Disclaimer: The Blog on ‘Is Coal The Real Gold’ is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. Please read the detailed disclaimer at the bottom of the post.

Overview of Indian Coal Sector :

The coal mining and coal-fired thermal power generation sectors are two of the core industries and together contribute ~10% to India’s Index of Industrial Production (IIP), affirming their importance to the economy. Further, India’s logistics industry, sponge iron industry, aluminium industry among several others, as on date, depend on India’s domestic coal industry. Economic activities in three eastern states (Chhattisgarh, Jharkhand & Odisha) are significantly dependent on coal. Hence, the importance of the coal sector in India, not just in terms of energy source for the country but also for the socio-economic role it plays, cannot be denied.

History of Coal In India :

Coal mining in India started in the 1770s in Raniganj coalfield. The early coal mines were owned by the British mercantile firms, Indian private sector players and also state-owned entities like Railways. Mining operations continued on a smaller scale until 1950 when the National Coal Development Corporation (NCDC) was formed with the task of exploring new coalfields and expediting development of new coal mines.

The oil shock in the early 1970s and the imperative of growth, forced the Indira Gandhi administration to nationalise the coal industry with a motive to end the unsafe practices and lack of investment in suitable technology, which was threatening to lead to large demand-supply gap. This led to formation of Coal India Limited (CIL) – which is currently the largest coal manufacturing entity in the world.

After nationalisation of coal industry in India, India never witnessed demand-supply gap until 1991. Soon after came the liberalisation of India with a clear impact on economic growth. In 1993, to focus on the increasing energy demand, the government decided to allocate coal mines to various players for captive consumption. In the meantime, the power sector reforms took place in 2003 – resulting in significant growth in power sector. Growing power sector started demanding higher supply of coal which could not be fulfilled by the state run CIL leading to higher demand-supply gap which started converting to imports. The demand-supply gap by 2012 widened to ~18 to 20% of India’s coal demand.

Further the LARR Act, Forest Rights Act, delineation of Go and No-Go areas, etc., also contributed in creating challenges for further expansion of coal mines. This led to the letter of assurance issued to power companies not converting into fuel supply agreements (FSA). And then came the Comptroller and Auditor General of India (CAG) report followed by the Supreme Court verdict in 2014 that overturned the allocation of almost all the coal mines allocated after 1993.

In March 2015, Parliament enacted the Coal Mines (Special Provisions) Act, 2015 containing provision enabling the government to allocate coal mines through auctions. Over 70 coal mines were auctioned/allocated through government dispensation route. On 20 February 2018, the Cabinet Committee on Economic Affairs (CCEA) permitted private firms to enter the commercial coal mining industry in India. Under the new policy, mines will be auctioned to the firm offering the highest per tonne price. However, further decisions on commercial mining are yet to be taken.

Coal Demand, Production & Imports in India :

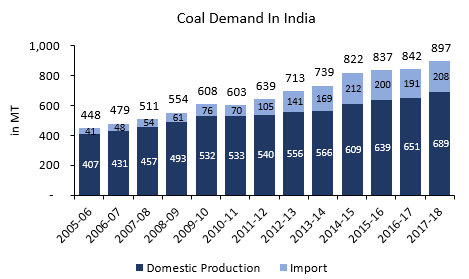

- In 2017-18 coal imported in India was worth ~Rs 1,38,500 crores ($20.17 bn) which was up 38.2% compared to previous year and up ~9% in volume terms.

Pricing :

*INR / USD rate is the average rate for the year

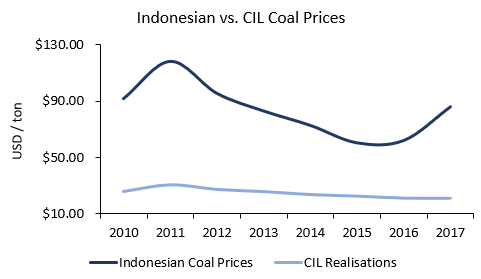

- Historically Indian coal prices have been consistently very low compared to the global / import prices (3/5 of coal is imported from Indonesia) as the major purpose of the state-owned companies is not profit maximisation.

- Also due to higher tariffs and logistics costs involved the landed cost of the coal for the end users goes up significantly but is still lower than imported coal prices.

- The revision in coal prices is done after considering its impact on the overall economy particularly the power sector.

Costs :

- The estimated average cost for coal production (ROM coal, excluding crushing, sizing, transportation charges and all levies, duties, etc) is ~Rs 1,000 per tonne.

- Majority of the coal production is favourably placed with respect to cost of production except for about ~10% of overall coal production.

