A Simple Understanding of how Iron and Steel Industry in India Works. Globally, steel can be found in a variety of products and structures – from personal vehicles to the Burj Khalifa: the world’s largest skyscraper. But what is steel, and why is it so important? Steel is an alloy, meaning that it is made by combining iron with another element, usually (but not always) carbon. This alloy can be up to 1,000 times stronger than iron, making steel an extremely useful and sturdy building material.

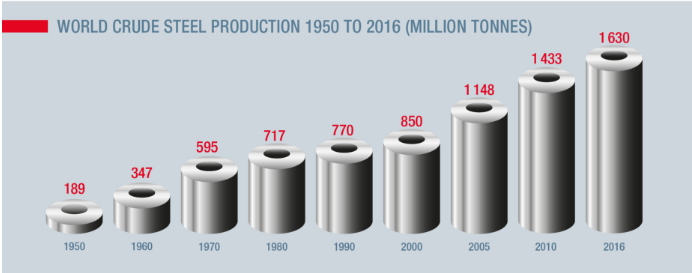

Currently, Indian steel industry has a steel capacity of 122 million tonnes (2015-16) and the world is producing 1630 million tonnes of steel. India has an aspiration to take this capacity to 300 million tonnes by 2030. Today steel industry contributes approximately 2% to our country’s GDP and employs 5 lakh people directly and about 20 lakh people indirectly.

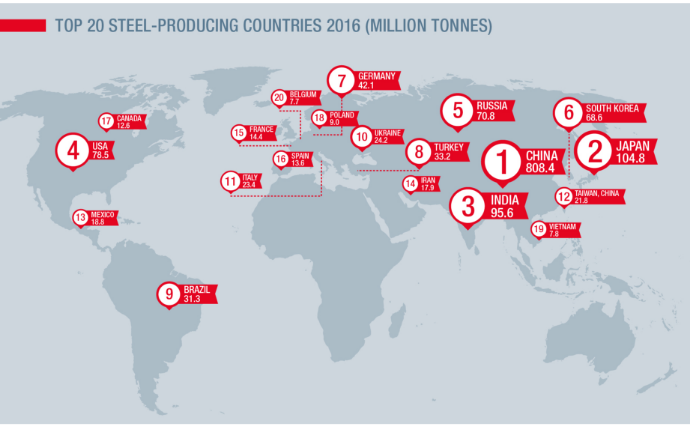

India has quickly touched the number three spot in terms of steel production, overthrowing many industrialized developed nations such as the US, Russia and South Korea.

From the infographic below it is clearly evident where India stands and where China stands in terms of capacities of crude steel installed. China is a powerhouse for infrastructure spending and things happen at a very different scale there and a steel capacity of over 800 million tonnes is a testimony of that.

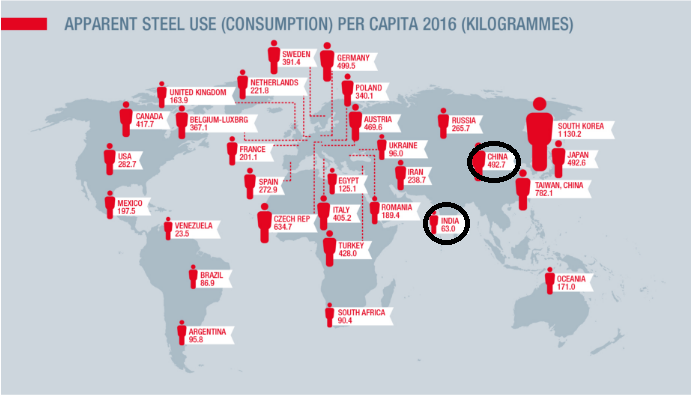

In Spite of being third largest steel producing country in the world, our per capita steel consumption is nothing to be proud of, we are a developing nation having high resemblance with China but our per capita steel consumption is one-eighth that of China at 63 kg per person, see the image to understand per capita steel consumption across geographies.

National steel Policy 2017 has pledged a target of achieving 160 kg of steel per person from current levels by increasing production capacities to 300 million tonnes.

World Steel Outlook of Steel Industry

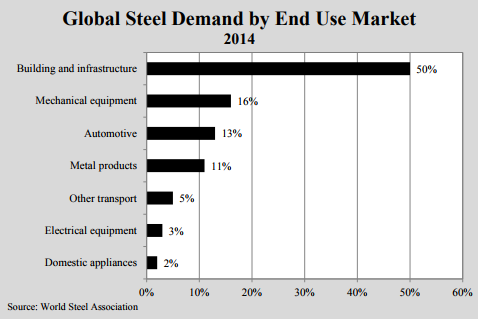

Steel finds applications in various sectors from infrastructure, automotive, electrical appliances to mechanical equipment. The image below shows sectoral steel consumption across the globe. Generally, the same pattern is seen in various countries around steel consumption and when we read India’s per capita steel consumption as 63k kg’s, we can imagine very little infrastructure spending (roads, bridges, highways etc) happening in our country of 1.25 billion inhabitants.

