- Don’t lose perspective

- Why are you worried? – Because the stock price has gone down or because the investment hypothesis has gone wrong ?

- Our mistakes & what we could have done differently

- What are we doing now

- What are we not doing

Disclaimer – Alpha Invesco is a sebi registered investment advisor. This write up is not an investment advice or a stock recommendation. Kindly consult your stock advisor before taking any decision.

Very Important To Not To Lose Perspective

These are indeed very tough times for Indian stock market investors. Especially for those who are invested in midcaps & small cap stocks. As I write this, almost 1400 stocks have hit their 52 week lows. 85% of the companies with market cap below 1000 crores have fallen by more than 50% from the top.

It is very easy to lose perspective in such an environment. Investors tend to lose sight of medium-long term possibilities when there is too much negativity all around. Most of us start echoing the negativity – iss desh ka kuch nahi hoga, all governments are same, itna bureaucracy hai idhar & what not. Investors must not forget, the biggest opportunities are born during such points of maximum pessimism. Are we there at the point of maximum pessimism yet ? Tough to say. But looking at the stock valuations in certain pockets, we may already be in the bottom quartile.

India disappoints the optimist & the pessimists both. Things are not as bad as they seem to be. We remain net buyers in the current fall. It is very difficult to predict strong economic growth. Similarly, it is equally difficult to predict a strong slowdown as well. What i have learnt from the past is, it pays up to buy undervalued shares of good businesses when there is very high uncertainty & negativity all around. There is a widespread fear that Modi 2.0 will be all about socialism, tax terrorism & doles. These forecasts do not assume any fiscal, monetary & regulatory response from the establishment.

Stock Price Has Gone Down Or Investment Hypothesis Has Gone Wrong?

In the investment world, things do go wrong and we must remain open to changing our mind when the hypothesis goes wrong.

As full-time investors & investment advisors, we are asking one simple question to ourselves while re-evaluating the portfolio. Whether our investment hypothesis has gone wrong or the price has acted against our anticipated direction ?

We think you should do the same. If you have bought a certain share at fair valuation & only the price has gone down, while the hypothesis remains the same, then should you be worried ? If investors start reacting just because the price has gone down, then what’s left in any equity investments approach ?

Off course – In many cases, a major fall in the stock price is a sign of things to come. And one must act irrespective of the price if the data suggests so.

When should you be worried about your stocks falling ?

We are more worried about the fundamentals of our portfolio companies than anything else. We think you should worry about the falling price of a stock only if any of the below symptoms occur;

-

- Liquidity risk – the business does not have the capital to run day to day operations

-

- Solvency risk – the business may go bankrupt

-

- Business risk – the business model itself is under threat due to change in technology, regulations etc.

-

- Fraud risk – the reported numbers are fudged & management is questionable

-

- Valuation risk – astronomical valuations getting de-rated

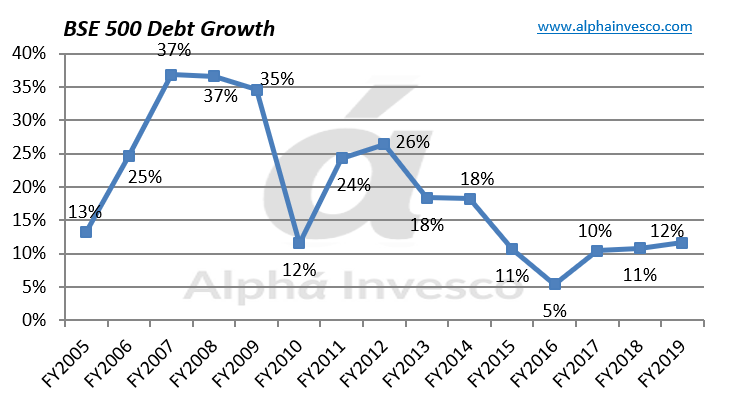

Since the time liquidity issues in the system came to the fore, every company with debt is being viewed as bad. Every capital-intensive business has become untouchable. Can the economy function & grow without debt, without asset heavy industries? Do all companies with debt on the balance sheet go bankrupt? Right now, markets are not differentiating between solvency, illiquidity & bankruptcy. It cannot continue for long & this phase too shall pass. We do not think any of our company may potentially cause a permanent capital loss.

