Disclaimer: The Blog on Indian coffee sector is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. Please read the detailed disclaimer at the bottom of the post.

Coffee is world’s premiere caffeine provider, 2.5 billion cups are drunk everyday. It provides 54% of the world’s total caffeine, followed by tea and soft drinks.

Coffee Plantation

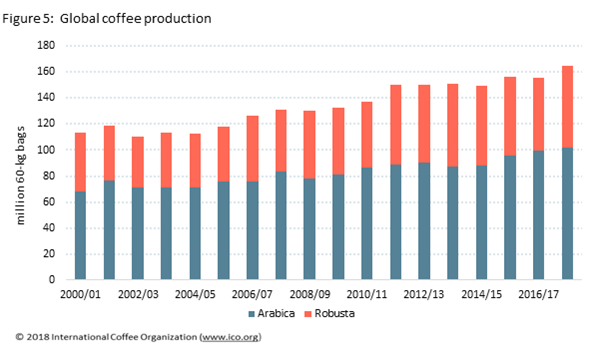

Coffee plant is woody shrub that is grown in subtropical and tropical climates. Coffee beans are seeds of this plant. There are two major types of coffee: Arabica and Robusta. Arabica coffee is generally considered superior to Robusta. About two thirds of world production is Arabica and one third Robusta. From planting, it takes three to five years before the coffee plant begins bearing cherries. This long lead time can create periods of supply-demand imbalance, as farmers plant coffee when prices are high but then do not produce a crop for several years, by which time circumstances may differ.

Processing

Coffee beans are seeds of the coffee plant. Processing a coffee bean requires many stages of processing before it can be brewed into a cup of coffee. Coffee cherries are either plucked by hand or machine. The purpose of processing is to separate the coffee bean from the cherry and dry it.

Once dried, we call coffee bean ‘green coffee’.

In second stage of processing we have two methods:

- Dry method

- Wet method.

Dry method involves laying the coffee cherries in the open sun and letting them dry out. The seed or bean is later separated by a process known as hulling.

The wet method involves the usage of water and seed or bean is separated from cherry before drying. Wet method of separation produces higher quality and therefore higher priced coffee.

Almost all Arabica coffee is processed by wet method.

Next step in coffee processing is roasting. Roasting brings out the flavor we like in a coffee.

Roasting generally takes place in the importing country because once roasted the coffee beans begin to lose their freshness. Importing nations will always have captive or domestic roasting facilities for coffee.

World Coffee Production

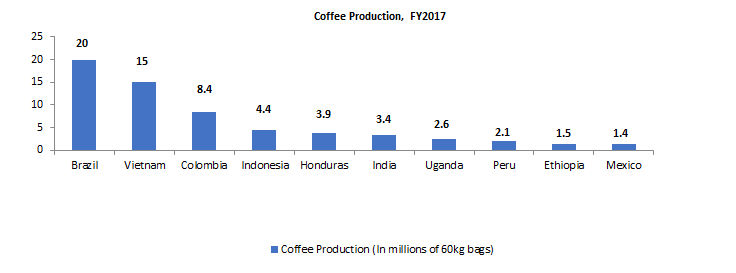

Coffee is produced in approximately 70 countries, but the world’s largest coffee producer by far is Brazil. This makes the price of coffee sensitive to weather conditions in Brazil.

The countries of west Africa and Vietnam produce mostly Robusta coffee. Although Brazil produces mostly Arabica coffee, it is actually world’s second largest Robusta producer, behind Vietnam.

