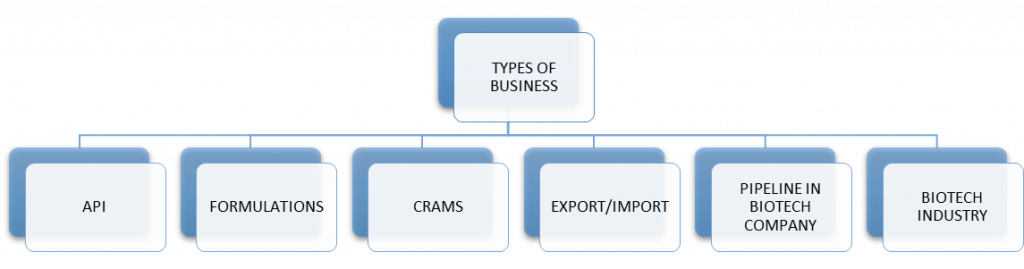

Different Business Segments Of Pharma Company

1) API- Active Pharmaceutical Ingredient

To understand the pharmaceutical business model, it is worth understanding the price relationship between the API, the tablet, and the drug market price. The main ingredient in Pharmaceutical is API [Active Pharmaceutical Ingredient]. It is the main drug which cures the disease. There are many companies which produce and are specialist in only producing APIs. In producing APIs the companies either purchase intermediates from different players and mix them to produce a final API or they themselves produce all the intermediates and mix at their own place. These are the companies which deal only in API. They sell their produced APIs to different formulation players who then further process it to make it a consumable drug. The companies who produce and sell APIs need their product to get registered with US FDA by filling a Drug Master File [DMF] which makes sure that the facilities of the API manufacturing company are in proper shape and are safe.

The companies in this business do not attract high profit margins because there are many players who produce a single chemical and even if they try to charge high price from their customers then they can lose their revenue because of high competition in the market. However, such business work in bulk deals as the formulation players purchase finished API from them in bulk due to which even if they lose a single customer a good amount of revenue is lost. Generally, the size of the market of the API used in a formulation is 10% of the total formulation market. The great expense that goes into a patent challenge means that API suppliers working in support of such challenges must be extremely reliable, sophisticated and capable of working on a highly confidential and exclusive basis. DMFs are filed with USFDA, MHRA UK, Japan and other country specific bodies for receiving a marketing authorization grant. A DMF provides the regulatory authority with confidential, detailed information about facilities, processes, or articles used in the manufacturing, processing, packaging, and storing of one or more drugs.

There are basically three streams of API’s sold by the companies : Oncology, Hormones & Steroids. Major revenue is earned from oncology segment. This is basically because it costs a lot to put up manufacturing facilities for these streams, usually 5-6x than normal, as these drugs require specialized handling. These facilities require stringent entry procedures and isolation chambers/procedures to reduce risks of product contamination, cross-contamination and also protecting people from hazards and toxicity. These are as mandated by the regulatory Authorities. Scaling up proves very costly and barriers to entry are strong.

2) Formulations

Pharmaceutical formulation, in pharmaceutics, is the process in which different chemical substances, including the active drug, are combined to produce a final medicinal product. The word formulation is often used in a way that includes dosage form. There are two types or classifications for Pharmaceutical Formulation, these types are the following:

Oral formulation –

The most important characteristic for oral formulation it must be overcome the problems which associated with oral administration. The most critical problem is rate of drug solubility i.e., the active ingredient of the drug must be soluble in aqueous solution in a constant rate. This point can be controlled through some factors like particle size and crystal form. The oral formulation divided in two parts which are: A- Tablet form & B- Capsule form.

Topical medication forms – This type include several parts as the following: A-Cream, B- Ointment, C- Gel, D- Paste, and E- Powder.

Within the Domestic formulations market the major therapeutic categories are ‐

Antinfective, gastrointestinal, cardiac, gynecology and dermatology.The leading drug classes were Cephalosporin, Antipepticulcerants, oral antidiabetic and Ampicillin / Amoxycillin, etc. The top ten drug classes contributed 35% of total domestic market. Formulations are the end-products of the medicine manufacturing process, and can take the form of tablets, capsules, injectables or syrups, and can be administered directly to patients. The production of formulations in India increased at a CAGR of 17% during the period FY1991-2001. The exports of formulations from India increased at a CAGR of 29% during FY1991-2000. The strong growth in formulation exports during the 1990s can be attributed to exports made to the developing markets and the access gained by Indian players to the generics markets of developed countries.

