Disclaimer: The Blog on Indian Power Sector is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. Please read the detailed disclaimer at the bottom of the post.

Indian Power Sector- Are Green Shoots Appearing For The Sector?

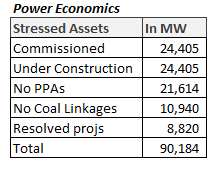

The commitment by the government to provide electricity 24/7 to every household plus a robust consumer demand has led to the power demand growing at 5%+. We have very few CAPEX announcements from power companies. Over 40,000 MW of stressed power capacities either without PPAs from SEBs or FSAs from coal India and also power capacity without linkages to Natural gas. At the same time, valuation band for almost all power stocks is at the lower end.

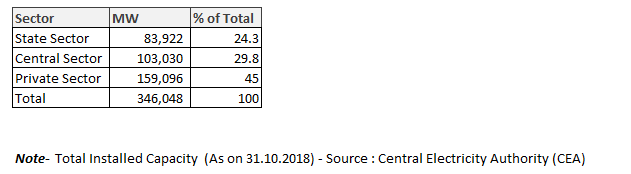

Power Sector At A Glance All India

Sector Wise Power Production

Fuel Wise Power Production

PLF Trend (2009-10 to 2018-19)

Note – Up to October 2018 (Provisional), Source : CEA

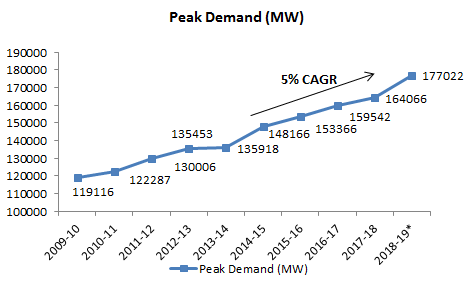

Peak Demand Growing At 5% CAGR

Note – Up to October 2018 (Provisional), Source : CEA

Is the Power Sector going to rebound with rising PLFs (Plant Load Factors)?

The Panel discussion took place on the 22nd of December 2018, and it saw participation from The Honorable Power secretary Mr Ajay Kumar Bhalla, former-chairman of CERC Mr. Pramod Deo and Neelkanth Mishra of Credit Suisse.

Stressed Assets

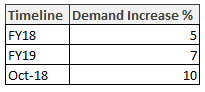

Healthy Demand Growth

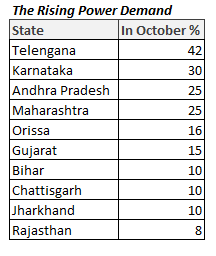

Power demand grew by 10% in the month of October for the first time in 3 years and the merchant power rates grew by 46% in the same month. Yet none of the private power companies saw any increase in their PLF (Plant Load Factor).

‘Do we need additional CAPEX when the private power companies are running at low PLFs?’

Ajay Kumar Bhalla (Power Secretary)

Subdued PLFs for Private Companies–

Coal availability is one of the biggest reasons for slower pickup in the PLF of the private companies.

Government’s Coal Tolling Policy–

Government kick started the ‘Coal Tolling Policy’ to utilize the coal.

Plants Under IBC/NCLT–

Plants under construction where in the economics (older bids, which were low) does not make sense to start off the plant and the promoter is also unable to provide equity then the promoter will have to walk out and resolution will take place in IBC/NCLT.

Lack of PPAs and FSAs-

Under SHAKTI Policy FSAs are being made available and the 40,000 MW which was categorized as stressed has come out of it and more will come out as lenders resolve more cases.

Scrap page of Older Plants–

Committee has decided to reduce the coal quantity to the inefficient plants and slowly phase them out and the committee has already identified around 22,000 MW of capacity to be retired and this can be fast tracked.

Regulated Rate of Return-

State Gencos (NTPC) get regulated rate of return for the power they produce ( even for plants which came on stream post 2012 ). It allows them to bid aggressively at lower rates with independent power suppliers can not do. This is unfair to private power companies and the matter is under debate with the committee.

Pramod Deo (Former Chairman, CERC)

Mr Deo acknowledged that demand has gone up and the reasons are –

- Election

- Seasonal increase

He said the plant or capacities under stress should suffice till 2022. Execution by state discoms is very crucial going forward. They will supply power to rural households where recovery of money is difficult.

