Indian Banking Sector has been through volatile period over last few years. The bad times were majorly for Public Sector Banks. We will see below how has the last 5 years been for the Indian Banking Sector and few top banks in Public Sector Banks and Private Sector Banks list.

In the below analysis, we have focused on top 4 Public Sector Banks and top 4 Private Sector Banks to understand whether the sector is headed for consolidation.

Analysis of Banking Sector in India

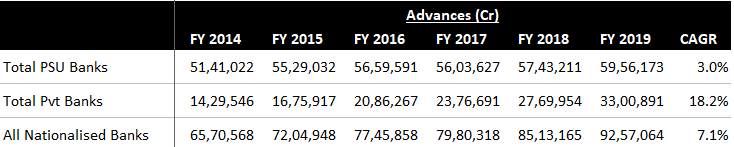

Advances of Public Sector and Private Sector Banks

Overall credit growth in Indian Banking Sector mirrored our GDP growth, with 7.1% CAGR since FY 2014. However, there was high disparity amongst Public Sector Banks and Private Banks, with Public Sector Banks growing their credit at just 3% CAGR, v/s. Private Banks growing at 18%.

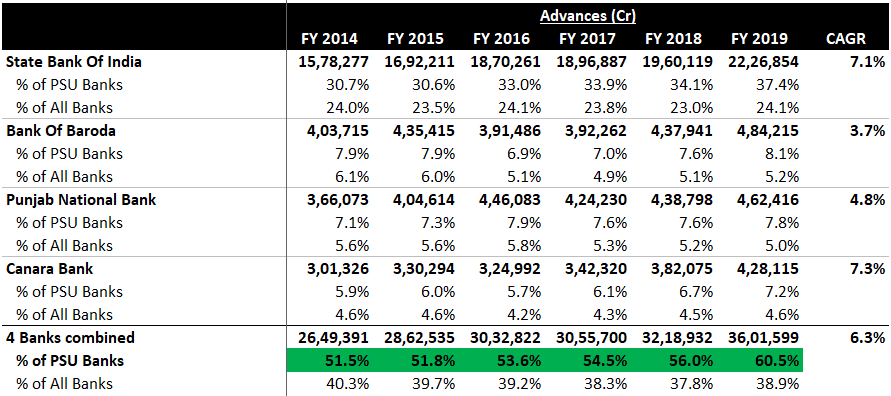

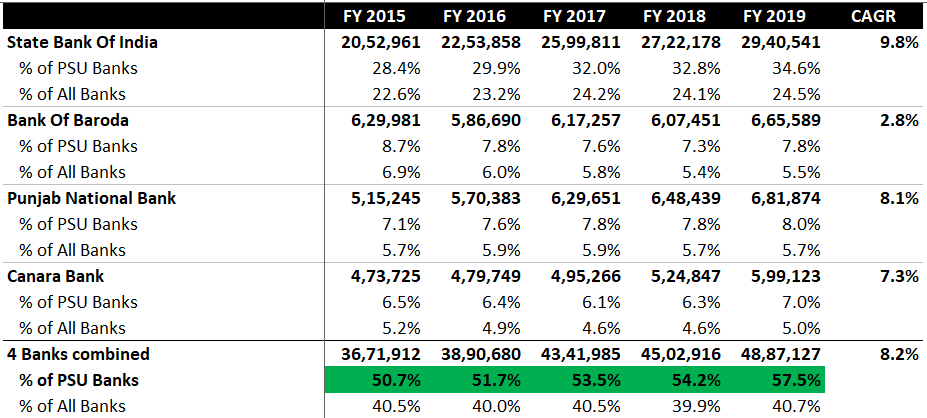

Top Public Sector Banks

Public Sector Banks have seen consolidation, with top 4 banks accounting for 60% of total Public Sector Bank advances in FY 2019, which used to be ~51% in FY 2014. However, these top Public Sector Banks have lost grounds on their share amongst All Nationalised Banks. Still the top 4 Public Sector Banks account for 39% share, whereas top 4 Private Sector Banks account of ~25% share.

