Ethanol Industry Overview

Ethanol is a very key by-product for integrated sugar mills. On an average, 10.8 lt of Ethanol can be produced from 1 tonne of sugar. B-Heavy molasses have better yield of Ethanol (explained in detail later on in the article) than the molasses currently used for Ethanol production.

Ethanol is blended in the fuel to reduce the dependence of the country on crude imports generally, and also ethanol is a cleaner fuel. ‘E20’ is a term to express 20% blending in the fuel.

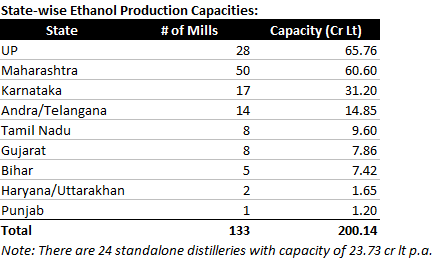

India has ~330 distilleries which can produce over 4 bn litres of rectified spirit (alcohol) per year. Of these, ~162 distilleries have the capacity to distil over 200 cr litres of conventional bio-ethanol. India produces conventional bio-ethanol mostly from sugar molasses and partly from grains. Production of advanced bio-ethanol is still in the R&D stage.

To understand the potential of ethanol, let us have a brief look on the Brazil sugar industry initially, which is considered to have the world’s first sustainable biofuels economy.

Brazil Sugar Industry

Brazil has a sugar production of ~40 mn tonnes and consumption of ~10-11 mn tonnes. Most of the sugarcane grown is used to manufacture ethanol for domestic gasoline blending and sugar for exports.

Past 4 Decades Of Brazil Sugar Industry

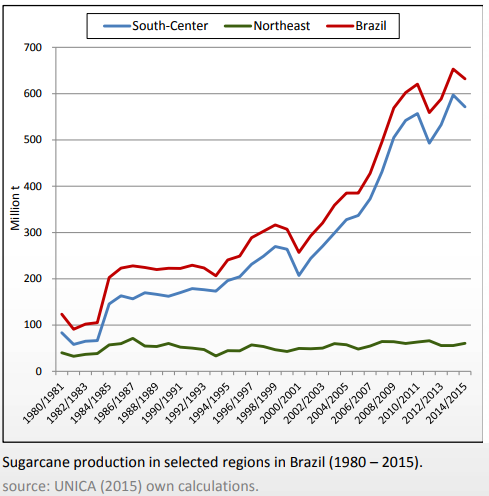

The Centre-South region (CS) constitutes for 90%+ of the total sugarcane production in Brazil. The sugarcane production in Brazil has become 6x in last 35 years.

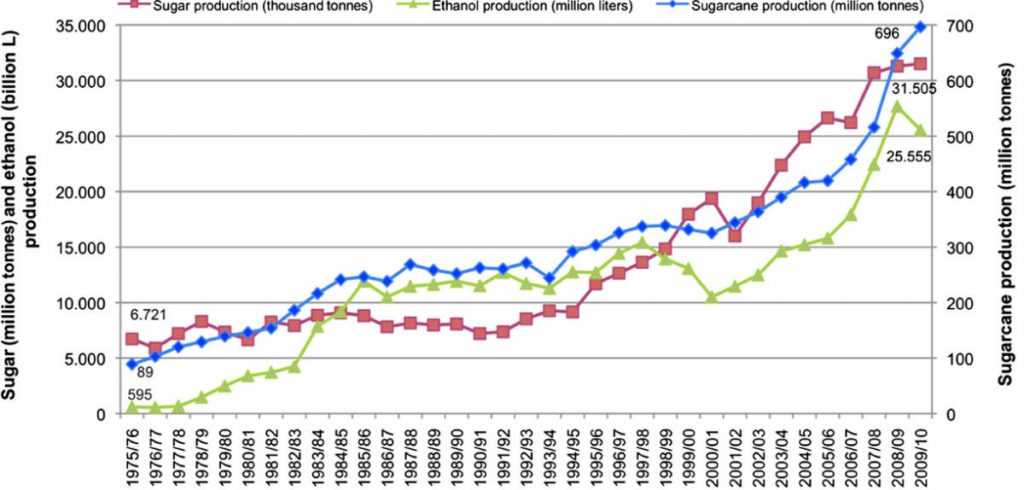

Ethanol production was virtually zero in Brazil during 1975. Ethanol production saw a sustainable jump from ~7 mn tonnes to ~13 mn tonnes during the 1980-1985 period. However, ethanol production was stagnant in Brazil from 1985 to 2000, after which the ethanol production jumped again rapidly.

