Continuing our study on steel we have come up with part 3 of the series (Nucor Corp) where we are studying Nucor Steel from the US, Nucor’s journey from a very small mini-mill (a steel joist manufacturer) to a steel producer has been incredible. It is a case of how intangible assets in an organization and that to in an industry like steel can make it profitable.

Part One – Understanding How The Indian Steel Industry Works – Part 1

Part Two – How The Indian Steel Industry Works, Current Scenario & Outlook – Part 2

Competitive advantage never grows out of a single activity. Unique products and services are often imitated by competitors. True sustainable advantage comes from activities that are complementary. Competitors no longer have to match just one thing but rather the whole system if they wish to enjoy many of the same benefits. Companies with sustainable competitive advantage integrate a lot of activities within the business, all of which are consistent and mutually reinforcing.

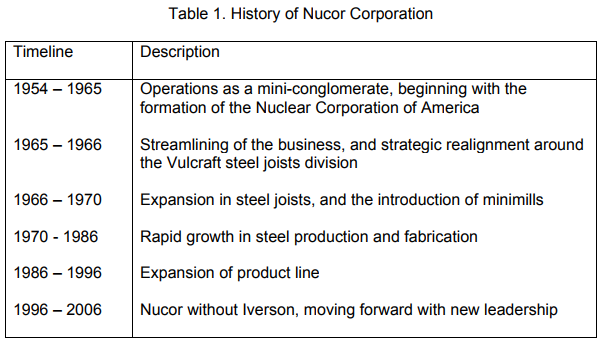

The article examines Nucor’s development from an unprofitable conglomerate to a highly efficient enterprise.

Nucor was known as Reo Motor Works, an automobile producer founded in 1904. The company abandoned automobile manufacturing after the great depression in 1929 and instead focused on producing trucks for the military, the demand for military trucks waned after WW2 and company faced serious financial difficulty.

In 1954, Reo liquidated all its assets and after a proxy battle, Reo was named Nuclear Corporation of America. Nuclear wished to capitalize on the emerging nuclear technology but lacked clear vision. Its divisions varied from consulting to chemicals and instrument manufacturing. In 1960 the company had not yet turned a single profit and David Thomas was elected as the president.

Thomas found the concept of conglomerate business appealing and led to a series of acquisitions and divestments. In 1962 Nuclear acquired Vulcraft, a leading steel joist manufacturer.

In all these acquisitions only Vulcraft played out well for Nuclear and F. kenneth Iverson was hired to oversee the operations of Vulcraft.

Iverson’s management style had two goals: improving productivity and fostering strong employee relationships, his first decision after arriving at Vulcraft was desegregation of bathrooms and events in the company. He also formed a safety committee and enforced strict safety rules in the company, accidents declined and productivity improved.

These measures helped Iverson foster a deep relationship with his workforce and helped in combat a much greater threat to overall profitability: Unionization

In 1964 Iverson was recalled to the headquarters and promoted to Vice President because in his 2-year stint at vulcraft, the division had tripled earnings.

In 1965 Iverson was elected as the president of the board unanimously and then there was a top-level turnover, conglomerate strategy of the first half of the decade disappeared. Iverson divested all loss making divisions of the company. The focus of the company was profitable steel joist operations run under the name of Vulcraft.

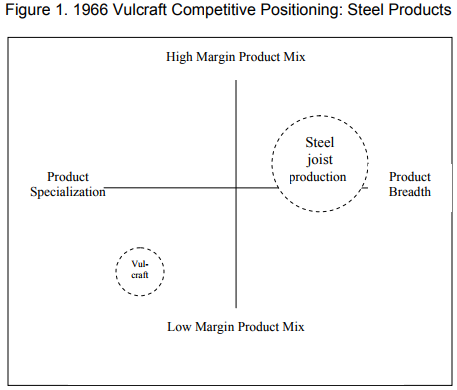

Although significant pressure arose from other steel joist speciality shops, the primary source of competition was the Integrated Steel Mills such as US Steel.

