Neeraj Marathe @NeerajMarathe is an individual investor based out of Pune. He has been practicing value-based investing for the past 13 years in the Indian Stock Market. Neeraj Marathe’s four-day course “Art of Investing” at FLAME University provides lots of insights on the fundamentals of the equity investment process.

I had the opportunity to attend the course last year, and it has been a rewarding experience. “Art of Investing” is a short residential course that focuses on how investors can train their mind with lots of case studies. Being relatively new to investing, the course helped me to get some real sense of stock market investments. This course is for practitioners who wish to sharpen their ability to research, investigate companies & understand businesses to become better equity investors.

I highly recommend the course to all those who are interested in equity investment research guidelines. While you’re there, you can also take advantage of FLAME University’s outstanding library. Those who want to learn to invest in the stock market and want to know how to start the process, i have shared the slides and picked up a few topics from the vast course on “Art Of Investing”.

Before we begin….

This is just a compilation of few thoughts that I picked up. Full course is far more exhaustive & detailed with case studies, examples, discussions, Q & A and more. The presentation is solely for informational and discussion purposes only and is not, and may not be relied on in any manner as legal, tax or investment advice.

Download Presentation: How to Invest in Stock Market: Equity Investment Process

How to Invest in Stock Market: Back To Basics

- Investing in stock market is about having an overall picture of a business. Annual reports should be watched like a movie , to have a true essence of the business.

- To learn stock market investment one should be good at reading Balance sheet, Income statement, Understanding business, Peer comparisons etc.

- To unlearn sometimes becomes difficult but you have to do it a couple of times when it is necessary.

- When you keep trying new things again and again ,( going against your mind and learnt things) you will surely conquer your thinking.

When you have learnt something it will always stay in your mind, though you unlearn them.

Mind is like a parachute it should be open to work and new knowledge or else you will die due to narrow mind.

It is always better to accept the changes rather going against them.

Stock Market Investment Philosophy

What is investment philosophy?

- Sometimes not having any philosophy will be useful but to have one will make you different.

- When you have your own philosophy you will know where you are wrong and you will understand what to adapt and adopt.

- You should write down your own beliefs and thesis that will help you know what you don’t know.

Investing is a lonely process, do it alone!

Investing can never be done in a committee.

What Type of Equity Investor Are You?

1] Honey Badger

- Brave animal yet stupid enough to attack a lion that is multiple folds bigger than her.

- Honey badger dares to run open in ground full of danger and has risky attempts on grabbing her food (eggs) from dangerous spots where she can get herself easily into trouble.

- An equity investor who continuously hunt for stocks to sustain in the competition.

2] Cheetah

- Cheetah is known for its speed, it sees the whole heard but spots one and chases it without any other distractions.

- Cheetah gives in everything he can, they are known to run at higher speed but that speed can last for only a couple of seconds.

- Cheetah spots an opportunity and hunts it down keeping other things unaffected.

- Sometimes having just physical abilities won’t work in the stock market but it should be combined with strategy.

3] Sargassum Fish

This fish, due to its inability to swim hides in between the weed called sargassum, it can camouflage easily in this weed that keeps floating on the surface of the ocean.

This fish does not move at all, saves energy and wait for the prey to come close, how much ever time that may take (unlike cheetah that runs behind the opportunity, the fish waits for the opportunity that the prey falls for the fish and saves all the energy).

Whatever an individual understand he should step there only, Don’t just flap through everything. For beginners it’s necessary to know that their operating expenses should never be dependent only on share market investments.

Generation of Ideas for Stock Selection : Few Pointers

1) Price Based Criteria

- Companies hitting 52 week low (near 52 week) or 52 week high in stock exchange.

- 1 month, 3 months, 6 month losers

- Stock market hates certain sectors at certain point of time, you can figure this out in 52 week low company.

2) Management Change

- Company where management has changed can be a good trigger for stock selection purpose.

- You should know the history of the company, When you know the problem you will realise when new management starts to do good or bad functions in the company.

- Check reliability of the accountant.

- You will observe some changes in the behaviour of management and way of presenting their data.

- Management change will be verified by :

- Is new management better than the old?

- Is there enough to be changed in the company business?

- Is there enough opportunity for management to expand the company business?

