Disclaimer: This post on the Indian Banking Sector is not a recommendation to buy / hold / sell any securities mentioned in the blog post. The published post is for information purpose only. The intention to share write ups on this blog is to create a repository of ideas so that investors can have a look at various frameworks & approaches. Please read the detailed disclaimer at the bottom of the post.

Key Terminologies To Understand The Banking Sector

Indian banking sector, dodged the global financial meltdown in 2008. But they promptly embarked on a frenzy of lending to big companies, sowing the seeds of a home-made crisis. The PSBs gleefully funded infrastructure projects that never got the required permits, mines with an output made much less valuable by slumping commodity prices, PSBs have tried to gloss over the problem for years, but the RBI is now forcing them to admit the true extent of the damage.

We will be publishing 3 articles on the Indian Banking sector, starting with the first article we will cover banking related terms and definitions like what are the different types of banks, Basel accords, performance related metrics (CASA ratio, ROA & ROE of banks) and various solvency (capital adequacy), and liquidity ratios.

Commercial Banks –

Commercial Banks are profit making financial institutions that accept deposits, make loans, and offer funds transfer (including transaction banking) services. Commercial banks usually provide short-to-medium term credit as they gather funds from general public that could be withdrawn at a short notice.

Public Sector Commercial Banks –

Public sector banks constitute the majority of commercial banking space in India both in terms of credit outreach and asset size. These are the banks in which government is a majority shareholder. These banks comprise the 19 nationalized banks plus the State Bank of India Group.

Private Sector Commercial Banks –

India started giving licenses to private sector banks in 1990s. A bank having its majority shareholding in private hands is called a private bank. These banks are companies registered with limited liability and regulated by the RBI. Private Banks that have operating even before the liberalization started are known as Old private banks whereas those which came into existence are termed as New private banks.

Regional Rural Banks (RRBs) –

RRBs were established in 1975 in India as local level banks. These are structured as commercial banks and have the primary objective of providing credit and promoting growth in rural economy. However they accumulated huge amount of non-performing assets (NPAs) and due to their high cost of operation many were shut down.

Foreign Banks-

By the end 2015, 46 foreign banks had branch office presence whereas 39 had representative office presence in India. Standard Chartered Bank (SCB) had the highest 102 branches in the country whereas HSBC and Citi had 50 and 45 branches, respectively. Foreign banks are present in India since eighteenth century with HSBC and earlier versions of BNP Paribas, and Standard Chartered banks having their offices in Kolkata. These banks provide Indian corporations the access to global stock and bond markets. On the other hand, these banks bring global practices and technology to Indian banking sector.

Foreign banks in India operate as either as Wholly Owned Subsidiary (WOS) or in branch mode.

Payments Banks –

In 2014-15 RBI decided to give licenses to specialized banks known as payment banks. These banks can take small deposits (up to 1Lakh currently). However, these banks can’t issue credit cards or make loans.

Small Finance Banks –

Along with payments banks a new type of banks Small Finance Banks were also issued licenses recently. Their objective is to promote financial inclusion in the society.

Post-Office Savings Banks (POSB) –

Post offices have widespread presence in India. They complement rural banks in terms of providing deposit taking and money transfer facilities. However, they do not make loans or provide credit. Recently these banks were also granted payments bank’s licenses.

Wholesale and Long-Term Finance Banks (WLTFB) –

RBI has recently finalized guide-lines to issue licenses to another type of new banks to known as Wholesale and Long-term Finance Banks. These banks are being set-up to provide long-term funding to infrastructure projects.

Non-banking Financial Companies (NBFCs) –

NBFCs are companies registered under the Companies Act of 1956 or 2013, that carry out the businesses of loans and advances, advances, acquisition of shares, stock-bonds hire-purchase, insurance business or chit business. They are regulated by RBI.

– NBFCs cannot accept demand deposits

– NBFCs do not form the part of the payment and settlement system and cannot issue cheques drawn on themselves

– The Deposit Insurance and Credit Guarantee Corporation (DICGC) insurance is not available to them.

Basel 1 –

The first set of Basel Accords, known as Basel I, was issued in 1988 with the primary focus on credit risk. It proposed creation of a banking asset classification system on the basis of the inherent risk of the asset.