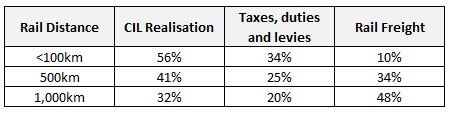

- However, the coal sector in India is constrained by tax structure and transportation cost. On landed basis, taxes, duties and levies account for up to ~25% and freight accounts for up to ~34% of overall coal cost.

Recent Update On Renewables :

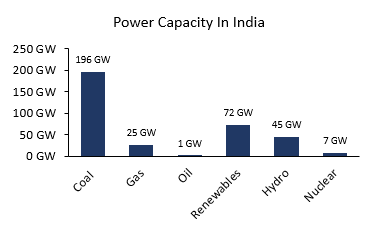

- 56% of India’s commercial energy is met by Coal whereas, ~73% of entire power generated in India is coal based.

- Currently, Renewables are being considered as the major threats to the coal sector globally.

- Indian Government has set a target of installing 175 GW of renewable energy capacity by 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro-power.

- The government is promoting development of solar energy in the country by providing various fiscal & promotional incentives like 10-year tax exemptions from solar.

Global Trends :

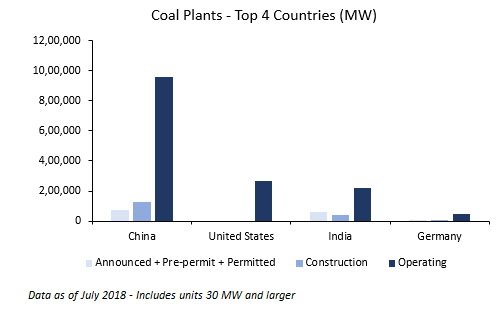

- Global coal demand grew by 1% in 2017 to 7,585 MT as stronger global economic growth increased both industrial output and electricity use.

- Global coal power generation increased by around 3% and accounted for about 40% of additional power generation worldwide.

- Coal kept its share in the power mix at 38% after some years of decline

- As per IEA, global coal demand is expected to be stable in next five years with declines in Europe and United States offset by growth in India and other Asian countries. China, the main player in global coal market, will see a gradual decline in demand.

- Coal’s contribution to the global energy mix will decline from 27% to 25%, mainly due to growth of renewable’s and natural gas

- Coal’s fate largely rests on the Chinese power sector. The rebound in electricity use in China since 2016 underpins the global growth of coal use.

- Coal power generation in India has grown continuously since 1974. With Indian economy expected to grow at ~7 to 8% and the electrification process continuing, power demand is expected to rise by more than 5% every year.

- The large scale ongoing renewable expansion and the use of supercritical technology in new coal power plants will slow coal demand growth, which might grow at lesser pace than 6% in last decade.

- Indonesia, Pakistan, Bangladesh, Philippines and Vietnam have per capita power consumption of just over 800kWh, one-seventh that of EU28. Increasing coal power generation, supported by new coal plants under construction, will be the main driver of coal demand growth in those countries

Panel Discussion – Coal India Limited’s Journey and Coal’s Future :

To understand what the experts think about the state of the Indian coal sector and what are the necessary step required for development of coal sector – watch below panel discussion with below panellists:

- Mr. Partha Bhattacharya – MD, Coal India Limited (2006 to 2011)

- Mr. Alok Perthi – Former Coal Secretary

- Mr. Sumit Bose IAS – Union Finance Secretary until March 2014

Link To The Panel Discussion – Link

Summary of the panel discussion –

Introduction

There have been reports / article published which say coal is dead, renewables have taken over the world but that is either not true or not so easy and not overnight by any stretch

The price of delivered coal isn’t contingent entirely on CIL but it actually levies the taxes and cesses and surcharge as well as transportation costs that actually are far higher than what CIL receives for the coal so that is actually the dominant factor in looking at price trends which then of course propagate into end-users paying for it

If we look at last decade the growth rate of coal was ~6.5% which is further expected to slow down to ~4% till 2030

When we talk of what is the future of coal in India we cannot do it without asking what the future of coal India is as well because Coal India is not only 83 percent of the production of coal in India but it’s also the largest coal producer in the world right now and somewhere the government owns 78.4% and so there is strong governmental links to purchase policy and actual production

When Coal Turned Gold – by Mr. Partha Bhattacharyya – The book combines sort of what has happened and more or less what can happen – that there are success stories that need to be not only shared but also there are lessons to be drawn from it

Why this Book?

