Disclaimer: The Blog on ‘REITs India’ is not a recommendation to buy / hold / sell any stock. The published post is for information purpose only. Please read the detailed disclaimer at the bottom of the post.

Real Estate is one of favorite asset classes for Indians to park their saving. To give a context, the average Indian household has more than 80% of its wealth in Real Estate and other physical assets.

However, Investments in Real Estate has always been criticized due to below few reasons :

- Real Estate has been an outlet for people with unaccounted cash

- Lack of diversification – As the ticket size involved to buy a property is very high

- Lack of divisibility – Cannot book partial profits

- Lot of hassles involved

- Liquidity is considered to be a major issue

- People getting stuck with incomplete projects

But can Introduction of REITs solve above mentioned issues?

Let’s first try and understand what a Real Estate Investment Trust (REIT) is?

A REIT can be viewed as a closed ended mutual fund for real estate with a structure similar to mutual funds i.e. Sponsor-Manager-Trustee. A REIT is funded by its sponsors and managed by its managers with key underlying investment instrument as real estate assets. A manager manages a portfolio of real estate assets which generally generates returns in form of rent and interest. REITs are generally listed on the stocks exchanges and trades similar to a stock.

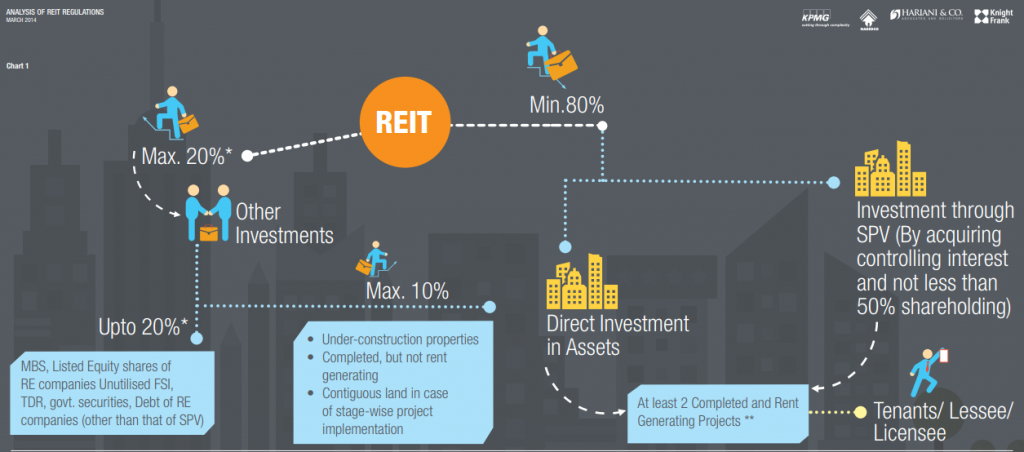

Concept of REIT in India is on a very nascent stage. Below are few major guidelines for REITs in India –

- REITs in India have to invest at least 80% of funds in completed and rent generating real estate.

- Rest (Max) 20% funds can be invested in below securities :

- Debt of companies/body corporates in the real estate sector,

- Mortgage Backed Securities (MBS), government securities,

- Money market instruments/cash equivalents,

- Listed equity of companies having 75% or more operating revenue from real estate activity,

- Unutilised Floor Space Index (FSI) and Transferable Development Rights (TDR) for utilisation in investee projects,

- Under-construction properties/completed but not rent-generating properties, subject to a cap of 10% of the value of the REIT assets.

- Investments in other REITs is not allowed.

- A REIT shall invest only in commercial real estate assets.

- A minimum 2 projects to be held by a REIT with an investment cap of 60% per project.

- REITs have to pay-out at least 90% of the cash flows to investors on at least 6-month basis.

- Minimum investment in IPO of a REIT to be Rs 2 lakhs and later trading lot of Rs 1 Lakh.

- Sponsors of the REIT should hold at least 25% of the total units for first three years and at least 15% after three years.

- Aggregate net consolidated borrowings and deferred payments of the REIT to be capped at 49% of the value of a REITs assets.

- Aggregate net consolidated borrowings and deferred payments of the REIT higher than 25% of the REIT’s assets to be subject to the following :

- Credit rating (no minimum rating prescribed)

- Approval of the unitholders

Introduction of REIT could solve various mentioned issues involved with typical real estate investment :

Lack of Diversification :

Considering the larger ticket size, for an average Indian it would be very difficult to diversify in a typical real estate investment but buying a REIT could help in diversification as a REIT would have invested in various properties across regions.

