Sushil Kumar Modi, Bihar deputy chief minister and designated convener of Group of Ministers on IGST, on Saturday (21st December 2019) was speaking at FICCI’s 92nd Annual Convention “India: Roadmap to a $5 Trillion Economy”.

In a short presentation of 47 minutes, Mr Sushil Modi flagged certain characteristics of GST which we aren’t aware of such as –

- 23.8% of gross tax revenue of union government comes from GST while 42% of gross tax revenue of states comes from GST.

- Tax to GDP ratio in country is 17.2% – should have been 22.6%

- In the first year of GST (2017) average monthly collection was 89,000 cr, in 2018 the revenue collection improved to 98,000 cr and in 2019-20 it has touched 100,000 cr, and this according to the minister is less due to negative growth in imports. The Domestic GST growth was +8.3% in the first 8 months of 2019-20 but IGST on imports observed a negative growth of -7% because imports declined.

- Further, it worth highlighting that post GST, taxes have climbed down on 99% of the items. During VAT regime for states – standard rates are 13% to 15%, in the GST regime – standard rate is only 9%.

- Just for illustration purpose, Pre GST – white goods had 31-32% tax, now it is 28% rate. Earlier excise part was not visible; it was part of the price. Now excise is visible as a form of CGST.

- In cement pre GST VAT + Excise was 31-32% and now it is 28% post GST.

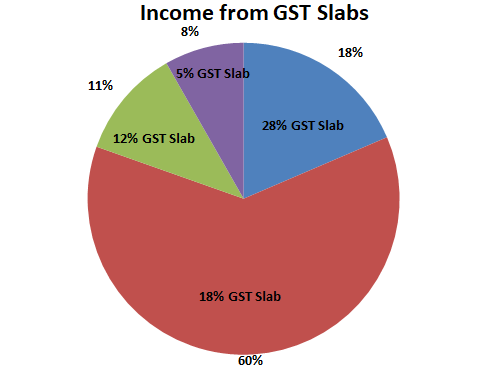

- If we breakdown the kitty of entire tax revenue, we find that 60% of GST is collected from the 18% slab, 18% revenue is collected from the 28% slab and only 11% revenue from the 12% slab and close to 8% of tax revenue is collected from the 5% GST slab.

People refrain from paying taxes when it is showed as a cost on the invoice to the customer while they pay excise duty (a type of tax) when it becomes part of the price of the product which showcases the resistance to pay taxes when it is explicit.

Sushil Modi allayed fears of any hike in GST rate saying the media reports have been wrong in predicting an increase in the rates said that there was no possibility of any change in goods and services tax (GST) rates until the revenue stabilizes.

He further said at a time when the economy is in a slowdown, if you cannot cut the tax rate, do not increase the rates to boost consumption. At these times you cut the duties and tax rates, and not increase them.

- Previous governments had assured states that their revenue will be protected by giving them 14% annualized growth rate, but going ahead it will be difficult to compensate states. This compensation is provided via cess fund (of tobacco etc.), not from consolidated fund of India. If growth is 4-5%, union government will not be able to provide funds. Pre GST – no state had revenue growth rate of 14% (Gujarat had 3.6 %, MP 11%, west Bengal 7%….average state growth was 8.9%). State tax officers stopped making efforts since they were assured of 14% growth. At Current GDP growth rate of 5-6%, GST cannot grow at 10 to 11%.

- Cess fund declined in the recent past due to slowdown in the automobile sector.

- Another menace that hinders GST collection is Fake Invoicing – a big issue! 44000 cr fake invoice revenues have been registered.

Remedy measures to curb theft in GST collection have been proposed such as –

- Without AADHAR authentication – no new registration will be allowed. 1.2 cr tax payers in GST. In 2.5 years, more than 60 lakh new registrations have come in.

- In BIHAR – 2.5 lakh registrations have come in over the last 1 year.

- New return forms from 1st April – will increase revenue as you match the invoicing.

- If GST is not filed for 2 consecutive months. E way bill will be blocked.

- QR code mandatory for companies with revenue of more than 500 cr.

The outcome of these measures was reflected in the month of December (2019) – 7 lakh more returns have been filed till date on a month on month basis.

Subscribe to our WhatsApp and receive updates directly:

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 022-48931507.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.