“Brothers and sisters, it is over 70 years since Independence. All governments have done a lot of work in their own way. Every government, irrespective of the party, be it the central or the state, has tried in its own way. But still it is a fact that today almost half of the houses in India do not have drinking water. People have to struggle to get drinking water. Mothers and sisters have to travel 2, 3, 5 km carrying the load of water on their heads. A large part of their lives is spent in struggling for water. Therefore, this government has decided to emphasize upon a special task and that is – how to ensure availability of water in every house.

How does every house get water, pure drinking water? And so, I declare from the Red Fort today that in the days to come, we will take forward the ‘Jal-Jeevan’ Mission. The central and the state governments will jointly work on this ‘Jal-Jeevan’ Mission. We have promised to spend more than Rs. 3.5 lakh crores on this mission in the coming years.,” said Modi ji in his speech on 73rd Independence Day of India. Well what does this mean?

Recently similar drinking water supply project was undertaken in Assam but on a much smaller scale. The total cost of the project was ~Rs 260 crs and ~60% of the cost was spent on distribution line (chiefly pipes, minor pumps, labour, etc), whereas the rest was spent on the water treatment plant (~20%) and civil work (~20%).

Another similar project was launched by Telangana’s water grid named “Mission Bhagiratha” with an outlay of ~Rs 42,000 crs. Major cost is expected to be spent on pipelines – 60% to 70%, 20% to 25% on civil work (includes water treatment, civil structure, excavation) and rest on pumps.

Clearly pipe companies expected to be key beneficiaries of the government “Jal-Jeevan Mission”. As per JM financial report, 40% of the project cost is expected to be spent on distribution pipes. Among pipes, DI, MS and HDPE pipes (major expense) are used for the distribution and for reaching out to the house-holds. Amongst the three DI pipes manufacturers could have an upper hand (reasons mentioned further). For Mission Bhagiratha in Telangana, the total pipeline requirement for the project stands at ~1.3 lakhs km leading to a demand of 8 lakhs tons of DI pipes.

DI Pipes:

Ductile Iron is an iron-carbon silicon alloy (also known as spheroidal graphite iron or Nodular Cast Iron) which was invented due to developments in cast iron technology. Ductility refers to the ability of a metal to deform before breaking or can be simply stated as the ability of a component to be stretched into wires. Ductile iron basically consists of various materials that can be produced to have a wide range of properties. Ductile Iron retains the corrosion resistance of cast iron but has more than double the tensile strength.

Ductile Iron pipe is considered as the most preferred pipe material for water supply and pressure sewerage application all over the world. Pipes made from Ductile Cast Iron, provides substantial benefits in terms of pressure bearing ability, impact resistance and capacity to sustain external static/dynamic loading. Today, more than 600 utilities (in the United States and Canada) have had Cast Iron mains in continuous service for more than 100 years. Additionally, at least 21 utilities have had Cast Iron mains in continuous service for more than 150 years.

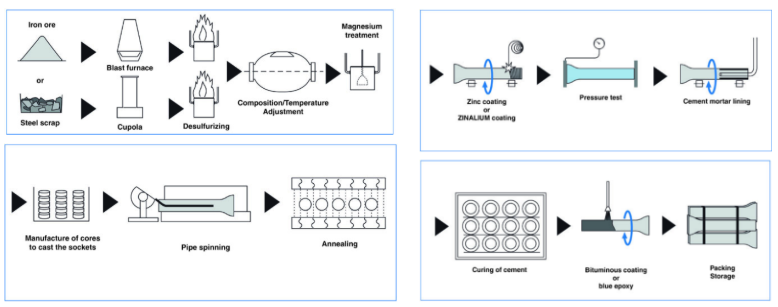

Manufacturing Process:

Applications of DI Pipes:

DI pipes find applications in the entire chain of water transportation starting from sourcing of water from the water bed to transporting water to the last mile. Di pipes are used in varied applications like:

- In distribution network of potable water

- Raw & clear water transmission

- Water supply for industrial/process plant application

- Ash-slurry handling & disposal system

- Fire-fighting systems – on-shore and off-shore

- In desalination plants

- Sewerage and waste water force main

- Gravity sewerage collection and disposal system

- Storm water drainage piping

- Effluent disposal system for domestic and industrial application

- Recycling system

- Piping work inside water and sewage treatment plants

- Vertical connection to utilities and reservoirs

- Piling for ground stabilisation

- Protective piping under major carriage-ways

DI Pipes are better than steel / PVC / HDPE pipes:

- Ductile iron pipe can provide over 100 years of unrelenting, high-level performance! Proof of this performance is provided by more than 560 utilities throughout North America that have iron pipe still in service that are over 100 years old, as well as many over 150 years old. Additionally, iron pipe served the fountains of Versailles, France for over 300 years.

- DI Pipes also saves operating costs in several ways including pumping costs, tapping costs, and possible damage from other construction, causing failure and the cost to repair in general.

- Lifecycle costs of DI Pipes is one of its greatest benefits. Since it lasts for generations, is economical to operate, and easily and efficiently installed and operated, its long-term or lifecycle cost is easily lower than any other material.

- Ductile iron pipe in itself is 100% recyclable material.

- It is strong enough to withstand the most severe conditions, from high-pressure applications, to heavy earth and traffic loads, to unstable soil conditions.

- Installation is easy and safe for workers who can cut and tap Ductile Iron Pipe on site.

- The metallic nature of Ductile Iron Pipe means the pipe can be easily located underground with conventional pipe locators.

- DI pipes offer higher tensile strength than mild steel and retain the inherent corrosion resistance of cast iron.