Lack of Divisibility :

In a typical real estate investment it is very difficult to book partial profits after appreciation. However, investment in REITs solves this problem.

Lots of hassles :

Typical real estate investment involves lots of hassles like registration, notary, stamp duties, etc. Investing in REIT is as simple as buying a stock.

Liquidity :

REIT investment solves issue of liquidity as selling a unit of REIT is as simple as selling a stock. The volume might be lower compared to stocks, but it is way easier than a typical real estate transaction.

Management :

Managing a real estate asset is not easy. It involves costs, plus generating good rental yields is again a challenge. REITs are professionally managed, an investor need not worry of the vacancy and other maintenance related issues

Important Factors To Be Considered Before Investing In REITs

Remaining Lease Terms :

Before investing in REITs, one should evaluate the length of remaining lease terms with overall state of economy as short remaining lease terms provide an opportunity to raise rents in an expansionary economy, while long remaining lease terms are advantageous in a declining economy or softening rental markets.

In-place Rents vs. Market Rents :

One should compare the rents that a REIT’s tenants are currently paying with current market rents.

Costs to Re-lease Space :

When a lease expires, expenses typically incurred include lost rent, any new lease incentives offered, the costs of tenant demanded improvements and broker commissions.

Tenant Concentration In The Portfolio :

One should pay attention to any tenants that make up a high percentage of space rented or rent paid. As, the risk would be higher with single tenant vs. multiple tenants.

Tenant’s Financial Health :

The possibility of a major tenant’s business falling poses a significant risk to a REIT.

New Competition :

Evaluation of new planned spaces / construction could bring in additional supply leading to lowering rentals for existing REIT properties.

Balance Sheet Analysis :

Due diligence should include n in-depth analysis of the REIT’s balance sheet, with special focus on the amount of leverage, the cost of debt, and debt’s maturity.

Quality Of Management :

Senior management’s performance record, qualifications, and tenure with the REIT should be considered

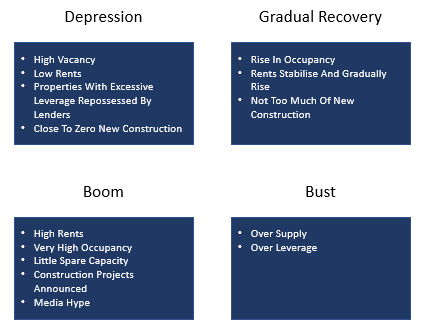

How Does A Real Estate Cycle Look Like ?

Is Investment In REITs A Good Idea For Indian Investors ?

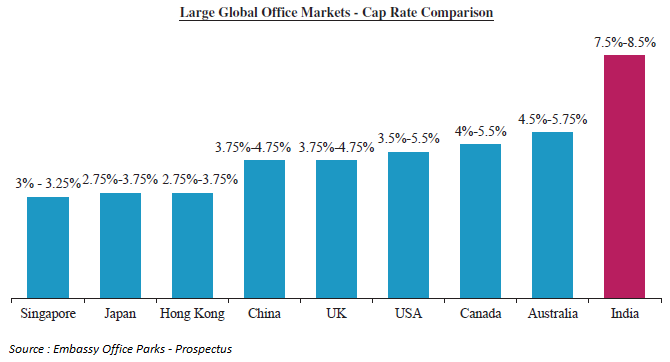

Historically, in developed countries REITs have generated returns somewhere between bonds and stocks. In a country like US rental yields on office properties range from 3.5% to 5.5% vs. current 10-year government bond yield around ~2.5% with an increasing interest rate environment. However, in India office properties yield in a range of ~7% to 9% vs. current 10-year government bond yield at 7.5%.

However, REIT also witness some capital appreciation. In US, Nareit REIT index has witnessed ~4% CAGR growth in past five years. Also, in India real estate price have generally witnessed an upwards trend expect for past few years.

An Investor can expect a rental yield of 7% to 9% plus capital appreciation of 4% to 5% over a long period in REIT investments i.e. total returns of 12% to 14%. Comparing these returns with the current cost of funding in India, the returns are at par / slightly higher.