Spot Prices : Average ICO indicator Prices (cents/pounds)

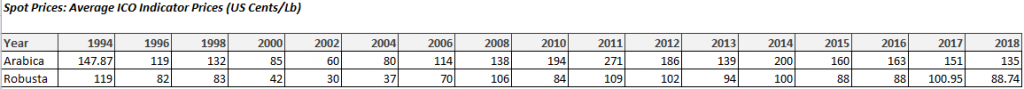

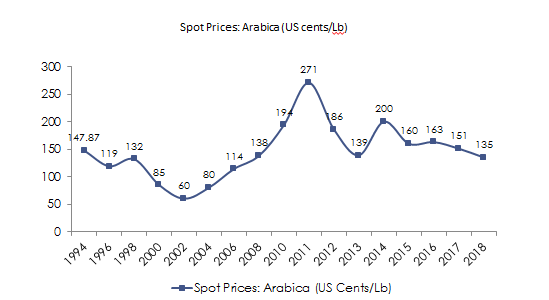

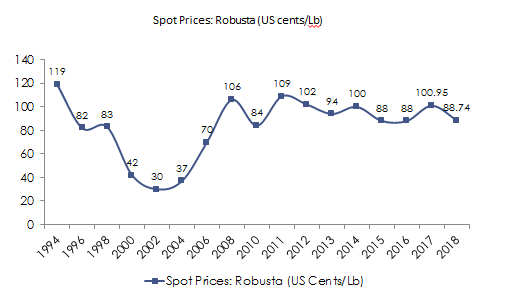

Coffee prices dynamically vary based on weather situations in major coffee producing nations such as Brazil and Vietnam. In the year 1994, Arabica and Robusta coffee prices made new highs at 147 and 119 cents per pound due to frost damage in Brazil, frost in Brazil was followed by drought in 1997, when again coffee prices touched 132 and 83 cents for Arabica and Robusta coffee respectively.

Coffee touched its low in the year 2002 when Arabica and Robusta were priced at 60 and 30 cents per pound and this happened due to oversupply of coffee in the world market.

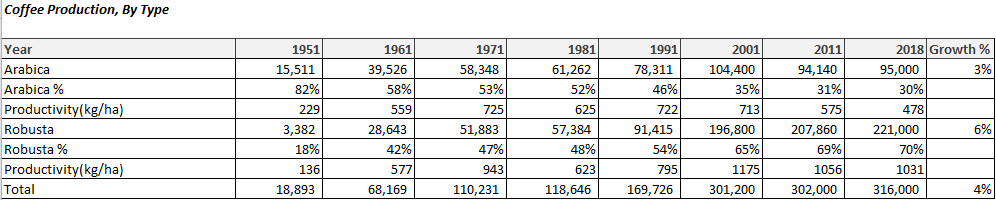

In the same period (2000-02), India dramatically produced 301,200 MT of coffee which encompassed 104,400 MT (35%) of Arabica coffee production and 196,400 MT (65%) of Robusta Coffee production. Since 2002 and till 2018 India has grown from a nation producing 301,200 MT of coffee to a nation producing 316,000 MT of coffee, a meager .28% of CAGR.

Coffee Prices again made a new peak although short lived this time in the year 2010-11 when there were concerns about supply in Brazil and Columbia and it was followed by aggressive speculator activity.

Arabica coffee prices touched 271 cents per pound and Robusta coffee touched 106 cents per pound on the commodity exchanges that year.

Indian Coffee Sector – Area, Production & Productivity

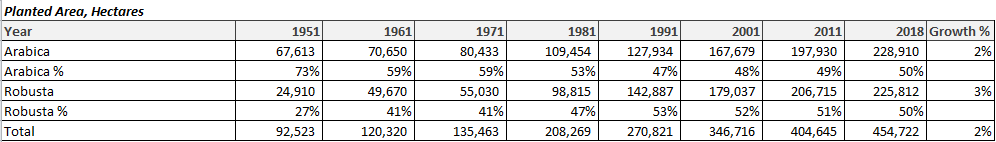

Over a period of 68 years from 1951 till 2018, we observe that the area under cultivation for coffee has gone up from 92,523 hectares in 1951 to 454,722 hectares in 2018. During this period the area under cultivation for Arabica coffee as percentage of total area has decreased from 73% in 1951 to 50% in 2018, whereas the area under cultivation for Robusta coffee has gone up from 27% in 1951 to 50% in 2018.

