Rubber Chemicals are chemicals used in the manufacturing of different rubber products, and help in enhancing strength, durability and elasticity of the rubber. Rubber Chemicals are basically used by manufacturers who convert Natural/Synthetic Rubber into finished products such as Tyres, and non-Tyre industries like Hoses, Footwear, Moulded Components for vehicles, Industrial Belts, Gloves, etc.

Types of Rubber Chemicals:

Rubber Chemicals are divided into different types based on product segments like anti-degradants, flame retardants, accelerators, processing aid/promoters, and others.

Anti-Degradant Rubber Chemicals:

Anti-Degradant is mixed with natural rubber during vulcanization to improve its quality to get better results, increase tensile strength, better finishing, and high resistance from heat. These rubber chemicals help in deterring the ageing and inhibit degradation due to oxygen attack of rubber products, helping to improve product life. It is the largest segment with ~55% market share globally in 2018.

Accelerator Rubber Chemicals:

Accelerators are used in combination with sulfur, zinc oxide, and stearic acid during vulcanization process to improve its effectiveness. These rubber chemicals basically help to increase the speed of vulcanization.

Flame Retardants and Other Rubber Chemicals:

Flame Retardants help to prevent the rubber from flaming incidents and heat. Additionally, Flame Retardants also help in preventing rubber from moisture, dust, and heat. Other Rubber Chemicals are used for Pre-vulcanization inhibition, Post vulcanization stabilization, Latex based applications, etc.

(Source: Grand View Research and NOCIL PPT)

Raw Material for Rubber Chemicals:

Benzene and its derivatives form the raw material for rubber chemicals. Benzene itself is a derivative of Crude. Hence, crude price fluctuation has indirect impact on raw material price for rubber chemical manufacturers.

Global Rubber Chemicals Industry

Global Rubber Consumption:

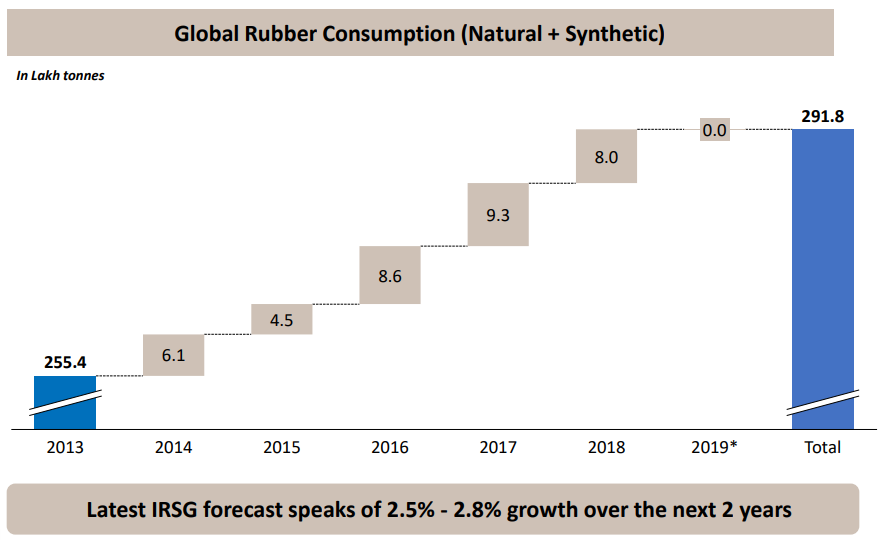

Rubber consumption globally reached ~290 lakh tonnes, growing at 2.2% CAGR. The growth was muted in 2019, and de-growth is visible in 2020.

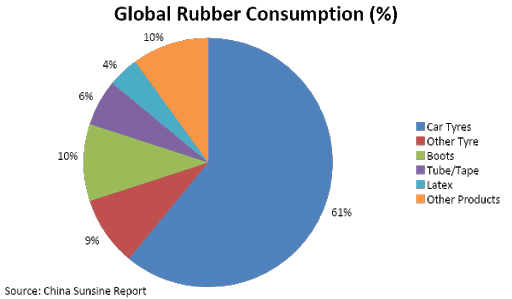

Global rubber consumption is mainly for tyre manufacturing, as can be seen in the chart below –

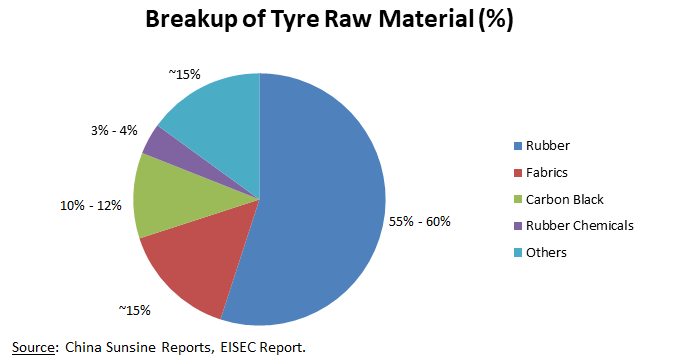

For every 100 tons of tyre, 6 tons of weight is of rubber chemicals. Rubber chemicals account for ~3% of total tyre cost. However rubber chemicals are important raw material for the tyre, and hence tyre companies cannot compromise on the quality.

Global Tyre Industry Growth and Capacity Expansion Plans:

Global tyre demand was expected to increase by 4.1% to 3 billion tyres in 2019. In value terms, it was forecasted to value at $258 billion, growing at 7%. However, there might be degrowth in 2020. (Source: Freedonia – World Tires)

Globally, ~$22 billion worth of investment had been planned between 2016-2021. Asia accounts for the majority share with ~46% of the total investments. These investments might be postponed in 2020 due to the economic slowdown resulting from coronavirus outbreak.