Formulations account for over 50% of the total pharmaceutical exports from India. A series of mergers and acquisitions in the pharmaceutical industry has resulted in the concentration of market share among the leading players in the formulations segment. Also, over a period of time, the incumbent players in the formulations market have been able to set up extensive distribution networks, thus driving sales of their brands and increasing market share.

3) CRAMS-Contract Research and Manufacturing

Pharmaceutical companies are increasingly outsourcing research activities to academic and private contract research organizations (CROs) as a strategy to stay competitive and flexible in a world of exponentially growing knowledge, increasingly sophisticated technologies and an unstable economic environment. It has been widely recognized that the global pharmaceutical industry is currently experiencing dynamic change. Under high pressure to contain fixed costs, all drug companies are currently reducing their internal capacities in R&D, manufacturing, and even marketing and, instead, increasing their outsourcing. To a significant extent, the drug companies, large or small, now rely on outsourcing service providers more than ever to fulfil their tasks, solve their problems, and improve their efficiency and productivity.

The worldwide outsourcing demand for preclinical research and development is, however, still soft at present. Almost all major pharma companies have publicly announced that their current and near future R&D focus will be on the late-stage drug candidates. Meanwhile, many drug companies also are shifting their research methodologies for toxicology (tox) studies to include molecular biomarkers, imaging, and companion diagnostics, as these innovative technologies are able to provide better safety profiles of trial compounds. There are three broad outsourcing opportunities available to India – Custom Chemical Synthesis or CCS, clinical trials and contract manufacturing or CRAMS.

The most scalable business opportunity for Indian players would be contract manufacturing or CRAMS. This is because: CCS would typically involve supply of material at gram or kilogram level, while CRAMS involves supplies in tons. CCS supplies are linked to the success of the partner’s R&D pipeline and are, hence, volatile. CRAMS supplies, on the other hand, are linked to the success of a product post commercialization and can provide relatively stable revenues (since probability of success post commercialization is higher than that at the R&D level). However, custom synthesis or CCS skills are important from the following perspective: CCS assignments give Indian players an opportunity to lock-in into MNC relationships very early in the product lifecycle. This augurs well for the partnership approach that lays the foundation of the outsourcing business. CCS projects demonstrate a company’s ability in process innovation. CCS skills can help a company to graduate from only a ‘supplier’ to a ‘preferred strategic partner’. CCS projects are characterized by high margins but low scale, but CRAMS projects offer scale plus reasonable margins. Hence, a proper mix of CCS and CRAMS projects is a prerequisite for success in the outsourcing space. It can be observed that CRAMS player who is also a substantial API player can enjoy very good profitability.

The key factors that help win outsourcing (CRAMS) contracts:

Time and quality:

Time and quality are of extreme importance to the innovator companies. In R&D, time is very important to save on the limited patent life, and in manufacturing, it is a matter of reputation for innovator companies to market the drugs during the entire patented period. Also, high quality products are essential to win contracts. Due to the nature of pharmaceuticals, threat of product contamination or excess impurities is enough to scare the potential customer. Also, the drug quality has significant implication on the reputation of the innovator and financial liabilities of the company.

Availability of manufacturing capacity:

Just as timeliness of supply is critical, sufficient capacity is key to the new business especially for contract manufacturing. Innovative companies generally request rapid turnaround time. Existing manufacturing capacity is critical for time-sensitive projects. However, where supply relationships already exist, the ability to plan for projected new capital needs can be jointly accomplished.

Reputation and track record:

If the CRAMS player was the service provider for the innovator company in the past, and had delivered satisfactory services, the customer will most likely opt for the same CRAMS player for similar or new projects on the basis of the trust that has been built. Also, innovator companies will generally prefer big CROs and CMOs due to available infrastructure and service quality.

Array of services offered :

Generally, innovators like to get maximum possible services from same contract research company due to ease in administration and effective communication regarding requirements. For example, if a company has synthesized a chemical, it might be a good choice for other services such as process chemistry too.