Today (2018) we observe that Arabica coffee, despite covering 50% of the soil in India for production produces only 30% of the volume (tonnage) and in value terms it is 39% ($256 million worth of Arabica coffee at 135 cents per pound) and the rest is Robusta coffee which is 61% ($388 million worth of Robusta coffee at 88 cents per pound).

It is no surprise that growing Arabica coffee is dragging Indian coffee sector behind when it comes to optimally utilizing its resources (land and labor).

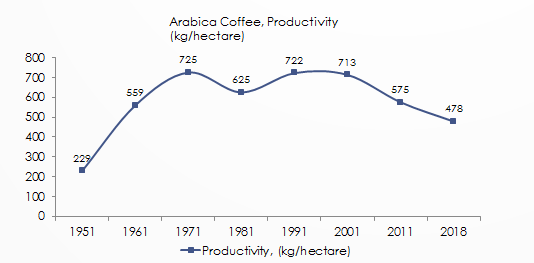

If we observe closely the productivity of a Arabica coffee farm land is decreasing (from 1971 to 2018), India witnessed increased productivity of Arabica soil from 229 kg per hectare in 1951 to 725 kg per hectare in 1971 and since then it has decreased gradually and today (2018), despite mechanization and the best in class technology available, Arabica soil in india produces 478 kgs of coffee per hectare.

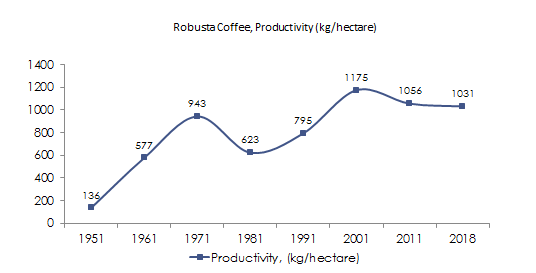

At the same time Robusta soil’s productivity has gone up gradually from 136 kg’s per hectare in 1951 to 1031 kg’s per hectare in 2018.

Karnataka’s Coffee Farms – Time To Mechanize

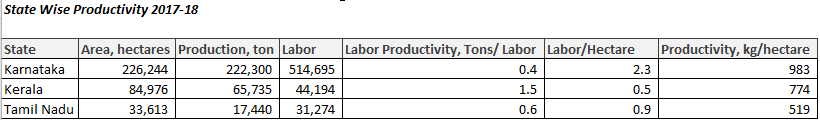

Karnataka accounts for over 50% of the coffee land under cultivation in India at 226,244 hectares and it produced 222,300 MT of coffee in 2017-18. Karnataka also has the highest soil productivity at 983 kg’s per hectare in contrast to Tamil Nadu which has the lowest soil productivity among the three states at 519 kg’s per hectare.

Although Kerala has the marginally low soil productivity at 774 kg’s per hectare but it has comparative advantage versus Karnataka and Tamil Nadu in terms of labor utilization. Kerala employs an aggregate ~44,000 people in its coffee farm lands but at a unit level in terms of coffee produced per labor, Kerala has the highest productivity at 1.5 tons of coffee production per labor.

Karnataka and Tamil Nadu states lag behind kerala on these metrics and this comparative advantage of kerala is possible because of more mechanization of coffee farm lands versus that of Karnataka and Tamil Nadu.

Coffee producers in Kerala will see operating leverage kicking in when coffee prices rebound as there operations are less labor intensive versus coffee producers of Karnataka and Tamil Nadu.

Mechanization proves to be a major challenge considering the undulating terrain that coffee is grown on. Much work needs to be done in this area.

In Brazil where coffee is cultivated on a flat terrain, mechanization is employed successfully where a single worker covers 100 acres.

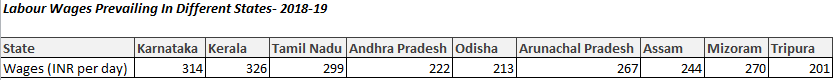

It is evident from the table above that wages in major coffee producing states such as Karnataka, Kerala and Tamil Nadu are high with the highest wages in Kerala followed by Karnataka and Tamil Nadu.

