Infrastructure sector is very crucial for faster growth of an economy. With default of one of the major Indian infrastructure company and recent elections, infrastructure sector in India has gone through a tough period in the last year.

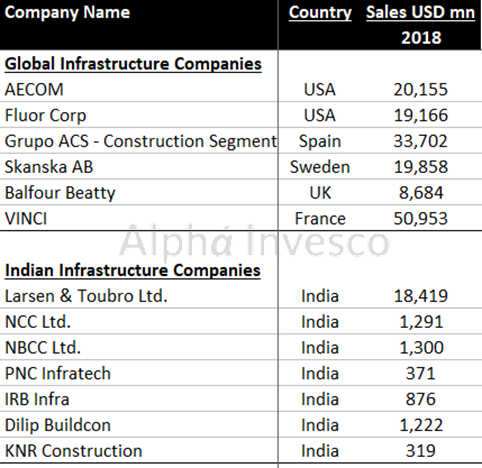

Let us compare and see how top infrastructure companies in India fare compared to global major infrastructure companies.

Key point to remember for the below analysis is –

- Mentioned year is financial year for respective companies.

- For simplicity of comparison, all financials have been converted into USD millions.

We have covered 6 global infrastructure companies and 7 Indian infrastructure companies.

Global Infrastructure Companies:

AECOM –

AECOM’s business is designing, financing, building and operating infrastructure assets for federal and state governments and businesses.

Fluor Corp –

Fluor Corporation provides oil and gas infrastructure construction services. The Company offers engineering, procurement, maintenance, outsourcing, equipment rental, and project management services. Fluor serves customers worldwide.

Grupo ACS –

The Spanish contractor was formed in 1997 through the merger of two other construction companies. It has grown through several high-profile acquisitions including that of Hochtief. It is an engineering and contracting company that develops civil and industrial infrastructures. The Company provides Civil Works Construction, Greenfield Concession Development, Industrial Services (electricity, oil and gas) and Environmental Services.

Skanska AB –

Based in Sweden, the multinational operates in the residential, commercial, residential and infrastructure sectors. In the US, the company is known for constructing the Meadowland Sports Complex, home to the NFL’s New York Jets and Giants. Skanska employs more than 50,000 people.

Balfour Beatty –

The multinational was founded in 1909 by George Balfour and Andrew Beatty. Headquartered in London, the company is currently an integral part of the Crossrail project in the UK capital. It operates in more than 80 countries around the world and employs some 40,000 people.

VINCI –

VINCI SA is a global player in concessions and construction with expertise in building, civil, hydraulic, and electrical engineering. The Company offers construction-related specialities and road materials production, as well as finance, management, operations and maintenance of public infrastructure such as motorways, airports, and road and rail infrastructures.

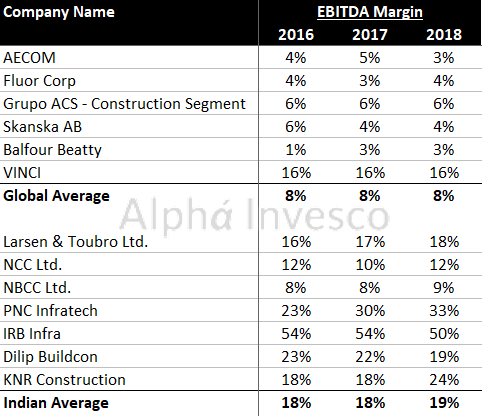

Infrastructure Sector – EBITDA Margin

Indian infrastructure companies have been generating better EBITDA Margins compared to global infrastructure companies on consistent basis. A major benefit that Indian infrastructure companies have is of lower employee cost.

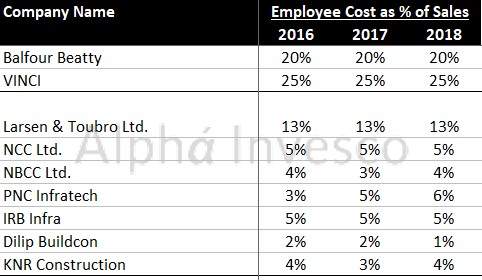

Infrastructure Sector – Employee Cost as % of Sales

Indian infrastructure companies have comparatively way lesser employee cost.

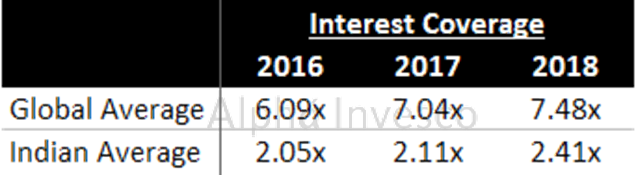

Infrastructure Sector – Interest Coverage

Indian infrastructure companies have higher debt, and hence higher interest cost compared to global infrastructure companies.