Features Of Basel 1 –

The Basel I Accord attempted to create a cushion against credit risk. The norm comprised of four pillars, namely Constituents of Capital, Risk Weighting, Target Standard Ratio, and Transitional and implementing arrangements.

Tier 1 –

Tier I capital or Core Capital consists of elements that are more permanent in nature and as a result, have high capacity to absorb losses. This comprises of equity capital and disclosed reserves. Equity Capital includes fully paid ordinary equity/common shares and non-cumulative perpetual preference capital, while disclosed/published reserves include post-tax retained earnings. However, given the quality and permanent nature of Tier I capital, the accord requires Tier I capital to constitute at least 50 percent of the total capital base of the banking institution.

Tier 2 –

Tier II capital is more ambiguously defined, as it may also arise from difference in accounting treatment in different countries. In principal, it includes, revaluation reserves, general provisions and provisions against non-performing assets, hybrid debt capital instruments, and subordinated term debt

Basel 2 –

Basel II, the second set of Basel Accords, was published in June 2004 – in order to control misuse of the Basel I norms, most notably through regulatory arbitrage. The Basel II norms were intended to create a uniform international standard on the amount of capital that banks need to guard themselves against financial and operational risks. This again would be achieved through maintaining adequate capital proportional to the risk the bank exposes itself to (through its lending and investment practices). It also laid increased focus on disclosure requirements.

Limitations of Basel 2

The financial crisis of 2007 and 2008 exposed the limitations of Basel II, wherein certain risks were not under the purview of this regulation. Amendments were made to the Basel II in 2009 to make it more robust.

The revisions were as under:

Augmenting the value-at-risk based trading book framework with an additional charge for risk capital, including mitigation risk and default risk.

Addition of stressed value-at-risk condition. This condition takes into account probability of significant losses over a period of one year.

Basel 3 –

The issues surrounding Basel II together contributed to the emergence of the Basel III accord. The essence of Basel III revolves around two sets of compliance:

i. Capital ii. Liquidity

While good quality of capital will ensure stable long term sustenance, compliance with liquidity covers will increase ability to withstand short term economic and financial stress.

Liquidity Rules :

One of the objectives of Basel III accord is to strengthen the liquidity profile of the banking industry. This is because despite having adequate capital levels, banks still experienced difficulties in the recent financial crisis. Hence, two standards of liquidity were introduced.

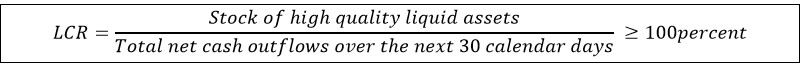

Liquidity Coverage Ratio (LCR) –

LCR was introduced with the objective of promoting efficacy of short term liquidity risk profile of the banks. This is ensured by making sufficient investment in short term unencumbered high quality liquid assets, which can be quickly and easily converted into cash, such that it enables the financial institution to withstand sustained financial stress for 30 days period. It is assumed, within 30 days, the management of the bank shall take corrective actions to deal with the adverse situation.

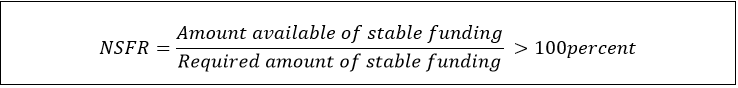

Net Stable Funding Ratio (NSFR) –

Long term stability of financial liquidity risk profile is an important objective to be achieved. The Net Stable Funding Ratio incentivizes banks to obtain financing through stable sources on an ongoing basis. More specifically, the standard requires that a minimum quantum of stable and risk less liabilities are utilized to acquire long term assets. The objective is to determine reliance on short term means of finance, especially during favourable market periods.

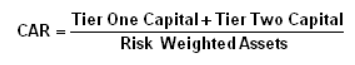

Capital Adequacy Ratio (CAR) –

The Capital Adequacy Ratio (CAR) is a measure of a bank’s available capital expressed as a percentage of a bank’s risk-weighted credit exposures. The Capital Adequacy Ratio, also known as capital-to-risk weighted assets ratio (CRAR), is used to protect depositors and promote the stability and efficiency of financial systems around the world.

Two Types Of Capital Are Measured:

tier one capital, which can absorb losses without a bank being required to cease trading, and tier two capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors.