Coal India (CIL) has been going on for about 40 years now and it has undergone a massive transformation – during four decades it has transformed from being a highly loss-making company amongst which first two decades after formation it was a loss-making enterprise and from there it has moved to become one of the most profitable tax and dividend paying public sector enterprises and ultimately becoming a Maharatna company

Initially CIL was the only unlisted company which earned a status of Navratna Company as it is easier for a Navratna company to speed up project approvals, but the status was earned with the condition that the company will be listed in next three years else the status could be withdrawn

As the IPO was expected to be amongst top three global IPOs, global investors perception was very important. However, the response from global investors was quite scary and negative. Global investors accused company of being inefficient as other PSU, negligent towards land restored reclamation’s and various such allegations were passed. CIL significantly improved its efficiencies by improving its KRA’s and various achievement were achieved which were later included in the DRHP which silenced the critics and helped the listing to be a bumper one

So Mr. Partha Bhattacharyya wanted the story out on carpet and people to know about the achievement that a PSU can achieve

As per Mr. Alok Perthi –

2011 was a very harsh and bad time for the coal industry majorly because of the environmental reasons. It virtually stopped commencement of various projects which led to significant drop in production in the year which was then seen recovering in December

Some concepts were being talked about as to how to reform not only the sector but even the company – what kind of reforms should be brought into the company. A team was engaged to see whether there can be a restructuring of the company – it didn’t result in any but then government got involved and it started pushing to see whether the auctioning of the coal blocks could be done in 2013 – an attempt was made but it failed and that is where government should had brought commercial mining, but they dint. There is a cabinet decision out now, but no further steps have been taken

However, the production in that year grew at 3% to 4% and then new government came in 2014 and after that Supreme court ruled re-elections of all the blocks which was a big shock to the industry

It is also very important that the coal that we provide to its end users (power, steel or cement) as feedstock should not be unnecessarily expensive as the cost of coal is actually lower than the additives cost be it government cess or Rs 1.7 per ton per kilometre transportation cost and ultimately it’s the consumers who are paying the price and the manufactures are the ones who take huge hit. So, when we are looking at the competitive world, we have to think out of the box take necessary step to bring in the equilibrium

When we talk about coal – we are making coal very costly and at the same time trying to partly justify by saying that we are moving to renewables so let us discourage the use of coal, but we have to understand that there is no point dragging this and believing that we are getting away with coal atleast not for another two to three decades. So, we have to address these issues and find a solution

To bring in various reforms in the coal segment it is necessary institutions like CVC’s stop looking at PSUs as government departments, they are independent business entities and should be allowed to operate as business entities. There are lots of instances where unnecessary things which should be resolved by the company itself but were raised to the cabinet due to fear of ministry / institutes like CVC’s and instead of improving things we are moving into exactly opposite direction. So, there was a committee headed by additional secretary which looked at coal linkages – so they take recommendations from the end user ministries say cement, power and then they sit with CIL, Railways and other two departments and decide till what extent these linkages can be supplied and was further decided by all the CMDs of CIL at Subsidiary levels but today these decisions are taken at cabinet level. There have also been proposals which should have been directly rejected by CIL but even such decisions have been taken on cabinet level. So, it is very important that this is done independently maybe by forming different committees in the company and procedures to resolve issues

As per Mr. Partha Bhattacharyya –

When coal auctions started the initial results were scary as the prices were just going up and up and as Mr. Partha were part of advisory group in the ministry, they escalated these issues to ministry. The then secretary Mr. Swaroop responded that nothing else can be done because we have to take care of CAG, CVC & CBI so let the process roll wherever it ends

If we look back things in the industry weren’t that bad. So, in 2000 the CIL’s board took a decision to hedge its foreign exposure by hundreds for currency swap transaction which even other huge companies dint do and today if such hedging or procedure is to be done it is not that easy. One major reason why PSUs in India have such image is because the authority has been taking decision for the company which isn’t the right thing to do. So, in 2015 there have been instances where ministers and other institutions have passed statement like CIL will do production of 1,000 MT by 2020 and that to after Mr. Partha (that time CIL CMD) saying that the maximum production that CIL can do by 2020 is 750 MT which kills the self-initiative of public sector which otherwise they could deliver much better results because of which it is very important for the government will have to trust in the company’s management

