In this post, Ashwini Damani & Pradeep Jaiswal write on how cement industry in india works & what should be the parameters while analyzing any cement company.

Ashwini is a chartered accountant & CFA. He has worked with Lafarge, one of the largest cement players in India for more than 6 years. Prior to joining Lafarge, he worked with Ernst & Young, Deloitte. He is an individual investor based out of Kolkata.

Pradeep has worked with Lafarge for more than a decade. He is hands on with Indian cement sector dynamics. Pradeep is a chartered accountant & based out of kolkata.

Cement Industry in India

Basics of Cement Industry

- Cement can be sold to two sets of customers

- Retail Customer – Trade Segment – Has Higher Margins

- Infra Customer – Non Trade Segment – Has Lower Margins

- As far as the retail customer is concerned – cement is a push market industry – so whoever is able to push its product first to the customer, will be able to successfully sell it.

The reason being – at the end Cement is a commodity. A layman doesn’t differentiate between different brands. The lead sales influencer is the mason and the shopkeeper.

He goes to buy Cement only when he immediately needs it, and will buy whichever is immediately available. So it is important for a manufacturer that he is able to successfully push his product on the shelf of shopkeeper (ship it on time) and incentivise the shopkeeper enough (discount and commission) so that he sells your product.

- Sales Price is determined based on demand and supply. It’s a dynamic pricing market.

- Cement is a bulky material – hence handling this bulky material takes a lot of effort. It occupies a lot of space and carries a lot of weight. Hence higher the distance a cement bag travels, higher is the freight and handling cost involved and lower is the profit a manufacturer makes.

Therefore it is important that the manufacturer keeps his production unit as close as close as possible to the end customer.

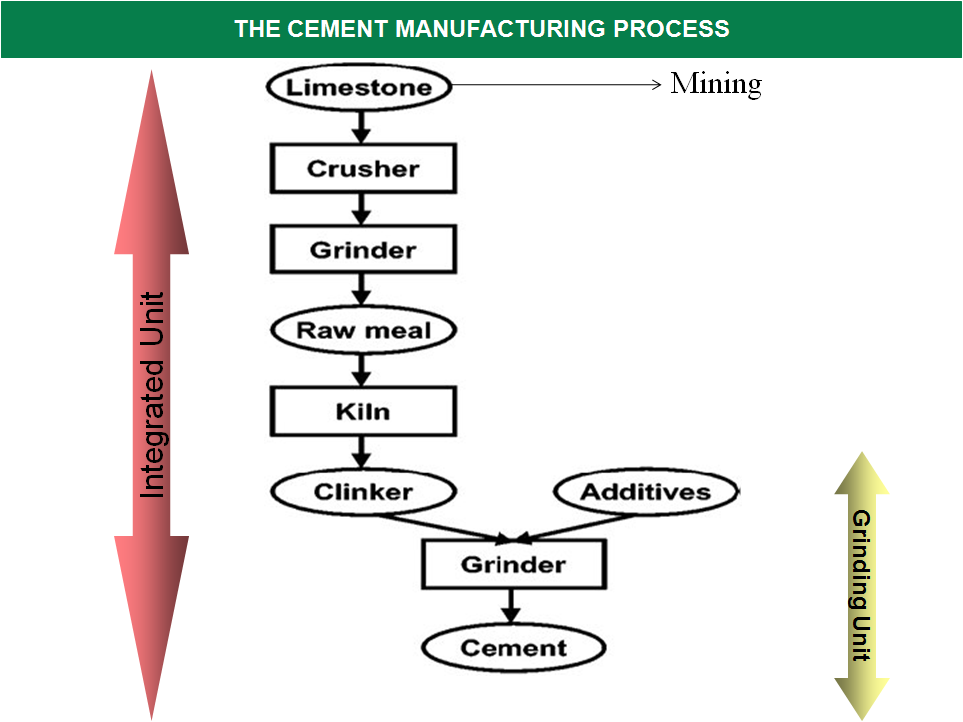

- Cement is basically is made by heating limestone (calcium carbonate) with small quantities of other materials to 1450°C in a kiln. The resultant hard material which is recovered after heating limestone and chemicals is called ‘Clinker’.