Global Rubber Chemicals Industry:

Global industry was valued at $4.8 bn in 2018. Global industry is expected to reach $5.31 bn by 2025 as per Global Market Insights. Global Rubber Chemical demand is of 1.0 to 1.1 mn tonnes. (Source: Grand View Research, Global Market Insights)

Top Global Rubber Chemical companies are –

| Company | Capacity (MT) |

| China Sunsine Chemicals | 172,000 MT (Expanding to 192,000 MT) |

| Lanxess | 135,000 MT |

| Eastman | 75,000 MT |

| NOCIL Ltd. | 73,000 MT (Expanding to 110,000 MT) |

| Tianjin Kemai | 51,000 MT |

| Yanggu Huatai | 30,000 MT |

Anti-Dumping Duty:

USA has applied anti-dumping duty on rubber chemicals from China of 15% tariff in addition to 10% customs duty. This will lead to Chinese players shifting their focus from US to other countries like India. (Source: Review anti-dumping duty on cheap rubber chemicals, Gujarat High Court directs Centre)

Indian Rubber Chemicals Industry

Indian Rubber Chemicals Industry was valued at $288 mn in 2017 and is expected to grow at 7.5% CAGR to reach $443 mn in 2023. Indian Rubber Chemical demand is of ~70,000 – 75,000 MT. (Source: Worldofchemicals)

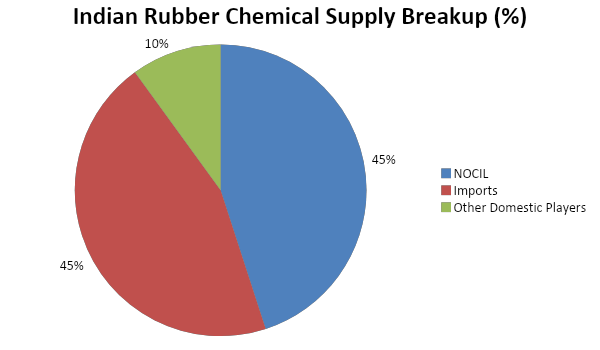

Some of the Indian Rubber Chemical Companies are NOCIL Ltd., PMC Rubber Chemicals, Lanxess India, Associated Rubber Chemicals, Yasho Industries, Swarup Chemicals, BASF India, etc. Indian Rubber Chemical supply breakup is as following –

Shift towards Radialization:

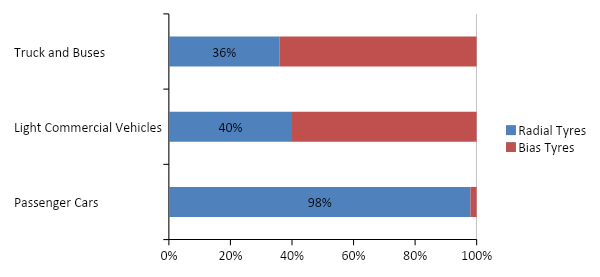

In India, only passenger cars have high radialization of tyres. More on radialization of tyres can be understood in the blog on Indian Tyre Industry. Radialisation by vehicle types in India is as following –

Source: How Tyre Industry is Evolving and Adjusting to Global Trends?

Weight of radial tyres of 20% – 30% more than that of bias tyres. This will lead to high rubber chemical consumption in radial tyres compared to bias tyres, further increasing the demand as radialisation of tyres increases.

(Source: EISEC Report)

Anti-Dumping Duty:

India had anti-dumping duty on rubber chemical imports, which was not extended in 2019. Post that, dumping has been increased in India, which is impacting margins of domestic manufacturers.

Indian Tyre Industry Growth and Capacity Expansion Plans:

According to ICRA, Indian tyre industry was expected to grow at 7-9% between FY19-23. The tyre companies were expected to do a capex of ~Rs. 20,000 cr in FY19-23 period, which will further increase demand for rubber chemicals in future. However, the expected growth and capex plans might be delayed due to the coronavirus pandemic impact. More details on Indian Tyre Industry can be found on our another blog Understanding The Indian Tyre Industry. (Source: Tyre sector may grow 7-9% in 5 years buoyed by demand, lower crude)

Industry Economics

Margins v/s Capacity Utilization:

Rubber Chemical companies prefer volume growth and increasing capacity utilization over margins. The same can be understood from the following management commentary:

NOCIL Q3FY20 Concall:

“The price trends in the market have been on a decline and we did not want to stop supply due to pricing situation. With our capacities that has been scheduled to be doubled, as a strategy we aggressively are pushing volumes in the market. Further we are consciously looking at sales from all our 22 products and we would utilize our capacities so that the productions and sales are optimized. The strategy may have a temporary impact on our margins, but it falls in line with our long-term strategy to expand our sales substantially in view of the expanded capacities coming on the board shortly.”

China Sunsine Annual Report 2019-20:

“Guided by the strategy of “higher sales volume leads to higher production, which in turn stimulates even higher sales’ and the combined efforts in marketing, research and development, as well as environmentally friendly production and workplace safety, the Group achieved satisfactory results amid the challenging economic conditions.”

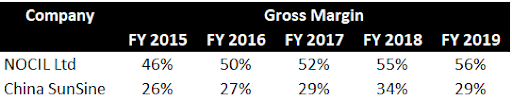

Additionally, with 50%+ Gross Margins, the companies like NOCIL actually can afford temporary drop in realisation to maintain/gain market share.

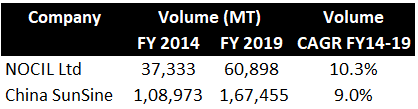

Meanwhile, volume growth for both the companies is as following –

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.