Reliability and flexibility :

Suppliers should be reliable in terms of dedicated management team, financial stability, strong track record of supply, manufacturing, logistics, etc. Flexibility is also extremely important to innovators, as CMOs often collaborate with them to develop a new drug. In particular, the ability to adjust manufacturing schedules to meet deadlines, adjust manufacturing processes, and meet critical timelines is very important.

Scalability:

Pharmaceutical customers prefer suppliers who have the ability to increase their scale of production, as products move from early stages to later stages of drug development. In general, this means suppliers should have ready availability of CGMP capacity as products pass through FDA hurdles, or the means to rapidly build additional capacity in conjunction with the anticipated product launch. In addition, it requires a scalable process used to manufacture the molecule. In other words, the contract manufacturer must develop a process that can effectively and affordably manufacture commercial quantities of the molecule. This ties closely to contract-manufacturing process chemistry skills. We believe that these skills are critical, yet very difficult to assess (other than increased contract wins).

4) Biosimilars

Biosimilar are medicines made from living cells through highly complex manufacturing processes and must be handled and administered under carefully monitored conditions. Biosimilar are used to prevent, treat, diagnose, or cure a variety of diseases including cancer, chronic kidney disease, autoimmune disorders, and infectious diseases. A biosimilar is exactly what its name implies — it is a biologic that is “similar” to another biologic drug already approved by the FDA. The clinical trials carried out on a potential biosimilar are designed differently to those for approval of a novel biologic. When assessing a potential biosimilar, the aim is to confirm that there are no clinically meaningful differences in its efficacy and safety compared to the reference product.

Biosimilar approval is based on the totality of data demonstrating similarity between the biosimilar and the reference product, including quality characteristics, biological activity, safety, and efficacy. Because of this complexity, there is a significant difference between the development of a generic drug and a biosimilar: on average, a generic drug takes 3-5 years to develop at a cost of USD $1-5 million; a biosimilar, on the other hand, takes on average 7-8 years to develop at a cost of USD $100-250 million. It’s worth highlighting that the technology involved in manufacturing and characterisation of biologics has advanced significantly. Manufacturers are now able to develop highly detailed characterisations of the molecular and functional attributes of products, including tracing potential product impurities, uniformity, and concentration. This allows for a multi-level assessment of the purity, safety, and potency of biological products.

The biologics market is predicted to continue to grow faster than the total pharma market and is expected to account for almost 30% of global prescription sales by 2020. Interestingly, according to some analysts, by 2020 biosimilars will comprise between 4% and 10% of the total biologics market, with their market value expected to exceed $25 billion.

5) Export/Import Business:

The Indian pharmaceutical industry is the largest supplier of cost effective generic medicines to the developed world. With the widest range of medicines available for exports and with the availability of the largest number of approved pharmaceutical manufacturing facilities, India is all set to become the leader of pharmaceutical exports to the world. The domestic Indian pharmaceutical industry is estimated to be $ 26 billion in 2014 growing at nearly 20 percent and is expected to reach nearly $ 50 billion in 2020.

It is evident that a lot of internal factors are responsible for the growing Indian pharmaceutical industry. The year on year growth has taken a promising growth since 2008 with an incremental increase in the range of $ 1-1.5 billion each year. The US is the largest consumer of Indian pharmaceutical exported medicines followed by the UK. Many of the top 50 domestic Indian pharmaceutical companies contribute to this growth both in value and volume. The size of Pharma industry in India is expected to increase to USD 48 billion by 2017-18, growing at a CAGR of 14%.

The industry has a large part of its revenues coming from exports. India exports pharmaceutical products to more than 200 countries. The Government of India has come out with its policy document – ‘Pharma Vision 2020’, which aims to make India a global leader in end-to-end drug manufacture. Both the domestic and export market are set to witness high growth.

Export Through API (Bulk Drugs)

API’s exports are likely to grow at a CAGR of 12-14 % over 2013-14 to 2018-19, driven largely by exports to regulated markets as well as continued growth in the semi-regulated markets. Exports to the regulated markets would be driven primarily by three factors:

- A large value of drugs going off-patent in the next 5 years

- The expected rise in penetration of Indian API players in regulated markets

- The need of global pharmaceutical players to outsource API manufacturing to cut costs.

We expect that major global innovators will not only extend existing deals with Indian players but will also look to increase sourcing of bulk drugs from Indian companies. The exports in the year 2008-09 was 43% which increased to 49% in the year 2013-14 and is expected to rise by 51% in the forthcoming years 2018-19.