- Clinker looks like small lumps. These lumps are crushed with a small amount of gypsum into a powdery form – which gives the final product – ‘OPC Cement’.

So in essence following components are compulsory for making OPC cement

- Limestone – Natural Reserve, extracted or mined from Mines

- Heat – requires heat of 1450°C , ideally obtained from Coal or its variants.

- Gypsum –a mineral compulsory for providing the binding nature to cement

However with time, people figured out that limestone can be substituted with other materials namely Flyash or Slag, which will still provide the strength but to a lesser extent. The threshold limit of mixing Flyash is maximum 33%

For big infra projects, limestone component of upto 95% is required, but for the daily homebuilding use, the lower component limestone works fine enough.

- Thus, there are various varieties of Cement depending on the composition of materials, namely OPC (Ordinary Portland Cement), PPC (Portland Pozzolana Cement) and PSC (Portland Slag Cement (PSC).

| Items |

OPC |

PPC |

PSC |

| Clinker |

95% |

65% |

45% |

| Gypsum |

5% |

5% |

5% |

| Flyash |

– |

30% |

– |

| Slag |

– |

– |

50% |

|

Total |

100% | 100% |

100% |

| Margin profile for manufacturer |

Lowest Margin |

Higher Margin |

Highest Margin |

- Flyash is a by-product of Thermal Power Production. Most power producers want to dispose of fly-ash and one of the ways is by selling it to cement manufacturers who can substitute it for lime-stone in the cement making process. Similarly slag is a by-product of Steel making process and is often sold to cement makers as a substitute for lime-stone in the cement making process.

| Cement manufacturers often try to keep their plant near to a power plant, because neither slag nor flyash can be transported across long distance. You have to be near to a steel or power plant to use Flyash or Slag in the production process. |

Cost Structure Of A Cement Company

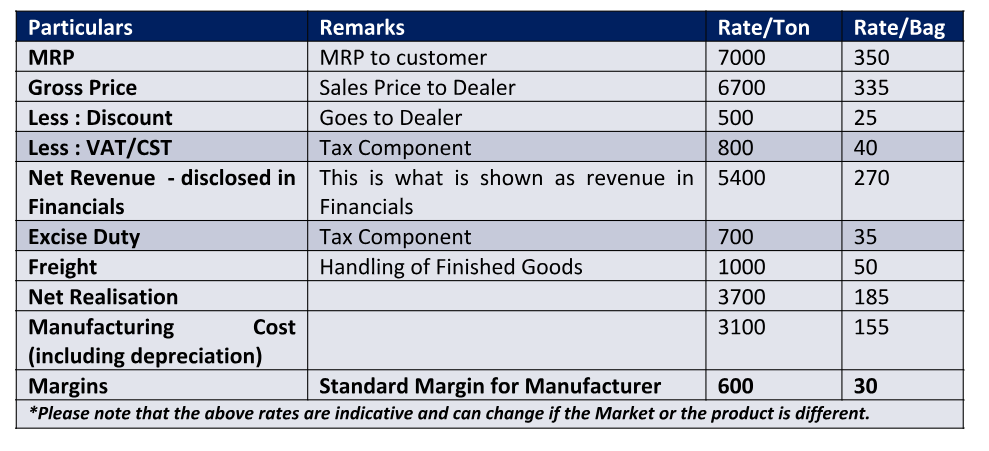

*Please note that the above rates are indicative and can change if the Market or the product is different.

So If A Cement Bag of Rs. 350 Rs is sold

- Indirect Taxes levied by the government form almost Rs. 75/ bag – Not to mention there are other taxes which are levied during the manufacturing stage such as Entry Tax, Cement Cess, Royalty etc

- Dealer Margins typically are around Rs. 40/Bag (Rs. 25 as discounts and and Rs 15 as markup to customer)

- Handling of Finished Goods costs almost Rs. 50/Bag

- Manufacturing Cost is almost Rs. 155/Bag

- In the end, a manufacturer earns Rs. 30/Bag on a Cement Bag which has MRP of 350

