Theme 2020: Management Integrity – Understanding Sharp Practices

Ramdeo Agrawal (co- Founder of Motilal Oswal) presented the 24th Annual Wealth Creation Study.

This study is indeed unique, in the sense that it looks back at some of the wealth creators of the past and it is also forward looking in the sense that it explores equity investing concepts which can be applied to the future. The study is split in two parts-

- The first part is statistical which talks about the biggest, fastest and the most consistent wealth creators.

- The second part explores the aspect of equity wealth investing.

24th wealth creation study is indeed unique in the sense that, it is the first time management quality was explored in investing and the sharp practices one needs to be watchful of.

Sharp Practices Guiding Principle

Financial trash can be stuffed into 2 places in the balance sheet

- Working capital – Will be caught in the Operating Cash flow

- Fixed Capital – Will be caught only in Free Cash Flow

If the management decides to increase the profits by 100 cr, the management would have to compulsorily bake numbers in the balance sheet.

The management will try to change numbers on the working capital side such as –

- Increase trade receivables by 100 cr or

- Increase inventory by 100 cr

To identify such fraud an analyst should monitor cash flow from operations. An increase in working capital would translate into lower CFO.

Further, the management can also increase gross block by 100 cr in the balance sheet to balance the balance sheet.

The analyst should then calculate the free cash flow and plot the trend of free cash flows, a declining trend of free cash flows should make you question the management on rationale behind such investments.

Common Accounting Sharp Practices

- Recording bogus revenue

- Shifting current expenses to future date – Management can delay recording expenses to show good results. One such way of doing it is by postponing depreciation into the future. If the management has capitalized capital stock worth 10,000 cr and ideally the depreciation for such an investment should be 1,000 cr based on classification but the management classifies the capital stock differently and records only 200 cr as depreciation thereby inflating the profits.

- Recording revenue too soon – Contracting companies can record revenue too soon prior to completion of work. Recording 60% of the revenue for 50% of the work completed.

- Boosting income using one time activities-

- Sharp practices during acquisitions

- Taking items off- balance sheet – Contingent liabilities are the biggest source of hiding big problems of the main balance sheet.

Case Study

- True Case – How the books should actually have been

- Case A of sharp practice 1 – inflating sales by 200 in P&L and debtors by 200 in the balance sheet

- Case B of sharp practice 2 – capitalizing R&D costs of 200

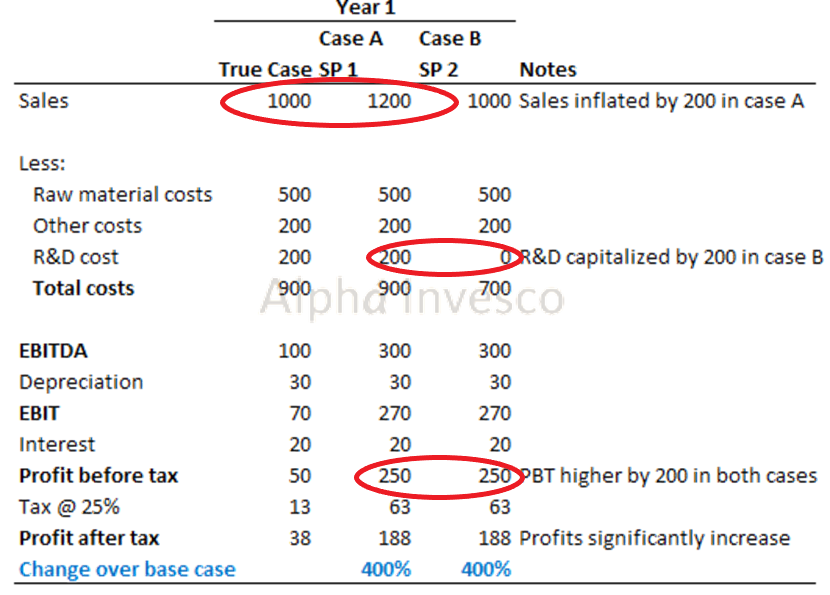

Income Statement

When the management increase the sales by 200 Rs, the profits rise from 38 to 188 in Case A.

In Case B, management capitalizes the R&D expenditure by 200 Rs keeping the sales true to 1000 Rs. The profits rise to 188 Rs in Case B, similar to Case A.