Export Through Formulations (Domestic)

The growth story of the domestic formulations market is expected to remain strong, led by a rise in life-related diseases, better healthcare diagnostic infrastructure adding to increasing disease detection rate, new product introductions, volume growth driven by increasing penetration, and better access to healthcare. Domestic formulation sales are set to grow at a CAGR of 12-14% between 2013-14 and 2018-19, with the market size crossing USD 20 billion.

Export Through Formulations (International)

India’s formulation exports are expected to grow at a CAGR of 14-16% between 2013-14 and 2018-19. Steady growth is expected in exports to both regulated and semi-regulated markets over the next 5 years. During the period between 2012 and 2018, drugs generating annual sales of about USD 130 billion are likely to lose patent protection and will be exposed to generic competition. We therefore expect sales of generics to grow at a CAGR of 7-9% over the next 5 years, outperforming the overall global pharmaceutical market, whose growth is expected to be limited to 3-5%.

6) Pipelines In Biotech Companies:

The word pipelines in biotech companies generally refers to the stages of clinical trials. In the pharmaceutical industry, pipelines are frequently used when describing and evaluating a biotechnology company’s activities, research and development progress and overall potential for success and growth. The status of a drug in the pipeline refers to the stages of clinical trials that it is at (or must pass through) before being approved for sale and/or public use. The pipeline overall is the group of unique products or processes reported or in development by a company. Drugs that have entered into clinical trials and are pending approval by the U.S. Food and Drug Administration (FDA) are said to be “in the pipeline”.

A company that has several drugs in various stages of development has multiple products in the pipeline. Likewise, a product in the pipeline is one that we can anticipate hearing more about and, possibly using, in the future. However, the value of each individual pipeline drug depends upon its progress through clinical trials and, ultimately, approval. When evaluating a company pipeline, each drug is assigned a weighted value which increases as it progresses through these trials.

7) Biotech Industry:

The Indian Biotechnology sector is presently divided into five segments based on the products and services offered. These segments are Bio-Pharmaceuticals, Bio-Services, Bio- Agriculture, Bio-Industrial and Bio-Informatics. Bio-Pharma is the largest sector contributing to 62% of the total revenue followed by Bio-Services (18%)Bio-Agri(15%) and Bio-Industrial(4%). Bio-Informatics is still at a nascent stage contributing to only 1% of the total revenue.

Growth Drivers Of Biotech Industry:

Increasing cost of bringing a new drug to the market: India can play a key role in reducing cost and time to market for new drug development through outsourcing of various components of the drug development process. Top pharma companies spend a large part of their research for in licensing new modules: There is an opportunity for R&D focused Indian biotech companies to enter into such alliances through collaborative development projects. Inflammatory & Infectious disease segment high on agenda:

In the Indian context these are the two of the strongest disease segments with a huge domestic market. Early stage deals are more common compared to the middle and late stage deals: Indian companies with limited financial resources can optimize business models by partnering with larger companies for product development and licensing at an early stage.

How pharmaceutical companies make money?