On the contrary, we find a great deal of value in old economy & asset heavy industries. Capacities are getting filled up & capital is scarce. It is very difficult to put a new asset on ground. Companies with existing installed capacities are in a position to have a good multi year run in their profitability.

We must be counterintuitive if we have to succeed in the long run. In lot of cases, untouchability of an investment idea in the early phases is the source of alpha generation. Majority of our portfolio stocks are out of favor at this point due to perception issues, or temporary headwinds. As long as we are paying dirt cheap valuations while buying them, we should be okay.

We believe our investee companies have the business strength & balance sheet which gives them enough staying power to get through this period of economic difficulty. Rather, majority of them are likely to do well even during the downturn. Therefore, the drawdowns we are seeing in our portfolios is temporary & quotational.

What we could have done differently ?

If we have to go back & do something different, what we would have done ? If we were old and hopefully wiser, we would have certainly curtailed our allocations to more normalized levels. When a batsman comes to the pitch, he takes some time to settle down. After a while he starts seeing the cricket ball like a football & plays the big shots. Similarly, it is very important to start small & scale up your investment positions. Discovery of an idea is not everything. How you build a position over a period is equally critical.

We do not have the ability to time everything perfectly. The only way to tackle with this issue is to control allocations & scale up on evidence. Too large allocations create a lot of peer pressure or self-generated pressure. And it eventually leads to exit / selling the stock exactly at the wrong time. Allocations in some of our large positions have dragged the portfolio performance. We realize these allocations must be brought down. We will navigate through the situation and optimize on our allocations by switching, reducing at opportune moments.

Another mistake we did was to buy in few themes too early. Some of our clients blame us of being stubborn on these ideas, and for all the right reasons. Sitting on a stock with no returns for 3+ years is painful. While buying on the way down has no competition, and you get a chance to enter at throwaway valuations, the key question to ask is – ‘are we too early?’. We have incorporated this as a part of checklist now.

Buying too early + large allocation is a stressful cocktail. We may still make some mistakes in the future, but we are consciously trying to reduce our error rate on both these fronts.

What are we doing now ?

In the midst of all this chaos & negativity, we continue to run screeners, scan annual reports, talking to industry people, collaborate with likeminded colleagues in search of new investment ideas. Investors tend to get carried away during big market corrections & focus shifts from individual stocks to general market chatter, finding faults within the system etc. We think its time to do exactly the opposite, ignore all the noise & work on potential ideas, review existing ideas etc.

Most of our existing investment ideas have corrected significantly over the last 6 months. And they have become even more attractive after the recent fall. At the same time, we are open to switching into new opportunities if something fits in our investment criteria. Present correction is a god sent opportunity to re-balance portfolio’s or correct the mistakes of the last cycle. Big money is waiting to be made if investors are willing to adapt & are open to switching.

Area’s that we are interested in –

-

- Anything which is not expensive, unpopular, has a good runway ahead & where the growth is underpriced.

-

- Stocks with temporary headwinds but long term tailwinds. Stocks that have not done well during 2014 to 2018, and have become even cheaper in present correction.

-

- Companies where balance sheets are expected to improve with a steady state growth, return metrics i.e. ROE, Roce, Debt to Equity can improve substantially. And markets are not pricing it in.

-

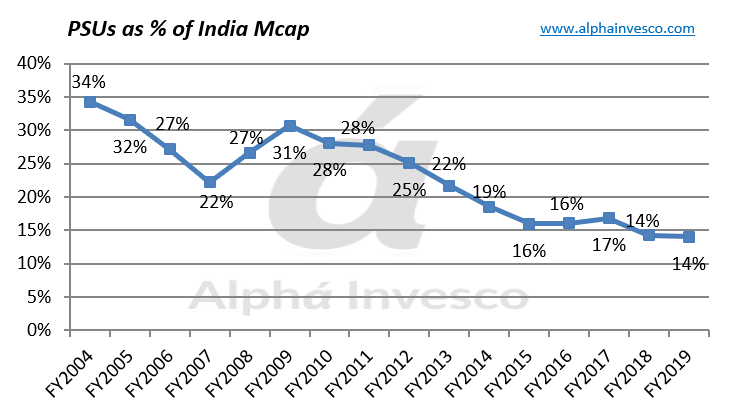

- Stocks / pockets where, asset based valuations are at 12-15 year low & the prospects are at 10 year high.

