Steel consumption is a firm signal of economic development as more than 65% of steel consumption comes from infrastructure-related activities. The global steel sector is facing challenges due to the correction in steel prices over the last 8 months. However, India’s steel demand continues to remain strong at 7%, highest globally. India’s steel industry’s improvement has been pushed by domestic consumption & lack of new capacities coming online. The restrained global economic outlook impacted domestic steel prices, but the capacity utilisation across industries is improving. In such a scenario, the equity investment opportunities in the Indian steel sector merit a revisit from a steel stock market investors perspective.

After a two-year strong steel cycle, an increase in steel supply coupled with trade actions led to a fall in steel prices globally towards the end of Q3 of FY19. Further, countertrade measures by the US-led diversion of steel from surplus countries like Japan, South Korea and China to India. The combination of lower international steel prices and increasing imports weighed on domestic steel prices as well.

Now, we have already entered FY20 and completed Q1. The gone financial year FY19 saw raw material prices rising in the second half of FY19 but the finished steel prices declined. Unlike FY18, steel producers found it difficult to pass on the increased cost of raw material to end-users. Though steel demand did not contract as it did in FY16, however, it slowed during the second half of FY19 and steel demand in India sustained growth of 7.1% in CY19.

Steel Price Trend

Source- JSW Investor presentation Q4FY19

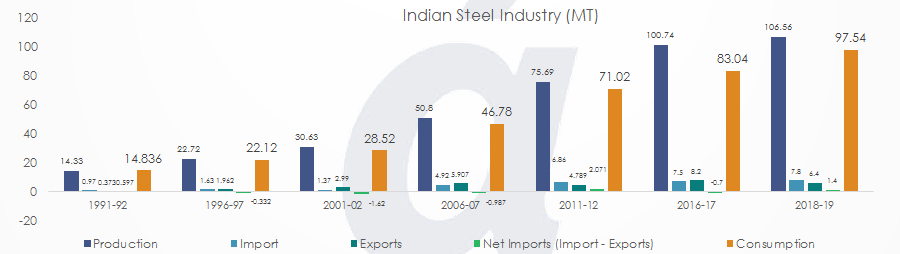

India’s Steel, Production, Consumption & Import – FY 2019:

India produced 106.56 mt of crude steel vs 103.13 mt in FY18 (3.3% growth) and India consumed 97.54 mt of steel in FY19 vs 90.71 mt in FY 18. India became a net importer of steel in FY19 with imports rising 4.6% and exports declining 26.4% in FY19.

Source- JSW Investor presentation Q4FY19

Cost of Production Has Risen Since Implementation of Anti Dumping Duties:

India had first imposed provisional anti dumping duty on 8th August 2016 and the HRC reference rate of USD $ 489/ ton was put in place two years ago when CoP (Cost of Production) was much lower with iron ore at $70-75 / ton and coking coal at $ 90-95/ ton. Since then iron ore prices have risen to USD $ 110 + and coking coal to USD $ 200 +, so CoP has jumped USD $ 110-130/ ton.

The government would be keen to keep an eye on the health of the Steel industry and would protect it if needed because it has just successfully completed IBC (bankruptcy proceeding) for the steel sector and those assets need some time to ramp up and start paying back dues.

