Disclaimer: The Blog on ‘Inevitable Recovery In The Old Economy Sectors’ is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. The intention to share write ups on this blog is to create a repository of ideas so that investors can have a look at various frameworks & approaches. Please read the detailed disclaimer at the bottom of the post.

A mere continuation of existing policy framework will unleash animal spirits in the economy over the next 18 to 24 months. Investors should keep this in mind while positioning their portfolios

Nobody really knows if PM Modi will win 2019 elections with absolute majority till the last vote is counted. However, given the fragmented opposition across states and lack of credible alternative have led to a situation where odds are in favour of NDA forming the government again.

A mere continuation of present policies is likely to fuel an impressive turnaround in India’s old economy sectors. And even if the regime changes, these pockets are likely to benefit from the work that has been done over the last 5 years.

Consumer inflation has eased to an average of 5.5% (approx.) during 2014 to 2018 period compared to 10.1% (approx.) during 2009 to 2014. Even the fiscal deficit has averaged at about 3.8% (approx.) of GDP during 2014 to 2019, compared to 5.5% (approx.) during 2009 to 2014.

Primary deficit continues to be low at around 0.2% of the GDP, while remaining deficit comes from the interest receipts towards the accumulated government debt over the years. As interest rates fall, the next government is likely to have more headroom to step up spending on key projects & welfare schemes.

Taming inflation creates plenty of room to go for a big drop in interest rates. India continues to have highest real rates globally. Our manufacturing needs a significant cut in the rates to remain competitive. And we might get it provided there is no oil shock. Barring an external shock, the stage is all set for a more than 100 bps interest rate cut in the coming months.

Investment Cycle Is Looking Up

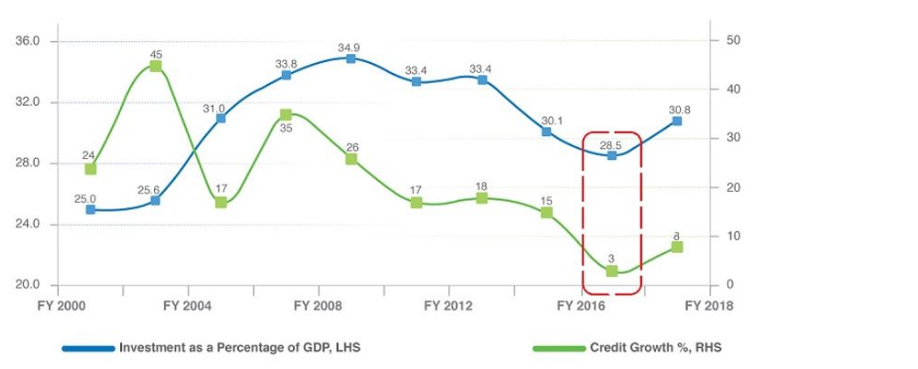

Incidentally, industrial capacities are getting filled up and we are moving towards a larger base every year. Manufacturing capacity utilization is on its way to reach 78-80% zone. Corporate balance sheets are getting deleveraged and new capacities have not come up in the last 3 years which is visible in the lackluster corporate credit growth.

GST regime has stabilized. Implementation of Insolvency & Bankruptcy code has triggered significant recoveries for the banking system. Improving capital structure & a cultural change in credit discipline post IBC (Insolvency & Bankruptcy Code) augurs well for corporate banks.

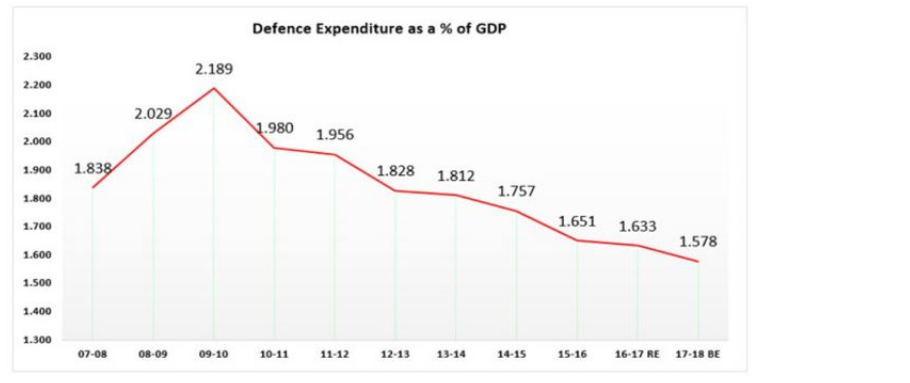

Defence budget as a % of GDP has fallen over the last decade. Defence forces are keen on downsizing the personnel which is likely to keep defence expenditure around present levels. ~67% of our defence budget goes into salaries & pensions. Which means incremental defence spending will go into capital expenditure.

Modernizing the forces and push for indigenous manufacturing of equipments is an important agenda for present policymakers. Also, state plus central government salaries & pensions as % of GDP have topped out at 8.5% of the GDP after the implementation of 7th pay commission. This number is likely to moderate by another 1% of GDP over the next 5 years, which creates more fiscal space.

A combination of these factors set the stage for next leg of upcycle in overall investment climate/GFCF ( gross fixed capital formation) expansion.

Industrial Recovery On A Larger Base

While government was fixing the key issues, core sectors base has expanded over the last 5 years. Steel production has grown from 87 Million Tons to 110 Million Tons. Peak power demand has expanded from 130 Gigawatts to 180 Gigawatts. Demand in power & steel continues to be robust at 6-7% while very little capacity addition has happened over the last 3 years.

Recently, the Gujarat government invited bids for securing 3000 Megawatts long term PPA (power purchase agreement) after a gap of almost 5 years. Merchant power availability is likely to fall from 19 Gigawatt to 9 Gigawatt within a year as states rush in to secure their demand.

If we just extrapolate the current growth rates in steel, power, infrastructure on the present higher base, the next investment cycle is going to be far bigger than what we have seen in the past. If we don’t start adding capacity by 2020, India may face power shortage by 2024. Incremental capex of 50 million tonnes in steel & 50 to 70 Gigawatts in thermal power over the next 5-7 years is likely to percolate down the related value chain.

Close to 40% of the value addition in India’s manufacturing sectors comes from non-corporate sector. Which implies a huge boom for SME sector as well. All of this is likely to fuel a strong credit cycle.

From whatever we have seen till now, Mr. Modi & the present policymakers believe in having an incremental approach. A mere continuation of existing policy framework will unleash animal spirits in the economy over the next 18 to 24 months.

Investors should keep this in mind while positioning their portfolios and consider asset heavy businesses or companies that will benefit from a wide recovery across core sectors. Valuations across industrials and old economy sectors are still at a significant discount.

Stocks in power, steel, infra related activities, corporate banking appear to be in a sweet spot. If Modi 2.0 happens, this pocket should outperform. And even if the present NDA government changes, a mere natural progression on a higher base will ensure investors still make decent profits. In short – heads I win, tails I win less.

The article was part of the Personal Finance section of MoneyControl and it was published on 23rd April 2019.

Link to the article – click here

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.