India produces 84% of the coal produced in India with a market share of 60% to 65%. The estimated geological resource of India coal stood at ~315 Billion tons as of 1st April 2017. Coal India has total coal reserves of ~88.4 Billion tons (68.6 BT resources + 19.8 BT reserves) as of 1st April 2013. Coal India operates 369 mines via 8 coal producing subsidiaries.

Coal Demand In India :

As per the “Coal Vision 2030” –

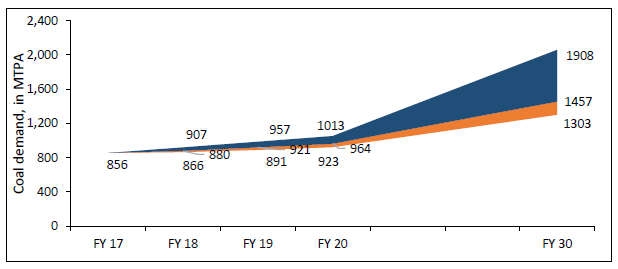

- The Indian coal demand shall continue to grow atleast until 2030. The expected demand is expected to grow at a lower CAGR of ~3%, compared to ~6% in last five years.

- Overall coal demand is estimated to be 900–1,000MTPA by 2020 and 1,300–1,900MTPA by 2030.

- By 2030, of the overall coal demand, thermal coal demand is estimated to be 1,150–1,750MTPA and the balance is coking coal demand.

- While this appears to be a very wide range, the nature of uncertainties in the ecosystem are also quite wide.

- The upper end of the spectrum of the coal demand corresponds to a GDP growth rate of 8 per cent. The lower end of the spectrum of the coal demand corresponds to an energy efficient scenario.

Coal India Operations (Annual Report 2017-18 / Company Filings) :

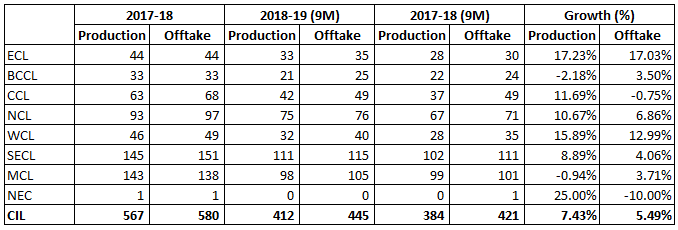

- In FY18 Coal India produced 567 MT & sold 580 MT of Coal –

- CIL expects to produce 610 MT and 640 MT in FY19 & FY20

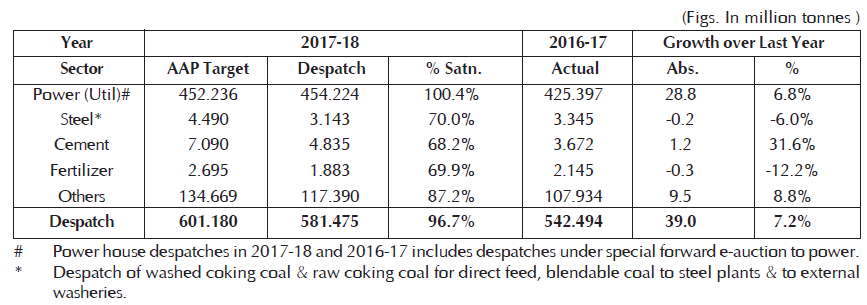

- Sector wise coal dispatch of coal & coal products

- In FY18, out of 567 MT (vs. 554 MT in FY17) of coal produced, 30 MT (vs. 31 MT in FY17) was produced from underground mining. Whereas, 537 MT (vs. 523 MT in FY17) of coal was produced via Opencast mining

- Presently CIL is operating 15 Coal washeries with total coal washing capacity of 36.8 MTY, of which 11 are coking and the rest are non-coking with capacity of 20.58 & 16.22 MTY respectively. The total washed coal production from these existing washeries for FY18 was 12.45 MT

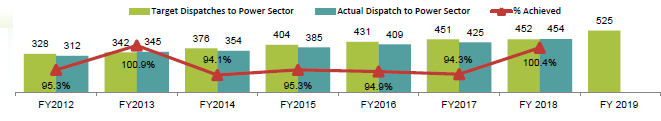

- Coal India is focused to meet the targeted dispatch to power sector (CIL Presentation – dated 14th July 2018)

- In FY18, Coal India commissioned two long pending major rail infrastructure projects, Tori-Balumath section & Jharsuguda-Barpali-Dardega section which were built on coal deposit basin and are now operational

- In the light of Paris Protocol and consequent upon changes in world energy sector scenario, CIL is looking forward to diversifying its operations towards Renewable energy like Solar Power and Clean Energy sources like CMM, CBM, CTL, UCG etc following the directives of GoI.