Once the asset base is adjusted based on credit risk, and reserves in respect of operational risk and market risk are computed, a bank can readily calculate its reserve requirements to meet the capital adequacy norms of Basel II. As in the case of Basel I, a bank must maintain equal amounts of Tier 1 and Tier 2 capital reserves. Further, the reserve requirement continued at 8 percent.

SLR –

SLR stands for Statutory Liquidity Ratio. This term is used by bankers and indicates the minimum percentage of deposits that the bank has to maintain in form of gold, cash or other approved securities. Thus, we can say that it is ratio of cash and some other approved securities to liabilities (deposits) It regulates the credit growth in India.

CRR –

CRR means Cash Reserve Ratio. Banks in India are required to hold a certain proportion of their deposits in the form of cash. However, actually Banks don’t hold these as cash with themselves, but deposit such case with Reserve Bank of India (RBI) / currency chests, which is considered as equivalent to holding cash with RBI. This minimum ratio (that is the part of the total deposits to be held as cash) is stipulated by the RBI and is known as the CRR or Cash Reserve Ratio.

Repo Rate –

Repo (Repurchase) rate is the rate at which the RBI lends short-term money to the banks against securities. When the repo rate increases borrowing from RBI becomes more expensive. Therefore, we can say that in case, RBI wants to make it more expensive for the banks to borrow money, it increases the repo rate similarly, if it wants to make it cheaper for banks to borrow money, it reduces the repo rate.

Reverse Repo Rate –

Reverse Repo rate is the rate at which banks park their short-term excess liquidity with the RBI. The banks use this tool when they feel that they are stuck with excess funds and are not able to invest anywhere for reasonable returns. An increase in the reverse repo rate means that the RBI is ready to borrow money from the banks at a higher rate of interest. As a result, banks would prefer to keep more and more surplus funds with RBI.

N.P.A – Non Performing Asset –

A non-performing asset (NPA) refers to a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest. In most cases, debt is classified as nonperforming when loan payments have not been made for a period of 90 days. While 90 days of non -payment is the standard, the amount of elapsed time may be shorter or longer depending on the terms and conditions of each loan.