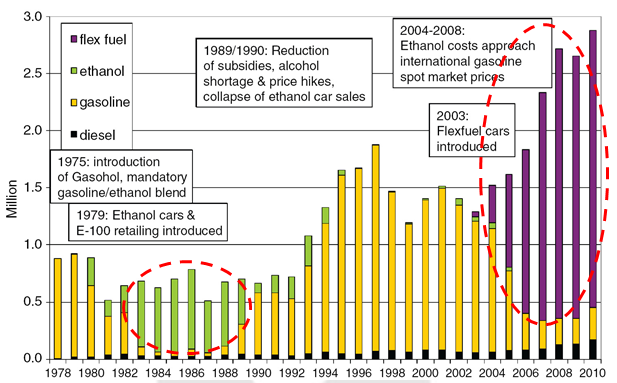

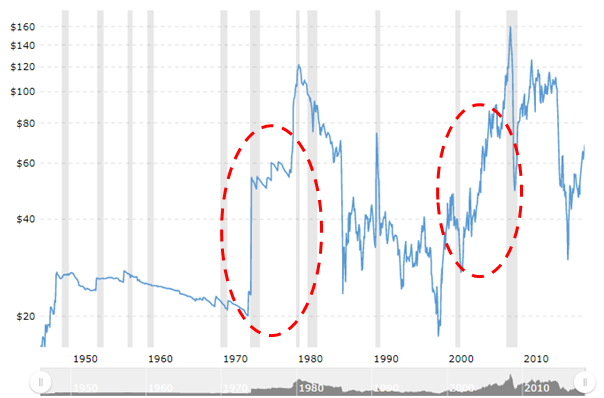

We can see a similar trend in vehicular fleet in Brazil. Due to rise in oil prices around 1975, the Brazilian government introduced ethanol based vehicles from 1980s, which were pretty much in demand, but started getting replaced by gasoline vehicles around 1990 (probably because of stabilizing of oil prices). However, there was again huge jump in usage of flex-fuel vehicles post 2004-2005 after another rise in oil prices, and the flex-fuel fleet count has kept on rising in Brazil since then. Brazil has increased the E20-E25 flex fuel fleet by over 5 times from 4.6 mn in 2007 to 26.2 mn in 2016, and parallely reduced gasoline vehicles from 15.1 mn to 9.7 mn in the same time period.

The corresponding movement in oil prices can be seen below:

To encourage growth of ethanol based fuel, the Brazilian government took following steps:

- Guaranteed purchases of ethanol by the state-owned oil company Petrobras

- Low‑interest loans to agro-industrial ethanol firms

- Lower excise taxes on ethanol than on petrol

- Fixing of hydrous ethanol prices at 59% of the government-set gasoline price at the pump

Other factors which benefited the growth were:

- Favourable climate

- Land availability

- Abundant low-cost labour

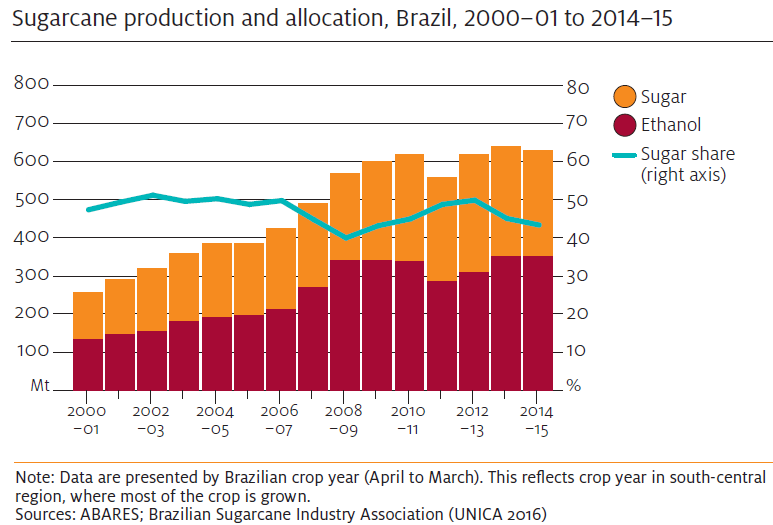

Less than 50% sugarcane is used for sugar production since 2000, with remaining sugarcane used for ethanol production. The share of sugar from sugarcane over past 15 years can be seen in the following chart:

