Greetings Of The Festive Season ! Wishing You & Your Near Ones A Very Happy Diwali !

Slowdown, liquidity, jobs, automobiles, fiscal deficit – these 5 keywords have driven the narrative in first half of the financial year. Most of us were expecting a strong revival in the sentiments post a historic & stable political mandate in May 2019. But it turned out exactly the opposite.

The liquidity crunch which started with NBFC’s in Sept 2018, has spread to other parts of the economy. What started as a problem in one sector has become a ‘crisis of confidence’. Banks are unwilling to lend to corporates. Vendor’s are not willing to supply material without releasing old payments, and companies continue to seek extended credit. Investors, rating agencies are not willing to trust promoters with debt on their books.

Wait For Earnings Recovery Has Led To ‘The Quality Bubble’

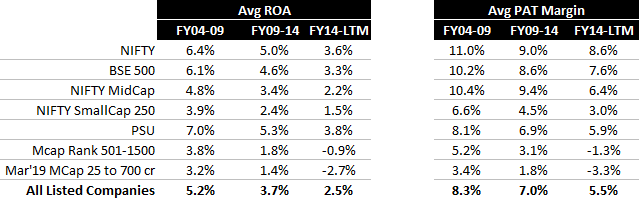

Wait for earnings growth continues to frustrate investors. As we can see, the average PAT margins & profitability for most of the listed companies continue to struggle.

In such an environment, equity funds too have shifted their preference towards pockets where there is certainty of earnings & growth. The valuations don’t matter now. All that matters is ‘certainty’. This certainty is being termed as ‘quality.’ But we have seen the definition of quality also changes with time. As growth in other pockets bounces back, money will chase them as well. Todays ‘quality’ theme is over owned, over valued & growth continuation too is over estimated.

Connecting The Dots

However – if we take a close look at the regulatory environment, government response & adjustments in the economy, things are falling in place for a much wider economic recovery.

- Interest rates a are falling. The transmission is taking time, but it will eventually percolate as banks pass it on gradually.

- Capacity utilization across sectors are moving up towards 80%.

- Yes – there is a slowdown in infrastructure orders since election cycle & monsoon both have hit the economy during first half of the year. But that too shall recover as we move into the second half.

- Government has firmly set its target towards achieving 5 trillion $ economy, we will eventually get there. Some large scale announcements like corporate tax cuts, sovereign debt issue in foreign currency, bank recapitalization worth 70000 cr have been announced.

- The much awaited PSU bank consolidation, asset recycling / disinvestment programme of PSU’s has finally seen some action. In our view, disinvestment of BPCL, Concor, SCI is just the beginning. Markets will see far too many big ticket announcements as we move forward.

- Private sector is still struggling. Hence government will have to do lot of heavy lifting to kick start the investment cycle & go for aggressive spending programs. With lower fiscal deficit & further room to reduce interest rates, Modi government has far more firepower with them and can go really aggressive in the second half of the year.

The real benefit of corporate tax cuts lies in its ability to attract big ticket investments & healthier competition among states to have better regulatory environment. If GDP growth continues at 6-7%, we are likely to run out of capacities in core sectors very soon. Corporate tax cuts + sovereign bonds + aggressive disinvestment programme is likely to result in a roaring investment cycle. We are likely to see multibillion-dollar investments flowing into the economy, especially with 75% of the global sovereign debt yielding below 2%.

New Winners On The Horizon

All of this is likely to throw new winners in the Indian stock markets as earnings in manufacturing, cyclical commodities, natural resources / mining, PSU’s, corporate banks are set to recover. None of which are priced in the valuations today & these pockets continue to remain highly under owned.

We have adjusted our portfolio’s as per the realities of changing external environment & undervaluation at a stock specific level. We believe underpriced moderate growth stocks will deliver far superior returns than overvalued high growth stocks as we move into the year ahead. The strategy has not delivered a great outcome over the last 24 months. However, we are confident of superior performance as earnings in our investee companies are set to recover. Deep undervaluation gives us further comfort to keep on holding & ride through the painful periods like these.

Once again, wishing you a very happy Diwali from the entire alpha invesco team.

Regards,

Chetan Phalke

CIO – Alpha Invesco Research

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.