National Steel Policy of Steel Industry in India

Steelmaking Process & Key Components in Steel Industry

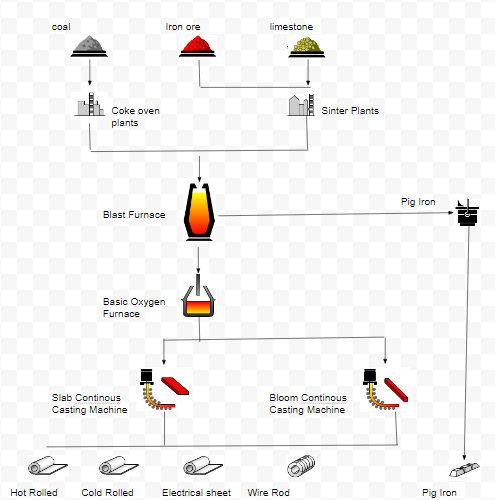

The following Flowchart shows steps of steel making pictorially in a steel plant.

There are essentially 3 steps to steelmaking-

-

- Ironmaking Process

- Steelmaking Process

- Continuous Casting Process

Iron Making Process in Steel Industry

This is the first step in the making of steel, iron ore is extracted from the earth and melted to turn into melted iron.

The process begins with sintering operation where iron ore particles are heated till they become aggregates and this is done for proper heat transfusion to occur in the blast furnace following this step.

In a similar fashion, just like iron ore, we carry out coking operation in coke oven for our coking coal till they become lumpy aggregates and this is also done to ensure proper heat transfusion to occur in the blast furnace following this step.

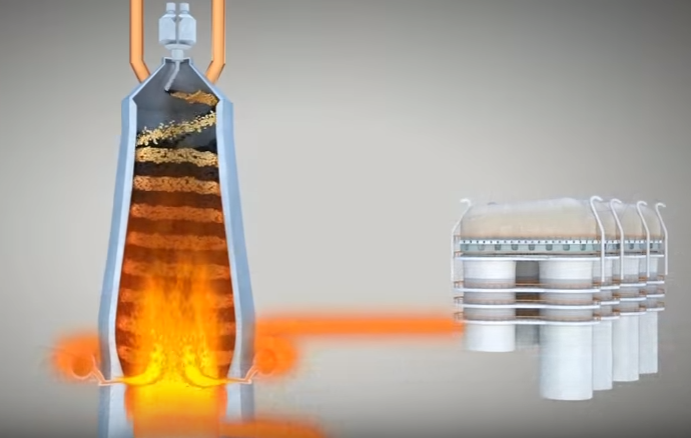

Blast Furnace Operation

Sintered iron ore and coke are layered inside a 100 m long furnace, then hot air at 1200 degree Celsius is blown into the blast furnace from the bottom causing the coal to burn and this heat, in turn, burns the iron ore to create molten iron at a temperature of 1500 degree Celsius. This is also called hot metal (pig iron) in the industry.

Steel Making Process

Today, two distinct processes make up bulk of worldwide steel production: Basic Oxygen Furnace process and the Electric Arc Furnace process (EAF).

Basic Oxygen Furnace (BOF)

In basic oxygen furnace, iron is combined with varying amounts of steel scrap (less than 30%), after that very pure oxygen is blown into the vessel causing a rise in temperature to 1700 degree Celsius. The scrap melts, impurities are oxidized and carbon content is reduced by 90%, resulting in liquid steel.

Electric Arc Furnaces (EAF)

Electric Arc Furnace or mini-mill, does not involve iron making. It reuses existing steel (scrap), avoiding the need for raw material and their processing. The furnace is charged with steel scrap, it can also include some Direct Reduced Iron (DRI) and pig iron for chemical balance. The electric arc operates with an electric charge between two electrodes providing heat for the process.

This furnace does not require coke as raw material but depends heavily on the electricity generated by coal-fired power plant elsewhere in the grid.

How do the Two Processes Stack Up?

Although the BOF and EAF processes both produce steel as the end product, the varying means to this end between the two processes give each certain economic advantages and disadvantages. The main area of discussion centers on the supply side and the raw materials going into steelmaking. For BOF firms, producing steel requires sourcing a variety of raw materials, namely iron, coal, and limestone. Due to the necessity of securing these raw materials, large-scale steel firms like to vertically integrate its production process backward into coal and iron ore mining.