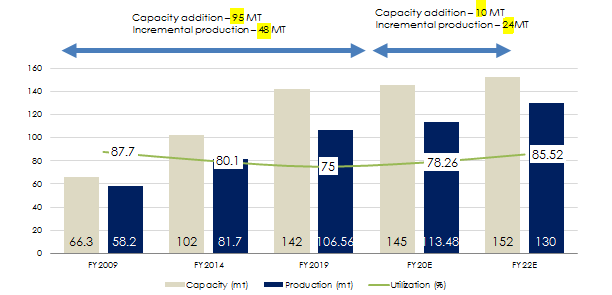

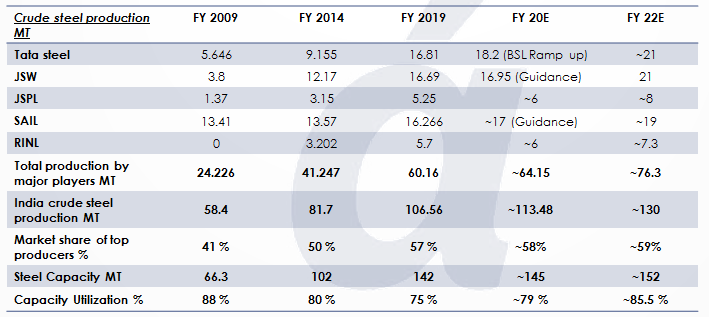

Industry Landscape – Supply Side of Indian Steel Industry

In another three years, the incremental capacity addition would be to the tune of ~10 MTPA whereas the incremental production due to demand would be ~24MTPA, unlike the period between 2009 and 2014.

India’s steel industry utilization is 75% (FY19). A surge in imports in FY19 led to lower utilization of the country’s capacity. Two new major capacity expansions led by JSW Steel and Tata steel are the only capacities will come online in coming 3 to 4 years. The incremental new capacity will be close to ~10 MTPA (5 + 5).

Tata Steel – Kalinganagar Plant Expansion (5 MTPA) – Progress

- Engineering work is progressing as per plan; Construction work for steel making plant has started.

- Expansion includes investments in upstream facilities, 2.2 MTPA Cold Rolling Mill and raw material facilities.

- Project cost is Rs.23,500 crores; Rs.16,500 crores up to HRC stage and balance on raw material facilities and 2.2MTPA cold rolling mill.

- Commissioning: 48 months from zero date (FY18)

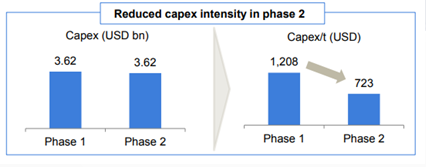

Kalinganagar phase 2 Capex intensity drops from $1,208 per ton to $ 723 per ton.

Source – Tata steel Investor Presentation

JSW Steel – Dolvi, 5 to 10 MTPA Expansion

- Doubling steel making capacity from 5mtpa to 10mtpa.

- To enhance capacity of flat products portfolio.

- Commissioning: by March 2020

How Did Section 232 Impact India’s Net Steel Imports

Exports from Japan and South Korea to the US declined by 1.2 mt in FY19. This surplus steel from Japan and South Korea got diverted to India and we imported .53 mt of additional steel compared with FY18.

Source – JSW Investor presentation Q4FY19

Iron Ore Price Trend

Iron ore prices stayed buoyant in the first half of FY19 on the back of robust demand and accelerated rapidly during the end of Q3FY19 due to supply disruptions in Brazil after Vale Dam Incident.

While the steel demand waned globally and iron ore prices have climbed down from the highs of Q3 FY19 but they remain still high. Q1 of a financial year is generally slow because we have monsoons in India; however, experts project further increase in the cost of iron ore in India due to mining licenses coming due for renewal in March of 2020.

Steel Makers without Captive Mines to Witness Rising Costs

Steel makers without captive mines are likely to face up to 20% increase in costs. This would put pressure on the profitability of these companies leading to 300-400 basis point fall in EBITDA in 2020-21 according to crisil.

March 2020, leases for more than 30 iron ore mines, which account for nearly 62 million tonnes of ore- comprising 55% of Odisha’s output and 10% of other states are expiring. This could lead to a 30% reduction in overall iron ore output.

In 2018-19, domestic production of ore is estimated to have been around 207 mt, 65-70% of which was by merchant miners and rest by captive steel makers. Odisha alone is estimated to have produced 114 MT, more than half of India’s iron ore production.