Neelkanth Mishra, Credit Suisse

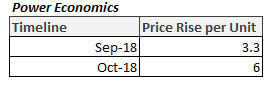

Medium Term Power Tariffs on The Rise–

Medium term power tariffs have started to go up because of seasonal demand and also elections are near, at the same time shortages are starting to happen and market dynamics will force more capacities to be added.

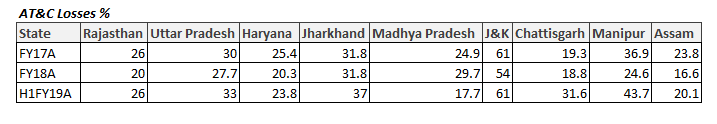

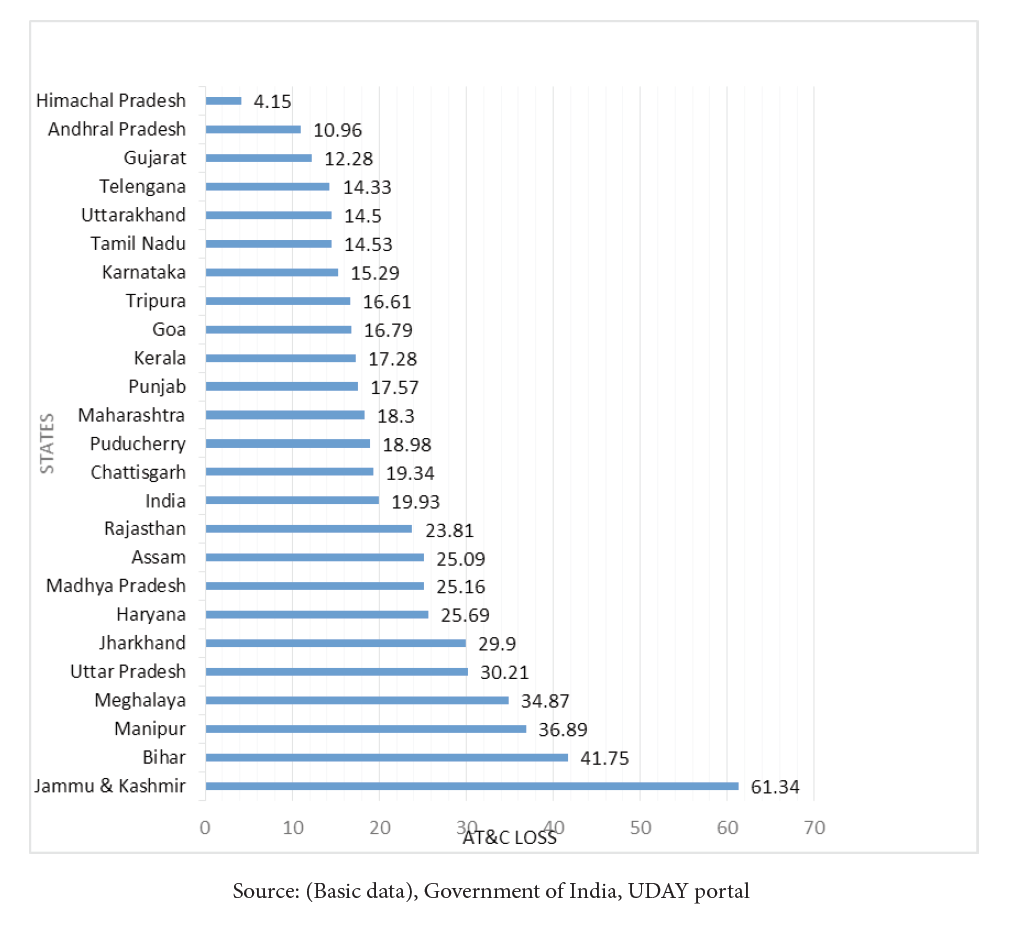

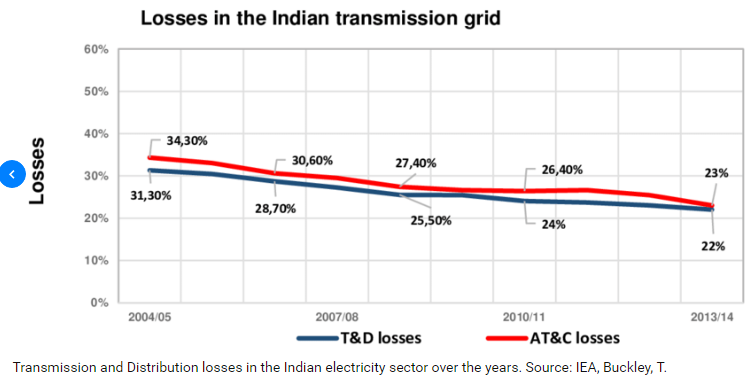

AT&C Losses –

AT&C losses are still very high in India but the trend has been coming down, there is improvement in metering but the pace is slower than what is desired.

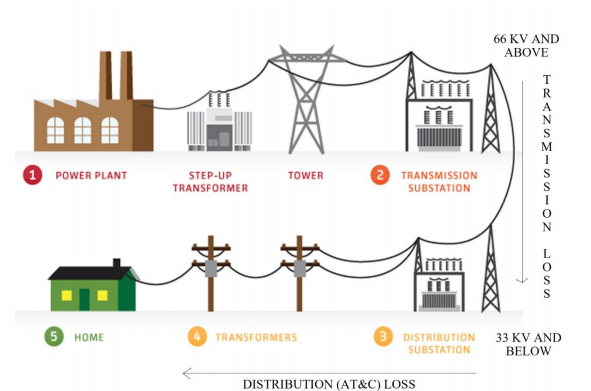

What Are AT&C LOSSES?

Energy losses occur in the process of supplying electricity to consumers due to technical and commercial reasons. The technical losses are due to energy dissipated in the conductors, transformers and other equipment’s used for transmission, transformation and distribution of power.

These technical losses are inherent in the system and can be reduced to a certain level.

Pilferage by hooking, bypassing meters, defective meters, error in meter reading is main sources of commercial losses.

Lack of PPAs–

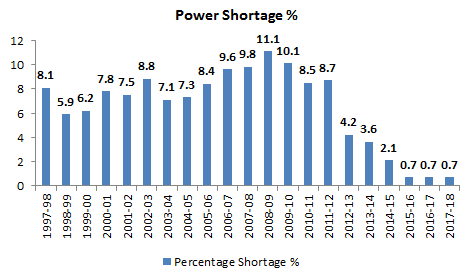

There is a political will and also compulsion to provide power 24/7 in the country, he rightly pointed to states such as Jharkhand and Bihar where at one time there was hardly any power for the rural household but today situation is a lot better. The chart below displays the reducing power shortage over years.

AT&C Losses are Accounted In Fiscal Budget-