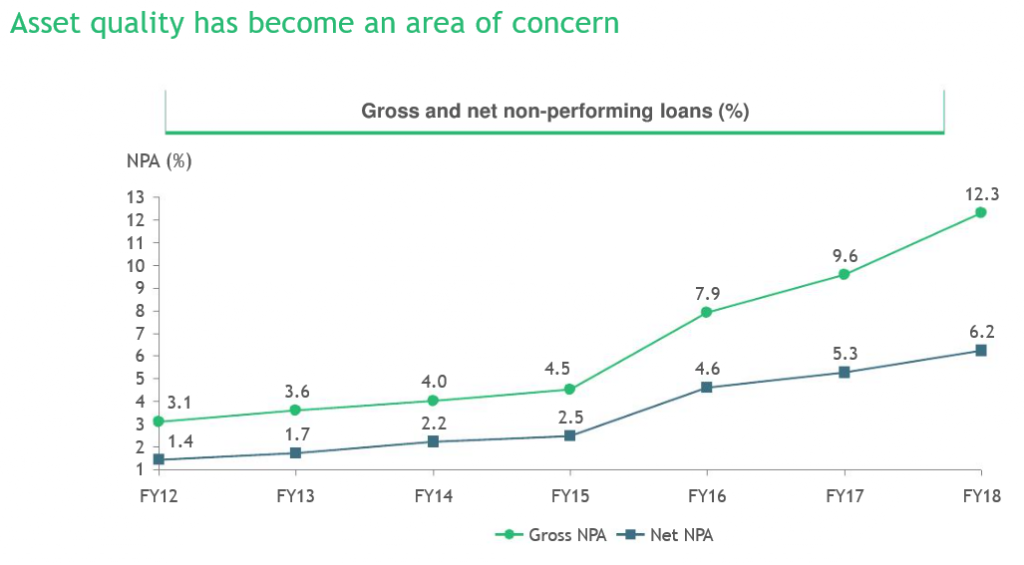

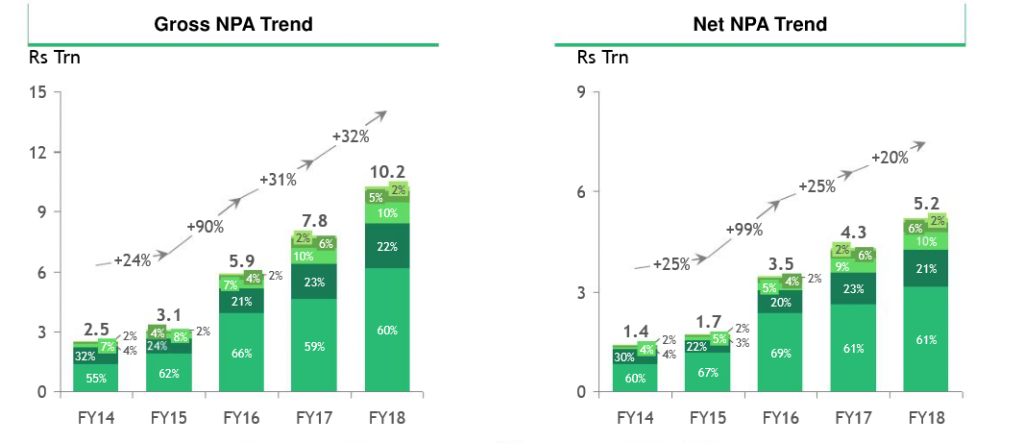

Growth In NPAs

Where The NPA Is Coming From?

CASA – Current Account And Savings Account –

CASA is a commonly used parameter that is used to understand the amount of liabilities that the bank pays relatively less interest on. The higher the amount of CASA as a percentage of total liabilities, the lesser will be the interest paid by the bank. Investors should look at the CASA numbers carefully, as CASA is a source of strength for the bank. For example, ICICI Bank is considered to have a comparatively healthy CASA percentage.

‘Out of Order’ status –

An account should be treated as ‘out of order’ if the outstanding balance remains continuously in excess of the sanctioned limit/drawing power. In cases where the outstanding balance in the principal operating account is less than the sanctioned limit/drawing power, but there are no credits continuously for 90 days as on the date of Balance Sheet or credits are not enough to cover the interest debited during the same period, these accounts should be treated as ‘out of order’.

POS Machine- Point of sale –

A POS, or Point of Sale System, machine is simply a way for business owners to conduct financial transactions. Sometimes a POS machine is an interactive device that allows consumers to make financial transactions themselves.

CDM – Cash Deposit Machine –

Cash Deposit Machine (CDM) is self-service machine terminal that enables you to deposit cash without any manual intervention of a bank officer. In a cash deposit machine, you can deposit cash with or without using the ATM cum debit card. CDM has inbuilt intelligence to identify fake notes and to sort cash deposited by customers into different denominations.

MCLR- Marginal Cost Of Funds –

Marginal Cost of fund-based Lending Rate (MCLR) is a methodology by the Reserve Bank of India (RBI) for setting lending rate on loans by commercial banks. (MCLR) refers to the minimum interest rate of a bank below which it cannot lend, except in some cases allowed by the RBI. It is an internal benchmark or reference rate for the bank. MCLR actually describes the method by which the minimum interest rate for loans is determined by a bank – on the basis of marginal cost or the additional or incremental cost of arranging one more rupee to the prospective borrower.

LIBOR- London Inter Bank Offered Rate –

The London Inter-bank Offered Rate is the average of interest rates estimated by each of the leading banks in London that it would be charged were it to borrow from other banks. It is usually abbreviated to Libor or LIBOR

MIBOR – Mumbai Inter Bank Offer Rate –

The Mumbai Inter-Bank Offer Rate (MIBOR) is one iteration of an interbank rate, which is the rate of interest charged by a bank on a short-term loan to another bank. Banks borrow and lend money to one another on the interbank market in order to maintain appropriate, legal liquidity levels, and meet reserve requirements placed on them by regulators. Interbank rates are made available only to the largest and most creditworthy financial institutions.

Interbank Rate –

The interbank rate is the rate of interest charged on short-term loans made between banks. Banks borrow and lend money between each other in the interbank market in order to manage liquidity and meet the reserve requirements placed on them by regulators, the rate depends on maturity, market conditions and credit ratings. The interbank rate can also refer to the price at which banks conduct wholesale foreign exchange transactions in both the spot and forward market; spreads are tighter than for smaller retail transactions.