Vulcraft offered one product (steel joist) while integrated steel mills offered full line of steel products. Joist were low margin steel product compared to top end product like steel plate. Integrated mills sold everything right from low end to high end products.

The competitive price for joist was close to cost and with price effectively fixed, the firm had to push down cost in order to increase profits. Vulcraft purchased raw steel and had little control on supply cost.

Vulcraft, in order to battle the cyclical nature of industry, initiated an incentive program for Senior Management based on productivity in Nucor corp. With workers knowing exactly what their efforts would net them, vulcraft enjoyed worker productivity far above the industry norm.

“We hire five, work them like ten, and pay them like eight.”

With its low-cost position, Vulcraft was able to gain market share and maintain profitability. Low cost focus was a primary feature for Vulcraft in 1966. The company’s head Quarter was lean and they worked out of a 2000 sq ft rented space, Iverson reduced bureaucracy in the organization. The company had four layers of management and responsibility was pushed to the lowest level possible.

Performance based compensation ensured that the managers would make decisions in the best interest of the company and these arrangement were also instrumental in maintaining quality of the steel products. Everyone had same vacations, health plans and holidays at the organization.

We should not forget that the steel joist business was commodity business and had a host of producers and limited buyers, product and services offered by all producers were nearly same, Nuclear dealt with this problem by improving productivity, controlling cost and offering host of services to win customer loyalty. By 1967 Nuclear had become leading joist manufacturer with 25% market share.

In the interest of controlling cost, the firm introduced its own fleet of trucks to guarantee on time delivery in all of 50 states. By doing this Nuclear gained trust of its contractors.

Iverson also realized that they could be profitable if they could manufacture their own steel, in 1966 Iverson sought permission from the Board to construct an Electric Arc Furnace, it was a minimill. In 1967 60% of revenue dollar which Nuclear earned was spent on buying steel and it was clear why Iverson wanted to minimise the dependence on steel. It is a volatile commodity and sudden price slumps could have created havocs in the firm.

Minimills were inexpensive to build, operate and were energy efficient, they could operate on scrap alone.

Iverson Said “The Big Steel companies tend to resist new technologies as long as they can. They only accept a new technology when they need it to survive.” Thus, Nuclear was in a strong position to take on Big Steel.

In the 70’s the management directed its energies towards two basic businesses- steel joist operated under Vulcraft and steel business operated as Nucor. 1972 was a major inflection point when the management decided to focus on steel business. It could now produce cost-competitive molten steel entirely from scrap at one-tenth the scale required by an Integrated Mill. This also translated into expenditures which were also one-tenth of that of Integrated Mills.

In early 70’s the industry experienced a brief surge in demand, as a result Integrated started expanding their capacities, this led to increase in operational cost. With huge CAPEX and union pressure the mills had to raise prices of steel. Since Nucor was sourcing cheap raw material (scrap) for its steel, it could focus on low cost structures to be competitive in the industry.

So from 1970 to 1986 Nucor experienced organic growth and capacity expansion. Iversion focused on constructing minimills in close proximity to its customers. Iverson was aware of the price sensitive nature of the commoditized industry therefore their competent distribution increased customers willingness to pay. So Nucor was able to increase the price of steel when the price of scrap increased.

Up until 1974, Nucor’s primary customer was itself- Vulcraft steel joist but later on, it was able to solicit large outside customers. Slowly nucor forayed into high margin steel products.

Nucor’s crown Jewel : Employee Relations

Iverson loved to reward all stakeholders of Nucor with cash, he dished out cash when times were good. He implemented systems which encouraged workers to build careers in Nucor. In 1974, The Nucor Foundation was established to support children of workers.

Iverson philosophy defined the most crucial factor in the steel industry: worker productivity, it is defined as number of labor hours per ton. In the seventies and eighties Nucor had worker productivity of 4 hrs/ ton compared with the National average of 8 hrs/ ton. Nucor was also known as the highest paying employer in the steel industry.

Iverson said in 1972 “ We are very confident that it’s going to be a very fine business for those people who are efficient, low-cost producers”. Nucor realized economies of scale and managed to position itself closer to its customers across the US.