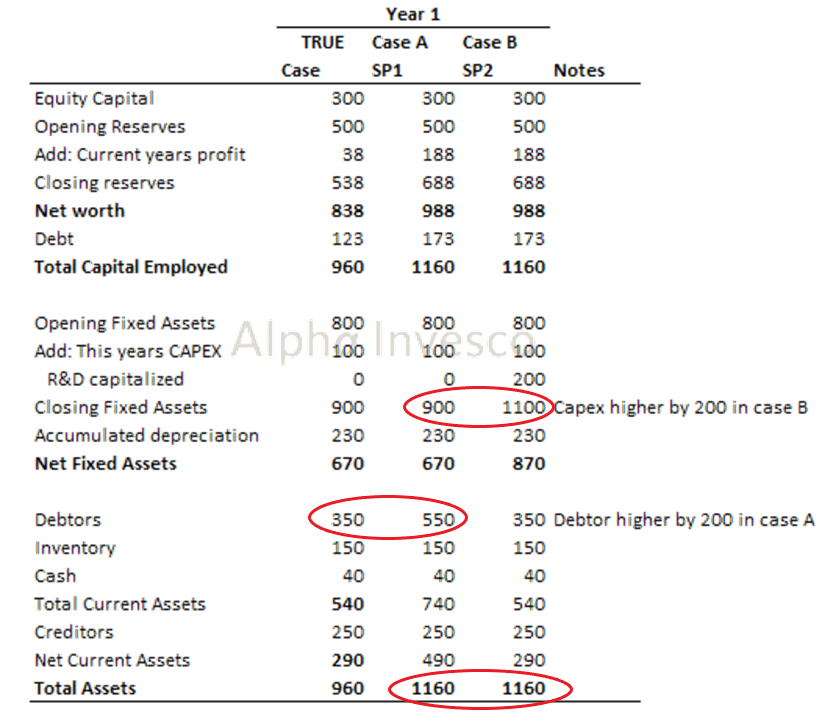

Balance Sheet

In the balance sheet, the debtors go up by 200 Rs in Case A where we had recorded 200 Rs of additional sales and fixed assets go up by 200 Rs in Case B where we had capitalized R&D expenditure.

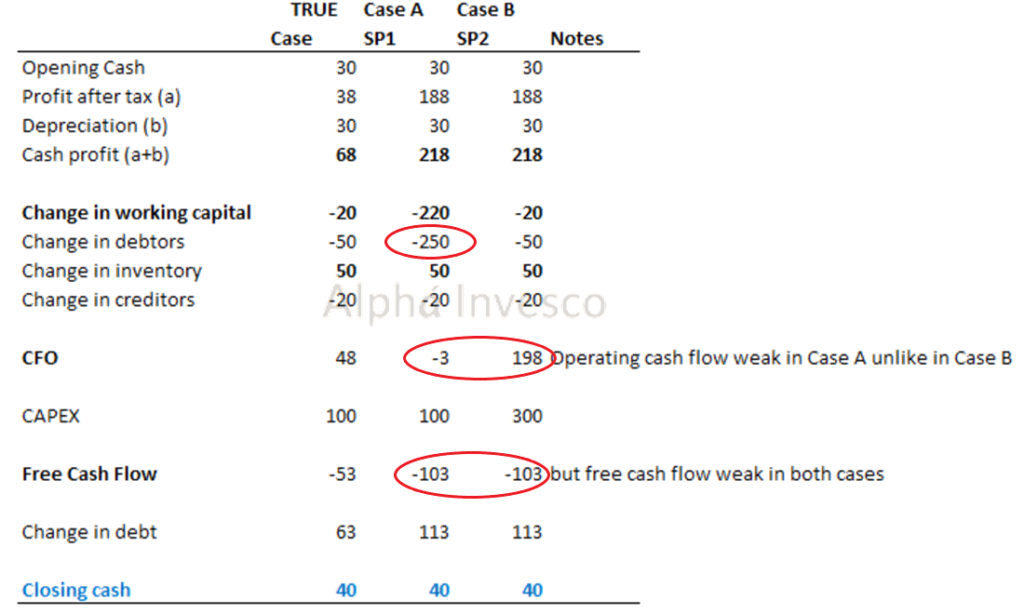

Cash Flow

In Case A, where you increased the sales in the Income statement and debtors in the balance sheet, you can catch it in the CFO, but we should go a little further and calculate the free cash flow because fraudulent entries such as those of wrong capitalization of R&D expenditure would be caught when we calculate free cash flow.

Capitalizing R&D expenditure would lead increased CFO, PAT but declining FCF (free cash flow).

The management can further have a fraudulent depreciation policy wherein they postpone recording just depreciation expense and write off depreciation in lumps whenever management has a view that there would onetime gains in the future against which they will write off the depreciation of the past which can also belong to the wrongly capitalized R&D expense.

Conclusion

- In equity investing, management is 90%, industry 9% and 1% everything else. Hence, getting management integrity right is the critical first step.

- There’s only one way of writing honest accounts, infinite ways to manipulating them.

- Most sharp practices are to inflate profits and stuff the ‘financial trash’ in the balance sheet (credit P&L, Debit Balance Sheet).

- Profit & Loss statement is easier to manipulate; hence, managements must be statutorily asked to present a simplified free cash flow statement.

- Auditors must be made more accountable to minority shareholders to avoid sharp practices by the management.

- As an investor, have a forensic mindset to get management’s explanation for all the perceived sharp practices.

- Finally, interact with various stakeholders- customers, employees, supplier etc- till you arrive at a moment of management integrity.

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.