However kerala has the lowest labor density per hectare and per ton of coffee produced therefore the blended labor cost would be lower for companies growing coffee in kerala.

Major Indian Coffee Exporters

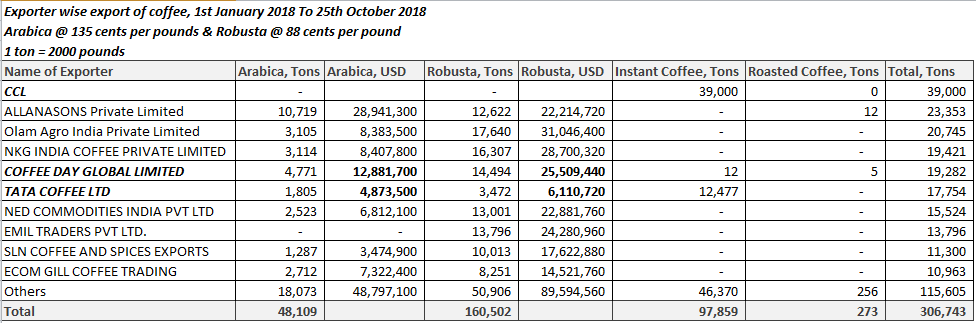

Allanasons pvt ltd is the biggest exporter of Arabica coffee from India and its export volume for the year 2018 stand at a staggering 10,719 tons or ~28 Million USD worth of exports of Arabica coffee.

Coffee Day Global ltd, parent of CCD stands second to Allanasons at 4,771 tons of Arabica coffee exports or 12.8 million USD of exports. Tata coffee follows coffee day global at the third spot with 4.8 million USD of Arabica coffee exports.

The biggest exporter of Robusta coffee is Olam Agro India Pvt ltd at 17,640 tons or 31 million of Robusta coffee exports.

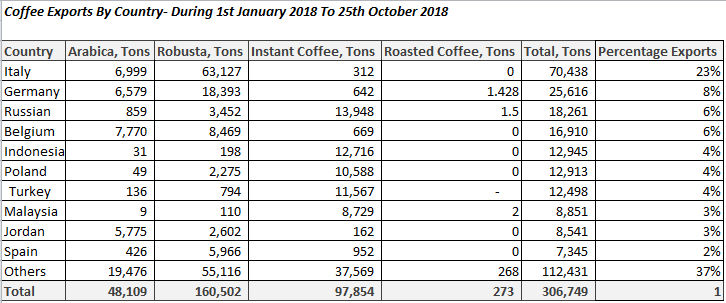

Major Export Destinations For Indian Coffee Producers

India’s largest market in volume terms is the Italian Market and that too for Robusta coffee and so far this year, India has exported 70,438 tons of coffee beans to Italy and of the total export of coffee beans, Italian exports stand rock solid at 23%.

Other major export destination after Italy are Germany, Russia and Belgium

Striking observation in the table is that of Belgium which imports a staggering 7,770 tons of Arabica coffee from India dwarfing other export destinations.

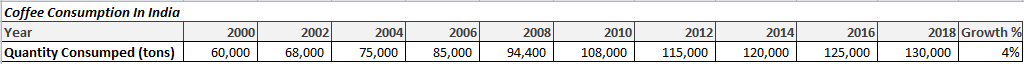

Modest Increase In Indian Coffee Consumption

Bulk of the Indian Coffee production is exported and the domestic industry focuses much of its marketing effort on export promotion. There are signs that the popularity of coffee is increasing with the spread of foreign and home grown coffee shops. However, exports continue to siphon large amounts of coffee away from domestic market and consumption estimates are largely unchanged in recent years.

While the coffee consumption is increasing moderately, it can be difficult to establish a repeatable trend given the industry emphasis on exports, especially when the export demand is high.

Tea continues to be the hot drink of choice for many Indian consumers. Consumers in southern India, where much of India’s coffee is produced, consume more coffee than in other areas of the country. While there is a small but growing cafe culture.