On the other side, EAF steelmakers have a much simpler input process: EAF furnaces only require scrap steel as the major input. As long as scrap steel remains plentiful in the market, these firms have easy and cheap access to the required raw material.

For a BOF firm, the average cost per ton of capacity is $1,100, while the cost for an EAF mini mill per ton of capacity is only $300. The barrier for entry is thus lower for EAF firms, which can in part explain the rise of such “minimills” in India over the last decade with over 300 small players across the length and breadth of the country.

Another reason of the adoption of BOF process over EAF is the quality of steel produced from it. Generally speaking, steel produced from BOF process is regarded having higher strength and durability than steel produced from EAF process giving it the pricing advantage.

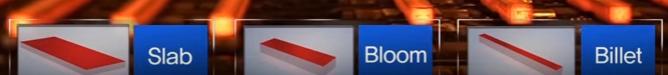

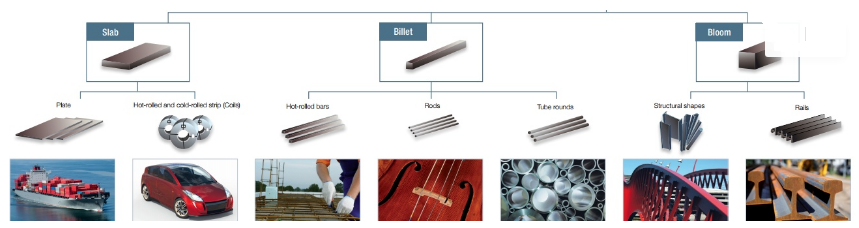

Molten steel is now poured into molds and cooled into solid steel reaping semi-finished material ready to be made into finished steel product. These semi-finished material are categorized into slabs, blooms, and billets.

Slabs –

Slabs are wide and flat and are mainly used to produce hot and cold rolled coils, heavy slabs, and profiles.

Bloom –

Bloom is rectangular bars used to make products such as springs, forged parts, heavy structural shapes and seamless tubes.

Billets –

Billets are bars from a square section of long steel that serve as input for the production of wire rods and rebars.

Continuous Casting Process

The final stage of producing steel is the Continuous Casting Process where steel is forged into various steel products.

Hot Rolled Product– When a slab is heated above 1100 degree Celsius and passed between rollers, it turns into a thin and long sheet (hot rolled). This hot rolled product is widely used as a construction material and pipes in various industries.

Cold Rolled Products – Cold rolled products are made by making hot rolled products thinner at room temperature which is then used in making appliances, barrels and auto frames.

Coated Steel – Coated steel is made by coating cold rolled product with Zinc and it is used in high-end appliances, office equipment, and automobile exteriors.

Electrical Steel Plates- Electrical steel plates are made by adding silicon in molten steel and find applications in transformers and motors.

Wire Rods– When a billet is above 1000 degree Celsius and passed through a hole, it turns into a wire rod which is used as automobile tire cord, wire for bridges etc.

Stainless Steel– Stainless Steel plants in steel industry are equipped with the additional production facility. Nickel and chrome are added to steel to produce stainless steel products which are used in kitchen appliances, medical equipment, exterior walls and roofs of the building.

Steel Making Process from Start to Finish

Factors Affecting Profitability of a Steelmaker

Steelmaking requires iron ore, metallurgical coke which is also called coking coal and limestone as input ingredients, out of these three essential raw materials India is self-sustaining on iron ore and limestone whereas about 85% of coking coal requirement of the domestic steel industry is being met through imports.

What Does it Take to Produce a Ton of Steel?

Typically, it takes 1.6 tonnes of iron ore and around .450 tonnes of coke to produce a tonne of pig iron or hot metal, the raw iron that comes out of a blast furnace.

Chinese Hammer

Raw material price volatility along with dampening demand for Indian steel because of Chinese imports has taken our companies for one great ride of losses and has caused huge NPA’s problems for our state-run banks.

Even after imposition of various tariffs by Government of India on cheaper Chinese imports, Indian companies have to still battle the raw material price volatility across the globe, these price swings of essential raw material like coking coal act like a hammer on the bottom line by further squeezing it down.

What to Look for in the Financial Statements/Notes of a Steel Company?

Generally the entire financial storyline in a steel company revolves around the prices of coking coal and iron ore as raw materials and the top line in a steel company depends on prices per ton of steel as driven by market forces, the producers are in no position to set steel prices nor in a position to negotiate on raw material prices from the suppliers, this puts margin/profitability under pressure. However, procurement strategies and continuous cost reduction strategies can help a company to maintain reasonable profitability in volatile market conditions.