How Does A Cement Manufacturer Optimize His Profits

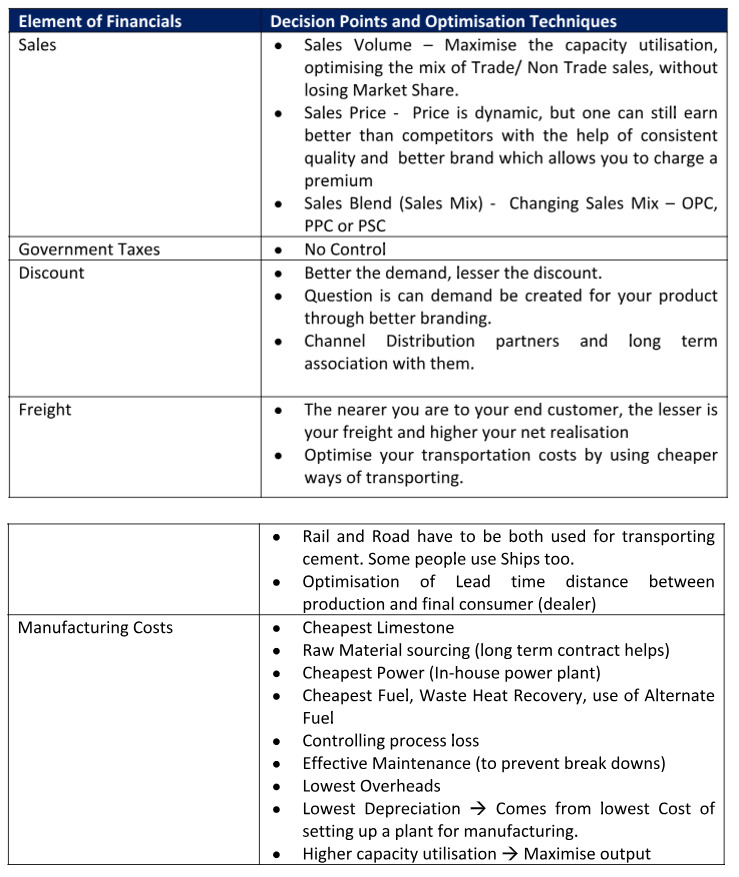

- Given the fact that it is a commodity industry, with little or no differentiation in the end product – how does one manufacturer make a higher profit than his peers? Well let’s look at the formula

Sales – Govt Taxes – Discount – Freight – Manufacturing Cost = Profit

How To Maximize Sales

- So basically a manufacturer has to ensure that he realises maximum sales price. This he can do by :

- Selling in markets with Best Prices – Demand Supply Mismatch creates better. If competition sets up a new plant in your market, the mismatch reduces and price falls.

- Trying to sell high margin products such as PPC and PSC – You have to be near the source of Flyash or Slag to be able to do this

- Higher Volumes – Better the demand in the market , higher the volumes

- Better branding – Since it is a commodity – You need to ensure that brand recall is high when customer goes for buying the product.

- Set up additional capacity

- Maintain the quality of the Product, Home building services

- Incentives schemes for Clearing and Forwarding Agents and Dealers

Manufacturing Costs

Limestone

- To make cement you have to first make clinker.

- So a plant has to first make Clinker

- Then Grind the Clinker with Gypsum to make Cement

- Limestone is the pre-requisite to make Clinker. Limestone is extracted from Mines. A company that has its own mines is at an advantageous position than the one which doesn’t have mines. Limestone cannot be traded, so a company which has no mines cannot make clinker.

- However limestone is a natural resource and more than 65% of India’s limestone comes from five states of Madhya Pradesh, Rajasthan, Andhra Pradesh, Gujarat and Chhattisgarh.

- So companies have two options

- Make cement in the areas where limestone is available and the ship the finished good to those parts of country that want cement, or

- Make only Clinker in the state where limestone is available, and then do the grinding of clinker in the region which requires cement.

A unit which does both grinding and clinker manufacturing is called an Integrated Unit. A unit that does only grinding work is called Grinding Unit.

- It may so happen that a company makes Clinker and directly sells it to another player who dies, but these situations are rare.

