Turkish Lira hit a new low against the Euro and the Dollar in the first week of August 2020. Well, it went unnoticed therefore I thought of spending time on why Lira became violent and does Indian rupee have any symptom to cause havoc in the capital markets.

Indian Forex Reserves:

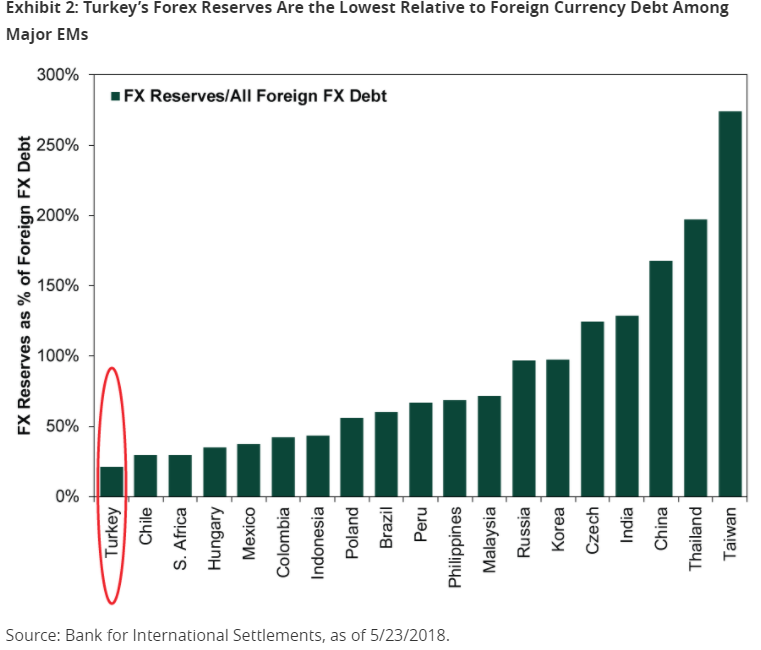

Well, India has exposure to dollar-denominated debt (external debt) but we are better placed among emerging nations. Our USD denominated debt (US dollar loan) stands at 558 billion dollars while our foreign exchange reserves are whooping 534 billion dollars as of 31st July 2020. Therefore our Foreign Exchange Reserve to US dollar Loan ratio is 0.956 or 95.6% (534 divided by 558).

At the same time, Turkey and 14 other emerging nations are poorly covered with dollar reserves in their coffers against dollar-denominated debt.

God forbid if investors lose confidence in a Nation’s ability to repay foreign debt, then you have wild currents in the domestic currency value against all major currencies (US dollar, Yen, Yuan, Euro, Pound).

India’s Central bank has autonomy and little interference from the Government.

On the contrary Turkish PM happens to threaten the governor of the central bank of Turkey against hiking interest rates to curb inflation in order to win populist votes and retain the presidency.

Unlike Turkey, India’s premier and Government does not stop RBI Governor to meet his mandate to keep CPI inflation range-bound between [2% to 4%]. Recent MPC (monetary policy committee) meeting where the RBI did not take a rate cut because inflation soared at 6.93% in July 2020.

A hawkish stance of the RBI in the recent MPC meet is a testimony of zero interference of the government in central banks routine work.

Even If we have a repeat of the famous Asian Currency crisis of the late ‘90s (1997), India will be among the last of Nations to experience a severe correction in the domestic currency (Indian Rupee).

China’s Forex Reserves

China had relied on a hard peg regime against USD to generate GDP growth. When a nation purposely keeps its currency fixed against USD, it is called hard peg. India has a free-floating exchange rate. 1 USD can be 60, 65,70, 75, 80 etc. But the yuan has stayed range-bound [1 USD has floated between 6 and 7 yuan] over the last 15 years or so.

If China had kept yuan free-floating then yuan would have appreciated against USD over time due to natural flow of capital. Capital from nations would have flowed into businesses in China because of the growth characteristics and return expectation.

In order to keep yuan range-bound, China has to increase the supply of yuan so that they can absorb USD and reduce the supply of USD in order to keep yuan range bound and arrest its appreciation.

When we are talking about currencies, we cannot ignore inflation. Inflation is always a monetary phenomenon. Yes, the oil price hike does not cause inflation. Inflation is too much money chasing fewer goods and services.

Therefore to arrest appreciation of yuan vs USD, China prints yuan or money which arrests yuan appreciation but increases the probability of higher inflation.

Therefore it is a balancing act, increasing money supply (yuan supply) and keeping inflation range bound.

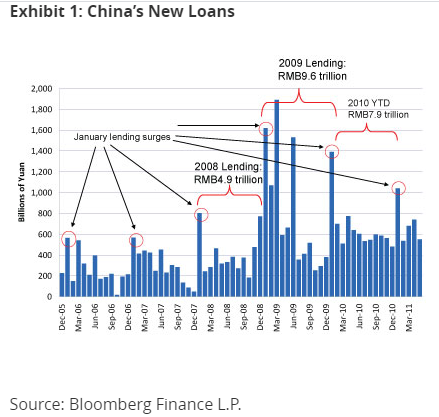

China does it by employing a policy of Loan Quota. Every bank is given a target loan to underwrite in a period and the principle of Macroeconomics says, loan growth enables money supply (yuan supply) which helps the Central bank to keep the yuan range-bound against USD.

Refer Image- Jumps in loan underwriting can be seen in January of each year in China because Banks get loan quota targets at the beginning of the year and banks engage in highest loan underwriting in January of each year.

Side effects of Loan Quota Policy

When banks are forced to underwrite a loan when the need for money is minimal, you tend to make more bad loans and in this structure where the incentive to gain market share from other banks is also minimal because of fixed quota policy, banks are generally indifferent to the quality of borrowers (high credit score vs low)

Therefore China will witness more bank restructuring than India.

India’s loan or credit growth is as per the natural tendency of ours to consume, it is healthy. Banks are competitive. Banks also have a mandate to deliver returns to shareholders. That is why you will find private banks in India making fewer loans to corporates because corporate loans are riskier vs Retail (credit cards, auto loan, education loan, house loan etc).

Policies in India allow creative destruction. Government debt to GDP in India (67%) is not exorbitant like that of Japan (130%) and China (>100%).

I would say, don’t have high growth expectations from India but at the same time don’t try to smell a rat in every corner.

But for investors, this is actually good because dour expectation keeps stock prices depressed and thus allows the investor to latch onto good stocks in the capital markets generating above-average returns over the long run (>14%).

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.