-

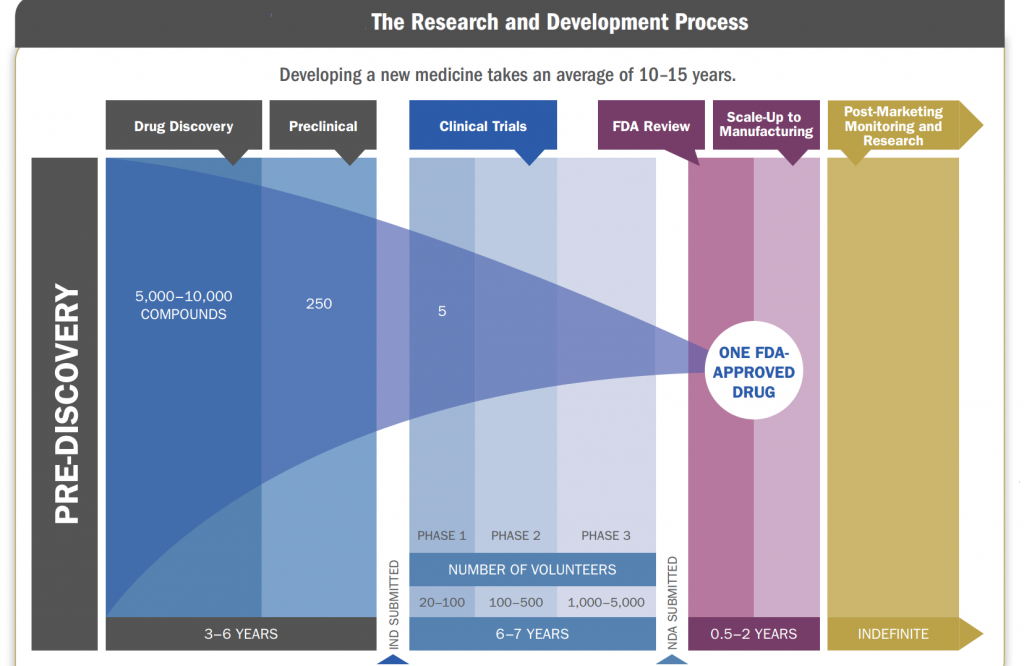

Research And Development

Research and development factors plays a vital role in pharmaceutical industry, as major part of revenue is dependent on research and development. Company spends its major revenue in R&D spending as once research of a new formulation is done profit can be booked for future. Pharmaceutical markets, however, are extremely complex in many respects. Large public-sector investments in basic biomedical R&D influence private companies’ choices about what to work on and how intensively to invest in research and development. The returns on private-sector R&D are attractive, on average, but they vary considerably from one drug to the next. Consumer demand for prescription drugs is often indirect, mediated by doctors and health insurers.

New drugs must undergo costly and time-consuming testing before they can be sold. Moreover, it may cost hundreds of millions of dollars to develop an innovative new drug that then will cost only a few cents per dose to manufacture—and the price of the drug will have no obvious connection to either cost. Research and development costs vary widely from one new drug to the next. Those costs depend on the type of drug being developed, the likelihood of failure, and whether the drug is based on a molecule not used before in any pharmaceutical product (a new molecular entity, or NME) or instead is an incremental modification of an existing drug. Research and development spending per NME has grown significantly in recent years, for various reasons.

- First, failure rates in clinical trials have increased, possibly because of greater research challenges or a willingness to test riskier drugs in such trials.

- Second, larger drug firms are said to have shifted the focus of their development efforts away from drugs for acute illnesses and toward drugs for chronic illnesses. Drugs that treat chronic illnesses can be more expensive to develop because they often require larger and longer clinical trials.

- Third, greater technological complexity in drug development and greater specificity in disease targets have helped to raise average R&D costs, as firms now identify drugs with particular molecular characteristics rather than using trial-and-error methods to find compounds that work in some desired way.

The research and development process of a drug is as follows:

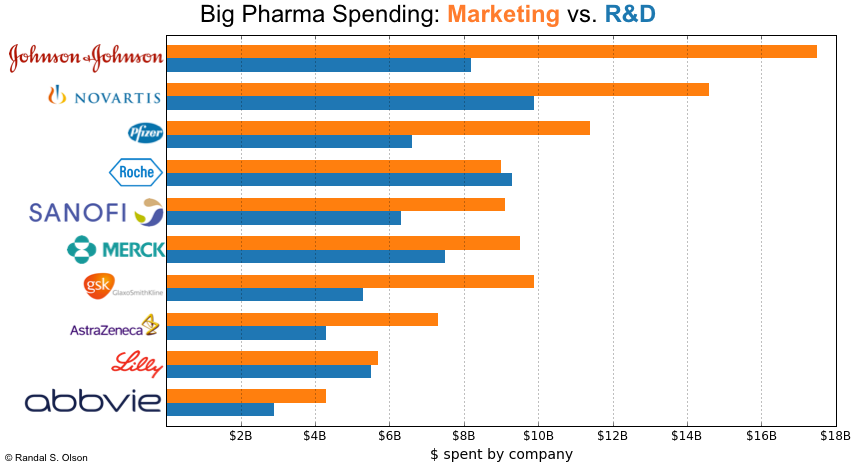

2. Marketing

Marketing always starts with the customer and ends with the customer as they are the valuable assets for the country. Marketing is a business activity by which it means the flow of goods and products from the manufacturer to the customer (End user). Pharmaceutical marketing is a well organized information system. It helps the physicians to update about accessibility safety, effectiveness and techniques of consuming the medicine. The Indian pharmaceutical industry has been gaining momentum in the recent years and is expected to move towards an upward trend. Pharmaceutical marketing costs are phenomenal. The end users must have awareness about these high technology industries. Complex information must be communicated to customers properly.