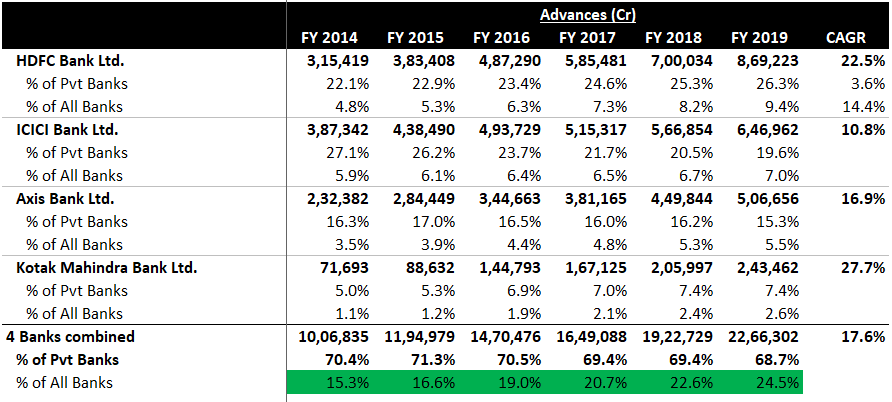

Top Private Sector Banks

Top 4 Private Sector Banks were not able to gain market share in the Private Banks segment. Due to Public Sector Banks’ poor credit growth, these top Private Banks have increased their market share from 15% to 25% of all nationalised banks in India.

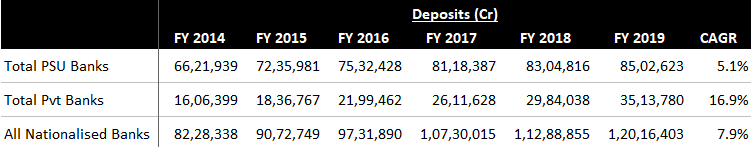

Deposits of Public Sector and Private Sector Banks

Deposits for all nationalised banks has increased at broadly similar to GDP growth rate at ~8%. Private Sector Banks were able to attract higher deposit growth rate.

Public Sector Banks

Public Sector Banks saw consolidation with top 4 banks’ share increasing from 50% to ~58% since FY 2014. Interestingly, these top 4 Public Sector Banks have managed to retain deposits share amongst all nationalised Indian Banks at ~40%.

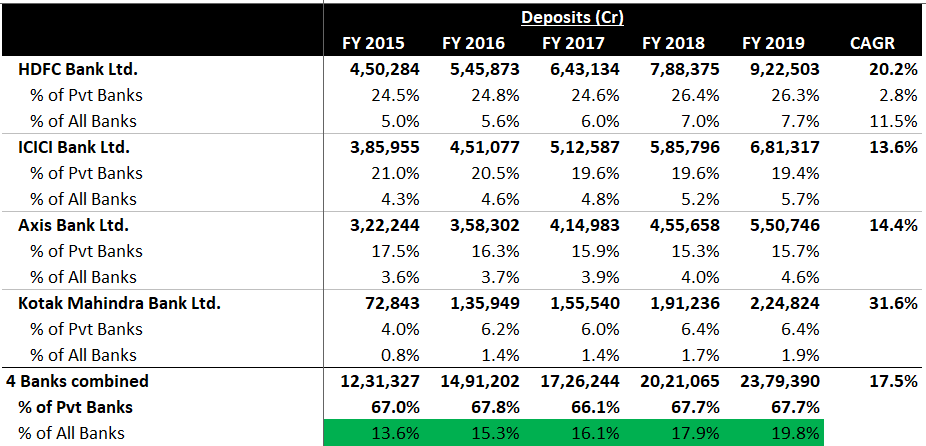

Private Sector Banks

Private Sector banks in India did not see any major consolidation in deposits towards the top 4 banks, however on all banks level, they gained market share from 13% to 20% of all total deposits.