Mumbai Interbank Bid Rate –

The Mumbai Interbank Bid Rate (MIBID) is the interest rate that a bank participating in the Indian interbank market would be willing to pay to attract a deposit from another participant bank. The MIBID used to be calculated every day by the National Stock Exchange of India (NSEIL) as a weighted average of interest rates of a group of banks, on funds deposited by first-class depositors.

Prime Lending Rate (PLR) –

The interest rate charged by banks to their largest, most secure, and most creditworthy customers on short-term loans. This rate is used as a guide for computing interest rates for other borrowers.

RWA- Risk Weighted Asset –

Risk-weighted asset (also referred to as RWA) is a bank’s assets or off-balance-sheet exposures, weighted according to risk. This sort of asset calculation is used in determining the capital requirement or Capital Adequacy Ratio (CAR) for a financial institution.

CRWA – Credit Risk Weighted Asset –

A bank’s assets weighted according to credit risk. Some assets, such as debentures, are assigned a higher risk than others, such as cash. This sort of asset calculation is used in determining the capital requirement for a financial institution and is regulated by the Federal Reserve Board.

CRAR (Capital to Risk Weighted Assets Ratio) –

Capital to risk weighted assets ratio is arrived at by dividing the capital of the bank with aggregated risk weighted assets for credit risk, market risk and operational risk. The higher the CRAR of a bank the better capitalized it is.

Leverage Ratio

The Tier 1 leverage ratio is the relationship between a banking organization’s core capital and its total assets. The Tier 1 leverage ratio is calculated by dividing Tier 1 capital by a bank’s average total consolidated assets and certain off-balance sheet exposures. RBI also calculates Coverage Ratio = (Equity-Net NPA)/(Total Assets – Intangible Assets). This is almost like leverage ratio above and tells about the amount of common equity available to support Net Assets.

CET1 Ratio (Core equity tier 1)-

It is a capital measure that was introduced in 2014 as a precautionary measure to protect the economy from a financial crisis. It is expected that all banks should meet the minimum required CET1 ratio of 4.50% by 2019. A bank’s capital structure consists of Lower Tier 2, Upper Tier 1, AT1, and CET1. CET1 is at the bottom of the capital structure, which means that in the event of a crisis, any losses incurred are first deducted from this tier. CET1 is a measure of bank solvency that gauges a bank’s capital strength. This measure is better captured by the CET1 ratio which measures a bank’s capital against its assets. Since not all assets have the same risk, the assets acquired by a bank are weighted based on the credit risk and market risk that each asset presents.

Additional Tier 1 –

AT1 consists of capital instruments that are continuous, in that there is no fixed maturity including: Preferred shares, High contingent convertible securities. Contingent convertible securities (often referred to as CoCos) are a major component of AT1 and their structure is shaped by their primary purpose as a readily available source of capital for a firm in times of crisis. CoCos can absorb losses either by: Converting into common equity; or Suffering a principal write-down.

Hybrid Debt Capital Instruments –

In this category, fall a number of capital instruments, which combine certain characteristics of equity and certain characteristics of debt. Each has a particular feature, which can be considered to affect its quality as capital. Where these instruments have close similarities to equity, in particular when they are able to support losses on an ongoing basis without triggering liquidation, they may be included in Tier II capital.

Hybrid Security –

A hybrid security is a single financial security that combines two or more different financial instruments. Hybrid securities, often referred to as “hybrids,” generally combine both debt and equity characteristics. The most common type of hybrid security is a convertible bond that has features of an ordinary bond but is heavily influenced by the price movements of the stock into which it is convertible.

Held Till Maturity (HTM) –

The securities acquired by the banks with the intention to hold them up to maturity.

Held for Trading (HFT) –

Securities where the intention is to trade by taking advantage of short-term price / interest rate movements.

Available for Sale (AFS) –

The securities available for sale are those securities where the intention of the bank is neither to trade nor to hold till maturity. These securities are valued at the fair value which is determined by reference to the best available source of current market quotations or other data relative to current value.