What are the needs for Pharmaceutical Marketing?

India is emerging as the global hub for contract research and manufacturing services due to its low cost advantage and world class quality standards. The introduction of product patent in India has brought some fundamental changes in strategies of Indian pharmaceutical companies, with focus shifting more towards Research and Development. The major revenue to the Indian pharmaceutical industry has been gained through exports. India pharmaceutical products are exporting to more than 200 countries around the world. Therefore Pharmaceutical marketing helps:

- To have a healthy competition

- To increase the customer knowledge

- To have a better customer relationship

- To reduce the initial development costs.

3.Distribution

Drug distribution in India has witnessed a paradigm shift. Before 1990, pharmaceutical companies established their own depots and warehouses. Now they have been replaced by clearing and forwarding agents (CFAs). Recording of what has been consumed at various supply chain nodes and replenishing it at the front end by the previous supply chain node. It is an end-to-end solution involving the front end distribution system, operations and procurement as well. It enables the company to be more agile in meeting market demands and helps to meet the two major challenges: Excess Inventory & Shortages in system. In pharmaceutical industry selling and distribution plays key role. If the product manufactured in the unit doesn’t reaches to its end customer on time it becomes use less and companies start losing there brand name.

In pharma industry selling and distribution channels flow in the below manner.

The distribution of medicines in most markets is carried out by importers and wholesalers, which act as a link between manufacturers and retailers to ensure the continuous supply of medicine, regardless of the geographical location and portfolio of medicine required. For those medicines which are imported, there is often an additional step from the importer who organises the logistics of bringing the medicine into the country which are then transferred to the wholesaler for domestic distribution. In some cases the two entities are vertically integrated, decreasing the number of steps in the distribution stage of the value chain. Pharmaceutical distribution needs to meet the logistical challenge of serving a large number of pharmacies with products sourced from many manufacturers and often in a short period of time.

4. Dispensing

This step includes the transportation and handling of the medicine from the manufacturer to the end user, whether this is a retail pharmacy (retailer), hospital or dispensing doctor. The complexity of this journey will differ depending on manufacturer location, the need for importation of the medicine, the nature of special handling requirements, and the geographic location of the end user which will vary between large urban centres and remote rural villages. Providing the correct medicine dosage and form, to the right patient, in a convenient and timely manner is the final step in the value chain.

This step can also involve a number of additional activities, including checking for potential interactions, providing advice, and processing reimbursement claims, each of which is intended to ensure the patient receives the full benefit and value from the medicines they receive. In some markets, retailers make a loss from selling prescription medicine, profit is instead generated from additional over-the-counter and health and beauty sales. An alternative business model finds other retailers which are very much focused on prescription drug dispensing to drive their business profitability.

At the time of dispensing There are various types of products produced in pharmaceutical industry, such as:

1) Prescription drugs are the main pharmaceutical industry products. These products are generating high revenue amounts but there are also other types of products that make up the whole pharmaceutical industry.

2) Biologics are composed of a variety of products that include vaccines, antibodies, blood, blood components, therapeutic proteins, tissues, allergenics and somatic cells. They are used for variety of medicinal, pharmaceutical and other important purposes.

3) Generic drugs are used interchangeably with branded drugs in the market. Basically, a generic drug is quickly approved in the market. Regulators of drugs would not necessarily require detailed testing and clinical trials for generic drugs. What the manufacturer of generic drugs needs to do is show evidence of the generic drugs’ equivalence to the original and branded version.

4) OTC or Over-the-counter drugs are those medicines that one can buy from pharmacies and drug stores even without prescriptions from physicians or doctors. There are many types of over the counter drugs in the market. There are those which relieve pains, itches and aches. Others may also be used in curing ailments and diseases like athlete’s foot and tooth decay. Migraines and other recurring problems may also be treated using OTC drugs.

After various types of products that are dispensed in the market there company start building its brand and after company becomes the famous brand in all the markets globally that’s the time when revenue flow becomes easy.