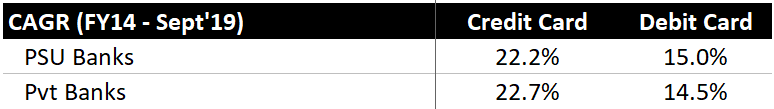

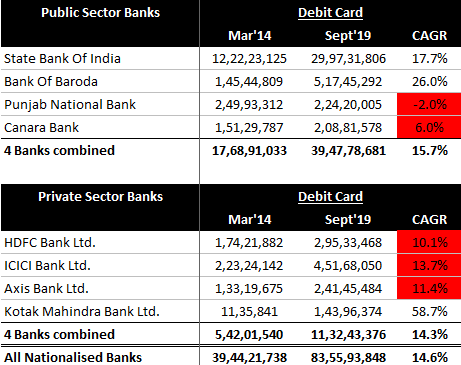

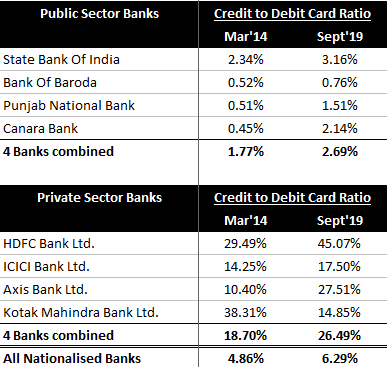

Cards Business of Indian Banks

Cards business is where Public Sector Banks have actually delivered at par with their Private Sector counterparts. From March 2014 to September 2019, growth in number of Credit Cards and Debit Cards has remained very identical at ~22% and ~15% respectively for Public Sector Banks and Private Sector Banks.

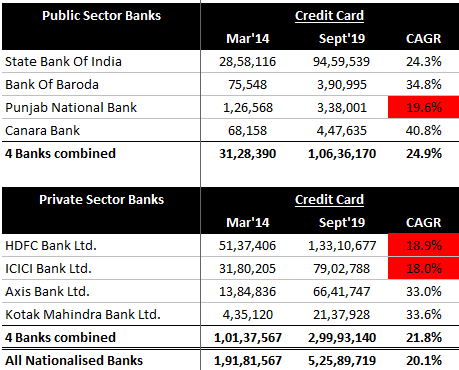

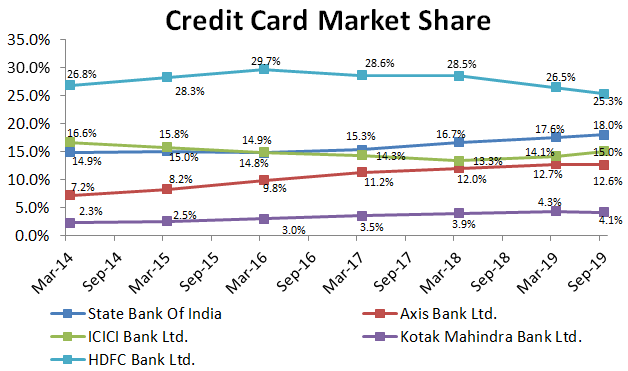

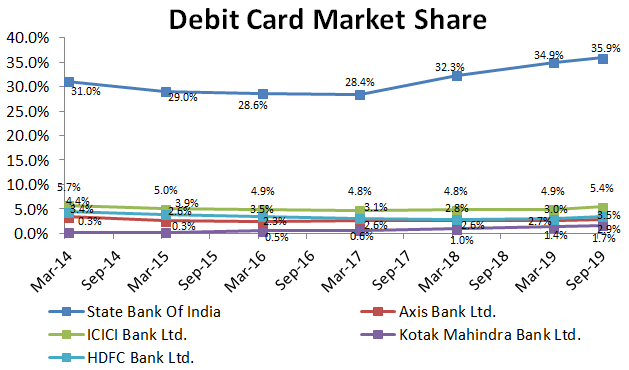

All Nationalised Banks in India have grown their credit card and debit card count at 20.1% and 14.6% CAGR respectively. Interestingly, many Private Sector Banks in India have grown at a slower rate comparatively. However, these banks already have garnered higher market share in credit card business.

Credit card market share has been increasing for SBI, Axis Bank and Kotak Mahindra Bank, whereas it is declining for HDFC Bank and ICICI Bank.

When it comes to Debit card market share, SBI has 30 cr debit cards v/s HDFC Bank have 3 cr debit cards, and is further growing at higher rate.

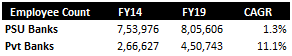

Employee Count of Indian Banks

Public Sector Banks have added only 50,000 employees since FY 2014, whereas Private Sector Banks have added ~200,000 employees. More can be found on Job Creation In Corporate India – BSE 500 Employee Cost & Employee Count Analysis.

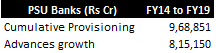

NPA Provisioning

Public Sector Banks’ provisioning for NPAs is more than their credit growth since FY 2014. More can be found Indian Banking Sector – NPA Mess & The Way Out.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.