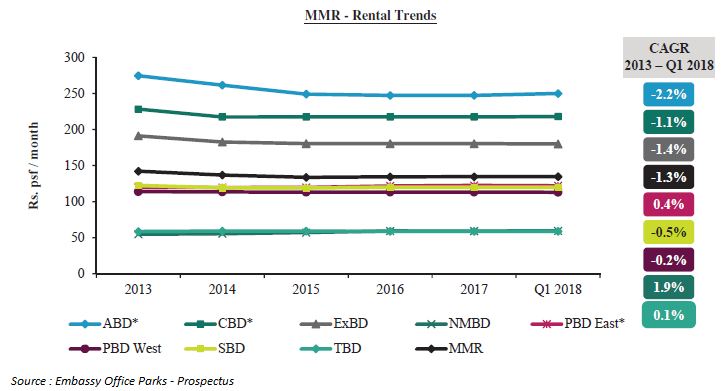

Also, with increase in supply of office properties the rental yields could slowly witness a downwards trend which office properties in Mumbai are already witnessing as newer & cheaper options are available at other locations.

*ABD (Bandra Kurla Complex, Kalina & Santacruz), CBD (Nariman Point, Fort Ballard Estate, Cuffe Parade), ExBD(Lower Parel, Worli, Parel & Prabhadevi), NMBD (Navi Mumbai), PBD East (Kurla, Vikhroli Kanjurmarg, Mulund & Powai), PBD West (Malad, Goregaon, Jogeshwari, etc.), SBD (Andheri, Saki Naka, MIDC, Sahar, etc), TBD (Thane), MMR (Mumbai Metropolitan Region)

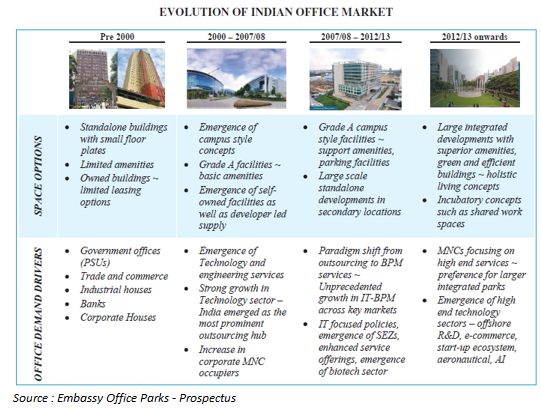

Overview of India Office Market :