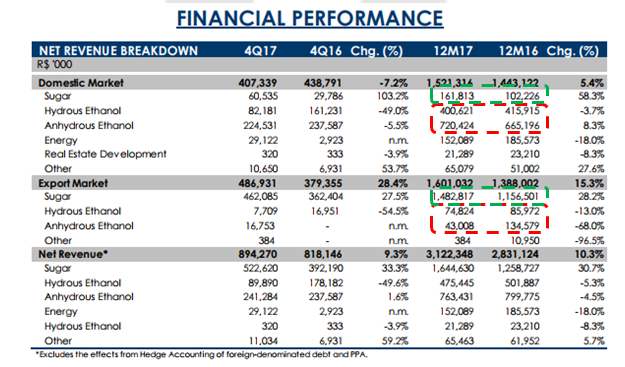

Let us have a look at recent financials of a major Brazilian sugar company named Sao Martinho. ~90% of sugar produced by the company is being exported and only ~10% sold domestically. At the same time, ~90% of the ethanol produced by the company is for domestic consumption.

Indian Scenario

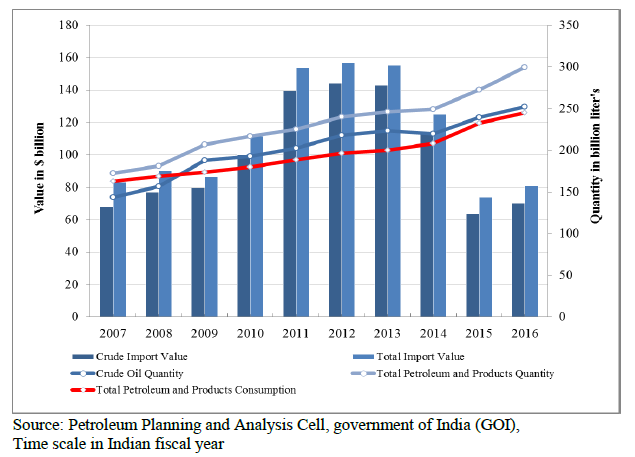

India imports 70% of its annual crude petroleum requirement (~110 mn tons). At 10% blending of Ethanol, 313 cr litres of Ethanol is required. Additionally, 1 mn tons of sugar can be replaced by 60 cr litres of ethanol. However, currently there is no policy to convert sugarcane directly to Ethanol.

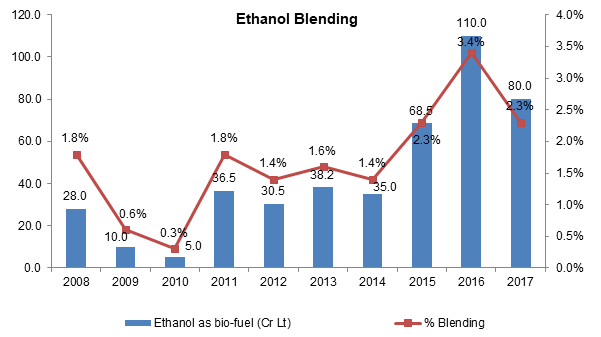

There have been many attempts to stabilise the sugar industry by having a stable ethanol revenue, with efforts being taken since over a decade. Additionally, our current import bill of crude oil is around Rs. 7 lakh crore, and the government plans to save atleast 1 lakh crore of this amount by shifting to higher ethanol blending in the fuel. However, the government has not been successful in achieving higher ethanol blending in the past since over a decade. Recently, the government has made statements on targeting 10% ethanol blending (also called as E10).

Total Ethanol production capacity in India is 223.87 cr lt per annum.

Ethanol capacity breakup based on private and cooperative companies is as following:

140 cr lt of blending has been finalized by OMCs for 2017-18, which is highest ever done. At 140 cr lt of ethanol, the blending would be ~4.5%, which is still way lesser than the targeted 10% blending which would require 313 cr lt of Ethanol. In 2016-17, OMCs achieved a blend of only 2.3% against the mandated 5%. However, the 140 cr lt (4.5% blending) being the highest ever blending proposal, there are hopes that going forward higher ethanol blending targets might be successfully achievable.