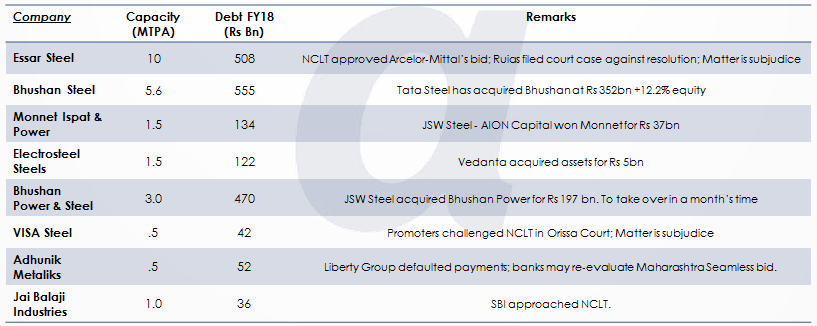

Current Status of Steel Stressed Assets

Around 23-25 MT of stressed steel making capacity came under the IBC. Except Essar, most larger stressed assets have already been acquired by incumbents. These assets are slated to contribute an additional 3-4 MT of steel in the next 12-18 month. Given the huge difficulty in setting up green field plants and as brown field expansion (JSW steel and Tata steel) are at least 12-15 months away.

Source: Phillip Capital

Major Indian Steel Companies Performance During FY19

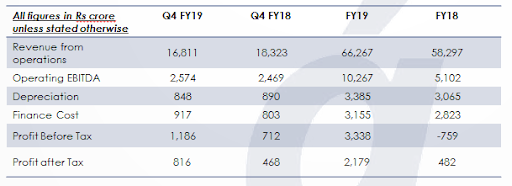

Tata Steel

Tata steel EBITDA per ton contracted in 4QFY19 due to lower steel realizations while higher deliveries resulted into benefits accruing to the tune of 774 cr.

Bhushan Steel

1. Deliveries at newly acquired Bhushan steel rose 24% QoQ, however, EBITDA was lower due to lower realization and higher exports.

2. For the full year, the Bhushan produced 3.58 MT of crude steel and delivered 3.52 MT. For the full year, the EBITDA per ton recorded by Bhushan was INR 8, 498 per ton.

Bhushan has a rated capacity of 5 MT and ramp-up of the remaining capacity will happen in FY20.

Tata steel started consolidating financials of Bhushan from 18th May 2018.

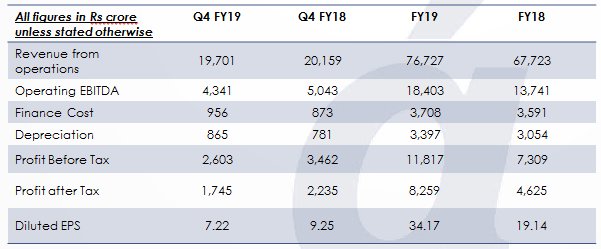

JSW Steel

1. JSW steel produced 16.69 MT of crude steel in FY 19 vs 16.27 MT in the previous year.

2. It also recorded steel sales of 15.76 MT of steel vs 15.62 MT in FY 18.

3. JSW sold 11.29 MT of flat steel in FY19 which making flat steel component 71% of the total sales. Flat steel command premium over long steel products and up until Dec 2018 the blended differential between flat and long steel product in the Indian market was close to ~INR 5,000 per ton. Higher weightage of flat steel helped JSW steel to deliver superior returns vs peers in rising cost market.

4. JSW bagged 5 iron mines with a rated capacity of 5 MTPA which will only cover up ~15% of the iron ore demand for JSW steel.

5. Further JSW commenced operation of the 24 KM long conveyor belt in Vijaynagar Plant with a rated capacity of 20 MTPA which will save iron ore freight charges to the tune of ~ INR 300 – 400 per ton. The belt would achieve full utilization in a span of 12 months.

6. Of the total exports from India, JSW steel exports are the highest at 2.34 MT of the total exports of 8.54 MT which makes it 27% of India’s steel exports.

7. JSW steel EBITDA declined for Q4 FY19 on a yoy basis because the financial performance got hit from two sides, first the overall realization for steel products declined in the second half of the financial year and the iron ore cost elevated post the Vale dam disaster in the worldwide market.

8. JSW’s EBITDA for Q4 FY19 declined by 362 cr on the NSR front and 425 cr on the cost front. JSW steel recorded EBITDA of INR 4,341 cr for Q4 FY19 vs INR 5,043 cr for Q4 FY18. EBITDA for the gone quarter Q4 FY19 was INR 10,302 per tonne.

SAIL

1. SAIL recorded highest ever hot metal production in FY19 at 17.5 MT, crude steel production of 16.26 MT and saleable steel sales of 14.115 MT.

