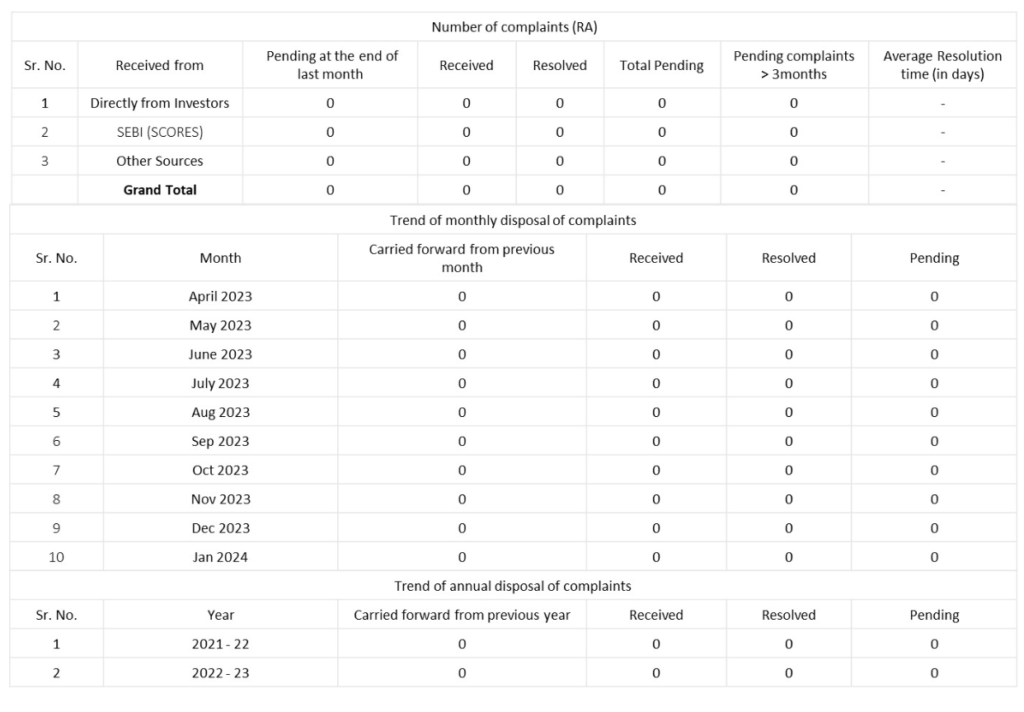

Contact us directly at support@alphainvesco.com for assistance with any queries, complaints or grievances. We will ensure your grievance is resolved within 30 days. If you feel that your grievance is not redressed satisfactorily, you may lodge a complaint with SEBI through the Scores website or the SEBI Scores app for Android or iOS. ODR Portal can be accessed via the following link – https://smartodr.in/