- Further with commercial mining opening to private players & RE target of 175 GW by 2022 could lead slower volume growth for CIL

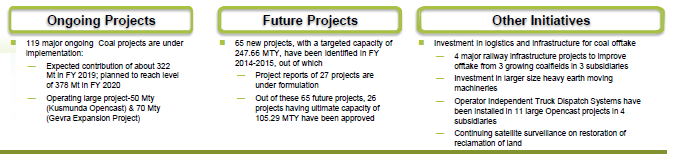

Ongoing & Future Projects:

- 11 coal blocks have been allotted together to ECL, BCCL, CCL & WCL. These new blocks will help company’s subsidiaries to produce more than 100 MT of coal per annum in near future

- 4 coal mining projects with an ultimate capacity of 24.60 MTY and total capital investment of Rs 4155.46 crs was approved by the board in FY18

- CIL has also planned to set up 18 new Washeries with state-of-the-art technologies in the field of coal beneficiation with an aggregate throughput capacity of 95.6 MTY

- Out of these washeries, 9 are planned to wash coking coal with a cumulative capacity of 28.10 MTY, and the other 9 are being set up to wash non-coking coal with an aggregate capacity of 67.5 MTY

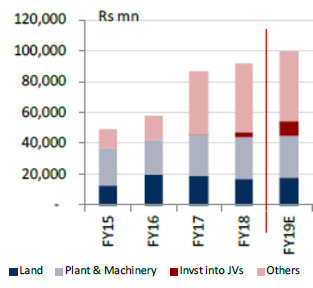

Coal India Capex:

- The capital expenditure for the year 2018-19 has been set at Rs 9,500 crores.

- Capex is being incurred for plant & machinery, land acquisition, mining infrastructure, railway sidings and so on.

- More land is needed to scale up production, while more plant, equipment & machinery are needed for increasing output at a time when the manpower is declining.

- Some amount of expenditure is also in the form of investment in JV projects related to the rail lines, power/fertilizer JVs, the solar project etc.

- CIL is also planning to be self-reliant in terms of coal dispatches. CIL plans to own ~1,500 to 1,600 rakes in upcoming 7 years by spending ~Rs 20,000 crores

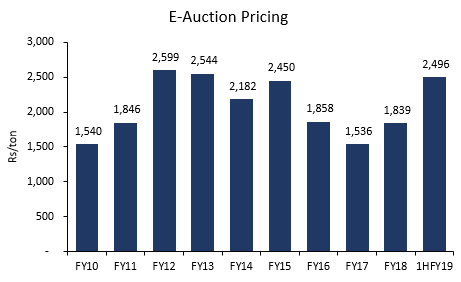

Coal India Pricing :

- India’s declared a price hike in January which can be seen in the 1H FY19 realisations. However, CIL pricing methodology has no profit maximisation motive.

- CIL coal price has been at a significant discount compared to imported coal prices. Although CIL is able to increase prices, it will not do unless there is a need to cover cost.

- CIL has taken a total of 9 prices hikes in the last 18 years for linkage consumers mainly to offset cost inflation.

- Recently e-auction prices have seen a significant uptick, but the volume of e-auction coal is very low.

- E-auction booked volumes for FY16, FY17 & FY18 were 15.3 MT, 59.4 MT & 40.7 MT.

- While revising the prices of coal, CIL considers its impact on overall economy particularly the impact on Power Sector is worked out separately and it is ensured that the impact is minimum.

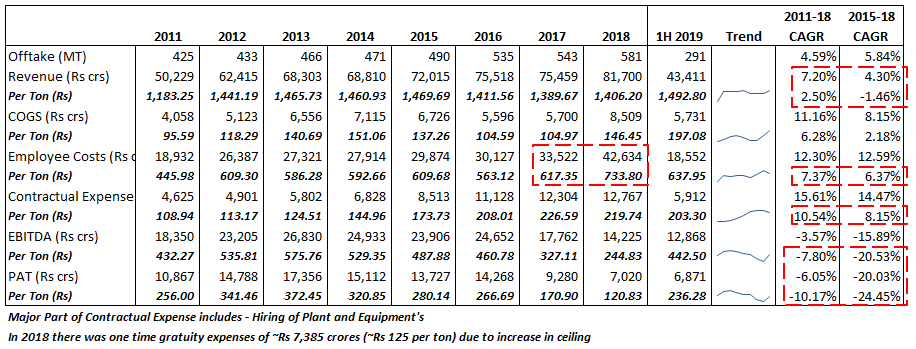

Coal India Historical Performance :

- Employee Cost and Contractual expenses are the major costs involved in the mining activity.

