Sensex companies have changed over years. In this article, we are looking at change in Sensex companies over period of time, beginning from pre liberalisation period. We have taken 1986, 2001, 2008, 2014 and 2020 years for Sensex companies list.

1986 represents companies during pre-liberalisation period, 2001 represents the time during global tech bubble burst, 2008 represents the time at the peak of global financial bubble, 2014 represents the period after global financial crisis, and 2020 is the recent times.

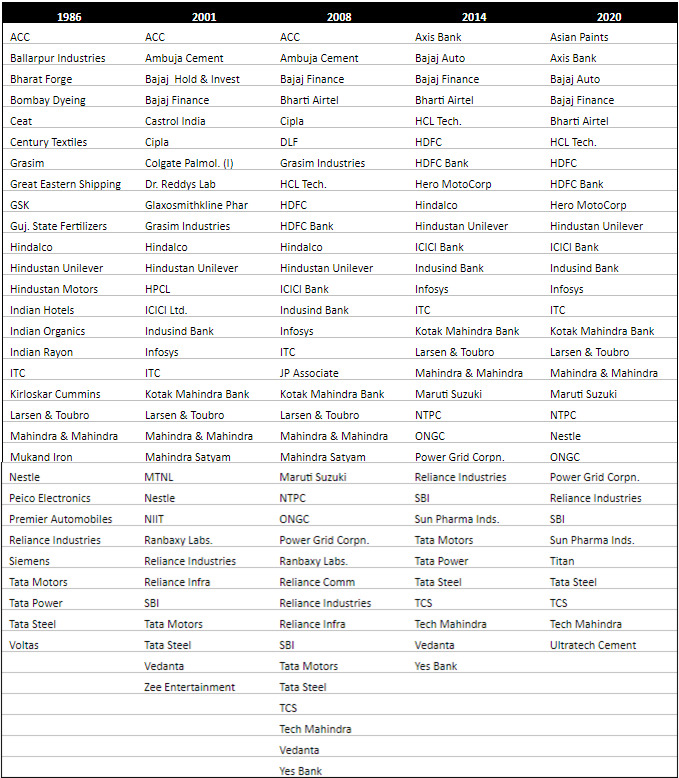

Sensex Composition – Company wise

List of companies in Sensex during different times are as following –

Companies which continue to remain in Sensex over years are as following.

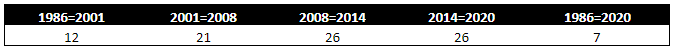

Number of companies which remained in the Sensex from one time period to next are as following. There are 7 companies which have remained part of Sensex from 1986 to 2020. Interestingly, number of companies continuing to remain part of Sensex has increased with time. Eg: There were only 12 companies which remain part of Sensex during both 1986 and 2001, whereas 26 companies remain part of Sensex during both 2014 and 2020.

Sensex Composition – Sector wise

We can see sector wise companies in Sensex during each period below.

1986: There were no banking and finance companies in Sensex during 1986. Automobile and Ancillaries had highest number of companies in Sensex. All heavy industries companies formed the part of Sensex. There is no Realty company.

2001: Healthcare, FMCG and Banks formed the highest number of companies in Sensex. Banking and Finance account for 6 companies in Sensex. There are no Power & Realty companies in Sensex.

2008: Banks take the top position with 6 companies in Sensex. Banking and Finance account for 8 companies in Sensex now. There are 5 IT companies now. FMCG loses its count from 4 to 2 companies. There are 2 Power and 1 Realty companies.

2014: There are 7 banks in Sensex and 9 Banking & Finance companies. Automobile & Ancillaries see their count jump to 5 companies. There are 3 Power companies but no Realty companies in Sensex now.

2020: More or less the companies remain same with no Realty company and 1 Power company dropping out. Sensex has become more diversified sector-wise compared to 2014, with concentration of Banks and Automobile & Ancillaries reducing by 1 each, and addition of company from Construction Materials and Diamond & Jewellery.

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.