Ethanol Generation From Different Sources

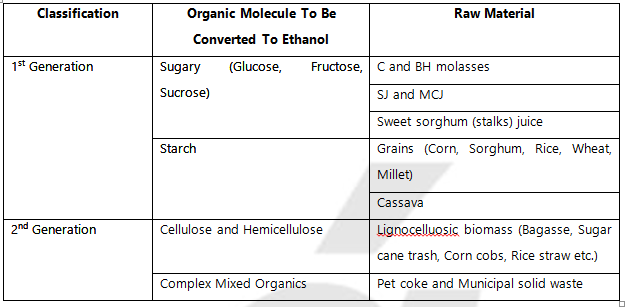

1st generation (1G) biofuels are made from sugar and vegetable oils; whereas 2nd generation (2G) biofuels can be manufactured from lignocellulosic biomass or woody crops, agricultural residues or waste like rice & wheat straw, cotton stalk, etc.

As the sugar mill’s capacity isn’t enough to supply the required 313 cr lt of ethanol for E10, government is looking for 2nd generation ethanol production. Steps have been taken in that direction, and OMCs (IOCL, BPCL, etc.) have already started placing orders for 2nd generation ethanol plants. These 2nd generation plants will take atleast 18 months to come online. Parallely, some sugar companies are also increasing their ethanol capacities to benefit from E10 blending.

B Heavy Molasses

Ethanol also can be extracted via B Heavy molasses route to get higher yield of ethanol per ton of sugarcane. Conventionally, sugar is extracted in 3 stages, with very little sugar left to be extracted after the 3rd stage. Left over after the 3rd stage is the molasses, which has very lesser sugar content left, and this molasses is processed in a distillery for ethanol generation traditionally.

As per the B Heavy Molasses route, the sugar extraction process is stopped after the 2nd stage extraction and the molasses post 2nd stage which are still rich in sugar content are used for extraction of ethanol. B Heavy molasses has Ethanol yield of over 300 lt per MT of molasses, whereas the yield of current molasses produced post 3rd stage is 230-250 lt per MT of molasses. Additionally, this process leads to overall ~2% reduction in recovery of sugar. This can serve 2 purposes: 1) Blending of the fuel by more ethanol; and 2) Conversion of extra sugarcane to ethanol rather than sugar which helps to solve the issue of oversupply of sugar during the years of overproduction of sugarcane.

As of now there is no policy in place to extract ethanol from B Heavy molasses. Also, the B heavy route is not possible from current distilleries. However, minor capex on existing distilleries would make them capable of extracting ethanol via B Heavy route.

National Policy On Biofuels – 2018

The Union Cabinet, chaired by the Prime Minister Shri Narendra Modi has approved National Policy on Biofuels – 2018 in May’18. The key points of the policy as are following:

- Funding: Policy would fund Rs. 5000 cr to 2G ethanol bio refineries over 6 years in addition to tax incentives, higher purchase price compared to 1G fuels. (Note – These steps are similar to those taken by Brazilian government to support the growth of ethanol as a bio-fuel market)

- Forex Savings: 1 cr lt of E10 would save Rs.28 cr of forex. So with current supply of ~150 cr lt of ethanol for 2017-18, it will help to save ~Rs. 4000 cr of forex.

- OMC Capex: 100 KLPD bio refinery would cost ~Rs. 800 cr investment. Currently, OMCs are in process of setting up 12 2G bio refineries with an total investment of Rs. 10,000 cr. This should lead to capacity addition of ~1200 KLPD.

Brazil is a benchmark for ethanol production stabilizing the volatility of the sugar industry. Can Indian sugar industry see ethanol evolving as a major stable end-product like it occurred in Brazil? If it happens, it will lead to a structural level change in Indian sugar industry, making it comparatively non-cyclical to some extent.

Going Forward

The Indian government has made many announcements recently to boost the ethanol blending and save the import bill on crude imports. This would also include introducing new vehicles supporting higher blending and also vehicles running 100% on ethanol.

If there is stable ethanol demand with stable prices, it will stabilize the sugar industry to great extent. Also, if there will be stable on-time export of sugar during times of overproduction, it can help stabilize the sugar prices.

With recent rise in crude prices, it makes even more sense to increase the blending of fuel with bio-fuels and to save on higher crude prices. In the current scenario of over production of sugar in India and on global level, it is a win-win situation to produce as much of ethanol as possible for India and Brazil, and simultaneously lower the production of sugar. As we can see in the above graphs, it is exactly what Brazil has done when crude prices have sky rocketed over past few decades.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.