- CIL’s Costs have been growing at higher rate vs. revenue leading to consistent fall in margins.

- In 2018 there was one-time gratuity expense – after adjusting the gratuity expense, employee cost has grown at CAGR of ~4.5 from 2011 to 2018 and is flattish compared to 2015.

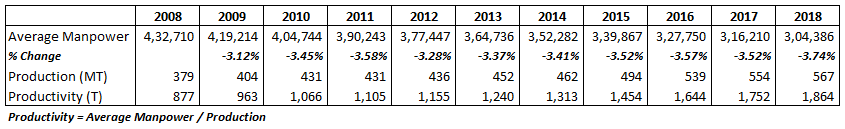

- Productivity has consistently seen an uptick with average manpower consistently dropping by ~3 to 3.5% every year.

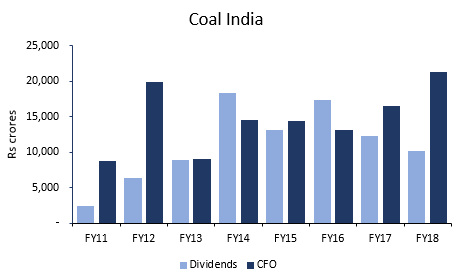

Dividends:

- In FY18 CIL paid a dividend of Rs 16.50 per share, making its dividend yield very attractive at 6.97% (At CMP of 236.50).

- Historically, CIL has been sharing its entire free cash flow with its shareholders as dividends and it continued to do so in FY18.

- In FY18, CIL paid ~Rs 8,000 crores to government as dividends with a cash flow from operations of ~Rs 21,000 crores.

Coal Imports :

-

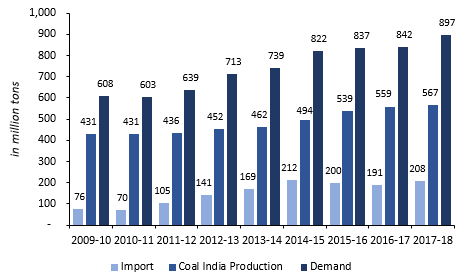

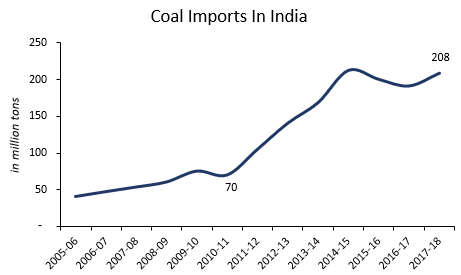

- Coal imports grew by 8.1% in FY18 on the back of sustained demand from steel sector for coking coal and steady demand from the power and cement industry.

- Total coal imports in FY18 stood at 208 MT, against 191 MT in FY17. Australia, Indonesia and South Africa are the three largest exporters of coal to India and contribute to 75-80% of the country’s total coal import.

-

- Coal imports were widely anticipated to fall during FY18. The Government has been pushing steam coal consumers especially power producers to replace imported coal with domestic coal. But inadequate coal transportation infrastructure especially availability of rakes has been hampering supply to power producers.

-

- Coal import trend is expected to continue as power, cement and steel industry are expected to witness improvement in demand and capacity utilization.

-

- India imported around 155-158 MT of steam or steam coal used as fuel for thermal power plants. Roughly 80-85 GW of thermal power capacity in India is partially or fully dependent on imported coal to fuel these power plants. Additional 6-7 MT of other types of bituminous and coke was imported for other industries.

-

- Indonesia (81.5 MT), South Africa (33.5 MT), USA (6 MT), Mozambique (3.1 MT) and Australia (1.7MT) are the largest exporters of Steam coal to India between April-Feb 2018

-

- India imported roughly ~47 MT of coking coal in FY18, 8.1% growth over import volumes in FY17. India also has coking coal reserves, but the quality of domestic coking coal is inferior to imported coking coal.

-

- Imported coking coal fulfils 65-70% of the total coking coal demand from steel industry.

- Around 3/4th of India’s coking coal imports come from Australia, and the remaining from Canada, USA, Russia, Indonesia etc.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.