Disclaimer: The Blog on Indian Paper Industry is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. Please read the detailed disclaimer at the bottom of the post.

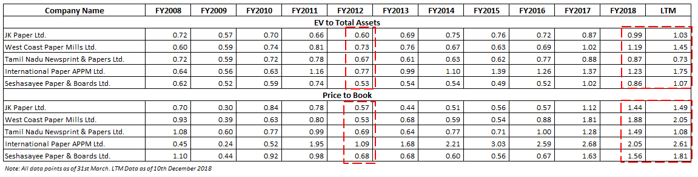

Indian Paper Industry – Valuations At All Time Highs

The valuations of all paper companies are at a decade high. Industry appears to be in a sweet spot with lot of tailwinds. One needs to have a firm view on paper prices / paper cycle for the next 3-4 years to take a call at these valuations.

Indian Paper Industry – Structure

The Indian paper industry turnover is estimated to be ~Rs 50,000 crores. India accounts for ~3% of the world’s total paper production. Paper industry in India provides direct employment ~5 lakh people and ~15 lakh people indirectly.

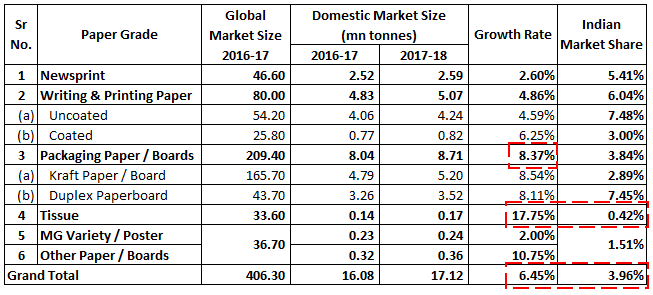

Indian paper industry can be majorly classified further as below :

Newsprints:

Newsprint serves the newspaper & magazines industry. This segment forms ~15% of the domestic paper industry.

Writing and Printing Paper:

Printing and writing segment caters to office stationary, textbooks, copier papers, notebooks etc. This segment forms ~30% of domestic paper industry.

Packaging Boards :

Packaging paper & board segment caters to tertiary and flexible packaging purposes in industries such as FMCG, food, pharma, textiles etc. This segment forms ~51% of the domestic paper industry. This is amongst fastest growing segment after Tissue owing to factors such as rising urbanization, increasing penetration of organized retail, higher growth in FMCG, pharmaceutical.

Tissue :

Tissue paper is majorly used as paper handkerchiefs for facial & toilet purpose. Currently due to it low base and increasing hygiene awareness, this segment witnessed fastest growth.

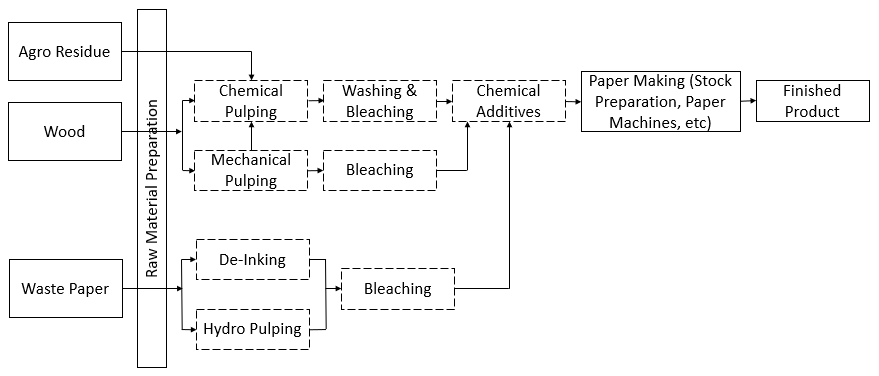

Manufacturing Process :

Raw Materials :

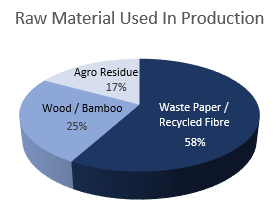

Raw material expense is ~45 to 50% of the revenue. Pulp is the primary raw material used for manufacturing paper, and it can be obtained through processing of wood, wastepaper and agriculture residue like bagasse and wheat straw. In early years, paper industry was majorly dependent on wood as a raw material. However, due to increasing awareness and restriction on cutting trees focus has slowly shifted to waste paper and agro residue.

Due to very low recovery rate companies who use waste paper as their raw material have to be dependent on imports. ~40% of the waste paper used domestically is imported.

In terms of wood as a raw material – Indian companies have always faced scarcity of wood supply which is fulfilled by government auctions of imported wood.