5.Making A Brand

Pharma Companies define a Mega Brand as a drug with the annual sale of more than $ 1billion. Many a times to make a brand pharma companies indulge themselves to partnership with foreign players. When any company wants to make itself a global brand at that time company goes for Merger & Acquisitions(M&A) with foreign reputed player which gives them a good edge in market and helps them to become a big brand. Pharma companies have mastered various product launch strategies to build the next billion dollar brand.

Some of these strategies include:

1) Involving key opinion leaders in the clinical trials.

2) Designing the trials based on payers needs.

3) Educating providers on new disease and usage under the garb of continuing medical education.

4) Working with the healthcare organisations to create disease protocols.

5) Providing grants to healthcare advocacy groups.

6) Educating the general population on why they should get themselves treated for the advertised disease.

6. Government Tarrifs, Taxes And Charges

Taxes have been shown to be one of the larger components contributing to the price build-up of medicines. To take careful steps which are in favour of customers as well as the manufacturer , Government is of the opinion that to streamline and simplify the procedure and to bring about a greater degree of transparency as well as objectivity, an expert body should be constituted with the powers, interalia, to fix prices and notify the changes therein, if any, of bulk drugs and formulations, from time to time, under the Drugs (Prices Control) Order. Government have now decided to establish an independent body of experts to be called as the National Pharmaceutical Pricing Authority.

The National Pharmaceutical Pricing Authority shall be empowered to take final decisions, which shall be subject to review by the Central Government as and when considered necessary. The Authority shall also monitor the prices of decontrolled drugs and formulations and oversee the implementation of the provisions of the Drugs (Prices Control) Order. There are various orders that have been passed by (N.P.P.A) such orders are as follows: To implement and enforce the provisions of the Drugs (Prices Control) Order in accordance with the powers delegated to it. To deal with all legal matters arising out of the decisions of the Authority. To monitor the availability of drugs, identify shortages, if any, and to take remedial steps. To collect/maintain data on production, exports and imports, market share of individual companies, profitability of companies etc. for bulk drugs and formulations. To undertake and/or sponsor relevant studies in respect of pricing of drugs/pharmaceuticals. To recruit/appoint the officers and other staff members of the Authority, as per rules and procedures laid down by the Government. To render advice to the Central Government on changes/revisions in the drug policy. To render assistance to the Central Government in the parliamentary matters relating to the drug pricing. (link: http://nppaindia.nic.in/index1.html)

The most prominent of these in certain markets is the import tariff, which is a customs duty imposed by importing countries on the value of goods brought in from other countries. Import duties are used to raise government revenues and help domestic producers by providing a price advantage versus international competitors. It is expected that GST would have a constructive effect on the Healthcare Industry particularly the Pharma sector. It would help the industries by streamlining the taxation structure since 8 different types of taxes are imposed on the Pharmaceutical Industry today. An amalgamation of all the taxes into one uniform tax will ease the way of doing business in the country, as well as minimizing the cascading effects of manifold taxes that is applied to one product. Moreover, GST would also improve the operational efficiency by rationalizing the supply chain that could alone add 2 percent to the country’s Pharmaceutical industry.

GST would help the Pharmaceutical companies in rationalizing their supply chain the companies would need to review their strategy and distribution networks. Furthermore, GST implementation would also enable a flow of seamless tax credit, improvement the overall compliance create an equal level playing field for the Pharmaceutical companies in the country. The biggest advantage for the companies would be the reduction in the overall transaction costs with the withdrawal of CST (Central Sales Tax). GST is also expected to lower the manufacturing cost.

7. Margins

- In India, under the Drugs Price Control Order 2013, both the wholesaler and retailer margins are differentially regulated based on essential drug classification, with maximum margin for distributors at 8% for scheduled drugs and 10% for non-scheduled drugs. Retailer remuneration is determined by two key factors.

- Firstly the level of discounts negotiated from the wholesaler, which determines the acquisition cost of the medicine. Secondly, the margin made on the acquisition cost of the medicine paid by the end user.

- Importer margin : applied by the importer who is tasked with procuring and receiving delivery of imported goods.

- Distributor margin : applied by wholesalers and sub-wholesalers to perform the logistical role of storing and subsequently transporting medicine to point of sale.

- Retailer margin : applied by retailers in the final step of the distribution chain, the point at which medicines are dispensed to patients.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.