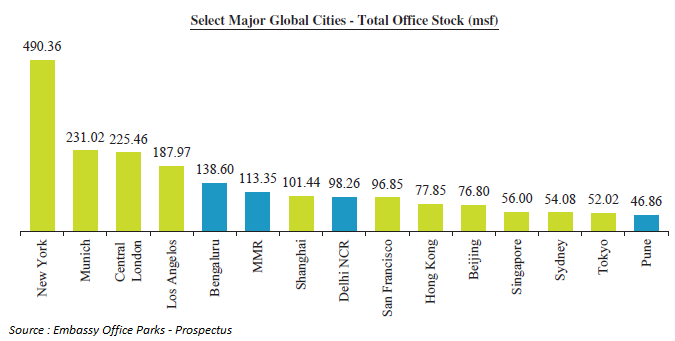

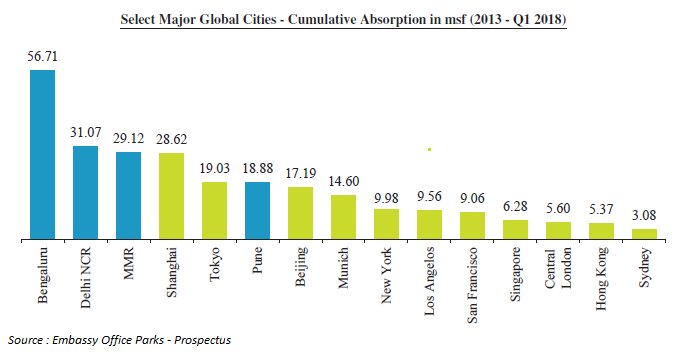

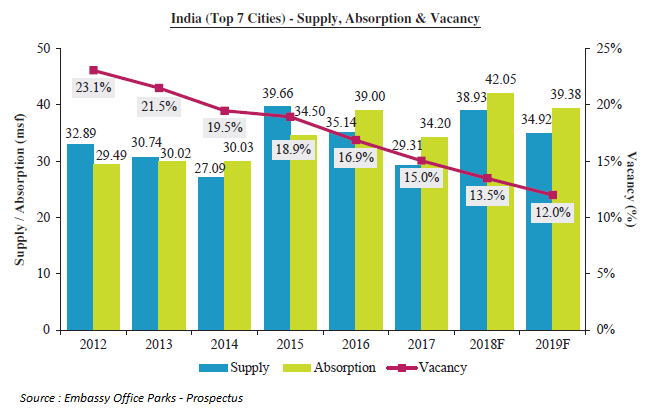

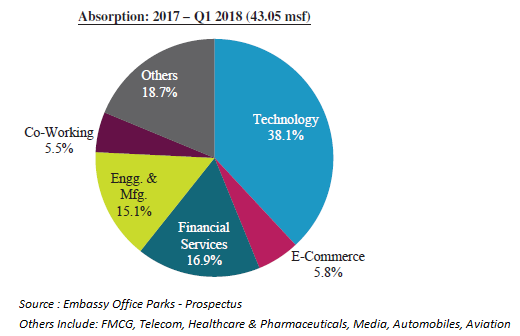

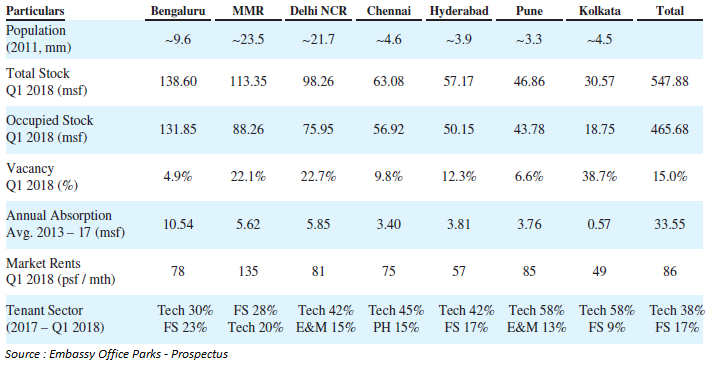

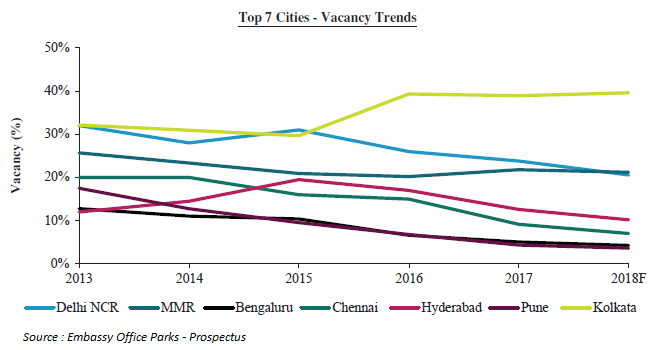

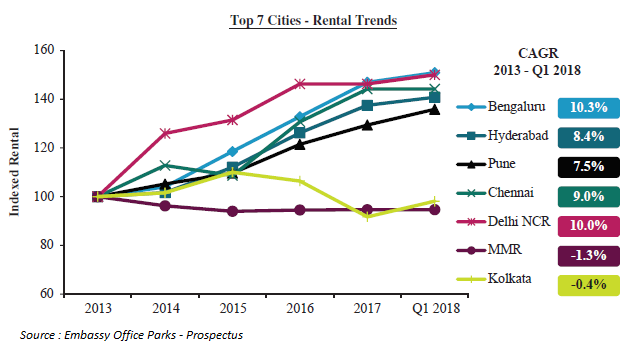

India office market has grown more than 20 times from ~25 msf (million sq. ft.) in 2000 to ~548 msf as of 31st March 2018 and is concentrated in the Top 7 cities compromising of Delhi NCR, Mumbai Metropolitan Region (MMR), Bengaluru, Chennai, Hyderabad, Pune & Kolkata.

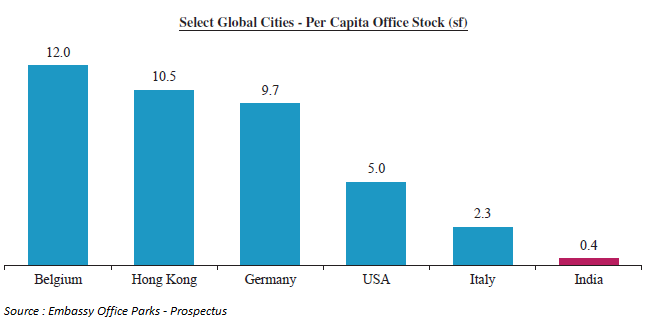

India vs. Global Office Market :

Key Statistics of India Office Market :

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.