When you benchmark an asset as being expensive, we have to ask relative to what? Indian real estate is expensive and it is only getting costlier despite demonetization and RERA.

The metric which indicates if real estate in a nation is expensive is PRICE to INCOME ratio. Price in the numerator is price of a dwelling and Income is national average income of the nation.

To understand the PRICE to INCOME ratio, please read the definition-

Price to Income Ratio is the basic measure for apartment purchase affordability (lower is better). It is generally calculated as the ratio of median apartment prices to median familial disposable income, expressed as years of income (although variations are used also elsewhere). Our formula assumes and uses:

- Net disposable family income, as defined as 1.5 * the average net salary (50% is assumed percentage of women in the workforce)

- Median apartment size is 90 square meters or 968 sq ft.

- Price per square meter (the formula uses) is the average price of square meter in the city center and outside of the city center.

India had price to income ratio of 7.69 in 2009 and since then it has inched up and it has already touched 11.38 in 2020. 2018 onwards the price to income ratio has rapidly risen from 9.73 to 11.38.

In simple worlds, if a person wants to buy a house today in 2020, he will spent 11.38 lacs on the purchase when his median disposable family income is 1 lac only or it will take the person 11.38 years at current median disposable family income to buy the house.

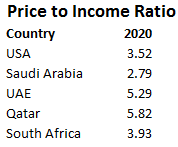

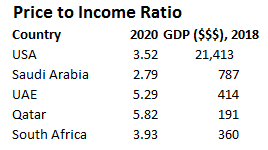

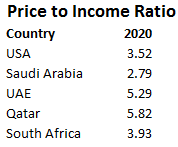

Let’s look at other countries and try to gauge housing affordability

I have plucked these names from the bottom of the ranking table, simply these nations have the highest affordability in terms of houses and the economy is reasonably big in terms of ($$$).

What can lead to higher house prices in any nation?

let’s try to list down some common factors

- Expensive land on which the construction takes place

- Easy credit availability

- Slowness in construction of good houses leading to increased bidding from buyers, hence higher prices

- Many more….

The main factor to be blamed is ‘Easy Credit Availability’ of the 3 factors to be more responsible for higher Price to Income ratio. Let’s look at how easy credit availability increases the price of the house we live in.

Indian’s have strong affinity for real estate, it gives comfort to individuals to own land parcels or houses and we classify it as an investment.

Illustration –

Imagine Mr X has a property on sale; it is a 2 BHK apartment in the city center priced at 80 lacs. Now suppose your family income is 14 lacs per annum. You live in a rented apartment and you desire to own the property on sale in the city center.

Imagine an ideal scenario which is highly unlikely to happen in our lifetimes, but for argument sake, if there were no property loans in the economy, no bank in the country has a product such as ‘House loans’. What would happen?

Will Mr X find a buyer of the property priced at 80 lacs?

The answer is maybe yes/maybe no. if there a willing buyer and willing seller then his transaction is possible in a free market, the condition is that the willing buyer has to have ‘OWN’ cash reserves of 80 lacs, he cannot go to a bank for a house loan since there is no such product.

What is the probability that there will many such buyers with 80 lacs of cash reserves?

My imagination tells me that, there would few buyers of the property at 80 lacs. What would happen then?

Mr X would have to simply wait until there are enough people to buy a property at 80 lacs. What if Mr X cannot wait that long, then ideally Mr X would have to adjust the ‘ASK’ of the property (80 lacs) downwards.

Mr X would revise the price tag to 70 lacs and wait for buyers to respond, he would then revise it again until he is able to complete the transaction in the stipulated time he has in his mind. Let’s say the transaction takes place at 50 lacs.

What signal does it send in the market place?

Any seller owning a property in the same area has a benchmark rate, therefore he cannot price his property at a rate such as 80 lacs to begin with because buyers do not have wallet that big.

Today, any seller or builder can price his property at such rates, why? Because of easy bank credit available to the buyer for houses. In financial jargons, there is froth in the real estate market because of cheap money available via banks.

When one individual agrees to pay 80 lacs for an apartment, it sends a signal that buyers have the wallet to buy properties at such rates.

Then sellers of properties only think of higher rates because they know banks will pitch in with the money. The banks underwrite these housing loans and they get predictability of Revenue in return for a period of 15 years or more. The buyer starts to pay EMIs against the house loan.

The recurring expense of EMIs for the person as percentage of his monthly income is so high that the person then subscribes to more such credit product like credit cards, zero down payment EMIs etc, this snow balls into a vicious circle of never ending EMIs and one loan after another.

People have aspirations and there is nothing bad in having them, but at what cost? If your aspirations makes you slog at a workplace which you do not like then what would that house bring to you? A recurring EMI, that’s it…..

Credit culture is on rise in India, this is what economist call, the initial stages of inflation where everything seems possible until prices of goods and services begin to rise.

Now coming back to the table-

What is common in Saudi Arabia, UAE and Qatar?

Even without undertaking deep research into each economy, on prima facie we can conclude that these nations have a poor credit culture or the banks in these nations have no ‘home loan’ kind of products.

What does it do?

Simply it does not let Mr X price his property at 80 lacs.

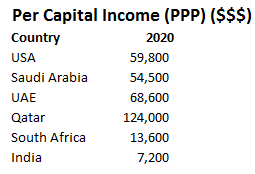

Now the next question to ask is- Does poor credit culture stops individuals from increasing incomes? Let’s find out –

To simply understand per capita income, imagine it to be your annual income. To read further on GDP per capita (PPP), please follow the link – https://www.investopedia.com/updates/purchasing-power-parity-ppp/

Our target countries, namely Qatar, UAE and Saudi Arabia have the highest GDP per capita.

What does higher per capita income means?

It simply means that your wallet is relatively big which empowers you to afford a lot of goods and services which people in nations such as India and South Africa find impossible. Only way they can consume expensive good and services is via credit products such as credit cards, zero down payment EMIs etc but it makes a person’s life much more stressful because of never ending EMIs

USA also has a credit culture, then how does it have a Price to Income ratio, which is second best in the world?

USA witnessed the great real estate crash in the year 2008, when it had a price to income ratio of 9, post the crisis house prices fell across the nation and they are on a path to recovery since then.

Easy credit availability led to the Great Financial Crisis in the US in 2008, post which the economy observed unemployment rates rising till 2012.

Something of similar nature could happen in India, but predicting ‘when’ is the most difficult thing.

The music (credit availability) is slowing. Let’s see how long the borrowers of money can dance….

A contrarian buyer would patiently wait to deploy capital when the music stops because there will lots of money to be made when the party is over.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.