Nucor’s investment in cutting edge technology was another reason that it flourished, Nucor had the highest labor productivity and lowest emissions in the Industry.

In spite of the 1984 recession Nucor managed to preserve profits and gain market share, there were huge industry wide losses of the order of $6 billion and one-third workforce of the industry was let go.

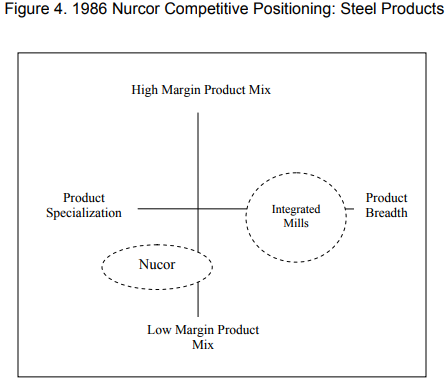

Integrated players did not consider Nucor a direct competitor at this juncture and chose to drop out of rebar, bar and rod production where gross margins were 4 and 12 % and concentrated their efforts on structurals and sheet production whose margins were above 20%.

Nucor was operating a mini mill and its growth had saturated thanks to increased competition of mini mills which also employed EAF/IF and eroded Nucor’s Profits (lower margins), but Nucor had not expanded out of the low end steel (rod, rebar and bar), and avenues of growth were limited without product diversification. In 1986 no mini mill had the technical ability to produce high margin products like (flat rolled, sheets etc).

Thin Slab Casting

Thin slab casting was an emerging science yet Nucor invested in the new technology which shows management’s willingness to invest in new technologies and expand into newer markets. Nucor estimated that thin slab casting would allow it to enter into the high margin category and also had enormous low cost features ($50-$70 per ton of cost advantage), leaner workforce when compared with an Integrated Mill, Nucor would employ 12 people for the same work for which Integrated players hired 50.

Nucor’s biggest customers were the construction and automotive industry at 60% and 15% revenue share respectively. In 1986 the price of sheet metal (high margin used in automotive industry) was $400 per ton as compared to a bar which was priced at $250 per ton, the market it earlier served.

Nucor was the first company to experiment with this technology and it was big gamble which played out as Nucor had tied $270 million in this and at some point 25% of the Assets were tied to this project.

Nucor had set very aggressive timeline to complete the project and get it up and running, this was typical of Nucor speeds which reduced the cost of capital. After some initial adjustments the plant was able to produce high quality thin sheets used to make automotive parts. Thin slab casting was a giant leap in steel making productivity, it reduced man hours to less than one.

Nucor’s competitors were always behind and Nucor had advantages in labor productivity and nimble management which was difficult to imitate as these were cultural advantages (intangible).

In 1991 Nucor signed an agreement with Gradic wire (Sweden) making it the first North American producer to use patented G-casting technique to directly cast wire, it was completely revolutionary like thin slab casting, required less capital and was faster than traditional techniques used in wire casting.

Nucor also signed a letter of intent with Yamato Kogyo, a JV to produce I-beams, again this high margin product and had 24% market demand in all steel products. All this time it is interesting to note that Nucor had no R&D but the highest collaborations with technology companies in Europe for licensing their technology, again this plant with Yamato was set up running in record time of 18 months which would otherwise would take 3 years.

Nucor acquired a Bearing company also but eventually it did not sought to expand it further, Nucor profit rose to $2.25 billion in 1993 roughly a 100 times from where they had been a decade ago. Despite industry slump, Nucor continued to remain profitable across all divisions and continued to expand which made it difficult for its competitors because of the overall slump across the industry.

Nucor’s last venture in 90’s was to start producing Iron carbide in trinidad and it was done to reduce dependence on scrap but the plant did not turn profitable for a long time and Nucor had to shut it which it did and it was again done at unimaginable speeds to cut losses.