-

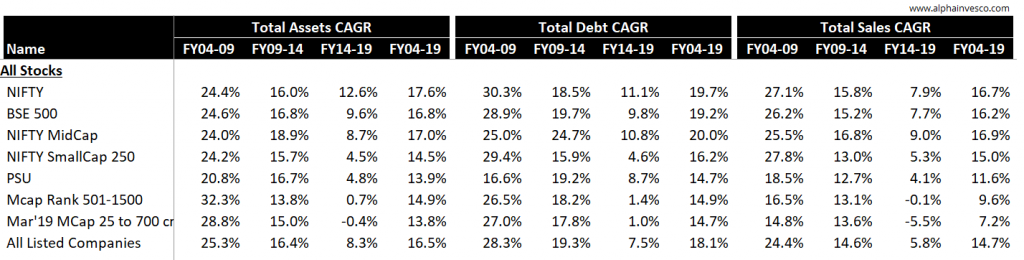

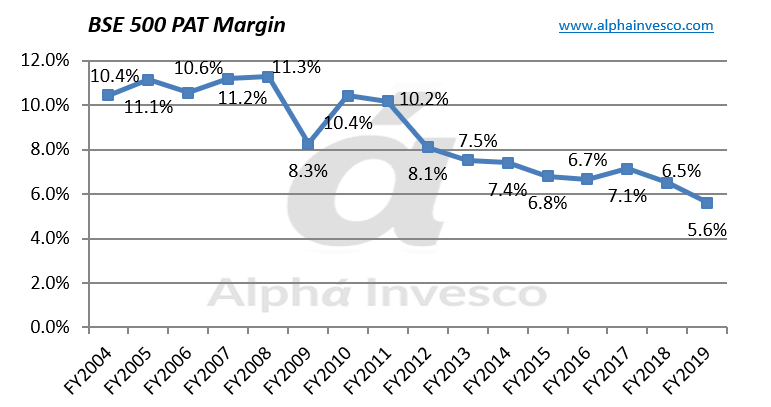

- 2014 to 2019 was a period where corporate balance sheets consolidated & we didn’t see much growth. After a long gap, we are likely to see revival of credit & capex cycle. Who is going to lend to corporates when the cycle revives ? Who is going to put up a new brownfield / greenfield steel or power plant ?

-

- Themes around infrastructure spend, railways, revival of core sectors.

-

- Out of 27 crore households, only 4.5 crore households have incomes that are above 6 lakhs per annum (average 5 persons per household). Consumption themes that are likely to benefit as more people cross this threshold. Apparels, media, dine out etc.

-

- Companies that can benefit from the productivity gains in logistics, agriculture sector.

Area’s that we are avoiding –

-

- Overcrowded trades, anything that is trading at expensive valuations on normalized earnings. In India, very few companies have real sustainable moats. Quite often, we mistake industry tailwinds for moats or management brilliance.

-

- Buying something just because it has done well in the last 5-10 years. The economic landscape & consumption patterns in India are changing. Growth is shifting from western & southern parts of India to eastern parts ( including uttar Pradesh ) & one must keep that in mind before extrapolating the future growth rates.

-

- Buying something just because stocks have fallen from the top. One may end up in getting into done & dusted themes.

-

- Buying into marginal players in the industry . For example – avoiding buying into the 6th / 7th / 8th largest player in the industry just because it is cheap or has fallen from the top. Better to stick with the leaders.

-

- Export oriented stories where companies are benefitting just because of weaker rupee, and due to technology, quality advantage.

Things are not really as bad as they seem to be. India going through a period of big re-adjustment due to new regulatory frameworks such as GST & NCLT, coupled with increased tax compliance. Short term concerns like slowdown in a certain part of the economy, taxation issues are not going to kill the 5 trillion $ story overnight. This period must be used to sharpen the skills, build a portfolio that will perform in the long run. This is certainly not the time to panic & run away from equity investments amidst all the gloom & doom.

Investors who stay the course over a long run & stay invested will witness the power of equity. While those invested since last 3 years or so are witnessing the horror of equity at this point. However, as these investors spend more time in Indian share market, they too shall witness the power of equity.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.