- Is the management capable enough to change the company business?

- Conflict of business or interest

3) Temporary Distress

- Any company that is going through temporary distress, then that is the time you should know the base of a company.

- When you know the business is good, management is good and stress is not permanent that’s the time you can look to those companies.

- In temporary distress always remember that market should have not extrapolated this.

- (Share market is not mostly stupid , or we are mostly not smarter)

4) Reading Annual Report

- When we look at 52 week low companies then look at their markets leader of that particular sector.

- Compare and analyse the market leader and 52 week low companies by reading annual report.

5) Media

(mostly biased or influenced ) don’t give much importance to newspapers, social mediums etc.

6) BSE Announcements

- When you read dozens of them you’ll find some interesting company to dig into.

- Always try to cross check across google.

- Always start with the past announcements.

7) Peers

- Get an idea by discussing it with fellow equity investors, stock market veterans, share market investor groups.

- Always look for first hand information.

- Whenever there is a discussion around stock market with questionable peers, ask basic questions like m-cap, who are the promoters, the main driver for the business etc. Helps in filtering out between peers who do their own work, or who merely talk on hearsay.

- Develop a circle of trust among your equity investor group.

8) Screeners / Filters

- When you look at screeners you’ll find that you will come across debt laden companies and companies with high ROCE as well.

- Screeners are used to get some good ideas about the companies that have not been discovered yet.

- There can be many permutations and combinations for the screener, after getting the companies of your own filter then delve deep into them.

9) Industry Sources

- Industry magazines and websites.

- Talk to whole-sellers, stockist, large traders.

- Attend industry exhibitions.

- Read foreign materials.

- Talk to unlisted players

10) Scuttlebutt

- Enquire and obtain information from a variety of sources, corporates and then confirm.

- Modern approach, look around you to find ideas.

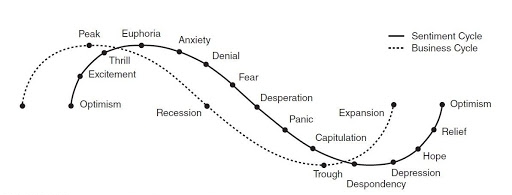

Role of Behavioural Finance in Stock Market

This diagram depicts the relationship between equity investor sentiments and the business cycle.

Different Types of Instincts of Equity Investors

1] Instinct of Greed

Equity Investors get caught up in greed (excessive desire). After all, most of us have a desire to acquire as much wealth as possible in the shortest amount of time.

2] Instinct of Instant Gratification

Instant (or immediate) gratification is a term that refers to the temptation, and resulting tendency, to forego a future benefit in order to obtain a less rewarding but more immediate benefit.

3] Instinct to Form Groups

Forming a group is a mentality that is distinguished by a lack of individual decision-making or introspection, causing people to think and behave in a similar fashion to those around them.

4] Instinct to Justify

People tend to run from their own mistakes, don’t hesitate to accepting your own mistakes . Accept your mistakes and learn from it.

5] Instinct to do Activity

Stock market investors can’t sit still. Humans have a tendency to do some or other activity and falling prices will tempt you investors more to indulge yourself themself in such activity.

How Should Equity Investors Escape from their Own Instincts ?

- Make a sell report on your major holding stock.

- Or else ask your peers to do the same.

- Always try to document your beliefs, when you buy any stock write down the reason of buying that stock.

- Have a no laptop workday. (sit back and recollect all the reasons peacefully)

- Self doubt is an equity investors best friend. Doubt everything you finalised. It will keep you on your toes.

- Arrogance and overconfidence are your worst enemy . The market will kick you where it hurts the most ——-The wallet

“Past success doesn’t matter , everyday is a new day.”

Importance of Behavioural Finance in Stock Market

1] Loss Aversion

Loss aversion is a tendency in behavioural finance where equity investors are so fearful of losses that they focus on trying to avoid a loss more so than on making gains. The more one experiences losses, the more likely they are to become prone to loss aversion.

2] Sunk Cost Fallacy

This loss aversion instinct is what leads us into Sunk Cost Fallacy. A Sunk Cost is money or time you have invested in a project or investment already and which cannot be recovered.

3] Decision Bias

Decision bias speaks to the ways we’re prejudiced or unduly influenced (consciously or unconsciously) when making decisions.