Other major cost includes power & fuel costs which is in the range of ~8% to 10%

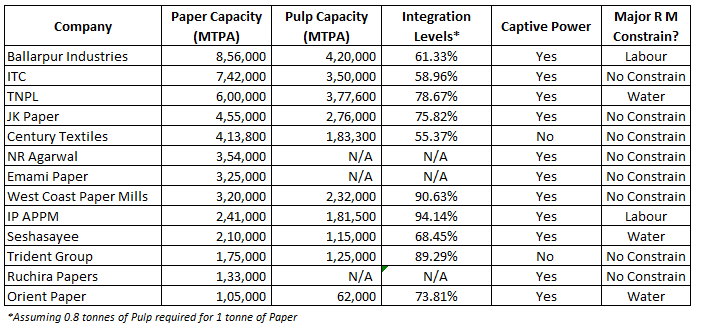

Quick Glance At Major Indian Players :

Key Financial Metrics

Unit Level Economics –

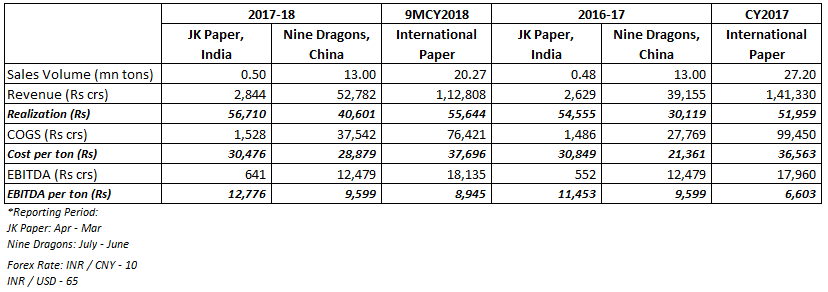

Like every other commodity business, it is very important to look at unit level economies (i.e. per ton analysis) of the Indian as well as global paper companies to understand the competitive advantage of companies.

-

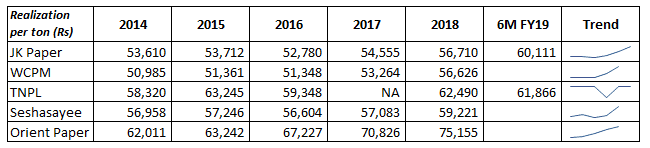

Realization per ton :

Realization per ton helps us understand the price trend in the industry. As we can see in the above table, clearly paper companies have been charging highest in last five years. Comparing it with other companies is a little tricky as it is subject to different product mix. We can see realizations of Orient Paper is very high compared to other companies as Orient paper manufactures writing & printing and tissue paper whereas no other above players are into manufacturing of tissue paper.

Indian pricing of paper is factor of global prices. Global prices have seen an uptick in last two years which lead to increase in Indian prices which can be seen the above chart

-

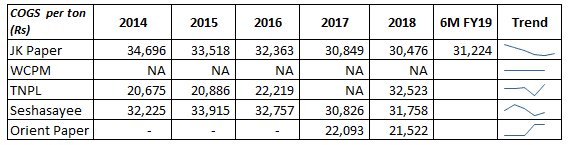

Cost per ton :

Looking at time series data of cost per ton helps us understand the stage of economies of scale, clearly JK Paper is more efficient than what it was five years ago. Whereas, for other companies cost per ton is in similar range over last four to five years.

Comparison with other companies is again a little complicated, as it is subject to raw material used for pulp manufacturing. Companies like JK Paper have integrated paper mills i.e. they manufacture their own pulp and hence are less volatile to global pulp prices which have gone up significantly in last two years leading increase in global paper prices.

TNPL uses bagasse as raw material for paper manufacturing which is cheaper source and hence can be seen in the above table.

-

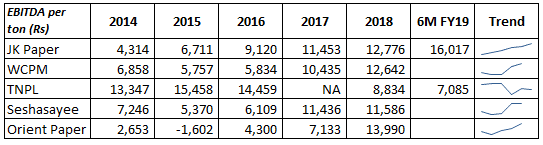

EBITDA per ton :

Comparing historical EBITDA per ton helps us understand the movement in efficiency of the company over a period. Comparing it with other companies help us understand which company is most efficient considering all fixed and variable factors.

- Common size (percentage of sales) is another matrix which could help us understand the improving efficiency of a company over a period and also comparing it with other companies will help us understand where it is placed in the industry. However, common size analysis misses important factors like improving price trend – which it could reflect in gross margins of all companies if all companies had integrated facilities which generally is not the case.

Expansion Plans

Is It Feasible To Set Up A Greenfield Project?