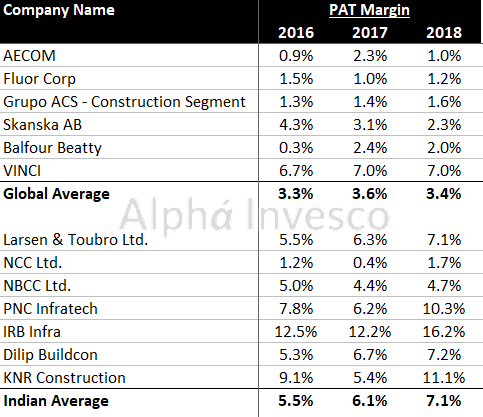

Infrastructure Sector – PAT Margin

Indian infrastructure companies are generating double PAT margin compared to Global infrastructure companies. Only one global infrastructure company is generating PAT margin above 5%.

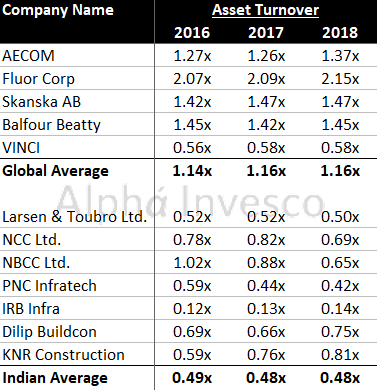

Infrastructure Sector – Asset Turnover

Indian infrastructure companies’ asset turnovers are half of that of the global infrastructure companies. None of the Indian infrastructure company is generating asset turnover above 1.0x.

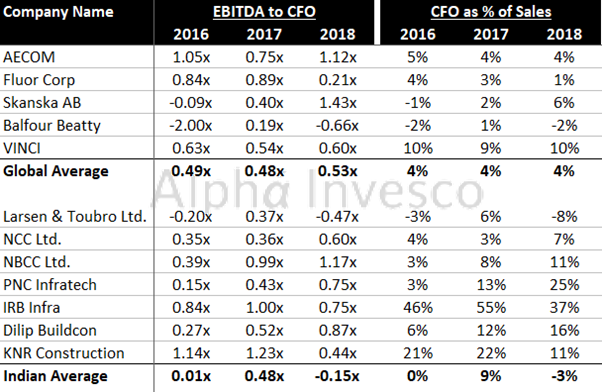

Infrastructure Sector – Cash Flow Generation

Indian infrastructure companies have much better cash flow generation compared to global infrastructure companies.

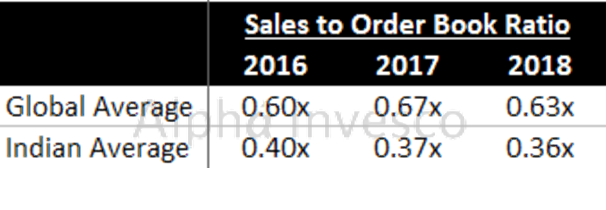

Infrastructure Sector – Order Book Conversion

Global infrastructure companies are converting their orders into sales at much quicker rate than Indian infrastructure companies. Global infrastructure companies have Order Book turnover ratio (Sales to Order Book ratio) almost double of that of Indian infrastructure companies. Global infrastructure companies take on an average ~1.5 years for execution of the order book v/s Indian infrastructure companies taking ~2.7 years for execution of their order book.

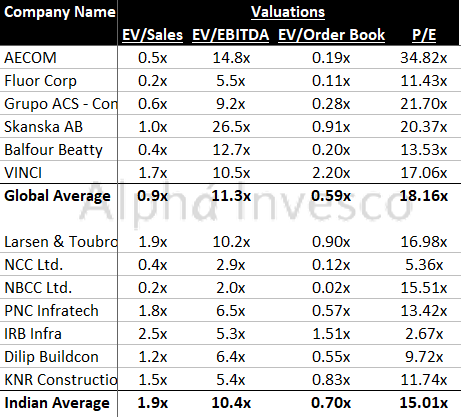

Infrastructure Sector – Valuations

The financials in the valuation ratios are as per respective latest financial year.

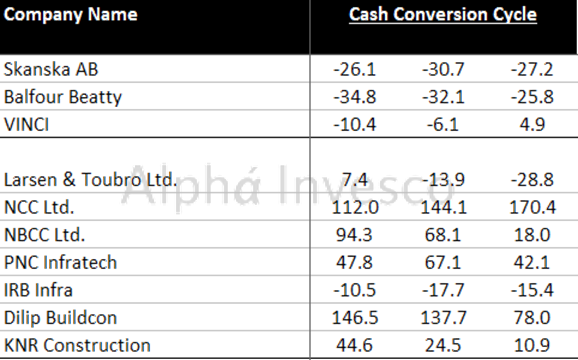

Infrastructure Sector – Working Capital

Cash conversion cycle for global infrastructure companies is way better than for Indian infrastructure companies. This helps global infrastructure companies generate quicker order book conversion to sales, consistent cash flows and remain low on debt despite of having lower EBITDA margins.

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.