Yield to maturity (YTM) or Yield –

The Yield to maturity (YTM) is the yield promised to the bondholder on the assumption that the bond will be held to maturity and coupon payments will be reinvested at the YTM. It is a measure of the return of the bond.

Slippage ratio –

(Fresh accretion of NPAs during the year/Total standard assets at the beginning of the year) *100

RAROC (risk-adjusted return on capital) –

This is the expected result over economic capital) allows banks to allocate capital to individual business units according to their individual business risk. As a performance evaluation tool, it then assigns capital to business units based on their anticipated economic value added.

The theoretical RAROC can be extracted from the one-factor CAPM as the excess return on the market per unit of market risk (the market price of risk)

RARoC = Adjusted Income .

Risk Based Capital Requirement

= Adjusted Income

Value at Risk (VaR)

Adjusted Income = [Spread (Direct Income on Loan) + Fees directly attributable to loans – Expected Loss (P(D)*LGD) – Operating Cost] * (1- Marginal tax rate)

Asset Quality

Sub-standard Assets –

a sub-standard asset would be one, which has remained NPA for a period less than or equal to 12 months. Such an asset will have well defined credit weaknesses that jeopardise the liquidation of the debt and are characterised by the distinct possibility that the banks will sustain some loss if deficiencies are not corrected.

Doubtful Assets –

an asset would be classified as doubtful if it has remained in the sub-standard category for a period of 12 months. A loan classified as doubtful has all the weaknesses inherent in assets that were classified as sub-standard, with the added characteristic that the weaknesses make collection or liquidation in full, – on the basis of currently known facts, conditions and values – highly questionable and improbable.

Loss Assets –

A loss asset is one where loss has been identified by the bank or internal or external auditors or the RBI inspection but the amount has not been written off wholly. In other words, such an asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted although there may be some salvage or recovery value.

Total Loan and Advances –

Loan is the definite money given to the borrower for a specific purpose and for a specific period of time.

Advance is a credit facility granted by the bank for short-term purpose such as meeting working capital requirements or short-term trading liabilities. There is a sense of debt in loan, whereas an advance is a facility being availed of by the borrower. However, like loans, advances are also to be repaid.

Thus a credit facility- repayable in instalments over a period is termed as loan while a credit facility repayable within one year may be known as advances. However, in our discussion here these two terms are used interchangeably.

Gross Non-performing Asset (GNPA%) –

An asset, including a leased asset, becomes non-performing when it ceases to generate income for the bank. Any loan or advance on which interest is missed for more than 90 days in India is classified as non-performing loan.

Gross NPA is defined as “Principal dues of NPAs plus Funded Interest Term Loan (FITL) where the corresponding contra credit is parked in Sundries Account (Interest Capitalization – Restructured Accounts), in respect of NPA Accounts.”

Net Non-performing Assets (NNPA%)-

It is calculated as:

Gross NPA – (Balance in Interest Suspense account + DICGC/ECGC claims received and held pending adjustment + Part payment received and kept in suspense account + Total provisions held).

*Interest Suspense Account holds the interest payments obtained on non-performing assets.

Restructured Asset –

A restructured asset is one where the bank, grants to the borrower concessions that the bank would not otherwise consider. Restructuring would normally involve modification of terms of the advances/securities, which would generally include, among others, alteration of repayment period/ repayable amount/ the amount of instalments and rate of interest. It is a mechanism to nurture an otherwise viable unit, which has been adversely impacted, back to health.

Restructured Loan –

Restructured asset or loan are that assets which got an extended repayment period, reduced interest rate, converting a part of the loan into equity, providing additional financing, or some combination of these measures. Hence, under restructuring a bad loan is modified as a new loan. A restructured loan also indicates bad asset quality of banks. This is because a restructured loan was a past NPA or it has been modified into a new loan. Whether the borrower will repay it in future remains a risky element. Corporate Debt Restructuring Mechanism (CDM) allows restructuring of loans.

Stressed Advances –

Defined as GNPAs plus restructured + standard advances

Maturity Profile of Assets –

Banks maintain the maturity profile of their loan assets to match it with that off the liabilities as a part of asset liability management (ALM) exercise.

Off-balance Sheet Assets –

Assets (liabilities) that are not on the balance sheet of the bank but effectively form the part of its assets (liabilities). Securitised loans and operating leases are such type of assets.