Schemes such as the UDAY are forcing states to add SEB losses to their fiscal deficits and fiscal deficits are hard barriers to break because it is constitutionally determined, therefore huge SEB losses (AT&C) will make states spend less elsewhere.

“Demand is growing at 5% even in the down cycle and if this trend line is extended into next 5 years then we will see power shortages in the country”.

Solving Coal Availability for FSA is Important-

Coal India was a monopoly until 2015 when legal monopoly to mine coal was unwound, still merchant mining licenses have not been issued to private companies, and once it happens it will take another 4 to 5 years for the coal to come out but that is increasingly important because as we see further depreciation of rupee vs the USD, imported energy gets expensive vs the domestic energy and there has to be a supply response to it.

Low PLFs-

Solar and wind power plants cannot have a PLF beyond 22% and hydel power is spiky because of the seasons, it runs at high PLF in monsoon when water level is high and in the rest of the year the PLFs are lower. In thermal you create buffers and there will outages for plant repair and maintenance and with a 6% demand growth we can see the thermal plants running at PLF in the high 70s but you can never have 100 PLF in any situation.

Key Inputs from the Panel Discussion

- As commercial mining picks up, we should more FSAs being signed

- Revival in merchant power rates will make the SEBs sign new PPA with power producers with languishing capacities under stress.

- Scrapping of old plants should accelerate post elections.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.