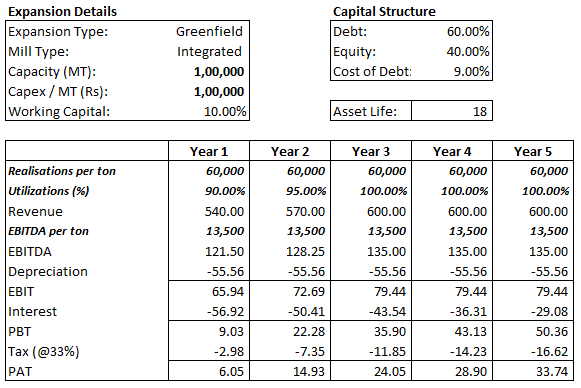

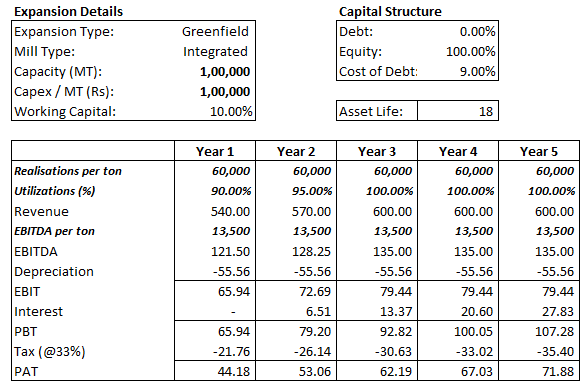

To set up an integrated greenfield paper facility, a company will have to spend ~Rs 1,00,000 per ton. Considering below assumptions:

- Realisations per ton stay at – ~Rs 60,000 per ton

- Utilisations – Year 1: 90%, Year 2: 95% and Year 3 onwards 100%

- EBITDA per ton of ~Rs 13,500 is maintained for 5 years

- Working capital (% of sales) & CFO / EBITDA considered average of paper companies

- Considering asset life of 18 years (average life used by paper companies) – depreciated straight line

- Company repays 70% of its CFO towards debt (In case debt taken)

Case 1: 60% Debt @ 9% and 40% Equity

At the end of year 5, company will earn an RoCE of 9.70% and cumulative CFO will be ~Rs 560 crores vs. investment of ~Rs 1050 crores.

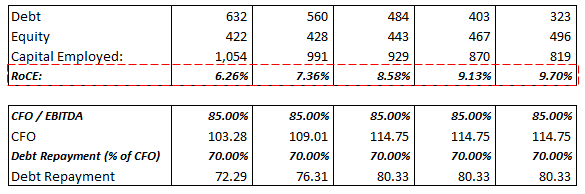

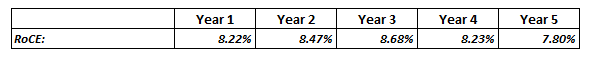

Considering, the company gets into brownfield expansion and spends ~Rs 85,000 per ton and all other assumptions being same the RoCE profile of the company with 60% debt and 40% equity could look as below :

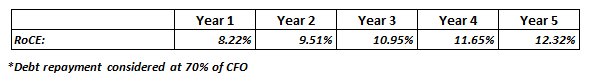

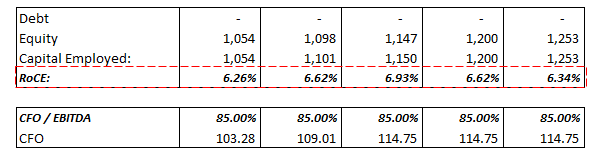

Case 2: 100% Equity

At the end of year 5, with 100% equity the company will earn an RoCE of 6.34% which is lesser than fixed deposit rates in India. (Lower than case 1 as there is no interest cost leading to higher PAT / higher Equity / higher Capital Employed in following year)

Considering, the company gets into brownfield expansion and spends ~Rs 85,000 per ton and all other assumptions being same the RoCE profile of the company with 100% equity could look as below :

However, there have been few announcements by the Indian paper companies to increase their capacities as below :

Emami Paper :

Emami Paper plans to spend ~Rs 2,000 crores to set up a packaged board facility in Gujarat. Emami plans to add 2,30,000 tons of packaged board capacity in phase 1 of the project which is expected to be completed by early 2020.

JK Paper :

JK paper recently acquired Sirpur paper mills from NCLT which is expected to come online in the end of FY19. JK paper is also planning an expansion in its Gujarat facility by spending ~Rs 1,400 to 1,500 crores. The brownfield expansion will add 1,50,000 to 1,75,000 tons of additional capacity of packaged paper which is expected to be completed in next 24 to 30 months.

TNPL :

TNPL plans to spend ~Rs 2,520 crores in its Tiruchi plant. The brownfield expansion will add another 1,65,000 tons of writing and printing capacity.

Ruchira Paper :

Ruchira Paper plans to spend ~Rs 1,000 crores over next two to three year to add 1,00,000 to 1,25,000 tons of writing and printing paper capacity.