Nal se Jal (piped water supply) till 2024 will lead to huge demand increase for DI Pipes:

- Development of water infrastructure has been one of the key agendas of the current NDA government.

- The government recently announced to spent Rs 3.5 lakh crores in upcoming few years for piped water supply across the country.

- A large amount of the project’s expenditure will be spent on distribution pipes (which include DI pipes, HDPE, MS pipes).

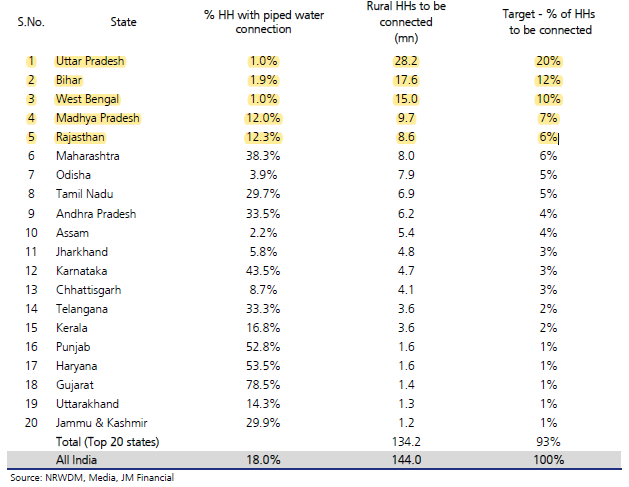

- The major (~55%) work to be done in states like UP, Bihar, West Bengal, MP and Rajasthan (as can be seen in the below table).

- Key player, Tata Metaliks is expecting industry to grow between 9 to 12% (on a conservative note which could also go up to 15%) over next five years.

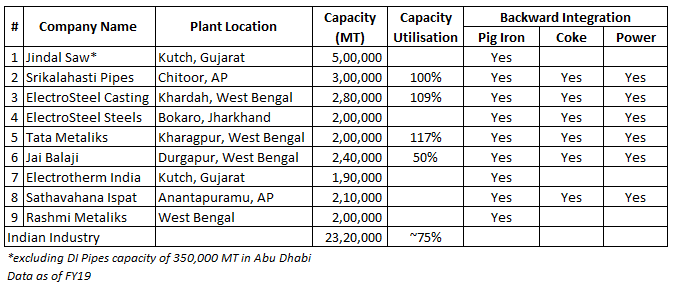

Overview of Indian DI Pipes Industry:

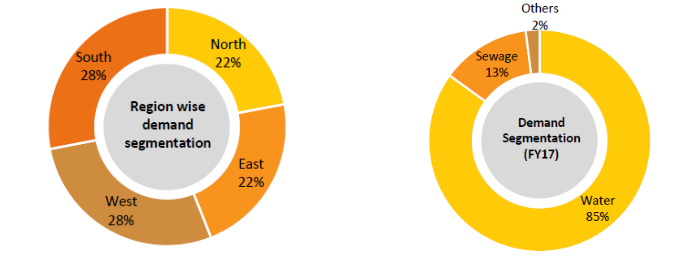

DI Pipes Demand Segmentation:

Key Players in the Industry:

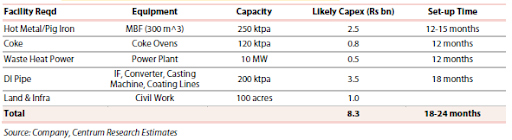

Capex required to set up a facility

Upcoming Capacities

- Srikalahasti Pipes is upcoming with a brownfield expansion of DI Pipes to increase its capacity by 200,000 MT for ~Rs 400 crores. The pipe capacity is expected to come online by March 2021.

- Another player to add capacity is Tata Metaliks. Tata Metaliks is also adding 200,000 MT of DI Pipes capacity (Brownfield expansion) which is also expected to come online by end of FY2021. Tata Metaliks is spending ~Rs 550 crores on the expansion of which Rs 80 to 100 crs to be spent on technological updates.

- KIOCL, a government of India Owed iron ore mining company plans to set up a DI Pipes facility in Mangaluru. The company intends to set up a 200,000 MT under forward integration project. The investment is expected to be around ~Rs 836 crs which would also include a 120,000 MT of coke oven plant and 10 MW co-generation power plant. The management could start the ground work by December 2019.

Few Entry Barriers

- High Capex costs (as seen above)

- New players also face challenges in obtaining the BIS quality standard for their DI pipes which is mandatory for supplying the pipes to any water project. This is one of the key reasons that there are no unorganised players in this space and only 7-8 existing organised players are active in this business.

- On average, the time required for a new player to enter this space from announcement of capex to successful set-up and commercialisation is 3 year+ and based on the per tonne profitability level attained, the likely payback is between 7-10 years.

Risk Factors:

Projects entirely dependent on government:

Delays in the government projects are not really uncommon in our country. Delays would lead to demand spread over few more years leading to slower growth. Plus considering the longer duration of the project change in state government might create issue in completion of project in future as water is a state subject.

Higher Initial Costs:

Even tough setting up DI pipes is more cost efficient over the life of pipes, the initial cost is high compared to other pipes like HDPE (plastic) pipes. States having lower budget to spend on the water supply projects might settle for HDPE pipes as they will be more focused on initial costs and deliver maximum till 2024 over long term benefits.

Raw Material Volatility:

Key raw material for manufacturing of DI Pipes are Iron Ore, Coke and Cooking Coal which have witnessed sharp fluctuations in the past. The raw material price fluctuations are not easily passed on to customers as majority sales are done through auction process.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.