Many a times you (investor & analyst) will come across companies which have widely varying Return metrics on a standalone basis and consolidated basis due to the subsidiary performance lagging that of the parent. In this short article we will investigate intent of a company’s management on mergers and acquisition.

Why would the RoIC (Return on Invested Capital) on consolidated balance sheet be less than the RoIC on a standalone basis?

While computing the ratio RoIC, we have Return, which could be your EBIT or PBT in the numerator and Invested capital in the denominator.

EBIT = Earnings before interest and taxes

PBT = Profit before taxes

Invested Capital = Total Assets – Excess cash on the balance sheet – Current investments (cash equivalents, investments in subsidiaries and associates) – Short term loan & Advances (prepaid expenses) – Trade Payable – Other current liabilities.

If the subsidiary has a lower RoIC, then it must either generate lower PBT/EBIT or it must be investing a higher capital (denominator).

Generating higher or lower amount of PBT/EBIT depends upon the quality of business, its moat, its pricing power in the market, market share etc.

A business could generate higher PBT/EBIT yet its RoIC could be lower due to higher trade receivables and stretched working capital cycle. Breaking down the invested capital into smaller components can give insights on the strength of business.

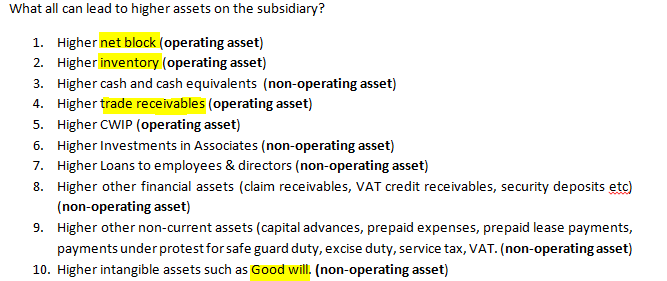

What can lead to higher Invested Capital in a Business?

#when calculating RoIC, please subtract all non-operating asset from the total asset base on the balance sheet to arrive at the operating asset number and then proceed ahead to calculate the RoIC.

##Capital advances, prepaid expenses, prepaid lease payments may look like operating assets and they actually are but, these assets will generate returns in the future and they have not generated any return in the current year, therefore for current year RoIC calculation, we ought to subtract these (capital advances, prepaid expenses, prepaid lease payments) from the total asset base on the balance sheet.

### Acquisition good will is subtracted from the asset base because good will is excess price paid over the fair value of net assets [Total Assets (fair value) – Total Liabilities (fair value)].good will is not amortized and it is not an operating asset also. It’s a book entry to balance the balance sheet.

Moving on, let’s try to find reasons on why would a Parent want to keep a lower RoIC subsidiary on its Balance sheet and contract the overall RoIC?

- The subsidiary is currently generating lower profits on its operating asset base but in the future it will generate higher returns and the consolidated RoIC will improve.

- The parent wants to increase equity by increasing the non-controlling interest because it owns more than 50% of the subsidiary and thus the parent wants to improve debt to equity ratio to raise debt in the future.

How to identify wrong intent of the management regarding acquisitions of firms and creating subsidiaries?

- Find out the names of the top management in the acquired firms, if there is a relation between the acquired firm’s management and parent then you should ask the management of the parent on the rationale of acquisition (how did they arrive at the valuation?).

- Find out good will as a percentage of total assets in the balance sheet in the consolidated balance sheet, a fraudulent management will want to increase good will as a percentage of total assets over years to hide wrong doings.

- Plot the trend of free cash flow to the firm over years. Generally, acquisitions made in order to hide frauds or steal cash will show declining free cash flow to the firm. We can then ask management on why it is acquiring businesses which generate lower returns on operating assets.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.