4] Endowment Effect

The endowment effect, in behavioural finance, describes a circumstance in which an individual values something that they already own more than something that they do not yet own.

5] Mental Accounting

Mental accounting contends that individuals classify personal funds differently and therefore are prone to irrational even detrimental decision-making in their spending and investment behaviour.

6] Hindsight Bias

Hindsight bias is a psychological phenomenon in which past events seem to be more prominent than they appeared while they were occurring. Hindsight bias can lead an individual investor to believe that an event was more predictable than it actually was.

7] Mental Heuristic

Heuristics are methods for solving problems in a quick way that delivers a result that is sufficient enough to be useful given time constraints. Equity investors and financial professionals use a heuristic approach to speed up analysis and investment decisions.

8] Representative Heuristic

Representativeness uses mental shortcuts to make decisions based on past events or traits that are representative of or similar to the current situation.

9] Pattern Recognition

Patterns are the distinctive formations created by the movements of security prices on a chart.

Biases of Value Investor in Stock Market

1] The Absolute Cheapness Bias

Value investors generally try to earn higher returns through stocks which stay at complete cheap valuations.

2] The Under Researched Stock Bias

A big number of value investors, even the best ones, are always keen to enjoy the process of making a diversified equity investment portfolio and are less concerned about the profit part.

3] The Conservatism Bias

Value investors have a licence to be conservative . Lots of them can be also classified as pessimists too! Of course, when a pessimistic guy finds an attractive idea and loads up on it, the results can be fabulous. Value investors tend to be more conservative while reacting towards selection of stocks.

4] The Closed Mind Bias

When value investors have researched a lot about some stocks, they will tend to close their minds and stop reacting to others opinion.

5] The ‘Ignore Macro Stuff’ Bias

A lot of value investors take investing decisions based purely on valuations and not based on macro scenario. There should be a fine line to be maintained here as per one’s inclination as well as ability to understand and analyse macro economic data.

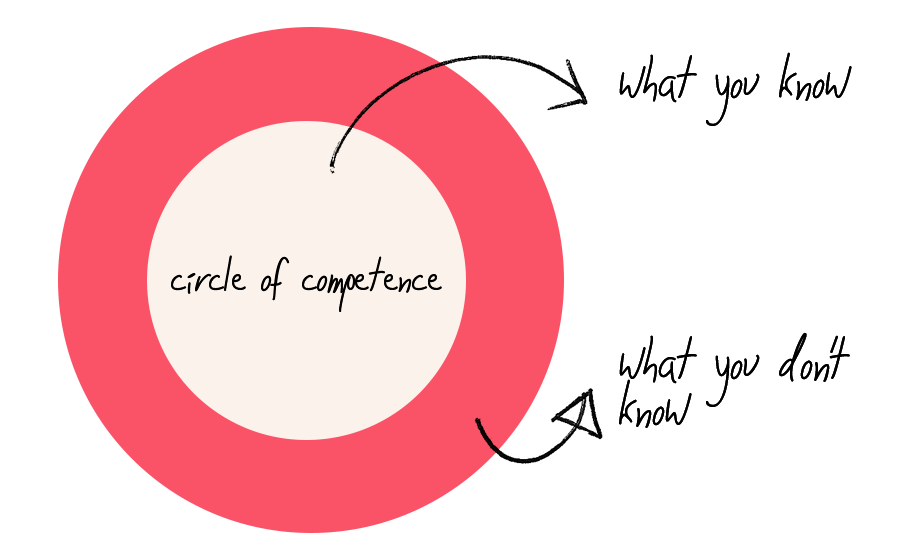

6] The Circle of Competence

Identify what you are good at and what you know, identify what you are not good at and what you don’t know and then just stick to the former. But some value investors escape taking efforts by saying that something is ‘out of my circle of competence’. But one should always try to expand their own circle of competence.

How to Analyse Management Integrity?

- History of the management

- Mental segregation of company and himself

- Attitude towards minority

- Promises v/s delivery

- Binding with law or breaking the law

- Playing in their own stock?

- Professional or family managed company.

- How they react in tough times?

- Do they have deep knowledge and technical expertise

- Scuttlebutt

- Attends AGM

How to Know the Quality of Management?