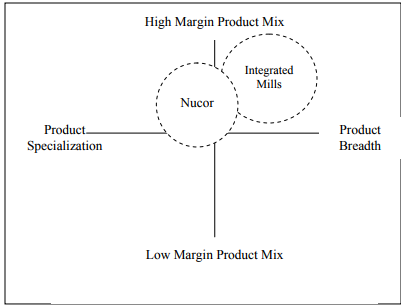

Nucor forayed into high margin products and the key was adopting thin slab casting technology to produce sheet or strip metal which comprised 49% of the overall steel demand as opposed to bar or rebar.

As visible, Nucor’s Product portfolio slowly started overlapping the portfolio of ISP as seen by the product mix (sheet, wire, I-beam, fasteners).

1996-2000 of Nucor Corp

In 1996 Iverson stepped down from his role of CEO and handed over it to company veteran John Correnti. In Correnti tenure the industry was under huge pressure from imports, the company battled it by slashing prices twice, earnings and sales declined due to lower realization per ton of steel and startup cost for new plants. The company raised prices again in 1999 to gain price integrity and the company experienced a boardroom musical chair as it saw two new CEO’s. Dimicco was elected CEO and under his leadership the company did a lot of JV’s.

Nucor tied up with Australia’s Broken Hill Proprietary Corporation and Japan’s Ishikawajima-Harima to manufacture strips. Nucor purchased Alabama-based Trico Steel, a steel sheet producer, In late 2002 Nucor bought financially troubled Birmingham Steel for $615 million in cash and debt. Backward integration also continued for Nucor as it teamed up with the brazilian producer of iron ore and reduced dependence on steel scrap.

Nucor also lobbied with fellow steelmakers and 30% import tariff was imposed, unfortunately government intervention was unable to boost bottom line because of high expansion costs, on the positive side revenues rose by 31% approximately by $1.53 billion on the back of acquisitions.

According to Dimicco the imports were 30% of the problem, the other 70% was self inflicted, cheap imports caused the domestic steelmakers to engage in price wars thus diminishing profits and the industry continues to be plagued by excess capacity due to large number of mini mills. Recognizing the impact of rivalry, the manufacturers started to consolidate.

To make matter worse the mini mill technology (EAF) of Nucor was highly transferable and all you needed was iron, cheap electricity and 300 people.

Supplier power of scrap is low when the steel prices are low, Nucor had advantage because of large supplier base and low switching cost among scrap suppliers. In 2005 supplier power was boosted because of increased demand for scrap from the emerging economies, largely from China, as a result Nucor experienced a sharp increase in input cost of raw material (scrap) as demand for raw material shot up in China due to increased construction activity.

So between 1996-2006 Nucor focused around reinforcing its core elements like low-cost structure, labor relations, technology focus and focus on high margin products. Overall Nucor was able to consolidate its position in the US.

Continual focus on technology – Kenneth Iverson said it best when he commented on Nucor’s success factor “70% of it has to do with culture and 30% has to do with technology” Strip casting technology which cast molten steel into thin sheets allowed steelmakers to switch between multiple steel grades quickly.

Over the years and largely through the vision of one man, Nucor has evolved towards a strong strategic fit with a consistent activity system. By strengthening around its core elements, the company has shown a strong commitment to its strategy. Even though competitors might attempt to imitate Nucor’s management system, but how would you imitate extraordinary strong worker relations as well as the complex host of interrelated activities which made the firm’s success difficult to replicate.

Disclaimer :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above-mentioned data. Investors should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents.

Author of the report has investment positions in the stock at the time of publishing this post.

Future estimates mentioned herein are personal opinions & views of the author. For queries/grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No: INA000003106

Readers are responsible for all outcomes arising of buying/selling of particular scrip/scrips mentioned herein. This report indicates the opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above-mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco or its associates are not paid or compensated at any point of time, or in last 12 months by anyway from the companies mentioned in the report.

Alpha Invesco & its representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock: No, Served as a director/employee of the mentioned companies in the report: No. Any material conflict of interest at the time of publishing the report: No.

The views expressed in this post accurately reflect the author’s personal views about any and all of the subject securities or issuers; and no part of the compensation, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.