So, if we look at CIL’s history at a certain time the industry was growing below 2% but the demand required the growth to be around 5% which CIL did and the major reason for that was because from 1975 to 1991 CIL had budgetary support. However, in 1991 the CIL was asked to be self-reliant and that is where CIL understood it can’t do anymore greenfield projects which led to few brownfield expansions. Soon after a study was revealed which said that CIL won’t be able to meet the power demand if the power sector accelerates as it was being visualised in next 15 years. However, in the next 15 years the power sector’s expected expansion dint take place and the capacity addition remained at 40 to 50% of target which CIL was capable of servicing. Then again in 2007 according to the eleventh five year plan the power capacity was going to go thrice of the average capacity at that time which was not possible for CIL to service and instead of opening the industry to commercial miners and bringing in formidable players the government pushed the burden over to CIL. Now this resulted in two thing one – imports started flowing in the country from 0 to 150 MT of thermal coal and second as the additional capacity was not being serviced and the PLF of the power companies which was around 79% in 2007-08 dropped to 60% because of which the power companies couldn’t services their debt which lead to NPAs. So, the message here is that it shouldn’t be the government or the ministry that decides the targets, but we should let the market decide the targets and productions

Other Panelist’s Views & Q&A’s

Today almost 72% of the coal is generated by MDO’s which is against the law and everybody knows this. There are about 48 MDOs and they are virtually independent. All CIL is doing that 72% of the production collecting it and selling it in market. Out-sourcing of projects of colonies and roads were started when Mr. Vasant Sathe was Coal minister on a very small scale and this went on and on and today it has overridden the company. Company now is totally stimulated of its own doing and right now these forty odd MDO’s are running the industry. However, even this could had been converted into good competitive approach by creating some set of benchmarks in terms of productivity. Now because of this Coal India will have to pay similar labour charges to their labours and this will push the prices up. So, if we see for Company like Mahanadi cost of production is ~Rs 75 to 80 per ton which when delivered is to ~Rs 2,000 plus. So, this is one point which has to be dealt in a very professional manner. When surface mining is done the quality of production is not better only size is better and all the stones mixed become black and are delivered with the block. In a situation like current demand-supply gap this cannot be corrected. So, it’s actually these factors like monopoly, cancellation of block, IPO that has created this situation today.

So, all the reforms that we are talking about what is the probability of these reforms as after the supreme court’s decision the government could had taken their time and restructured the coal sector, but the government dint do that, and the same thing is happening in the power sector, we need reforms, but the probability looks very less. How can this happen?

Mr. Sumit Bose:

Many people have given up on PSUs and their reform stories – but we believe that this is very much achievable and in order to achieve this the most important thing is to start with legal reforms. Let PSUs perform under same rules as private sector all the exemptions given under companies act or LODR of SEBI or competition law to the PSUs. Let them work under same environment as private sector

Is it viable to actually open the coal sector to private companies as we believe the producer (CIL), the transporter (Railways) and the buyer (State Power Companies) are all State-owned companies won’t it actually open up to more litigations instead why not just concentrate improve efficiencies?

Mr. Alok Perthi:

Any change is painful but just because it’s painful it doesn’t mean that we don’t give birth to a child. So, while a restructuring in CIL was happening, we received reports from some agency made similar arguments but let’s face it – we have seen enough monopoly and it’s time to give a chance to the market and there have been lots of attempts to improve things internally, but it hasn’t worked

There were always questions in terms of Oil? What will happen to oil? Will there be electric vehicle? But past 20 years oil has only grown worldwide. We have been listening about the renewables coming in and replacing oil and coal. So how does the coal industry thing about the renewables? Or electric vehicles coming in?

Mr. Alok Perthi:

We have been reading and listening that there is a threat coming from the solar to the coal sector. Technology is moving in many directions if we look at solar, we are trying to reduce the cost of panels which has come down then we are trying to see whether we can get cheap storage. We are moving in that direction and that would help us but to what extent? Then we can say that we have the requisite storage but how long? – eight hours, twelve hours what happens in the rainy day what happens on a dark day? It is very necessary to have a backup and that is not going to get away unless and until some magic comes up on storage

Today it is being projected that coal is a source of lot of Pollution – Yes, it is but should it be just replaced? So, if we look at what is the industry doing to bring down the pollution by use of coal – with use of coal power companies can come up to 30% of thermal efficiency and if we talk about ultra-supercritical then we are looking at an efficiency of around 45 to 50%. So, with same amount of emission we can get more power so can we then make comparisons as to where solar stands vs coal

The demand side for coal – there is an electric power survey taken every five years and the latest survey projected a demand of 220 Giga Watts by 2022 and 298 Giga Watts by 2027. The peak demand will come beyond sunset and we believe renewable can only help us in the short run. From power side the coal supply is much less than required. New plants whenever they get FSA are only given 75% of their ACQ and not beyond that. CIL being a monopoly the FSAs is one-sided power sector has to deal with it, so this issue has to be dealt with more equitably because ultimately, it’s the consumers who are hit hard.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.