While analysing the company such assets should be added back to the balance sheet with their risk characteristics. For example, collateralized debt obligations (CDOs) are off balance sheet liabilities. If loans that underlie the CDO turn toxic then the CDO liability falls directly on the issuer.

Provisioning Coverage Ratio (PCR) –

Provisioning Coverage Ratio (PCR) – is essentially the ratio of provisioning to gross non-performing assets and indicates the extent of funds a bank has kept aside to cover loan losses.

From a macro-prudential perspective, banks should build up provisioning and capital buffers in good times when the profits are good, which can be used for absorbing losses in a downturn. This will enhance the soundness of individual banks, as also the stability of the financial sector. It was, therefore, decided that banks should augment their provisioning cushions consisting of specific provisions against NPAs as well as floating provisions, and ensure that their total provisioning coverage ratio, including floating provisions, is not less than 70 per cent.

Majority of the banks had achieved PCR of 70 percent and had represented to RBI whether the prescribed PCR is required to be maintained on an ongoing basis. The matter was examined and till such time RBI introduces a more comprehensive methodology of countercyclical provisioning taking into account the international standards as are being currently developed by Basel Committee on Banking Supervision (BCBS) and other provisioning norms, banks were advised that:

1) The PCR of 70 percent may be with reference to the gross NPA position in banks as on September 30, 2010;

2) The surplus of the provision under PCR vis-a-vis as required as per prudential norms should be segregated into an account styled as “countercyclical provisioning buffer”.

3) This buffer will be allowed to be used by banks for making specific provisions for NPAs during periods of system wide downturn, with the prior approval of RBI.

4) The PCR of the bank should be disclosed in the Notes to Accounts to the Balance Sheet.

TReDS (Trade Receivable Discounting System) –

It is an electronic platform that allows auctioning of trade receivable. The process is also commonly known as ‘bills discounting’, a financier (typically a bank) buying a bill (trade receivable) from a seller of goods before it’s due or before the buyer credits the value of the bill. In other words, a seller gets credit against a bill which is due to him at a later date. The discount is the interest paid to the financier.

AUCA –

Advance Under Collection Account (AUCA) is an account to hold the portion of a Non-Performing Asset (NPA) accounts. AUCA is an NPA reduction strategy that allows the bank to take the bad debt off their balance sheet but will have the option of recovering the amount from its promoter. By writing-off bad and doubtful assets, bank can improve its NPA ratio.

Capital Conservation Buffer –

The Capital Conservation Buffer is intended to ensure that firms build up buffers of capital outside any periods of stress and is designed to avoid breaches of minimum capital requirements. This capital buffer can then be drawn upon in times when losses are incurred. As Per Basel III requirements, a firm must calculate a capital conservation buffer of CET1 capital equal to 2.5% of its total risk exposure amount.

Countercyclical Capital Buffer –

The Countercyclical Capital Buffer is an amount of capital a firm will have to set aside in relation to a firm’s exposure in other jurisdictions, the aim of which is to avoid a breach of minimum capital requirements.

SMA (Special Mention Accounts) –

Banks will categorise accounts as SMA when the money remains outstanding for 30-90 days after due payment date. There will not be any provisioning for SMA category loans. This is step before account gets classified as NPA.

Cost Of Funds –

Cost of funds is the interest rate paid by financial institutions for the funds that they deploy in their business. The cost of funds is one of the most important input costs for a financial institution, since a lower cost will generate better returns when the funds are used for short-term and long-term loans to borrowers.

Capital Asset Pricing Model (CAPM)-

A model that attempts to describe the relationship between the risk and the expected return on an investment that is used to determine an investment’s appropriate price. The assumption behind the CAPM is that money has two values: a time value and a risk value. Thus, any risky asset or investment must compensate the investor for both the time his/her money is tied up in the investment and the investment’s relative riskiness.

Z – Score Analysis –

The Z-score is the output of a credit-strength test that gauges a publicly traded manufacturing company’s likelihood of bankruptcy. The Z-score is based on five financial ratios that can be calculated by using ratios like profitability, leverage, liquidity, solvency and activity to predict whether a company has a high degree of probability of being insolvent.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.