Residential Space Housing Demand

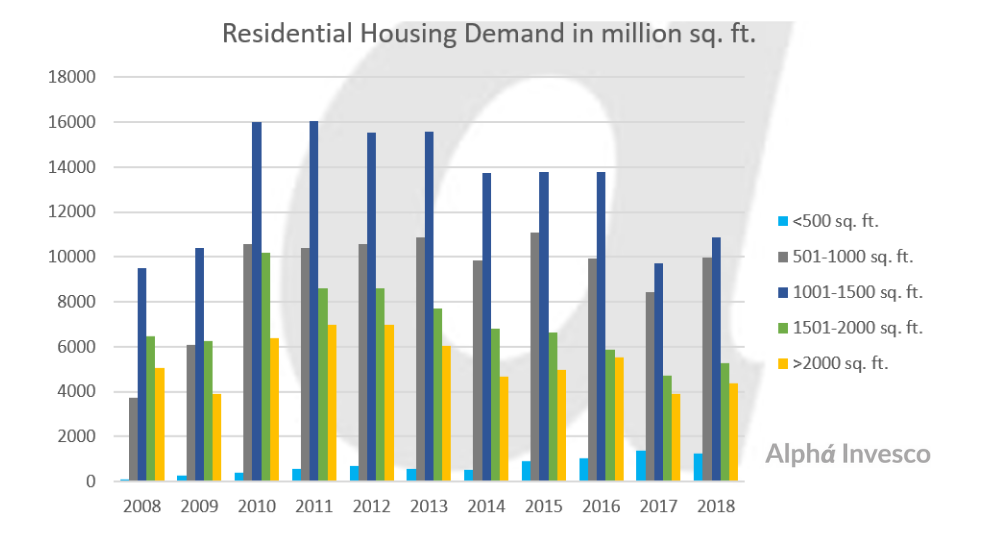

- Based on the above data, one can note that sales for under 500 sq. ft. area has gone up significantly over the years, except in 2018, when it took a hit.

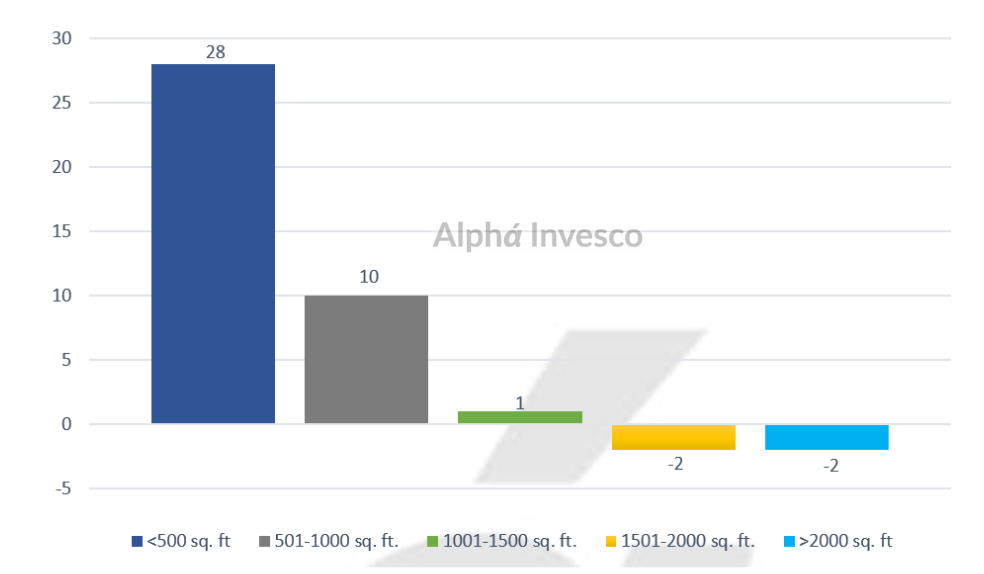

- The under 500 sq. ft. has grown at a CAGR of 28% whereas the 501-1000 sq. ft. housing demand has grown at a CAGR of 10%. There has been de-growth in the 1501-2000 sq. ft. and above 2000 sq. ft category of 2% each.

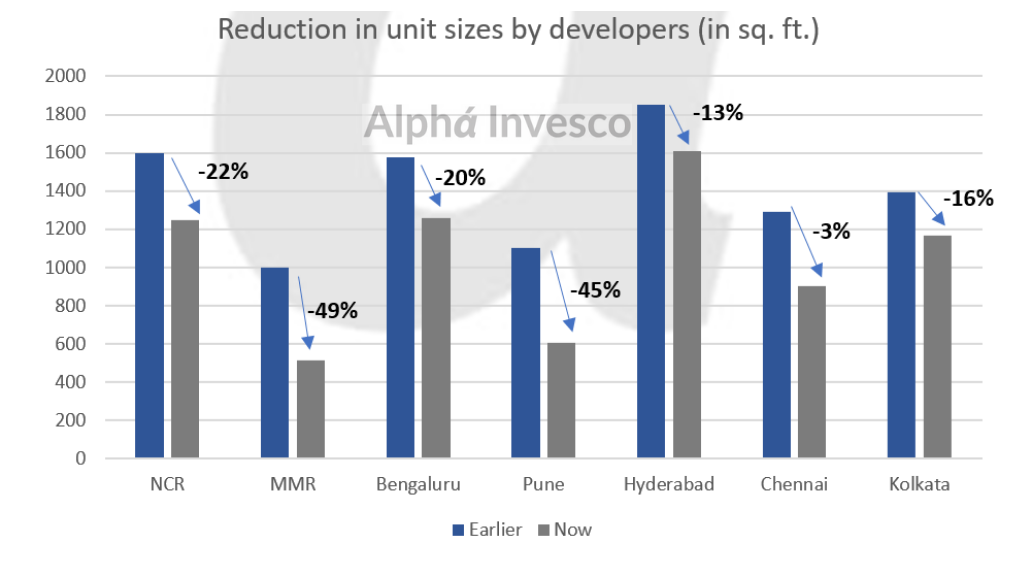

- Due to oversupply in the market and tepid demand, developers were already selling on thin margins. The developers were also desperately trying to make houses more affordable to ensure liquidity. That, combined with the housing demand trend, led developers to shrink unit sizes.

- Average sizes in the top 7 cities of India shrunk in the range of 3% to 49% from 2013 to 2019. MMR reported the maximum reduction of 49% in average size of the apartment followed by Pune at 45%.

- On the other hand, the average size of the apartment in Chennai reduced by only 3% in last seven years. While Hyderabad has shown its appetite for bigger sized units, approximately 1,600 sq. ft., MMR has the lowest average apartment size of nearly 500 sq. ft. in top 7 cities of India owing to scarcity of land resulting in higher prices.

- Despite having a majority of the launches in affordable segment in MMR, the city has the maximum unsold inventory and highest inventory overhang amongst top 7 cities of India. Hyderabad is the best performing market with unsold inventory of nearly 24,000 units and inventory overhang of 16 months only, which is the lowest compared to other top cities of India. In addition to that, unsold inventory in Hyderabad decreased by 12% in last one year owing to higher demand than new supply.

- NCR has the highest inventory overhang of 43 months with close to 1.8 Lakh units of unsold inventory.

(Source: Anarock Research)

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.