Demand Drivers

-

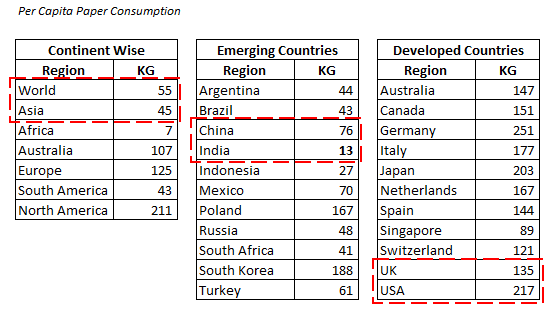

Very Low Per Capita Paper Consumption :

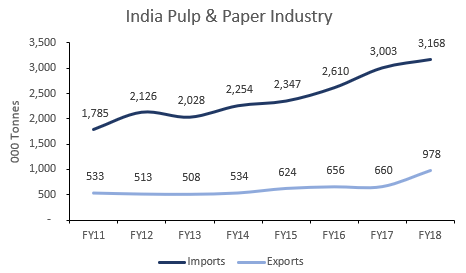

Globally pulp & paper consumption has witnessed negative / stagnant growth. Whereas, growth in India is for past few years has been very strong. With increasing income levels and urbanisation per capita paper consumption in the country will improve.

-

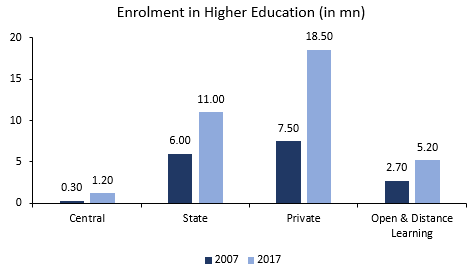

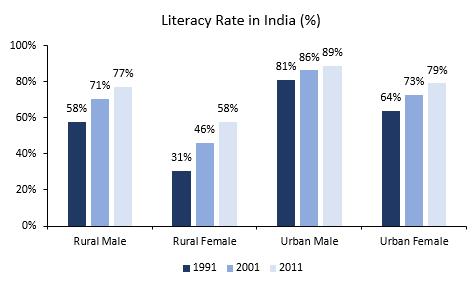

Increase In Literacy Rate And Increasing Enrolment In Education :

Number of colleges in India have gone up from ~37k to ~42k in last five years. With increasing awareness and enrolment in colleges and school could lead to higher demand of paper in India.

-

Rising Circulation And Number Of Newspaper & Magazines :

As per Audit Bureau of Circulation, the circulation of print media / newspaper has grown at a CAGR of ~10% in India. Continuation of the trend could lead to higher demand of newsprints.

-

Increase In Home Deliveries :

Increasing trend in the eCommerce space will use higher packaged paper for delivery purpose. Also, due to ban on one time use plastic bags, food delivery apps have started using packaged paper for delivery purpose which could lead to higher demand of packaged paper.

Risk Factors

Global Dependence :

India contributes only ~4% of total global demand and hence Indian paper industry is price taker. One of the major factors in pricing of domestic paper is landed cost of imported paper. 50% of consumed coated paper in India is imported. China is the major price influencer due to its mammoth share in market. As we recently saw significant rise in pulp prices as China banned imports of low-quality waste paper which led to increase in paper price globally. However, as major Indian companies have integrated facilities and manufacture their own pulp their cost of production remained stable and they enjoyed higher profits due to prices going up.

However, in October 2018 global pulp prices softened a little further softening of pulp prices ,may lead to softening of paper price which could reduce the additional delta in earnings of the companies running integrated facilities

Raw Material :

India is wood fibre deficient country – inadequate raw material availability domestically is a major constraint for the paper industry

Current demand for pulpable wood by paper industry is about 11 MTPA while domestic availability is only 9 MTPA

Unit level comparison of JK Paper, Nine Dragons & International Paper:

Imports :

Due to raw material constraint raw material in domestic market, paper companies in India have to import certain amount of raw material from global market which increases cost of production for domestic companies. Due to higher cost of production Indian companies are less competitive globally and cheaper globally prices lead to higher imports

Could We See Consolidation In Future?

- The water, power & chemical requirements for paper production reduce as the mills grow larger.

- In 1995, the US paper industry witnessed challenging market conditions which forced players to consolidate to reduce costs. In 2016 (after consolidation) top four players contributed ~75% of the total market share which was ~50% by top six players in 1995

- In Indonesia top 2 players contribute ~60% of total market share whereas, in China top three players contribute ~21% of total market share.

- Coming back to India top three players account for total market share of only ~9%. The average capacity of Indian paper mills is approximately 1/5th of European and 1/9th of US mills.

- There are a lot of listed players in the industry with stretched balance sheet and in order to achieve economies of scales / improve efficiencies we could see a consolidation in the paper industry ahead of us.

- The water, power & chemical requirements for paper production reduce as the mills grow larger.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.