Tata Steel – A Disciplined Steelmaker

The following table displays cost breakup in Tata Steel, an efficient player in the industry, Tata steel has has been able to establish backward linkages in terms of procuring iron ore from captive mines and fulfilling 35% of its coking coal requirement from captive and domestic sources, which helps it to bring down raw material expense significantly compared to its peers.

Coke Expense and Currency Depreciation

A lot of money in a steel industry goes towards buying (coke) and this is not in control of the Indian steelmaker because India is deficient of coking coal required for steel making, which it imports from Australia, with huge coking coal imports, the steelmakers pay the suppliers in USD and a depreciating rupee versus USD squeezes the bottom line further.

How can a Steel Maker Optimize his Profits

-

- Modernise the Blast Furnace operation in order to reduce power and fuel cost.

-

- Focus on backward integration for raw material security with special focus on coking coal procurement strategy.

-

- Bidding for Iron ore mines in India during auctions in order to reduce iron ore cost and they have to see that they don’t get drifted in the auction causing financial damage in terms of undercutting each other.

-

- Investing in slurry pipeline projects to reduce freight cost, slurry pipelines can be constructed end to end right from the iron ore mine to the steel plant.

-

- Staying lean all the time (hiring right).

-

- Focus on making premium products like stainless steel (utensils) and flats.

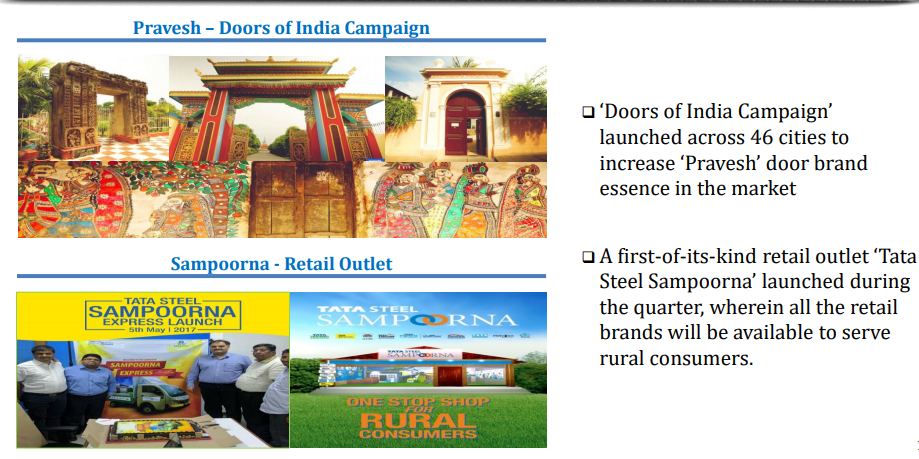

- Focus on building a brand in the consumer space, Tata steel has done a commendable job in brand recognition, see below image-

Parameters to Judge/Analyse a Steel Company

Building and Infrastructure form the biggest Chunk (50%) of the steel demand in India and hence this is the biggest demand driver in Indian Steel Industry. Housing has been growing at a steady pace. The infrastructure sector adds to the much-needed growth pushed by the Government. So one needs to judge uptick in demand.

Demand Scenario

- As a metric, check housing and infra sector expected demand growth

- Check whether the company has maintained or increased its market share with respect to the overall demand.

Prices

- Are prices of the steel industry in the overall market heading up or down in the foreseeable future?

- Whether the company has a premium product in the portfolio which helps it to distinguish from its peer in the marketplace.

Lowest Cost Producer

In a commodity type business, the low-cost producer wins. This is because the low-cost provider has larger profit margins, which gives it more freedom to set prices at levels that drive out the competition.

In order to be lowest cost producer, the company must constantly make manufacturing improvements that will keep the business competitive, this will require additional CAPEX, which tend to eat up earnings, which might otherwise have been spent on new product development or acquiring new enterprises- expenditures that would have increased the underlying value of the company.

Part 2: How The Indian Steel Industry Works, Current Scenario & Outlook

Disclaimer :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above-mentioned data. Investors should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents.

Author of the report has investment positions in the stock at the time of publishing this post.

Future estimates mentioned herein are personal opinions & views of the author. For queries/grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No: INA000003106

Readers are responsible for all outcomes arising of buying/selling of particular scrip/scrips mentioned herein. This report indicates the opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above-mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco or its associates are not paid or compensated at any point of time, or in last 12 months by anyway from the companies mentioned in the report.

Alpha Invesco & its representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock: No, Served as a director/employee of the mentioned companies in the report: No. Any material conflict of interest at the time of publishing the report: No.

The views expressed in this post accurately reflect the author’s personal views about any and all of the subject securities or issuers; and no part of the compensation, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.