The Scare Around Corona Virus – Once In Few Generations Event

Present situation reminds me of school days. If the examination paper was tough, me & my friends had a common complaint. “Lot of questions were from out of syllabus.” Corona virus is that out of syllabus topic for all of us. It has halted economic activities across the globe & to some extent in India as well. Will there be any impact ? Yes. But nobody has any clue on how big the impact will be, and how long it will take for the scare to recede.

Not just the big businesses, but even smaller / mid-sized businesses are going to have an impact as people stop going out during this period. And most of the smaller entities can not sustain a cash flow mismatch even for 3-4 weeks. The real impact will be seen as we progress into the year.

The event is just too big. We just do not know the extent of the situation. Whenever we are in a very difficult situations in life, we think it’s too big when we are in the middle of it. But when we look back, the event appears too small, just another dot in the entire journey. Perhaps, that’s where we are today.

End Of The World Is Priced in. But Is The World Going To End ?

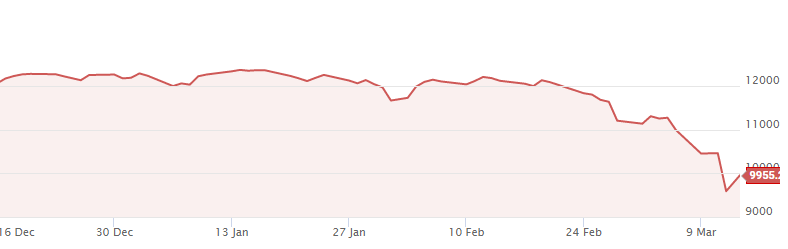

These are unusual times. Commodity prices are at multi decade lows. And markets have slipped faster than ever before.

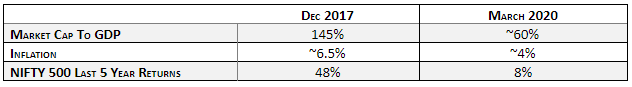

Investors are drawing parallels between 2008 crash & present fall in the Indian markets. However, there are no similarities apart from the price fall. Unlike broader participation prior to 2008 crash, this time the markets had a very narrow leadership & only few stocks have done well. In fact, most of the stocks that were outside BSE 200, had already fallen by 30-40% prior to the correction. In short, cheap has become even cheaper.

New Winners On The Horizon

Also – in the midst of this global gloom & doom, there are many positives to Indian growth prospects. At ~300 billion US$, Indian exports have been flat over the last decade. In the middle of global chaos, an inward-looking Indian economy is at an advantage, since it will be least affected due to external shocks. Also, global supply chains would start looking for alternate sourcing destinations. Sectors where India already has surplus capacities & capabilities to compete with Chinese competition are in a sweet spot. India has underinvested in its infrastructure over the last decade or so. This is the time to put accelerator button on infrastructure led growth along with manufacturing. Lower crude oil prices are an added advantage.

We continue to believe that the next leg of economic growth will be driven by old economy, asset heavy businesses like steel, coal, power, infrastructure, industrials. And these are the sectors where stock market valuations have been bombed out. Stocks are trading as if the world is going to end, and there will be no change in the industry structure. We have entered this theme early, and now we are witnessing dramatic drawdowns.

Historical evidences suggest that within the attractive universe of low price to book value, low P/E, low price to sales, exceptional returns have often come from companies where earnings are going to witness a significant spurt. We see that happening in the stocks we own at present. In our view, there is going to be a big sector rotation on the way up & there will be new winners on the horizon. Themes & stocks that have led the quality bubble over the last 3 years, may not show the same strength as we move forward. Money may move from high performing expensive stocks to deep value pockets.

What To Do Now – At Least Don’t Be Fearful When Others Are Fearful

If you have surplus cash to invest, then this is the time to go aggressive & add more. This is an “If not now, then when” sort of a situation. These are the times when the temperament & courage to put money matters the most.

If you are already fully invested & witnessing a drawdown, then just sit back. Sometimes we just can’t help but sit through these drawdowns. Time is the only answer. Unless you are of the view that, we are looking at a decade long global depression, you shouldn’t be out of stock markets. Rather, one must consider being aggressive & playing on the front foot.

As Warren Buffett put it during the 1998 Berkshire Hathaway annual meeting, “We don’t get paid for activity, just for being right. As to how long we’ll wait, we’ll wait indefinitely!”.

We honestly don’t know if this is the bottom. The markets may have few more bouts of sell offs. But there is no point in trying to time the exact bottom.

Given the chaotic markets, if you are not able to get greedy when others are fearful, either due to lack of cash or lack of courage. At least don’t be fearful when others are fearful.

Chetan Phalke

CIO – Alpha Invesco

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.