- The professional edge

- Integrity and efficiency

- Management efficiency

- Businesses and products

- Longevity of business

- Positioning in the industry

- Superior return ratio

- Favourable terms of trade

- Judging disruption / new products technology

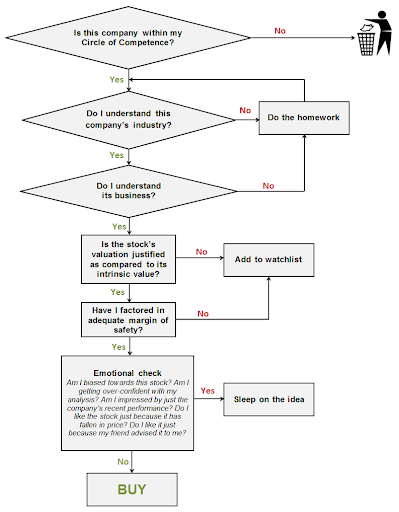

Checklist for Equity Investors:

Source – https://www.oldschoolvalue.com

Process to form an Investment Checklist:

- Clear understanding of business

- Understanding of the economics of the business (rough P&L statement and CF statement for both overall and per unit product/service sold)

- Understanding the barriers to entry, if any

- Valuation – Putting the above into context

- Investment Checklist

|

|

Define your Circle of Competence

Why it is important to know the circle of competence?

- Knowing what you know is very important, but knowing what you don’t know is more important.

- Defining circle of competence is most important, do it on paper. Marrying this concept with checklist and decision journal helps.

- Define a circle of incompetence also.

- Always remember there is no compulsion to invest.

How can you Expand your Circle of Competence?

- Pick up an industry you find interesting and you can easily relate to.

- Pick the big performer in the selected same industry and compare.

- Cover at least two business cycles of the company

- Download and go through all the material available on that selected company and sector.

- Find out the best and worst situation and understand the value drivers.

- Analyse and repeat.

Stock Allocation!

How much allocation to equity?

In equity how much allocation to a particular stock?

- The above are few questions that are to be asked before allocating the amount into equities.

- Don’t be too excited when allocating to a particular stock that you have researched more.

- Decide your allocation by judging your own risk absorbing capacity.

- Don’t try to clone your stock allocation with market giants, because there risk taking capacity will always differ from yours.

Allocate big when…

- There is low possible downside.

- Very low absolute valuations relative to past.

- Temporary distress.

- Strong balance – sheet, dividend yield support.

- An equity investors understanding of business in numbers and management is very high.

- Valuation is an art, so always try doing back-calculation , it will show real figure.

- When you find that your researched stock is falling and have the potential, so you should not allocate more just because prices are reduced. See the opportunity.

- Don’t average out just because stock prices are falling.

The Biggest Question of all Time

When One Should Sell the Stocks?

- The best sell decision is the one which you have thought at the time of buying that stock.

- When your own original hypothesis no longer hold true. The position is breaking your allocation rules.

- There is a change in management, and you are not comfortable with.

- Promises v/s delivery

- Cash calls due to market , sell % of all holding

- Business has undergone a huge change.

- When you have something in your portfolio and it doesn’t work as you thought for 1 year then sell.

Key Practical Points of Selling in Stock Market

- When you sell , write down the thesis why you are selling

- When sector leader prices go extraordinary high , one should take a view on even the reasonably priced stock.

- Be very cautious while justifying stuff to yourself , in a bull run you are your enemy.

- While buying any stock always write down the reason of buying and decide the range you will exit that particular stock.

- Avoid greed , or else market will avoid you forever.

- Equity Investment styles always depends from person to person from its nature to his risk bearing capacity , don’t clone others while investing in stocks.

- We can never time the market cycle , so just research and hold 3-4 stocks from the same cycle , one will surely be multibagger.

- Every industry goes through trend , just sit and analyse that trend thoroughly.

Important Sources:

- Partnership letters – Warren Buffett

- SSRN – Academic Research Report

- Report Junction

- Report Bytes

- Screener

- Rate star

- Trendlyne

- Markets mojo

- Stock adda

- Credit rating report

Book Recommendations:

- Money Master

- Little book that beats the market

- Contrarian

- The investment checklist

- The checklist manifesto

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.