- Mines are normally allotted through government auction and are leased to a company for time periods extending upto 99 years. After expiry of the lease term, the mines are again re-auctioned. Some companies like ACC have old legacy mines, allotted in 1960s with lease period of 99 years.

|

It also depends what amount of limestone reserves you have in the mines. Higher the reserves in your mines, better the prospects of your plant. Typically 1.5 Tones of Limestone, gives 1 ton of Clinker. Output from Clinker to Cement, depends on the blend of cement being manufactured (OPC, PPC or PSC) |

- If the quality of limestone procured from mines is not of correct quality, then a company has to add chemicals (Correctives) to make Clinker of desired quality.

|

Note: – Since mines are allotted by Government, they typically give a right of mining (by charging a hefty sum). Companies capitalise this amount as an Intangible Asset. Hence an analyst can quickly check the Intangible Assets Section in Balance Sheet to know if a company has a limestone mine. – This Intangible is depreciated on the basis of Quantity of Limestone extracted as a proportion of Actual Quantity of Reserves existing. So an analyst can actually do a reverse calculation to judge the life and quantity of reserves a company has in their mines. |

Heat

- High Temperature heat is the next biggest requirement in the manufacturing process

- This high temperature can ordinarily be obtained only from Coal or Petcoke.

-

- Coal can be procured from open market – generally costly, or

- Cheaper coal can be obtained through Government tendering – government rations a quota of cheap coal to each industry, or

- Petcoke can be substituted for coal – which is less costly than Coal – but reduces the life of plant – and increases maintenance costs

- Use of Alternate Fuel and new trend in the industry, like Rick Husk, Liquid Solvent, TDI Tar, Etc.

- Waste Heat Recovery is a mechanism which can lead to huge cost savings in Fuel cost.

Parameters To Judge / Analyse A Cement Company

Housing forms 65% of the cement demand in India and hence this is the biggest demand driver. Housing has been growing at a steady modest pace even during lean period. The infrastructure sector adds or restricts the much needed growth.So one needs to judge uptick in demand and more specifically, the demand supply mismatch in the Micro Market where the Cement player is located.

Demand Scenario

- As a metric, analysts should check the expected demand growth in the micro market and if anything is being done on housing or infra sector in the micro market, which can provide boost to volumes.

- Whether competition is setting up new capacity in the company’s region of operation? It is normally observed that whenever a new player enters the micro market, they capture market share (through better incentives) thus restricting volume growth of existing players.

- Whether the company has maintained or increase its market share, with respect to overall demand

Prices

- Are the overall prices in the company’s micro market, headed up or down?

- Whether the company has a brand good enough to charge premium pricing.

- Utilisation levels drive the price hikes – Sustainable price hikes hinges on high utilization level. Once the utilisation level starts touching 80%+, the cement manufacturers start getting a lot of pricing power. Optimal Capacity utilisation can only be driven by high infrastructure demand.

EBITDA/Ton

The best metric to measure the profitability of a cement company is EBITDA/Ton. Most corporate deals also use this as a measure of payment, and management too uses this metric to judge performance. EBITDA/Ton is a result of lot of small things done right. It starts from better pricing power and ends at better raw material costs and better overhead absorption. The following factors generally drive EBITDA/Ton

- Whether company has better access to key raw materials viz Limestone, Coal, Petcoke, Flyash, and Power. If a company has captive access to any or all of these factors, its cost of production is reduced and realisations improve.

- Whether company is enjoying and Government incentive schemes and for what tenure

- Cost effectiveness in Power and Supply Chain Management.

- Larger the player, higher is his bargaining power with suppliers. So one should judge whether the company is big enough to negotiate better with vendors.

An analyst should basically check, how much EBITDA growth does he expect and what is the market building in?

Why Balance sheet Of A Cement Company Is Important

- Cement is a capex Heavy Business. The ROAs of a cement plant is close to 1. So a Cement plant with 5000 Crores of Capex can typically do a turnover of 5000 Crores only.

- Hence it is important, that not only does the company set up a plant in the best market (which offers best prices), it should also ensure that cost of setting up the plant is cheapest.

- Further since the Cost of Setting up a plant is high; it can either be done by

- Taking debt or

- Through Internal Accruals

In both the cases, it is important that company should generate enough Free Cash Flows else they will not be able to service the debt or set up additional new capacities in future.

- Size and spread of a company also matters because

- It allows a company to negotiate better with suppliers,

- More a company is spread across India, more can it minimise the freight costs and serve a higher market – thus creating a even bigger brand.

- Working capital management and cash from operation are vital metrics to judge in this regard

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.