Over the longer term, Indian coffee consumption is not likely to increase significantly until the practice of home consumption becomes more common because the hard reality is that coffee consumption in India has not budged beyond 100 gms in the last 4 years.

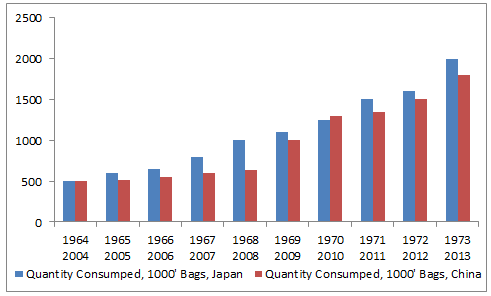

Coffee Market Explodes In China

Rapid increase in coffee consumption in China particularly from 2005 to 2013 can be compared to a similar trend in Japan from the years 1964 to 1973. For japan, it took 30-40 years total to become a recognizable coffee consumer and become the worlds fourth largest coffee consumer, China on the other hand, is still in premature stages of coffee development.

Today China’s coffee sector is valued at $4.72 Bn and Starbucks dominates the sector with 58.6% market share. Starbucks operates 3,400 cafes with each store generating $800,000 of sales per annum. The starbucks management has a target to have 6,000 cafes by FY22.

While India and china have similar coffee consumption (120,000 MTPA, 2018), the rise in disposable income which gives a boost to discretionary spending is driving growth in China. India would see similar growth in the number of cafes and hence greater coffee consumption with rise in per capita income.

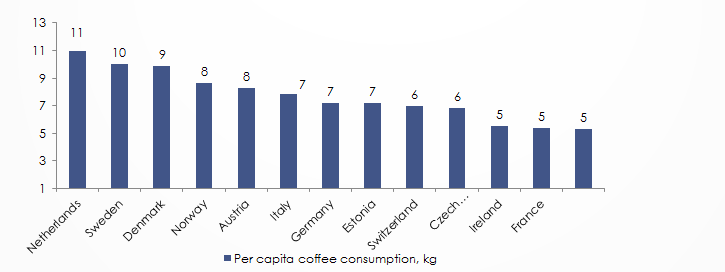

Global Per Capita Consumption Of Coffee

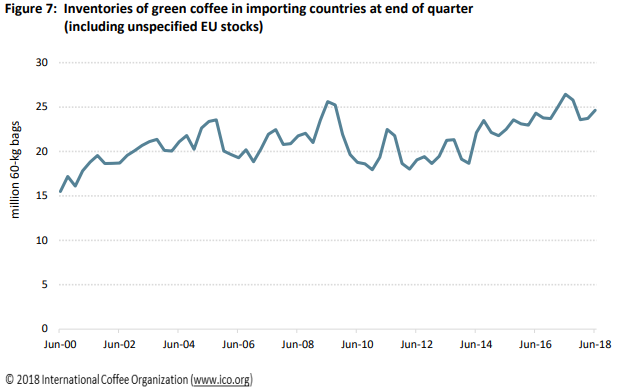

Coffee Inventories In Importing Nations

Stocks of green coffee in importing nations, have remained at high levels in the last two years. After reaching 17.94 million bags at the end of December 2010, stocks grew to record level of 26.44 million bags at the end of June 2017 and as of June 2018, stocks of green coffee in importing nations have been 24.64 million bags which is still high. High stocks of coffee in importing nations put downward pressure on global coffee prices.

Key Indicators In Coffee

- While studying coffee, be watchful of production levels in Brazil, Vietnam and Colombia.

- Any weather disruptions in major coffee producers such as Brazil and Vietnam will impact global coffee prices.

- Because importing nations import green coffee (Arabica or Robusta), they can store green coffee in cool and dry warehouses and this inventory build up will have impact on global coffee prices. Higher inventory levels in importing nations leads to downward pressure on coffee prices.

- Coffee consumption, however rising at 2% can see substitution by other caffeine rich beverages like cold drinks and tea which will put downward pressure on coffee prices.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.