2. However SEMIS component continues to remain high for SAIL which drags NSR.

3. JSW steel sold .78 MT of SEMIS in FY19 which is ~5% of overall steel sales while SAIL sold 21.59% of SEMIS of all steel sales. Higher proportion of SEMIS drags NSR for steel companies.

4. Sequentially SAIL has been working on improving the techno economic parameters such as coke rate and CDI rate. SAIL’s coke rate declined to 452 kg/thm in FY 19 from 456 kg/hm in FY 18. Further CDI rate remained flat at 77 kg/thm. Higher CDI rates and lower coke rate will bring down the coking coal requirement for SAIL which will accrue savings.

5. For the full year FY19, SAIL recorded EBITDA per ton of INR 6,900 per ton however in Q4FY19 the recorded EBITDA per ton for SAIL was INR 5,359 per ton vs INR 7,964 per ton in Q3 FY19.

6. Lower NSR across all products led to a decline of the EBITDA per ton for SAIL.

7. Employee count declined by 4,531 for FY19 with 72,339 employees remaining. In the coming years, SAIL will continue to rationalize the cost on the employee front.

8. SAIL’s SMS 3 at Bhilai steel plant will fully ramp up by Q2 FY20. Production coming out of the newer capacity would be of higher grade and will command higher NSRs.

9. SAIL has guided for 18 MT of crude steel production for FY 20 and it along with other big steel makers will go to the ministry of steel to request them to implement anti-dumping measures such as duties, quotas etc.

Essar Steel (Q1 FY20)

1. Essar steel posted its best ever quarterly performance in June quarter Q1 FY20.

2. Crude steel production witnessed growth of 9.5% at 1.88 MT and company posted operating profits of INR 1,120 cr for the quarter. Net sales increased in the quarter by 3% at INR 8,100 cr.

3. Operating profits is also 2.5% higher than the same period last year and more than double than that of the March quarter.

4. The improvement has come due to cost efficiency and better inventory management aided by better product mix. Further a banker aware of the resolution process said that the company is meeting working capital needs through internal cash and is not borrowing anymore from the banks.

5. Essar was able to offset the effect of low steel prices by focusing on high margin value added products, a strategy that both JSW steel and Tata steel adopted recently to cushion against the volatility in the primary steel market.

6. From 40%, Essar steel has graduated to producing at more than 80% of the capacity and expects to clock in 7.4 MT of crude steel this year which would require it to utilize 86% of its rated capacity.

Source – The Economic Times

Conclusion – Equity Investment in the Indian Steel Sector merits a close look

Looking at the supply side dynamics, India will witness a potential shortage of steel as demand grows by 7% on a higher base. Our steel production is 107 MT during FY19, while installed capacity is at ~142 MT. Another 10 MT of new capacity is slated to come online over the next 3-4 years.

At an Industry level the capacity utilization has never touched 100 % and utilization will more or less stay range bound in mid 80s (~85%-90% range). At any point of time some or the other plant keeps undergoing blast furnace shutdown for repairs, ancillary machines such as coke oven batteries also go periodic shutdowns. We are staring at a scenario where steel demand grows incrementally at ~7% and supply side growth wanes.

Further to launch a green field project, the EBITDA per ton should be ~ INR 10,000 per ton to recover the cost of capital if debt to equity is 60 : 40. ( capex – ~5000 cr for 1 MT ) It takes roughly 4 years for a new steel plant to come online i.e. time taken from announcement to commissioning. Even if someone decides to put up a new steel plant, will the banks lend ? What is the chance of a successful steel IPO over the next 2-3 years ?

Steel sector is very close to getting fully cleaned up in the IBC and stressed assets have changed hands. The sector has just come out of ICU & is looking at a recovery over the next cycle. Can the government allow chinese steel players to continue to dump in India below their cost of production ? Is there a scope for duties / protection to get tightened ?

If we try to find answers to these questions, and take a closer look at the sector dynamics, the findings are very interesting & counter intuitive. Are we looking at a lucrative equity investment opportunity in the sector or yet another prolonged & disappointing cycle ? Time will tell.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.